As February 2025 draws to a close, the global financial market is facing multiple uncertainties. The volatility of the US stock market, the expectations of the Federal Reserve's policy, the release of NVIDIA's financial report, and the intensive disclosure of macroeconomic data together constitute the core variables affecting the price of Bit. This article will delve into how these macroeconomic factors shape the short-term trend and long-term logic of Bit, and explore their potential impact in combination with the structural changes in the crypto market.

I. NVIDIA's Financial Report: The Linkage between AI Narrative and the Crypto Market

1. NVIDIA's Earnings Expectations and Market Sentiment

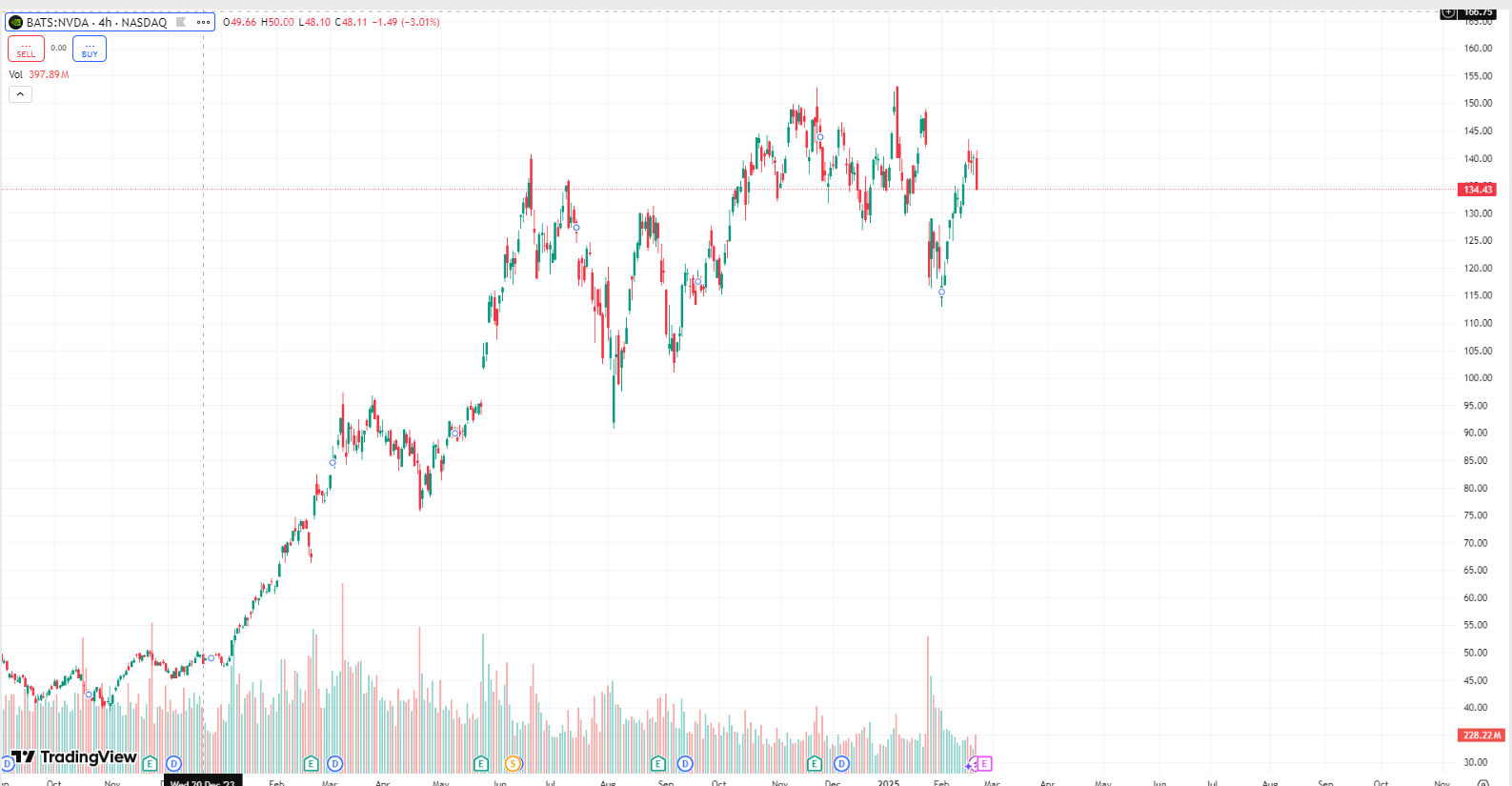

As a global supplier of AI computing power, NVIDIA's financial performance not only serves as a barometer for tech stocks, but also indirectly reflects the depth of AI technology's impact on the global economy. According to Yahoo Finance forecasts, NVIDIA's revenue is expected to grow 73% year-over-year, and earnings per share to grow 63% this quarter. If these figures meet expectations, they may further strengthen the market's confidence in the sustainability of AI hardware demand.

However, the risk of volatility after the earnings report cannot be ignored. If NVIDIA's management takes a more conservative view on AI chip demand (e.g., due to intensified competition with the Chinese company DeepSeek), it may trigger a market re-adjustment of tech stock valuations. From the perspective of the crypto market, this volatility will be transmitted through two paths:

- Correlation of risk assets: Tech stocks and Bit belong to the high-risk asset category. If NVIDIA's stock price experiences a significant correction after the earnings report, it may lead to a temporary withdrawal of investors from the crypto market due to an overall decline in risk appetite.

- Intersection of AI and crypto ecosystems: AI-driven blockchain projects (such as the decentralized computing platform Bittensor) or tokens related to NVIDIA's technology roadmap (such as the AI-themed meme coin $GOAT) may be directly impacted.

2. DeepSeek's Competition and Geopolitical Variables

NVIDIA may mention its competition with the Chinese AI company DeepSeek in its earnings report. According to the information on page 2, DeepSeek's technical breakthrough in January 2025 has accelerated the crypto market's attention to decentralized AI infrastructure and pushed up the prices of related tokens. If NVIDIA implies that its market share is threatened, it may strengthen the market's investment logic in the "decentralized AI" track, indirectly benefiting Bit's positioning as an underlying store of value.

II. Federal Reserve Policy and PCE Inflation Data: The Tug-of-War over Rate Cut Expectations

1. The Decisive Role of PCE Data in Rate Cut Expectations

The core PCE price index, the Federal Reserve's key inflation indicator, will be released on March 1. The market expects its year-over-year growth to slow slightly to 2.6% from the previous 2.7%. If the data meets expectations, it will consolidate the market's bets on a rate cut in June; otherwise, it may trigger panic over "persistently high interest rates"[citation: user message].

Historically, Bit and the US dollar index (DXY) have typically been negatively correlated. Recently, the US dollar index has been boosted by market optimism about Trump's policies, while Bit has benefited from the continued outflow of institutional capital. If the PCE data strengthens the rate cut expectations, it may break this short-term correlation and drive Bit to regain its "anti-inflation asset" attribute.

2. The Transmission Mechanism of Interest Rate Policy on Bit

- Liquidity expectations: Rate cuts will lower the risk-free interest rate, enhancing the appeal of Bit as "digital gold". Page 7 mentions that if the Federal Reserve cuts rates to 3.5% in the mid-to-late 2025, it may release trillions of dollars in liquidity, some of which will flow into the crypto market.

- Leverage effect: A low-interest-rate environment may stimulate the activity of the crypto derivatives market, increasing the scale of leveraged trading and amplifying price volatility.

3. The Lurking Concern of Economic Slowdown

Recent data on the University of Michigan Consumer Sentiment Index and S&P PMI indicate a weakening of US economic growth momentum. If this week's GDP revision further confirms this trend, it may exacerbate market concerns about "stagflation". Bit's performance in this scenario will depend on the interplay of two forces:

- Hedging demand: Expectations of an economic recession may drive capital inflows into Bit as a hedge.

- Liquidity contraction: If the deterioration of economic data triggers a stock market sell-off, the crypto market may come under pressure due to the withdrawal of liquidity[citation: user message].

Expert Forecast: A Year of Market Adjustments and Buying Opportunities

Additionally, the revised Q4 US GDP, consumer confidence index, and house price index will also be released.

As the New York stock market plummets amid concerns about inflation and economic slowdown, experts predict that market volatility will further intensify.

Scott Cronert, Chief US Equity Strategist at Citigroup, said: "The S&P 500 index still has room for further upside, but market volatility is likely to increase. This year will be a year of repeated adjustments and buying opportunities."

Conclusion: Seeking Bit's Alpha Amid the Interweaving of Macroeconomic Variables

NVIDIA's earnings report, PCE data, and economic indicator releases this week will collectively shape the transmission chain of "global liquidity expectations-risk appetite-crypto market capital flows". Bit's short-term volatility may be significantly amplified, but its long-term narrative (halving, institutional adoption, anti-inflation properties) remains intact. Investors need to be wary of the "flash crash" risk triggered by data surprises, while seizing the reconfiguration opportunities as panic sentiment subsides. Against the backdrop of heightened macroeconomic uncertainty, Bit is transforming from a marginal speculative asset into a core carrier of the global liquidity game.