In-depth Analysis of On-chain Data: The Essence of Market Bottoming

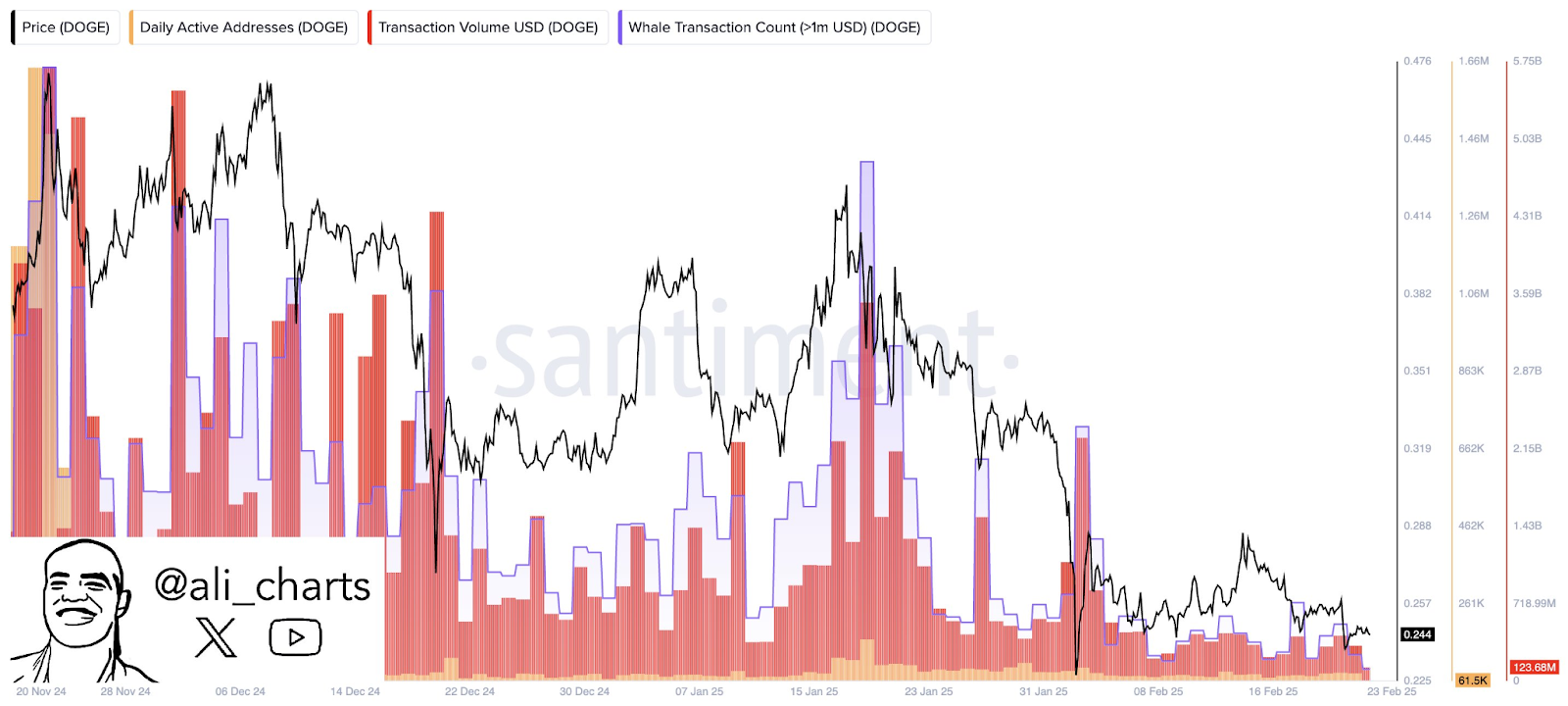

According to the views of blockchain analyst Ali, the on-chain indicators of the Doge network showed significant contraction in February 2025: the number of whale transactions (>$1 million) fell to 66 per day, a new low since October 2024; the daily active address count fell below 60,000, less than 10% of the peak period.

This phenomenon has been interpreted by some investors as a harbinger of market collapse, but in-depth analysis reveals that this is precisely the "golden pit" that value investors have been dreaming of.

From the historical patterns of the cryptocurrency market, the extreme shrinkage of on-chain activity often corresponds to the bottom area of the price cycle. Taking BTC in 2020 as an example, when the number of active addresses fell below 500,000 per day (the historical median is about 900,000), its price skyrocketed from $5,000 to $64,000 within the next 12 months.

The underlying economic principle is that when market participants have completed panic selling, the holding investors enter a "non-sellable" state, and any marginal buy orders can trigger a violent rebound in prices. The current on-chain indicators of Doge have already reached the "oversold extreme" in statistical terms, with its 30-day MVRV (market value to realized value ratio) falling to -23%, meaning that the vast majority of holders are in a loss state, and the market washout is nearing its end.

The technical analysis also sends a strong bullish signal. Since the 2021 bull market, Doge has constructed a standard symmetrical triangle structure at the weekly level, and has formed a standard support-resistance swap zone between $0.16-$0.21. The current price of $0.21 is exactly at the upper support of this formation.

The Musk Matrix: From Grok3 to the Paradigm Revolution of Government Roles

If the on-chain data has laid a solid technical bottom for Doge, then Elon Musk's recent series of actions are injecting a nuclear-level catalyst into this value return.

1. Grok3 Ecosystem Integration

Grok3, the third-generation artificial intelligence launched by Musk's xAI company, has confirmed that Doge will be the only payment token in its ecosystem. This not only means that millions of Grok users will directly encounter Doge payment scenarios, but more importantly, through the automated operation of AI agents, Doge may become the first cryptocurrency to realize the "machine economy".

2. The Policy Leverage of the "US Government Efficiency Minister"

Although this appointment has obvious symbolic significance, Musk clearly stated in a CNBC interview on February 19 that "Doge represents a revolution against the bureaucratic monetary system, and my responsibility is to accelerate this revolution." Musk's recent scrutiny of multiple financial sectors is seen as a challenge to the traditional financial system, and this anti-establishment narrative is highly compatible with Doge's grassroots culture, which may attract more retail investors.

3. The High Ground of Public Opinion in the Regulatory Confrontation

Musk's recent campaign on the X platform to scrutinize various government organizations such as the US Federal Reserve and the SEC is essentially a carefully planned war of attention. By publicly questioning the enforcement logic of the SEC, he successfully tied Doge to the ideology of "financial freedom".

Data from the social media monitoring platform Brandwatch shows that the relevant topics accumulated 2.3 billion exposures in February, and Doge's social media sentiment index soared to 92 (out of 100), a historic high.

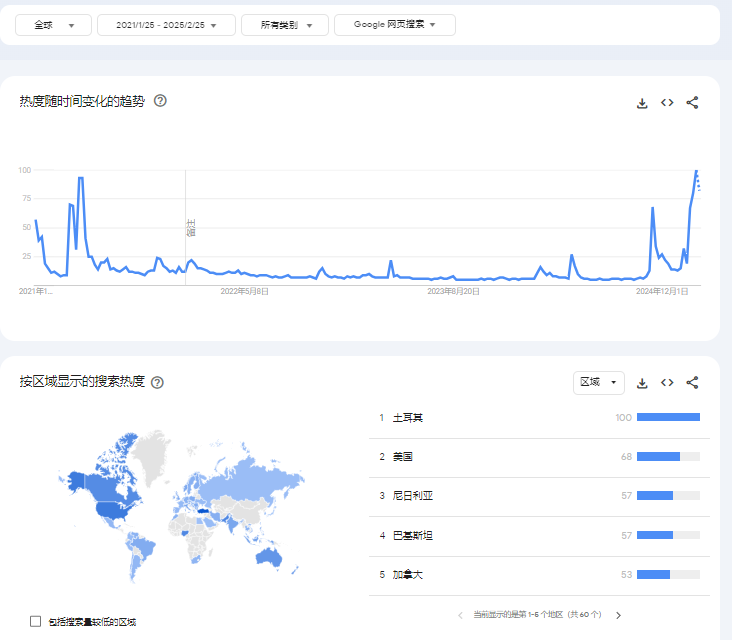

Google Trends also shows that the current Doge search heat has surpassed the previous high during the Doge breakout to $0.7 in 2021.

The accumulation of various public opinion forces has reserved a huge potential buying power for Doge's price breakthrough.

The Mystery of the On-chain Quiet Period: The Covert Battlefield of Whale Accumulation

On the surface, the shrinkage of on-chain activity seems to imply capital outflows, but Glassnode's on-chain intelligence reveals a completely different story:

Whale holding concentration reached a new three-year high: the top 100 addresses hold 45.2% of the circulating supply, up 11 percentage points from 2024.

Exchange balances plummeted: the DOGE balance of centralized exchanges dropped from 12.4 billion to 8.9 billion, a 28% decrease.

Non-liquid supply surged: the proportion of coins that have not moved for more than a year has increased from 34% to 51%.

These three indicators collectively point to a conclusion: the "silence" of current on-chain activity is not due to capital withdrawal, but rather the large holders entering a strategic accumulation phase. Whales are continuously accumulating through OTC channels, taking advantage of market panic sentiment and avoiding leaving traces on-chain. This "repairing the plank road in the open, and secretly storing grain" operation has appeared in the Bitcoin bear market bottom in 2018 and the March 2020 crash, and each time it has triggered a subsequent violent rebound.

The Ultimate Form of Meme Evolution: Doge's Path to Breaking the Circle

Doge's value support has long surpassed the simple "joke currency" narrative, and it is undergoing a triple paradigm shift:

1. Exponential Expansion of Payment Scenarios

According to the Doge Foundation's ecosystem report released in January 2025, the number of merchants supporting Doge payments has exceeded 520,000, an increase of 380% year-over-year. Notably, listed companies including Newegg and AMC have started using Doge for B2B settlements, marking its formal entry into the enterprise-level application field. Blockchain analysis firm Chainalysis estimates that the actual payment volume of Doge (excluding exchange transfers) has reached $230 million per day, surpassing LTC to become the second-largest payment-oriented cryptocurrency after BTC.

2. Global Penetration of Cultural Symbols

In TikTok's latest global trend report, the "Doge Challenge" topped the annual topics with over 17 billion views. This cultural penetration is creating a self-reinforcing network effect: as Doge becomes a component of Gen Z's social currency, its value storage function will gain a cross-generational consensus foundation. Goldman Sachs analysts point out that Doge's "cultural market value" (valuation based on brand influence) has exceeded its current market value by more than 3 times, and this gap will eventually be corrected by the market.

3. Strategic Position in Regulatory Battles

Recent hearing minutes from the US Senate Banking Committee show that Doge may be classified as a "commodity" rather than a "security" due to its highly decentralized holding structure (the top 10 addresses account for less than 12%) and clear payment attributes. This means that Doge may avoid the SEC's harshest regulatory attacks and take the lead in the compliance process. This regulatory arbitrage space will attract more institutional capital to position.

Price Forecast and Investment Strategy

Key technical levels:

Short-term support: $0.19-$0.21 (4-year cycle support zone)

First resistance: $0.28 (Q4 2024 consolidation platform top)

Trend reversal confirmation: Weekly close above $0.33

Investment Recommendation:

Establish core positions in the current price range ($0.18-$0.22) in batches

In extreme cases where it falls below $0.16, leverage DCA (leverage not to exceed 2x) can be initiated

Conclusion: The Crossroads of Historic Opportunities

When on-chain data hits bottom and the Musk effect forms resonance, when meme culture completes the transformation to value storage, when payment networks cross the critical scale - Doge is standing at the most explosive turning point in the history of cryptocurrencies. Those investors who see the essence in fear will ultimately reap excess returns in the process of market correction. Remember, bull markets are born in pessimism, grow in skepticism, and die in frenzy. And now is the golden moment to stay clear-headed.