Author: Pzai, Foresight News

On February 25, the Crypto Fear and Greed Index fell to 25, a new low since September 2024, with the market shifting from a neutral state to a state of extreme fear. On the back of Trump's aggressive tariff wielding and the shaking of the European political fundamentals, the US stock market closed on Monday with the S&P 500 index down 0.49% and the Nasdaq down 1.2%.

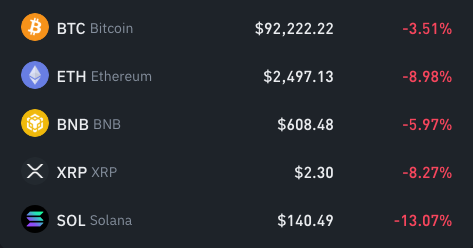

And a host of tokens have also devastated market expectations in a "high dive" manner. Bitcoin has temporarily dipped to around $90,000, and SOL has plummeted to the $140 level in a single day.

Looking at the performance of crypto-related US stocks, MSTR, affected by the volatility of Bitcoin prices, has fallen to around $282, retreating to the mid-November 2024 level, and Coinbase has fallen to $230, a new low since November 2024. What's going on in the crypto market today? This article will analyze the market sentiment and on-chain situation.

Market Analysis

On February 24, a Bitfinex report stated that due to the continued stagnation of market momentum, Bitcoin has been fluctuating between $91,000 and $102,000 over the past week. On February 21, after the news of the massive sell-off of S&P 500 options expiration, volatility soared, causing Bitcoin to fall 4.7% that day.

In addition, recent geopolitical factors have also raised red flags for market expectations, such as Trump's statement at a press conference that punitive tariffs on Canada and Mexico will be "on time and as planned."

Recent hacking incidents have also created some selling pressure in the market, with the theft of $1.5 billion in ETH assets from ByBit also significantly undermining the asset price of Ethereum, causing it to fall below the $2,500 level.

In terms of mainstream assets, under the selling pressure of the MEME recession and large-scale unlocking, SOL fell by 13.07%. According to DeFillama data, Solana's TVL has been declining continuously since reaching a high of $12.19 billion on January 19, falling to $7.346 billion, a drop of nearly 40%.

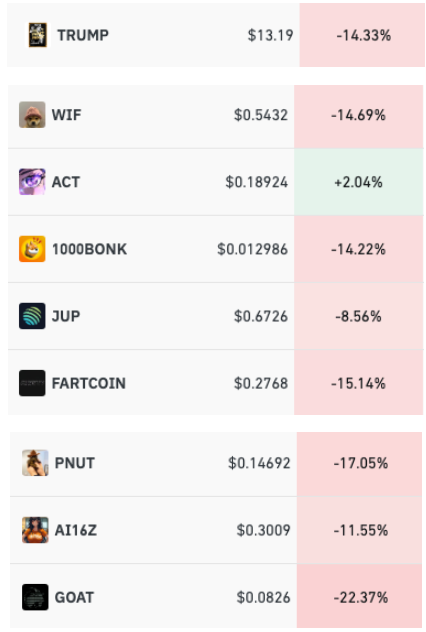

Overall, with the withdrawal and return of MEME liquidity, Solana's ecosystem tokens have also declined, with an average decline of more than 10%. Recently, whether it's Argentine President Milei's LIBRA coin or Kanye West's coin issuance turmoil, the impact on market confidence has been huge, leading to the focus shifting back to other projects. The founder of The Coin Bureau, Nic Puckrin, said that people in the current crypto market have begun to get tired of Meme coins, with new meme coins being launched almost every day, and some celebrities participating in hype and dumping. The current investor sentiment may be as low as or even lower than during the FTX collapse.

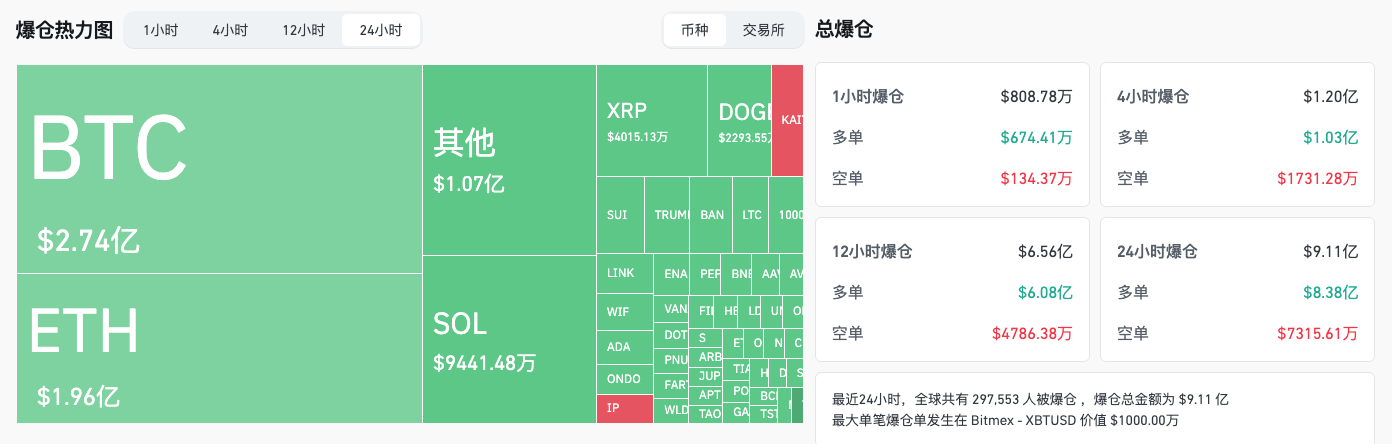

Sentiment Spreading

BitMEX co-founder Arthur Hayes analyzed from the ETF perspective that many IBIT holders earn higher returns than short-term US Treasuries by going long on ETFs and short on CME futures. If the BTC price drop causes the basis to shrink, these funds will sell IBIT and cover the CME futures. He also said he is bearish and sees it falling to 70,000 USDT. Jeff Dorman, Chief Investment Officer of digital asset management firm Arca, said: "The weakness in the cryptocurrency market is largely due to low market sentiment, losses from failed Meme coin issuances, and a lack of capital support for new tokens." According to Coinglass data, the 24-hour liquidation reached $911 million, a new high in nearly three weeks.

But behind the panic, many companies are still continuing to increase their holdings. On February 24, Strategy (formerly Microstrategy) increased its holdings by 20,356 bitcoins at an average price of $97,514, bringing its total holdings to 499,096 BTC. And Metaplanet also announced on February 25 that it had purchased an additional 135 BTC at an average price of $95,826, with a total purchase value of approximately $12.936 million. Overall, these companies still have sufficient confidence in Bitcoin's position as the mainstream crypto asset.