Source: Jinse Finance, Binance, RedStone official website, whitepaper, Twitter Compiled by: Jinse Finance

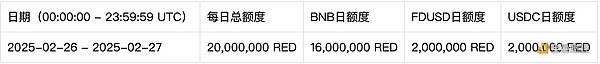

On February 25, 2025, Binance announced the launch of the 64th project on Binance Launchpool - RedStone (RED), a cross-EVM and non-EVM chain multi-chain oracle. Users can deposit BNB, FDUSD and USDC into the RED reward pool on the Launchpool website after 8:00 AM (GMT+8) on February 26, 2025 to earn RED, with the activity lasting for 2 days.

I. Pre-trading

Binance pre-trading for RedStone (RED) will be listed at 6:00 PM (GMT+8) on February 28, 2025, and the RED/USDT trading market will be opened.

Pre-trading Price Limit

Binance has introduced a new feature for the Binance pre-trading market - the price limit mechanism. The price limit mechanism will restrict the maximum trading price in the pre-market within the first 72 hours, and the token price increase will not exceed a certain percentage of the initial opening price. After the first 72 hours of the pre-market opening, there will be no more price restrictions, and trading will resume normally.

Pre-trading details:

Individual maximum holding limit: 5,000 RED

Price limit rules:

February 28, 2025 6:00 PM - March 1, 2025 5:59 PM (GMT+8): Maximum buy-in price is 200% of the opening price

March 1, 2025 6:00 PM - March 2, 2025 5:59 PM (GMT+8): Maximum buy-in price is 300% of the opening price

March 2, 2025 6:00 PM - March 3, 2025 5:59 PM (GMT+8): Maximum buy-in price is 400% of the opening price

After March 3, 2025 6:00 PM (GMT+8): No price limit

II. Launchpool Details

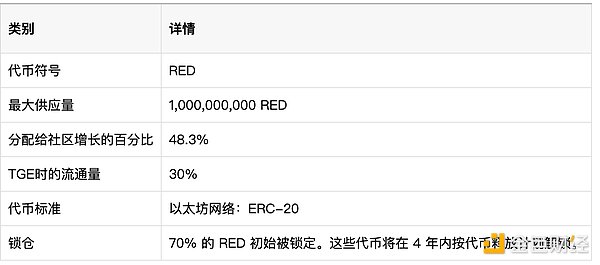

Token name: RedStone (RED)

Total/Maximum token supply: 1,000,000,000 RED

Launchpool total: 40,000,000 RED (4% of the maximum token supply)

Initial circulating supply: 280,000,000 RED (28.00% of the total supply)

Smart contract details: Ethereum mainnet (0xc43c6bfeda065fe2c4c11765bf838789bd0bb5de)

Restriction: KYC required

Individual hourly reward cap:

BNB pool: 66,666 RED

FDUSD pool: 8,333 RED

USDC pool: 8,333 RED

Reward pools:

BNB pool: Total reward 32,000,000 RED (80%)

FDUSD pool: Total reward 4,000,000 RED (10%)

USDC pool: Total reward 4,000,000 RED (10%)

Activity duration: 8:00 AM (GMT+8) on February 26, 2025 to 7:59 AM (GMT+8) on February 28, 2025

Reward allocation stages:

III. RedStone (RED) Introduction

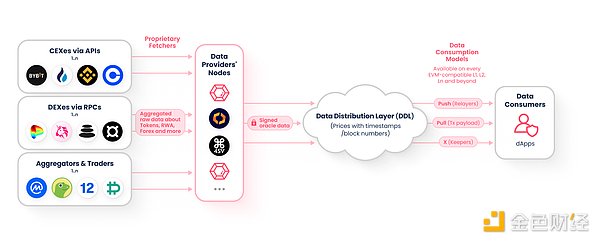

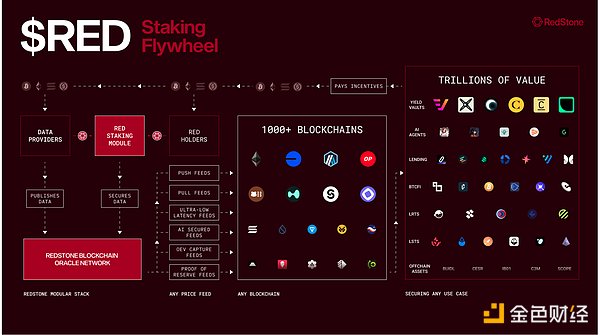

RedStone is a modular blockchain oracle, similar to Chainlink and Pyth Network, but it stands out with its unique advantage of modular design.

Data is stored on Arweave, and nodes provide data to DeFi projects through the EVM-Connector in the form of a decentralized public cache to ensure data integrity and security.

To ensure data integrity, data providers need to stake RedStone tokens as collateral to ensure they can continue to operate and provide high-quality data.

RedStone's modular design can provide push and pull oracle data services to multiple EVM and non-EVM ecosystems, Rollups, and various application chains.

The main function of blockchain oracles is to provide real-world data to smart contracts, ensuring that smart contracts can make decisions based on the latest external information when executed. The advantage of a modular oracle is that its components can be updated or replaced independently, ensuring scalability and integration on different blockchains.

Multi-chain Data

RedStone's modular architecture separates data collection from data transmission, creating a flexible system that can scale efficiently across the entire blockchain network. This design allows the same price information to be deployed to any supported chain without modifying the core data provider infrastructure. By eliminating the need to deploy new nodes for each integration, RedStone achieves faster and more cost-effective scaling while maintaining consistent security standards across all networks. This architectural approach has proven to be highly successful, enabling RedStone to extend its services to over 70 different blockchain networks while ensuring reliable price data transmission and maintaining the same rigorous security measures in all integrations.

IV. Token Economics

1. RED

RED is designed as a utility token with an innovative value accumulation mechanism, introducing the first truly sustainable oracle economics.

Utilizing RedStone's Active Validation Service (AVS), RED staking adds a layer of robust economic security to the RedStone oracle stack, leveraging the staked RED tokens and potentially tens of billions of dollars staked in EigenLayer to provide additional security assurances.

Data providers (who provide data for RedStone's modular oracle network) and token holders (who directly stake to enhance network security through RedStone AVS) can both stake RED.

RED stakers will receive rewards from RedStone data users across hundreds of blockchains, paid in widely adopted assets such as ETH, BTC, SOL, and USDC.

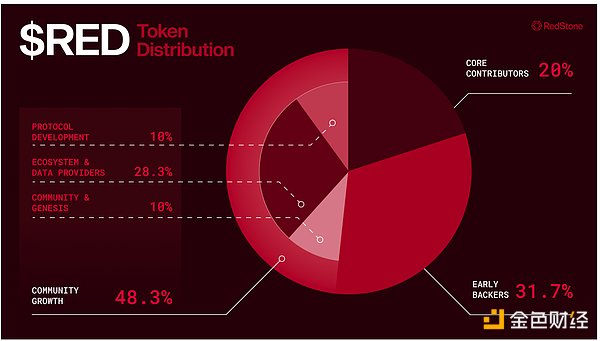

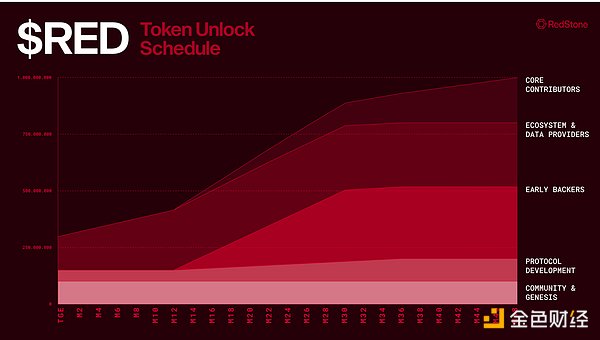

2. Token Distribution

The maximum supply of RED is 1,000,000,000 (one billion) tokens, with an initial circulating supply of 30%. RED is an ERC-20 token implemented on the Ethereum mainnet and will be used on Solana, Base, and other networks through the Wormhole native token transfer standard after the token generation event.

Nearly half of the RED tokens (48.3%) will be allocated to the RedStone ecosystem and community, specifically distributed to the following categories: Community & Genesis, Ecosystem & Data Providers, and Protocol Development.

3. RED Unlock Schedule

4. RED Distribution