The total supply of the native token RED is 1 billion, of which 48.3% will be allocated to the ecosystem and community.

Author: 1912212.eth, Foresight News

This article was first published in July 2024

On February 25, 2025, Binance Launchpool and Pre-Market will list RedStone (RED), with mining starting at 8:00 am on February 26 and lasting for two days. In addition, the Binance Pre-Market will list the RED/USDT trading pair and open Pre-Market trading at 6:00 pm on February 28.

RedStone Oracles released the RED token economics. The total supply of RED is 1 billion, of which 48.3% will be allocated to the ecosystem and community (10% for protocol development, 28.3% for the ecosystem and data providers, 10% for the community and genesis distribution), 20% will be allocated to core builders, and 31.7% will be allocated to early supporters.

Oracles have been highly sought after in the previous cycle due to the tailwind of DeFi and the important position of middleware. Now, Chainlink firmly occupies the market leadership, while Pyth has been rapidly expanding in the Solana ecosystem and various DeFi protocols. Public chains and re-staking tracks have been swept away by modular protocols, so where is the modular design in the oracle track?

In early July 2024, RedStone completed a $15 million Series A funding round, led by Arrington Capital, with participation from Kraken Ventures, White Star Capital, Spartan Group, Amber Group, SevenX Ventures, IOSG Ventures, as well as angel investors such as Smokey the Bera and Homme Bera from Berachain, Mike Silagadze, Jozef Vogel, and Rok Kopp from Ether.Fi, and Amir Forouzani, Jason Vranek, and Christina Chen from Puffer Finance.

What is RedStone

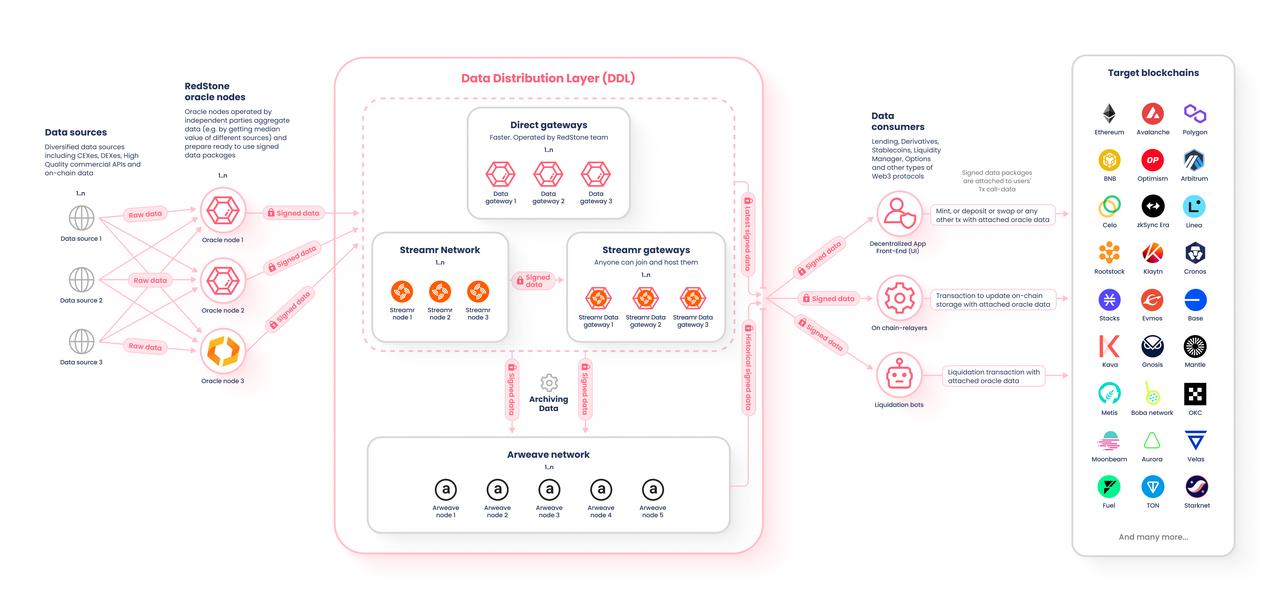

RedStone is a modular oracle network that can provide data sources for DApps and smart contracts on L1, L2, and Rollup-as-a-Service networks (such as EigenLayer), especially collateral yields in lending markets, such as LST and LRT.

The current oracle networks are not perfect, and there is still room for improvement in the accuracy and completeness of data sources. Furthermore, as more and more new assets are listed, with data increasing in volume and speed, some oracles often react sluggishly and even fail to support new assets.

RedStone adopts a differentiated modular design to meet the needs of DeFi protocols, allowing data providers to avoid continuously delivering on-chain data and allowing end-users to deliver signed oracle data on-chain themselves. RedStone also uses Arweave to archive and maintain oracle data.

According to official data, since the launch of the mainnet in January 2023, RedStone has supported more than 20 chains, integrating over 1,000 asset sources from 50 data sources, including not only cryptocurrencies, but also stocks, fiat currencies, commodities, and ETFs.

How does RedStone work

Most of the current market oracles use the third-party push model. The well-known oracle protocol Chainlink uses Pull, while Pyth uses Push, both to solve the issues of oracle trustworthiness and cost.

Specifically, Chainlink's main price source oracle nodes obtain data from secondary sources. The oracles update prices on-chain at set time intervals, and each on-chain update incurs Gas fees. Adding price sources or reducing the latency of on-chain updates will increase the costs for the oracle network, hindering its scalability. Pyth's Push model has data directly provided by entities within the network, such as exchanges, market makers, and DeFi protocols (e.g., Jane Street, Binance, and Raydium). These entities are incentivized to act honestly and provide robust data to maintain a good reputation and avoid being banned by the protocols.

RedStone adopts a modular design, using three different models to deliver data based on business needs and chain architecture, allowing it to fully leverage the advantages of each model while avoiding their drawbacks.

The Pull model loads dynamic data into user transactions, saving Gas and optimizing the user experience, suitable for individual transactions;

The Push model, where data is transmitted to the chain for storage via relayers, mainly adapted for protocols that previously used oracles;

The X model, which focuses on the needs of protocols such as perpetual contracts, options, and derivatives, by eliminating the risk of front-running.

A typical operational flow is as follows: first, data is collected from sources such as exchanges (Binance, Coinbase, Kraken, etc.), on-chain DEXes (Uniswap, Balancer, etc.), and market data aggregators (CoinMarketCap, CoinGecko).

The data is aggregated by independent nodes operated by data providers, using various techniques such as median, time-weighted average price (TWAP), linear-weighted average price (LWAP), and outlier detection to ensure data quality.

These data streams are then directly broadcast to open-source gateways that can be easily separated on-demand. The data can be pushed to the chain through dedicated relayers under predefined conditions, or by bots (e.g., for liquidations) or end-users interacting with the protocols.

RedStone first stores these data in the DA layer, then extracts them to the chain. This allows high-frequency broadcasting of a large number of assets to cheaper layers, and only placing them on-chain when the protocols need them.