Author: Marcel Pechman, CoinTelegraph; Translator: Tao Zhu, Jinse Finance

Between February 24 and February 25, the BTC price fell from $95,930 to $86,010, reaching the lowest level since November 2024. The unexpected 10.7% drop triggered over $760 million in long position liquidations, raising concerns among traders about the strength of the $90,000 support level that has been maintained for the past three months.

To determine whether the Bitcoin bull market has truly ended, the key factors behind the recent weakness must be analyzed. Some analysts point to the $516 million net outflow from Bitcoin spot exchange-traded funds (ETFs) on February 24 as the main reason. However, this explanation overlooks the fact that the total outflow reached $553 million over the previous four days, yet Bitcoin remained above $95,500.

Investor Concerns over Global Economic Growth and Trump Tariffs Trigger Sell-Off

Investor concerns over global economic growth appear to be the primary driver of the recent sell-off in risk markets, particularly after U.S. President Donald Trump confirmed plans to impose tariffs on imports from Canada and Mexico starting in March (a move that had previously been delayed by a month).

U.S. 10-year Treasury yield (left) and the DXY index (right). Source: TradingView / Cointelegraph

The U.S. 10-year Treasury yield has fallen to its lowest level in three months, indicating strong demand for the safest assets. Meanwhile, the U.S. dollar has weakened against a basket of global currencies, as reflected by the DXY index, which fell to 106.30 on February 25, also a three-month low.

President Trump believes that the U.S. has been "taken advantage of" by unfair trade policies, including the imposition of value-added taxes on North American products. The market reacted negatively to this statement, with Brown Brothers Harriman senior strategist Elias Haddad warning that "the U.S. economy is showing dangerous signs."

Bloomberg News macro economist Mark Cudmore stated that "the new U.S. administration has not yet achieved the growth expectations we had," and warned that "U.S. policy may start to cause real economic damage."

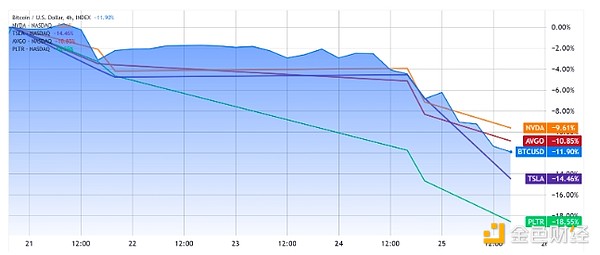

A decline in confidence in the U.S. as the dominant economic force is typically viewed as a downside risk to global economic growth. Since February 21, other major assets, including Nvidia (NVDA), Tesla (TSLA), Palantir (PLTR), and Broadcom (AVGO), have also experienced similar price declines.

The strong correlation suggests that Bitcoin is still viewed as a risk asset, moving in sync with the tech industry, which is heavily dependent on growth and typically does not provide dividends. However, specific events in the cryptocurrency market may lead Bitcoin traders to reduce their exposure.

OKX Settlement Case Reinforces View of BTC as a High-Risk Investment Tool

On February 24, OKX reached a settlement with the U.S. Department of Justice, agreeing to pay a $50 million fine, primarily from fees earned from institutional investors. The report shows that the exchange advised individuals to provide false information to circumvent regulatory procedures, facilitating over $5 billion in suspicious transactions and criminal proceeds.

While not directly related to Bitcoin, this event casts a shadow over the regulatory environment in the U.S., including strategic cryptocurrency reserves. More importantly, nation-states and pension funds often find it difficult to distinguish Bitcoin from illegal financial activities involving digital assets (primarily stablecoins). Therefore, the OKX case reinforces the perception of Bitcoin as a high-risk investment rather than a hedging tool.

There is almost no reason to believe that Bitcoin's price will fall below $86,000, as governments around the world are working to curb potential economic downturns and push central banks to take stimulative measures. While the initial reaction may be to reduce exposure to risk assets, investors are also concerned that monetary expansion could lead to currency dilution.

Therefore, Bitcoin's hard money policy and censorship resistance may prevail. However, it remains uncertain whether it will take days or weeks for Bitcoin to break through the $95,000 level.