The on-chain indicator that evaluates the degree of overvaluation and undervaluation of the Bit price has recorded the lowest level since mid-October of last year.

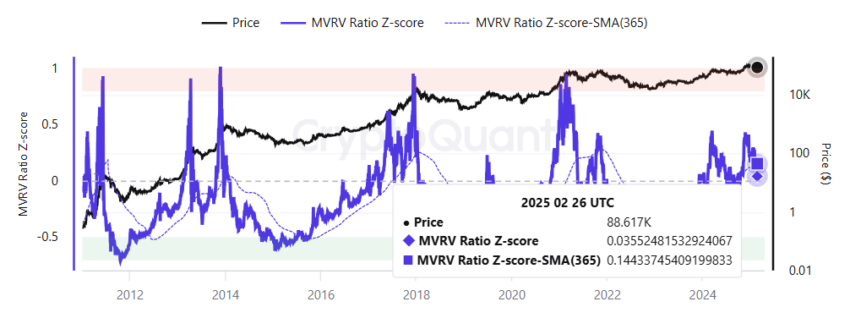

According to a comprehensive report by Beinincrypto, the Bitcoin MVRV Ratio Z-score indicator of the on-chain data analysis platform Crypto.com recorded 0.0355 on the 26th.

This indicator measures the difference between the market value and the realized value of Bit to gauge the appropriate price. The market value is calculated by multiplying the current Bit price by the number of coins in circulation, and the realized value is calculated based on the price at which each Bit was last moved on-chain. The Z-score is the value obtained by applying the standard deviation to this ratio.

When the MVRV Z-score value is 7 or higher, it means that the Bit price is overvalued and has reached a short-term peak. Conversely, when the Z-score value is less than 0.1, it is considered to be undervalued.

Another reference is the MVRV Z-score SMA(365) indicator, which applies a 365-day moving average to the MVRV Z-score. In the periods where the Z-score falls below this value, Bit prices tend to consolidate or decline.

Julio Moreno, head of research at Crypto.com, said on his X (formerly Twitter) on the 26th that "all valuation indicators are in the adjustment zone, and it is difficult to think that the Bit price is at the bottom level yet." He added that "MVRV is below the 365-day moving average, which is a simple but powerful adjustment indicator."