Written by: TechFlow

As the Berachain mainnet has been launched, ecological projects have also been gradually laid out.

With the official launch of the Ecosystem Page on Berachain’s official website, an ecological map covering multiple tracks such as DeFi, RWA, GameFi, SocialFi, and infrastructure has emerged, and nearly 100 ecological projects have successively landed on the Berachain ecosystem.

Thanks for reading TechFlow TechFlow! Subscribe for free to receive new posts and support my work.

TechFlow has TechFlow some of the projects that have been launched on Berachain to understand the current development progress of Berachain.

1. DeFi & RWA

Arbera : Volatility Arbitrage Protocol

Arbera is a DeFi protocol native to the Berachain ecosystem that focuses on volatility arbitrage and oracle-free returns. Its core function is to allow users to capture arbitrage returns generated by asset price fluctuations by establishing a permissionless secondary market.

The protocol does not need to be fed with prices by oracles, but achieves autonomous pricing by dynamically balancing liquidity pools and asset prices, avoiding reliance on external data sources. The income mainly comes from the trading behavior of arbitrageurs and MEV searchers, who use the price difference between the Arbera vault and the underlying assets for arbitrage, and the protocol extracts fees from them and distributes them to users.

Arbera's mechanism is called "Volatility Farming" , and its underlying logic is to convert market volatility into sustainable returns - regardless of whether the market goes up or down, price arbitrage can generate a revenue stream. Technically, the protocol is based on the Peapods Finance code base, adding adapter modules that support Berachain native assets (such as brTOKEN), and optimizing transaction execution efficiency to match Berachain's high throughput characteristics. According to official documents , its architecture includes three core modules: Dens, Growing Dens, and Fees. Users can participate in the ecosystem by staking, arbitrage, or providing liquidity.

Bearborrow : A stablecoin protocol based on POL

Beraborrow is Berachain's native stablecoin protocol based on Proof of Liquidity (PoL). It releases on-chain asset liquidity by minting native stablecoin $NECT through over-collateralization.

Its design concept emphasizes "lossless leverage". After users deposit Berachain native assets (such as iBGT, LSD derivatives or LP positions) into the collateral pool (Dens), they can mint $NECT and continue to participate in ecological DeFi activities without sacrificing the value growth of the original assets.

The technical architecture of the protocol is built around three major modules:

PoL Proof of Liquidity : Incentivize liquidity providers by staking $POLLEN tokens to accelerate the accumulation of collateral pool depth;

NECT stablecoin system : adopts an over-collateralization mechanism (minimum collateralization rate 110%) and combines Liquid Stability Pool to achieve automatic liquidation and arbitrage balance;

Multi-level collateral management : Supports Berachain native tokens, liquidity pledge certificates and LP positions, and controls risks through dynamic parameter adjustments (such as collateral rate thresholds and liquidation discount rates).

Currently $NECT is mainly used in yield farming, leveraged trading and liquidity mining scenarios within the Berachain ecosystem, and plans to expand to cross-chain bridging and derivatives markets in the future.

Berabot : Native TG Trading Bot

Berabot is Berachain's native Telegram Trading Bot, which provides trading services for large-scale users after the launch of the Berachain mainnet.

Unlike other Telegram Trading Bots, Berabot adopts a tiered fee structure, with transaction fees ranging from 0.1% to 1%. The specific rate will be dynamically adjusted based on factors such as the NFTs held by the user, referral points, etc. It is worth noting that all fees collected will be 100% returned to token holders in the form of revenue sharing.

Berabot was launched on the first day of Berachain mainnet, and its native token $BBOT was issued at the same time.

BurrBear : A one-stop stablecoin trading platform

BurrBear is Berachain's native "one-stop stablecoin trading platform", which achieves ultra-high capital efficiency in stablecoin trading through an innovatively designed liquidity pool structure. Its core product line includes three modules:

The Multi Stable Pool, which focuses on stablecoin exchange, is optimized for classic trading scenarios between US dollar stablecoins; the innovative Burr Pool supports various stablecoin asset transactions, covering multiple endorsement types such as fiat currency, commodities, and on-chain synthetic assets; the generalized pool adopts a multi-token constant product model to meet the needs of conventional token exchange.

The project's first Oracle Registry mechanism aggregates multi-source price data to provide accurate on-chain pricing references for various stablecoins. The NFT series (such as Printing BurrBeras) launched at the same time not only have collection value, but also holders can enjoy transaction fee discounts, governance proposal priority and other rights.

BurrBear has completed smart contract audits from Boyco and other institutions, and plans to achieve community governance through the $BURR token.

Honeypot Finance : Full-stack DeFi infrastructure

Honeypot Finance positions itself as the "liquidity proof accelerator" of the Berachain ecosystem. Through the three modules of Dreampad fair launch platform, Pot2Pump Meme launch engine and POT-WASABEE DEX, it builds a full-stack DeFi infrastructure covering token issuance, liquidity optimization and trading scenarios. Its original "flywheel model" deeply binds community participation and protocol liquidity.

Core mechanism analysis:

Liquidity arms race: Pot2Pump adopts a liquidity crowdfunding model similar to Daos.fun . Early participants inject funds as "liquidity soldiers". The automated liquidity manager (ALM) dynamically adjusts the centralized liquidity range to ensure that Meme coins have completed deep liquidity deployment before DEX goes online.

Fair issuance revolution: Dreampad supports the FTO hybrid issuance model, combining Fjord Foundry's LBP mechanism with fixed price sales, and controls the rhythm of liquidity extraction through a constant product formula to avoid drastic price fluctuations in the early stages of token listing;

Meme-exclusive transaction layer: POT-WASABEE DEX designs an incentive mechanism based on the characteristics of Meme coins, allowing project parties to deploy customized transaction fee collection hooks and inject part of the transaction fees into the liquidity mining pool, forming a symbiotic relationship between token holders and traders.

Project Token$HPOT Acts as an accelerator of the liquidity flywheel: DEX transaction fees, Pot2Pump's Meme coin issuance commission, Dreampad's IDO service fees and other income are redistributed to liquidity providers through the veHPOT governance pledge system. Its "liquidity proof" mechanism links the verification node income with the protocol TVL, and promotes Berachain validators to actively provide liquidity guidance services for ecological projects. It has reached strategic cooperation with institutions such as OKX.

Infrared : Native Liquid Staking Protocol

Infrared Finance is Berachain's native liquid staking protocol, focusing on building liquidity solutions around Berachain's unique Proof of Liquidity (PoL) mechanism. Its core products include two liquidity pledge tokens, $iBGT and $iBERA, as well as the supporting Vault system

The protocol architecture consists of three core modules:

Yield tiering engine : staking income is allocated to iToken holders first, and the rest is allocated to node operators

Liquidation protection layer : Introduce a dynamic debt ceiling mechanism to prevent large-scale liquidations by real-time monitoring of the mortgage rate

Cross-chain Gateway : Deeply integrated with the BEX cross-chain bridge, supporting seamless access of multi-chain assets to the Berachain staking system

Its "elastic validator network" allows any node that meets the 500,000$BERA pledge threshold to join freely, and optimizes the distribution of validator income in real time through algorithms.

As the official infrastructure of Berachain, Infrared has achieved deep integration with the native DEX platform BEX. The white paper shows that the protocol has specially optimized the MEV resistance mechanism and protected transaction privacy through threshold encryption technology.

InterPoL : Native Liquidity Governance Protocol

InterPoL is Berachain’s native liquidity governance protocol . The protocol allows token creators, launchpads, and protocols to continue to participate in PoL mining to earn revenue while locking liquidity, thereby solving the problem of “liquidity deployment is idle” for ecological projects and realizing programmable operation of POL assets through smart contracts.

The technical architecture of the protocol consists of three key modules:

POL as a Service (POLaaS) allows project owners to create liquidity pools with one click and retain asset ownership;

The liquidity staking layer converts locked LP tokens into interest-bearing assets;

The cross-chain adapter supports the migration of POL to other chains to participate in yield farming.

This design allows the initial liquidity deployed by the project party to participate in Berachain's liquidity proof flywheel at the same time, achieving the compound effect of "deployment equals profit".

Kodiak Finance : Native Liquidity Management Platform

Kodiak Finance is the native liquidity management platform of the Berachain ecosystem, providing a full range of liquidity solutions for the ecosystem through a vertically integrated multi-layer architecture.

The project is designed with four closely coordinated core modules:

The core trading layer (Kodiak DEX) adopts a hybrid AMM mechanism, combining full-range and centralized liquidity strategies to provide users with a highly capital-efficient decentralized trading experience. Its upper-layer automated liquidity management system (Kodiak Islands) helps ordinary users participate in centralized liquidity management through a "set-and-forget" strategic vault.

At the same time, the project has designed an integrated incentive layer (Sweetened Islands) to ensure the sustainable development of the ecosystem. By connecting to Berachain's liquidity proof mechanism, it provides continuous and stable incentives for Kodiak Islands. At the same time, it is equipped with a codeless token deployment factory (Panda Factory) , which supports project parties to issue tokens and initialize liquidity on the full range of AMMs with one click, which is particularly suitable for highly volatile assets whose price characteristics are not yet clear.

The project has completed multiple rounds of security audits and established a deep cooperative relationship with the Berachain core team.

Ooga Booga : Native DEX Aggregator

Ooga Booga is the native DEX aggregator of the Berachain ecosystem (officially defined as "native liquidity aggregator"). Its core innovation lies in integrating 12+ liquidity sources (including HoneySwap, Bex Protocol, etc.) to achieve optimal price discovery. The key mechanisms are as follows:

Off-chain deep simulation : Scan liquidity distribution in real time based on graph theory models, and predict transaction-by-transaction impact costs for the centralized liquidity characteristics of AMMs (such as HoneySwap of Berachain);

On-chain security : Through the output verification mechanism, the "slippage guarantee" is enforced. Even if the backend algorithm is attacked, users can still obtain the preset minimum output amount.

In terms of technical architecture, its off-chain engine adopts the "liquidity fragment reorganization" strategy, modeling the decentralized v3 AMM liquidity pools (such as Bex Protocol) within the Berachain ecosystem as dynamic weight graphs, and previewing transaction paths in combination with real-time block status.

After the launch of the Berachain mainnet, Ooga Booga has become an important infrastructure for institutional funds to enter the market by virtue of its deep binding mechanism with the ecological token $HONEY (staking $HONEY can increase transaction fee discounts). The founding team includes former 1inch core developers and early Berachain contributors, and the technical route emphasizes the sustainable architecture of "complex calculations off-chain and key verifications on-chain".

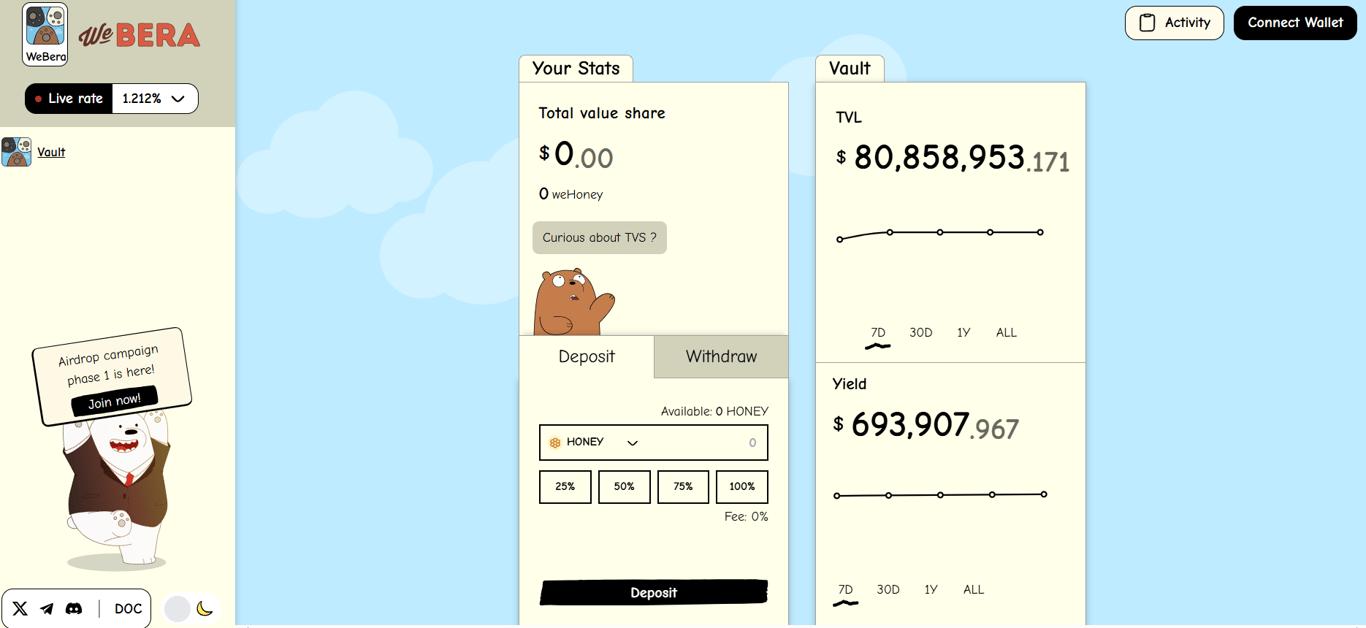

WeBera : Native DeFAI protocol

WeBera is Berachain's native "DeFAI" protocol, which deeply integrates AI technology with DeFi income strategies. The core product logic seeks to solve two problems currently faced by DeFi users: fragmented operations of cross-protocol income management, and the risk of strategy failure under market fluctuations.

In terms of technical architecture, WeBera uses the ERC-4626 standard to design a tokenized treasury system, making each strategy pool composable. Its AI Optimizer module dynamically adjusts the allocation ratio of funds in the AMM protocol and liquidity mining projects within the Berachain ecosystem by monitoring 20+ income protocol data in real time. In addition, WeBera uses 60% of the protocol income to repurchase $BGT, and combines it with the validator incentive design to form a compound growth model of income reinvestment.

Yeet : Comprehensive Infrastructure Agreement

Yeet is an innovative and practical infrastructure protocol (or comprehensive protocol) in the Berachain ecosystem.

Through the unique "quadratic proof of liquidity" (POL²) mechanism, a complete DeFi service matrix is built. With liquidity management as the core, Yeet focuses on three major sectors : YeetBonds bond agreement, Liquidity Trifecta Vault , and Yeet Game pledge game , forming a closed-loop ecology of "income acquisition-liquidity optimization-ecological feedback".

Users can participate in gamified mining by staking $BERA to obtain $YEET token rewards (holding Yeetard NFT can get up to 2x acceleration), or they can obtain tokens at a discount by purchasing YeetBonds. At the same time, the protocol will inject bond income into the liquidity treasury to achieve continuous accumulation of POL (protocol-owned liquidity).

At the same time, Yeet embeds the utility of NFT into DeFi scenarios - the Yeetard NFT it issues is not only a community identity identifier, but also associated with practical functions such as increased pledge weight and profit bonus.

2.GameFi & SocialFi

Bear Arena : Real-time Strategy Card Game

Bear Arena is the first large-scale blockchain game project in the Berachain ecosystem, which uses a combination of real-time strategy and card battle gameplay. Players can participate in PvP battles by collecting and cultivating Bear NFT characters with unique attributes. Each character has a unique skill combination and growth path.

The game's economic model revolves around the $HONEY token, and players can obtain rewards through daily tasks, ranked matches, and special events. The project has designed a "beehive system" that allows players to stake idle Bear NFTs for passive income, while providing liquidity support for the game ecosystem.

As of February 2025, Bear Arena has completed three rounds of internal testing, attracting more than 8,000 players. The project plans to open the first official season within two weeks after the mainnet launch and launch the Genesis NFT series containing 5,000 initial characters.

Bera Horses : Horse racing themed competitive game

Bear HORSES is a multi-mode blockchain game with horse racing as its theme. The core gameplay of the game revolves around horse racing, breeding and exploration. Players can participate in competitions and exploration missions in a unique fantasy world, and can also compete in multiplayer racing duels with other players.

The game is designed with a casual development system that allows players to customize stables, breed racehorses, and collect resources. The economic system is centered on the $HAY token, which supports peer-to-peer transactions and transfer of game asset ownership between players through an open market. Whether through competitive competitions, story missions, or casual gameplay, players can get corresponding rewards.

BeraTone : Farm management adventure 3A blockchain game

Beratone is Berachain's native AAA blockchain game, a multiplayer online farm management and adventure RPG created by a senior game development team. The game combines classic game elements such as "Stardew Valley", "Animal Crossing" and "Final Fantasy".

The core gameplay of the game consists of three main dimensions:

Farm Management System : Players can grow seasonal crops, raise livestock, and make handicrafts on their private farms to create a unique pastoral world.

Exploration and Adventure Mechanics : The game world is designed with rich exploration content, where players can collect resources, uncover secrets, complete tasks, and team up with other players for adventures.

Social interaction experience : As a complete online multiplayer game, BeraTone supports deep social interaction between players, including trading systems, cooperative tasks, and leaderboard competitions.

The project started development in the summer of 2022, and the core gameplay has been completed. The first playable version will be launched in 2025. Beratone adopts the "zero threshold" game design concept. Ordinary players can enter the game without holding tokens, and attract traditional game players through high-quality gaming experience. In terms of economic model, the project will generate income through the trading of limited edition in-game items and NFT assets.

Berally : A trading platform integrating SocialFi and AI Agent

Berally is the first decentralized social trading platform in the Berachain ecosystem that integrates SocialFi and AI agents. It is committed to using the dual-engine model of "no-code AI agent creation tool + on-chain asset management protocol" to benchmark mature products such as Friendtech and Hyperliquid Vault, aiming to enable users to create, own and profit from the trading activities of AI agents.

The agreement includes three main product modules:

The Pass reputation system allows users to establish an on-chain reputation system by minting social tokens (Pass) to form a "circle" community. Holders can automatically earn income through the liquidity proof (PoL) mechanism and realize "influence monetization" by setting trading strategy subscription fees, community access taxes, etc.

Pot Asset Management Protocol is an on-chain fund pool tool for professional traders. It supports users to create investment portfolios and raise funds from fans, and use Berachain's high-performance DEX (such as Kodiak) to execute complex strategies. Ordinary users can obtain passive income by following the investment of high-quality Pot, forming a two-way incentive ecosystem of "trading stars-fans".

Cybera AI Agent Network serves as a technical moat, providing a framework for creating AI agents without programming. Users can train dedicated agents to perform tasks such as market monitoring, strategy backtesting, and automatic trading, and obtain passive income through tax sharing and PoL mechanisms. The project has created an original "AI cluster collaboration" model, where different agents can form a task-based network to improve decision-making accuracy.

From the perspective of product positioning, Berally can be understood as a fusion of Friendtech, Ai16z and Hyperliquid Vault, but its functions are more powerful. The platform's AI agent can not only conduct token transactions, but also perform complex DeFi operations.

Honey Chat : A SocialFi app that can trade reputation on-chain

Honey Chat is Berachain's native decentralized SocialFi application. Based on the concept of "financialization of social capital", it builds an on-chain reputation pricing system on Berachain.

Its original "Access Pass Dynamic Token Model" adopts a segmented binding curve design, allowing creators to dynamically adjust the token supply based on community activity, allowing early supporters to capture the creator's IP value-added dividends by holding tokens, while forming a positive cycle of creator income and token destruction through on-chain transaction fees (0.3%-3%).

At the same time, the platform introduced a "social airdrop" mechanism (Beradrop), which quantified users' on-chain interactive behaviors (such as content creation, community governance, and liquidity contribution) into reputation points, and issued "achievement badges" based on the ERC-1155 standard. Through smart contracts, it realizes the tamper-proof storage and cross-protocol calls of on-chain behavioral data, providing the underlying data layer for subsequent DeFi protocol credit lending, DAO governance weight distribution and other scenarios.

In terms of technical architecture, Honey Chat adopts a hybrid storage solution: the core social relationship graph and content data are distributedly stored through IPFS, while the transaction order flow and token contracts are deployed in the Berachain EVM compatibility layer, using its sub-second block confirmation speed to support high-frequency social interaction scenarios. It is worth noting that its "social short" function allows users to place bearish bets on specific creator tokens through staking $HNY, forming a market-based reputation pricing correction mechanism.

Wizzwoods : A pixel-style farm management game

Wizzwoods is a pixel-style farming game. It is the first farm management game that integrates cross-chain functions and incorporates SocialFi elements. The project has been confirmed to be deployed on multiple chains including Berachain, Tabi Chain, TON and Kaia Chain. The game adopts a unique magic theme setting. Players can build territories in the game and earn $WIZZ tokens.

The game has designed a complex farm management system, including planting, upgrading and map customization functions, which cleverly combines casual games with immersive experiences. Players can get rewards by completing various tasks. This cross-chain game mechanism not only enriches the game content, but also provides players with more profit opportunities.

On the social side, Wizzwoods encourages player interaction and community building through the innovative SocialFi mechanism. The game economic model revolves around the $WIZZ token, ensuring the sustainable development of the game through carefully designed token economics.

We have also introduced Wizzwoods in detail before, please see the TechFlow article for details:

3. NFT & Meme

Beraplug : Community Meme Culture and Unique Destruction Protocol

Beraplug is the first community-driven ERC-20 token project in the Berachain ecosystem, originating from the Berachain and The Honey Jar communities. As an independent experimental project, Beraplug uses the innovative "Brown Hole" mechanism and Meme culture to redistribute assets, transfer the profits of short-term speculators to long-term supporters, and strengthen the long-term cohesion of the community.

$PLUG is Beraplug's Meme token, designed around the new "Brown Hole" economic model. Unlike traditional black hole protocols (such as Convex and Aura), Brown Hole does not permanently destroy tokens, but dynamically adjusts market supply based on a probabilistic mechanism. Through on-chain reputation scoring and incentive design, Beraplug encourages long-term holders to participate in ecosystem construction while ensuring asset liquidity. In addition, PLUG is deeply bound to Honey Comb NFT, an important asset of the Berachain community, to provide holders with exclusive rights and potential airdrops within the ecosystem.

Ooga Booga Beras : Bear Chain native NFT

OogaboogaBeras is a native NFT project on Berachain incubated by The Honey Jar. With its "cute Beras" image as its core, its design style emphasizes cuteness and humor, and it claims to be the cutest NFT series on Berachain. The project's slogan, such as "Such Cute! Such Wow! Such Ooga Booga!", reflects its relaxed and humorous brand positioning.

Steady Teddys : BearChain native NFT

Steadyteddys is an NFT project built on Berachain, with the core concept centered around community interaction and on-chain culture shaping. The project's NFT series is themed around the image of "Steady Teddys", with a unique artistic style and collection value. Currently, the project team is promoting the integration of Berarwave 2.0, intending to further optimize user experience and on-chain interaction through technological upgrades.

4. Projects throughout the Berachain ecosystem

The Honey Jar : The most influential incubation facility in the BearChain ecosystem

The Honey Jar (AKA THJ) is the native community incubation studio of the Berachain ecosystem and one of the most influential infrastructure builders in the ecosystem.

THJ operates the most comprehensive data analysis studio in the ecosystem, deepening community participation through innovative projects such as ApiologyDAO and Henlo. Its six-generation Honey Jar NFT series serves as a symbol of community identity and an important part of ecosystem governance. The Standard & Paws rating system launched by THJ in the fourth quarter of 2024 has become the authoritative standard for quality control of Berachain projects.

After the launch of the Berachain mainnet, THJ will participate in network governance as a validator node, and plans to provide more infrastructure support for ecological development through tools such as InterPoL and CubQuests. Current platform data shows that more than 73,000 wallet addresses have interacted with the THJ ecosystem, of which about 1.9% of users hold Honeycomb privilege credentials.

Standard & Paws : BearChain's native professional investment and rating agency

StandardAndPaws is a professional investment research and rating agency native to Berachain. It conducts a comprehensive analysis of projects within the ecosystem through a structured rating system. It is led by ecosystem seed investor janitoor.eth and co-developed with The Honey Jar.

S&P has established a dedicated rating system that focuses on the four dimensions of transparency, credibility, feasibility and reliability of projects. By publishing in-depth research reports and project ratings, it provides objective and professional decision-making basis for ecosystem participants. S&P maintains close cooperation with ApiologyDAO, and provides professional research support for the entire ecosystem through a rigorous analysis framework without providing specific investment advice.

In Berachain’s three-token economic model, S&P deeply couples the minting mechanism of the HONEY stablecoin—highly rated DeFi protocols can obtain higher leverage multiples, and for the first time, risk assessment is directly embedded in the liquidity generation link.

ApiologyDAO : A native DAO that guides the circulation of resources within the ecosystem

ApiologyDAO (apDAO) is the native core financial infrastructure of the Berachain ecosystem incubated by The Honey Jar. Its design concept is derived from the "Fat Bera Thesis". The theory believes that protocols with endogenous applications will dominate the DeFi field if they can share value with external protocols, applications and communities. As a "beehive" in the ecosystem, apDAO guides investment and resources to various DeFi protocols in the ecosystem and promotes liquidity integration.

The specific manifestations are:

Ecological value capture : By investing in Berachain's endogenous underlying protocols (such as liquidity layer, stablecoin system), the protocol income is distributed proportionally to exogenous applications (such as DEX, lending platform) and community members, forming a closed-loop economic model of "sticky liquidity".

Governance and participation : DAO seats are tied to Honey Jar Gen6 NFTs, 55% of seats are held by THJ ecosystem partners and early community members, and 45% are open to the public. Members can participate in key decisions such as fund allocation and protocol screening by staking Honeycomb NFTs and the sixth-generation Honey Jar series.

Revenue sharing mechanism : cooperative projects need to inject part of their profits or token shares into the DAO treasury. Members can obtain a share of the protocol fee, token airdrops and exclusive governance rights through staking certificates.

HENLO : A native Meme community with ecological influence

HENLO is one of the most influential meme projects in the Berachain ecosystem, also incubated by The Honey Jar. Although the project calls itself a pure meme, HENLO actually has considerable influence in the ecosystem through its unique community culture and deep integration with Berachain, and can be seen as a bridge to guide users into the Berachain ecosystem. The project received a $3 million seed round of financing led by ViaBTC Capital at the beginning of its launch in September 2024, becoming the first Berachain meme token to receive institutional investment.

In terms of technical architecture, HENLO deeply integrates Berachain's PoL mechanism, allowing users to obtain liquidity proof tokens plHENLO by staking $BERA. While retaining the meme propagation attribute, the stability mechanism of plHENLO provides a buffer for the token price. Currently, more than 52,000 $BERA are locked in the protocol. The HENLO Games module recently launched by the project realizes the token consumption scenario through on-chain mini-games, forming a closed loop of "acquisition-use-destruction".

According to the roadmap disclosed in February 2025, HENLO plans to launch an NFT staking protocol after the TGE (Token Generation Event), allowing users to earn additional income by staking Honeycomb NFTs. The project has currently completed 87% of the pre-mining allocation, and the remaining tokens will be used for liquidity incentives and game ecosystem construction.

summary

One week after the mainnet was launched, the Berachain ecosystem has taken shape.

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A