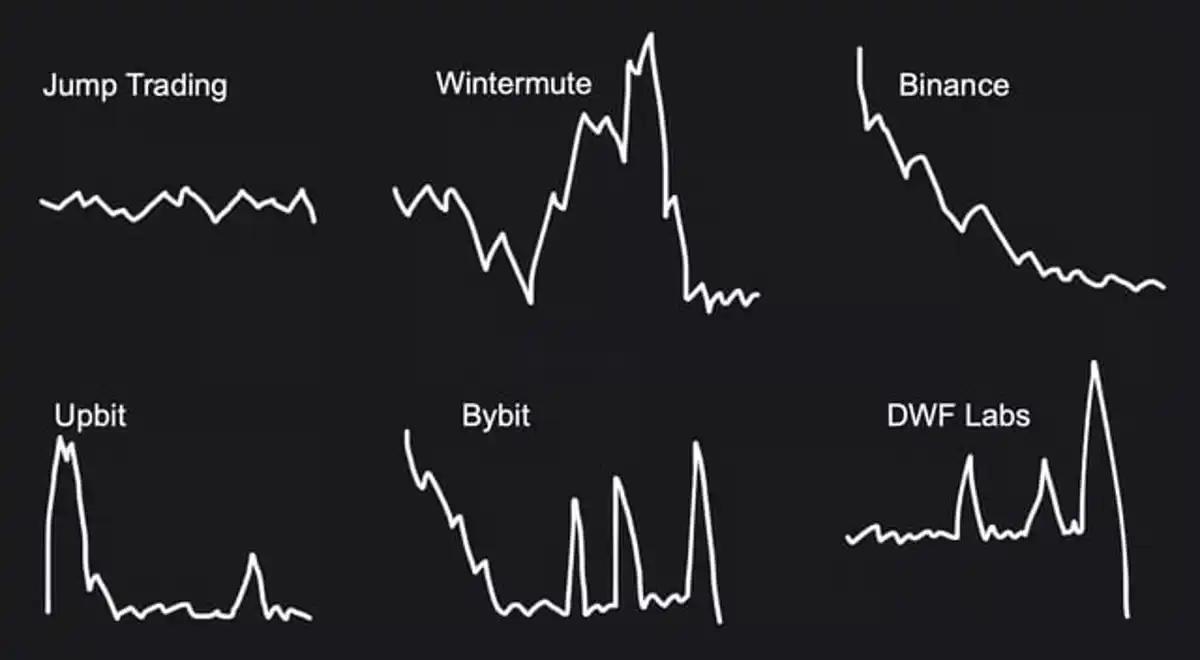

The market has been falling continuously, and many Altcoins have already fallen as much as they can, and many people believe that a bear market has arrived. The market adjustment period is often a stage of concentrated risk release, but it also contains opportunities for investors to improve their understanding and accumulate strength. Looking back on this market cycle, the exit strategies of various market makers have been quite varied, and the carefully designed selling techniques are worth our in-depth analysis.

Traditional market manipulation theory believes that the operation of market makers is mainly divided into four stages: accumulation, price increase, washing, and selling. However, the core essence is always the precise control of the emotions and behaviors of market participants. Through stock price fluctuations and the passage of time, market makers can subtly influence the decisions of retail investors, ultimately maximizing their own interests.

So, in the complex and changing market environment, how can retail investors effectively identify the signals of market makers' selling? How can they improve their own risk awareness and avoid falling into traps? BlockBeats has summarized typical selling tricks, including single-sided liquidity pools, false buyback incentives, spot market control and contract harvesting, and high-yield staking, for readers' reference.

Add single-sided liquidity pools, short to catch the white wolf

The typical operation of the single-sided liquidity pool selling method is the LIBRA token that was recently endorsed by the President of Argentina. The LIBRA project team set up LIBRA-USDC and LIBRA-SOL single-sided liquidity pools on the Meteora platform, where they only added LIBRA tokens and did not add any counterparty assets such as USDC or SOL.

Source: Bublemaps

The operation of the single-sided pool is that if only SOL is added, then when the SOL price rises, it is equivalent to continuously selling SOL to exchange for USDC. If only USDC is added, then when the SOL price falls, it will continuously buy SOL. Applying this logic to LIBRA, since the LIBRA pool only has LIBRA and no USDC or SOL, any buy order for LIBRA will directly push up the price, as there is no sell order counterparty, forming an early "only up, not down" illusion.

And because the project team controlled the vast majority of the circulating LIBRA tokens in the early stage, they did not need to provide real stablecoins or ETH as counterparties like Uniswap and other platforms. The project team only needs to place their own LIBRA tokens at different price levels, and these buy orders will be continuously executed due to the lack of circulating sell orders, further pushing up the price and creating a false prosperity.

When the "false prosperity" attracts a large number of investors to enter the market, and the price is pushed up to a high level with sufficient capital inflow, the project team will then take the next step - withdraw the pool. They will quickly transfer the stablecoins or other assets invested by previous investors to a pre-set collection address. Due to the special nature of the single-sided liquidity pool, there are no assets available for exchange in the pool, and investors are actually unable to sell LIBRA at this time, while any new buy orders will only further push up the price that is no longer supported by reality, and the project team has completed their selling purpose.

In addition to manipulating the price, the LIBRA project team also utilized the custom fee function of the CLMM pool. In this way, they earned an additional $10-20 million in fees during the entire process, which is similar to the high fees charged by TRUMP at the time.

Furthermore, Mindao, the founder of the DeFi protocol dForce, analyzed that although Uniswap V3 also provides single-sided liquidity functionality, its main purpose is to improve capital utilization and meet the needs of professional market makers. The key for LIBRA is its complex pool setup and high customization, which makes its single-sided liquidity pool design not for providing liquidity, but for facilitating subsequent price manipulation and liquidity withdrawal.

Buyback incentives but no breakthrough in the sideways trading range

In August 2023, the recently launched GambleFi platform Rollbit officially announced that it would change its token economics, with 10% of Casino revenue, 20% of Sportsbook revenue, and 30% of 1000x contract revenue to be used for daily buyback and burning of RLB. After this news was released, the token price rose due to the stimulus, but within two months, the token price has been continuously falling, and community users gradually discovered that there was a hidden "selling" operation behind it - the Rollbit team was washing tokens through the Rollbit Hot Wallet, and then selling the tokens to the market through algorithmic selling addresses.

Buybacks are usually seen as a means for project teams to stabilize the market and increase token prices. Normally, the funds for buybacks should come from the project team's profits or capital appreciation, but if these funds come from the project team's "hot wallet" - an internal wallet used to store a large amount of tokens or funds - then these funds are not external capital inflows to the market, but funds pre-held by the project team.

Assuming the project team uses funds from their own hot wallet to invest in the buyback market, these funds actually still belong to the project team themselves. When the project team uses these funds to buy tokens in the market, the tokens may not be truly burned or disappeared, but may flow back to the project team's control through their hot wallet, and then re-enter the market through the project team's algorithmic selling addresses.

As the token price continues to fall, community members question the lack of transparency from the Rollbit team in different chains and markets.

The "sell 30%, buyback 10%" approach will not be able to effectively increase the token price, but is another carefully deployed selling scam by the project team.

Spot market control, contract short positions crazily harvested

"If you don't like it, you can short" has become one of the most successful trading tactics within the community. Although the funding rates of new tokens are now often at the maximum, up and down, most secondary trading targets have experienced a few days of decline, followed by a rapid rise, and then entered a long period of downward trend. Little did they know that this is also a way of selling, the core of which is to utilize the lack of liquidity in the contract market and the psychology of retail investors chasing rising and falling prices.

The whole process can be summarized in several stages: First, in the early stage of the new token launch, market makers usually choose not to support the price, allowing early airdrop recipients to sell, the main purpose of which is to wash out short-term speculators and clear the way for subsequent operations.

Then, the market makers start to prepare for the price increase and selling. Before that, they will try to control the spot market inventory as much as possible, reducing the circulation, ensuring that the sell-side cannot have a substantial impact on the price, and also limiting the possibility of borrowing by short sellers. With the spot inventory firmly controlled, the market makers can use relatively little capital to drive up the price, even triggering a short squeeze. When users choose to follow along and buy spot and open long positions, it accumulates enough buyers for the project team/market makers/institutional investors to start selling in batches.

When the short positions in the market are reduced and the price is pushed up to a certain level, the market makers will start to harvest liquidity through the contract market. They will quickly drive up the token price to attract retail investors to chase the rise, creating a false prosperity. This round of price increase is usually significant in magnitude, but generally will not exceed the opening price. Subsequently, the open interest in the contract will increase significantly, and the funding rate will start to turn negative, which is a signal that the market makers are starting to build short positions.

Finally, the manipulators will gradually sell in the spot market, although this part of the profit is limited, but more importantly, they have obtained sufficient exit liquidity through shorting in the contract market. A large number of retail investors become long positions in the chasing process, providing counterparties for the market makers' short positions. As the market makers continue to increase their short positions in the contract market and sell in the spot market, the token price begins to fall, causing a large number of long positions to be liquidated, thereby achieving double harvesting.

Small investors can't play the staking game

The launch of a token's staking function was once seen as a positive development in a project's operations, with the intention of incentivizing users to participate in network maintenance, reducing market circulation through locked positions, and enhancing the scarcity of the token. However, many projects have used this mechanism as a cover to execute sell-offs and cash out.

Project teams attract investors to lock up large amounts of their holdings through high-interest staking rewards, ostensibly to stabilize the token price by reducing market circulation. But the actual result is often that the majority of the floating supply is trapped in locked positions, unable to exit in a timely manner. In this process, the project team and the staking retail investors operate in an information-asymmetric environment, where the former can freely offload their holdings while also earning high staking rewards, continuously dumping the price.

Additionally, there is a common script where, when the staking period ends, investors start panic-selling the tokens, and the project team then buys back the tokens at low prices. Once the market sentiment stabilizes and the price recovers, the team completes their sell-off, leaving the late-arriving investors as the 'cannon fodder'.

Reviewing the above sell-off tactics, their essence is the precise control and manipulation of market expectations and investor psychology. To survive in the volatile market, retail investors need to have the 'mindset of the big player'. This does not mean manipulating the market like the big players, but rather possessing the ability to think independently, not being swayed by market emotions, anticipating risks in advance, and formulating corresponding strategies.

The market is an amplifier of emotions, and only by maintaining calmness and rationality can one avoid becoming the target of exploitation. Next time you hear words like 'buyback', 'staking', or 'single-sided pool', be more vigilant, as they may be part of the project team's carefully designed 'traps'. Feel free to share in the comments what other sell-off tactics you are aware of.

Reference links:

https://x.com/MasonCanoe/status/1891364478572462296

https://x.com/kylopeung/status/1891063885911716341

https://x.com/Michael_Liu93/status/1830425923403059603