From the Bitcoin spot ETF to the tokenization wave, the institutional forces represented by Wall Street are profoundly influencing and changing the direction of the crypto market, and we believe this force will grow stronger by 2025. OKG Research has launched the "Wall Street on-Chain" research series to closely follow the innovation and practice of traditional institutions in the Web3 field, and see how top institutions like BlackRock and JPMorgan Chase embrace innovation? How will tokenized assets, on-chain payments, and decentralized finance shape the future financial landscape?

This article is the 4th in the "Wall Street on-Chain" research series.

Previous content can be accessed by clicking:

1. Wall Street Accelerates "On-Chain"

2. How Much Time is Left for Hong Kong's RWA Tokenization?

3. The Power Game Behind Wall Street's "On-Chain" Roadmap

Figure Markets recently obtained approval from the U.S. Securities and Exchange Commission (SEC) to launch the first interest-bearing stablecoin YLDS. This not only marks the recognition of the U.S. regulatory authorities for crypto-financial innovation, but also indicates that stablecoins are evolving from a simple payment tool to a compliant yield-bearing asset. This may open up greater imagination for the stablecoin track, making it the next innovative field after BTC that can attract large-scale institutional capital.

Why did the SEC give the green light to YLDS?

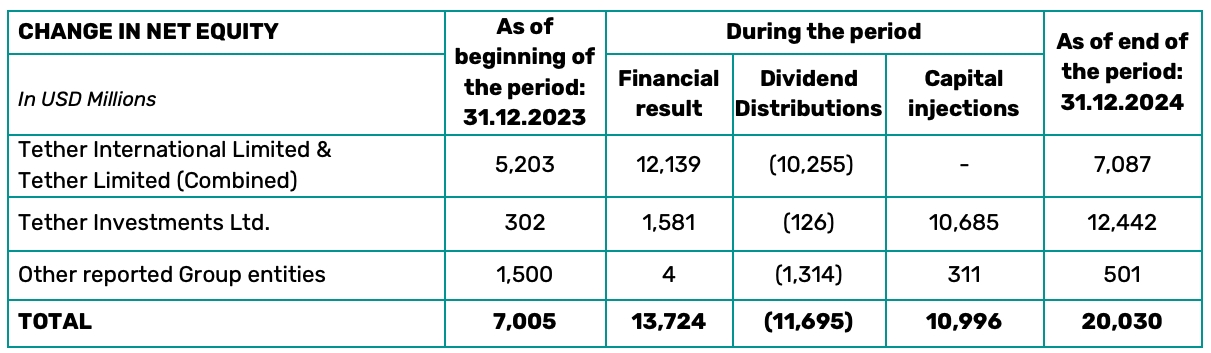

In 2024, the issuer of the stablecoin USDT, Tether, achieved an annual profit of $13.7 billion, even exceeding the traditional financial giant Mastercard (about $12.9 billion). Its profits mainly come from the investment income of the reserve assets (mainly U.S. Treasuries), but these are irrelevant to the holders, and users cannot obtain asset appreciation and investment returns through USDT - this is precisely the breakthrough point that interest-bearing stablecoins aim to disrupt the existing pattern.

Tether's Financial Report (2024)

The core of interest-bearing stablecoins lies in the "redistribution of asset income rights": in the traditional stablecoin business model, users exchange stability for the time value of their funds, but interest-bearing stablecoins can directly provide holders with returns while maintaining stability by tokenizing the income rights of the underlying assets. More importantly, interest-bearing stablecoins hit the pain point of the "silent majority": although traditional stablecoins can also obtain yields through pledging, the complex operations and security compliance risks have hindered large-scale user adoption. In contrast, "hold-to-earn" stablecoins like YLDS make investment returns accessible without barriers, truly realizing the "democratization of returns".

Although transferring the underlying asset income to holders will reduce the issuer's profits, it also greatly increases the attractiveness of interest-bearing stablecoins. Especially in the current unstable global economic environment and persistently high inflation, both on-chain users and traditional investors have an increasing demand for financial products that can generate stable returns. Products like YLDS that are both stable and can provide yields far higher than traditional bank interest rates will undoubtedly become the "darling" in the eyes of investors.

But these are not the main reasons why the SEC approved YLDS. The key reason why YLDS was able to get the green light from the SEC is that it bypassed the core controversies of SEC regulation, making it compliant with the current U.S. securities laws. Since a systematic stablecoin regulatory framework has not yet been introduced, the current U.S. stablecoin regulation mainly relies on existing laws, but various agencies including the SEC and CFTC have different definitions of stablecoins, trying to gain the dominance of stablecoin regulation. The power struggle between different regulatory agencies, as well as the divergence in recognition between regulation and the market, have led to a chaotic situation in U.S. stablecoin regulation, making it difficult to form a basic consensus. However, interest-bearing stablecoins like YLDS, with a structure similar to traditional fixed-income products, are clearly within the "securities" category even under the current legal framework, and there is no controversy. This is the prerequisite for YLDS and similar interest-bearing stablecoins to be included in the SEC's regulation.

But this also means that, while the approval of YLDS indicates that the U.S. crypto regulatory attitude continues to improve, and the regulatory authorities including the SEC are actively adapting to the rapidly developing stablecoin and crypto-finance market, and the regulation of stablecoins is shifting from "passive defense" to "active guidance", this cannot change the regulatory dilemma faced by traditional stablecoins like USDT/USDC in the short term. More transformations still need to wait until the U.S. Congress formally passes the stablecoin regulatory bill. Industry generally expects that the U.S. stablecoin regulatory bill may be gradually implemented within the next 1 to 1.5 years.

However, YLDS distributes the interest income of the underlying assets (mainly U.S. Treasuries and commercial papers) to the holders through smart contracts, and uses a strict KYC verification mechanism to link the income distribution to compliant identities, reducing regulatory concerns about anonymity. These compliant designs provide a reference for other similar projects to seek regulatory approval. In the next 1-2 years, we may see more compliant interest-bearing stablecoin products, and also force more countries and regions to consider the necessity of developing and regulating interest-bearing stablecoins. For regions like Hong Kong and Singapore that have already introduced stablecoin regulations and generally treat stablecoins as payment tools, when facing clearly securities-like interest-bearing stablecoins, in addition to adjusting the existing regulatory system, they may also consider incorporating them into the regulation of tokenized securities by restricting the types of underlying assets of interest-bearing stablecoins.

The Rise of Interest-Bearing Stablecoins Will Accelerate the Institutionalization of the Crypto Market

The SEC's approval of YLDS not only demonstrates the openness and friendliness of the current U.S. regulation, but also indicates that in the mainstream financial context, stablecoins may evolve from "cash substitutes" to a new type of asset with dual attributes of "payment tool" and "yield tool", which will accelerate the institutionalization and dollarization of the crypto market.

Although traditional stablecoins have met the demand for crypto payments, due to the lack of interest income, most institutions only use them as short-term liquidity tools. In contrast, interest-bearing stablecoins can not only generate stable returns, but also improve capital efficiency and instant settlement capabilities through disintermediated and 24/7 on-chain trading. Ark Invest's latest annual report points out that hedge funds and asset management institutions have already started to incorporate stablecoins into their cash management strategies, and the SEC's approval of YLDS will further allay institutional compliance concerns and raise the acceptance and participation of institutional investors in such stablecoins to new heights.

The influx of large-scale institutional capital will further drive the rapid growth of the interest-bearing stablecoin market, making it an increasingly indispensable part of the crypto ecosystem. To cope with competition and meet market demand, OKG Research is optimistic that interest-bearing stablecoins will experience explosive growth in the next 3-5 years, and account for about 10-15% of the stablecoin market, becoming another crypto asset category after BTC that can attract large-scale institutional attention and capital inflows.

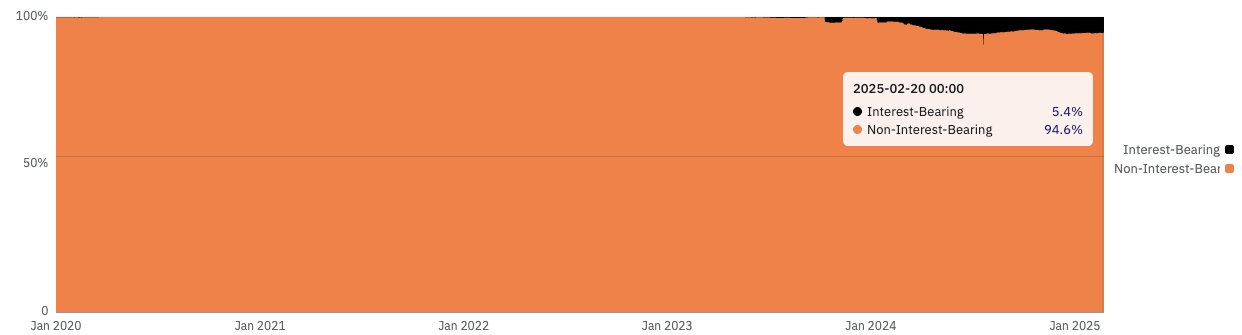

Share of Interest-Bearing Stablecoins in the Ethereum Ecosystem (@21co, as of 2025/2/20)

The rise of interest-bearing stablecoins will further consolidate the dominance of the US dollar in the crypto world. The current sources of income for interest-bearing stablecoins are mainly threefold: investment in US Treasuries, blockchain staking rewards, or structured strategy returns. Although the synthetic US dollar stablecoin USDe launched by Ethena Labs achieved great success in 2024 and became a major player in the interest-bearing stablecoin market, this does not mean that staking and structured strategies as a source of income will become mainstream. On the contrary, we believe that interest-bearing stablecoins backed by US Treasuries will remain the preferred choice for institutional investors.

Although the physical world is accelerating de-dollarization: China and Japan have sold large amounts of US Treasuries in the past few years, and Saudi Arabia also announced in June 2024 that it will not renew the "petrodollar agreement" that has lasted for half a century, causing the US dollar to decouple from oil after decoupling from gold, and the BRICS countries are constantly trying to bypass the SWIFT network to reduce their dependence on US dollar payments, the on-chain digital world is continuously gravitating towards the US dollar. Whether it is the large-scale application of US dollar stablecoins or the tokenization wave initiated by Wall Street institutions, the US is constantly strengthening the influence of US dollar assets in the crypto market, and this dollarization trend is being reinforced.

The possibility of a short-term reversal of this trend is relatively small, because in terms of liquidity, stability, and market acceptance, there are currently no more alternative choices for tokenization innovations and the crypto finance market other than US dollar assets represented by US Treasuries. The SEC's approval of YLDS also indicates that the US regulatory authorities have given the green light to US Treasury-backed interest-bearing stablecoins at this stage, which will undoubtedly attract more projects to launch similar products in the future. This is also the reason why, although we know that the income model of interest-bearing stablecoins will definitely become more diversified in the future, and the reserve assets may also be expanded to real estate, gold, corporate bonds, and other types of RWA, we still believe that US Treasuries as a risk-free asset will continue to dominate the underlying asset pool of interest-bearing stablecoins.

Conclusion

The approval of YLDS is not only a compliant breakthrough in crypto innovation, but also a milestone in financial democratization. It reveals a simple truth: the market's demand for "money making money" is eternal, given the risk can be controlled. With the improvement of the regulatory framework and the influx of institutional capital, interest-bearing stablecoins may reshape the stablecoin market and enhance the dollarization trend of crypto financial innovation. However, this process also needs to balance innovation and risk, and avoid repeating past mistakes. Only in this way can interest-bearing stablecoins truly achieve the goal of "letting everyone earn money while lying down".