Unlike the gradual warming of the recent temperature, since Bitcoin fell below $90,000 on February 25, the cryptocurrency market has been on a downward trend. Around 10:50 am today, Bitcoin even fell below the $80,000 mark, hitting a new low in the past 3.5 months. Coingalss data shows that in the past 24 hours, the total liquidation amount reached $728 million, of which about $621 million was long liquidation and about $107 million was short liquidation. In addition, according to Alternative.me data, although the cryptocurrency fear and greed index has rebounded slightly from yesterday, it is still in a "extreme fear" state.

However, in this anxious market environment, the recent actions of the US financial regulatory authorities have implied that their previously tough attitude towards cryptocurrencies is softening, and the "ice" of hostile regulation is slowly melting.

The Attitude of the New US SEC

If the previous US SEC led by Gary Gensler was full of hostility towards the cryptocurrency industry, the attitude of the new US SEC can be said to be actively embracing. Since Gary Gensler officially stepped down on January 21, the new US SEC, under the leadership of Acting Chairman Mark Uyeda, is working hard to change its image in people's minds.

In the past week, the US SEC has successively ended its investigations and enforcement actions against OpenSea, Robinhood Crypto, Uniswap Labs, and Gemini, and has officially withdrawn its lawsuit against Coinbase and plans to withdraw its lawsuits against ConsenSys and MetaMask. In addition, Binance and the US SEC submitted a joint motion earlier this month to suspend the litigation for 60 days on the grounds that "the newly formed cryptocurrency working group may have an impact on the case", which is the first request for a suspension of cryptocurrency-related litigation since Mark Uyeda took over as acting chairman. Affected by this, the TRON Foundation and Justin Sun also filed a joint motion with the US SEC to suspend the litigation.

Furthermore, regarding the controversial Memecoin, the US SEC has also changed its ambiguous attitude and issued clear guidance, stating that it "is not a security, but rather a collectible". The US SEC believes that the trading of Memecoins does not involve the issuance and sale of securities as defined by federal securities laws. Therefore, individuals involved in the issuance and sale of Memecoins do not need to register their transactions with the Commission under the Securities Act of 1933, nor do they need to meet the registration exemption provisions of the Securities Act. Of course, the department also pointed out that the buyers or holders of Memecoins are not protected by federal securities laws.

Perhaps due to the recent market downturn and the SEC's proactive and frequent signaling, people have begun to observe its huge changes. In fact, since the establishment of the new US SEC, various actions have never stopped.

The day after Gary Gensler officially resigned, Mark Uyeda announced the establishment of a special cryptocurrency working group led by Hester Peirce, "dedicated to developing a comprehensive and clear regulatory framework for cryptocurrency assets". On January 24, the US SEC officially revoked the cryptocurrency asset accounting standard SAB-121, which can be seen as the "first shot" of its comprehensive reform. Subsequently, the US SEC began to reduce the scale of the cryptocurrency law enforcement department, transferring some lawyers and staff to other departments, and forming a new task force, announcing ten tasks such as examining the status of different types of cryptocurrency assets under securities laws and providing clear statements on whether to approve or not approve cryptocurrency ETFs. Next, we saw various news about the SEC's review of ETFs, such as publicly seeking comments on the Grayscale Litecoin ETF, accepting the 19b-4 application for the Grayscale Solana ETF, accepting the application for the Grayscale XRP Trust conversion ETF, and accepting the 19b-4 application submitted by Cboe BZX to add staking functionality for the 21Shares Ethereum ETF.

All of this foreshadows that the new SEC will present a completely different image.

Other Regulatory Developments Beyond the US SEC

In addition to the SEC's positive reforms in cryptocurrency regulation, other regulatory developments are also worth noting.

The US House Ways and Means Committee recently passed a resolution to repeal the IRS "DeFi Broker Rule" by a vote of 26 to 16, which is a major boon for DeFi. It is worth noting that the resolution still needs to be passed by a majority in the House and Senate, and signed by the President to take effect.

Furthermore, at the first hearing of the US Senate Banking Digital Assets Subcommittee chaired by Cynthia Lummis, the legislative progress of stablecoins became the focus. Lummis emphasized that stablecoins will be the top priority for the subcommittee in the coming months, and "plans to develop a bipartisan legislative framework for stablecoins and their market structure within the next few months". Former CFTC Chairman Timothy Massad also suggested at the hearing that lawmakers should prioritize the legal framework for stablecoins and postpone issues related to market structure. In addition, Virginia Democrat Mark Warner asked the subcommittee members to discuss the possibility of KYC processes for stablecoin users.

At the same time, more and more government departments are accelerating their efforts to listen to the voices of the cryptocurrency industry. For example, US Treasury Secretary Scott Bessent recently hired Galaxy Digital legal counsel Tyler Williams as a digital asset and blockchain technology policy advisor. According to Michael Saylor's disclosure, he recently met with US House Financial Services Committee Chairman French Hill and proposed a digital asset regulatory framework to him.

These initiatives from the government, regulatory agencies, and industry leaders all signify that the regulatory environment for cryptocurrencies is gradually maturing. In this context, although the current market is cold, from a long-term perspective, the cryptocurrency market may usher in a healthier and more standardized development period.

Beyond Regulation, the Progress of State-Level Strategic Bitcoin Reserves

Unlike the direct regulatory benefits released by the US SEC and various institutions, although the progress of the state-level strategic Bitcoin reserves has not been as smooth, it is still generally positive.

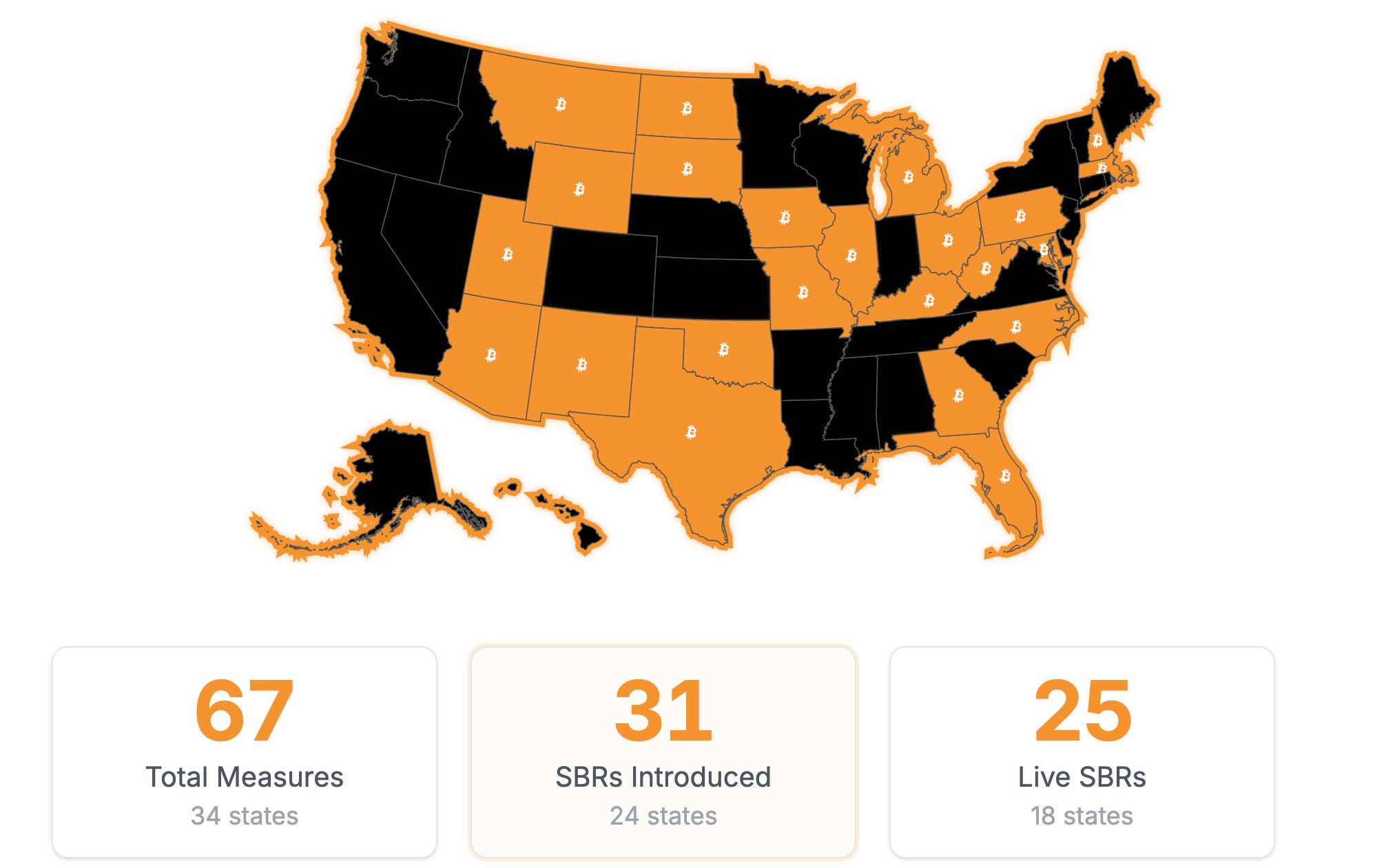

The "Bitcoin Laws" website established by Julian Fahrer shows that currently 24 states in the US have proposed strategic Bitcoin reserve bills, with a total of 31 bills. Among them, the Bitcoin reserve bills in Montana, South Dakota, North Dakota, Pennsylvania, and Wyoming have been rejected or postponed. The state with the fastest progress is Utah, where the relevant bill has been submitted to the Senate. Next is Arizona, where the relevant bill has passed the third reading in the Senate with a vote of 17 in favor and 12 against, and is now being submitted to the House for consideration. Other states with relatively advanced progress include Oklahoma and Texas.

Although the progress of different states varies, the legislative progress of strategic Bitcoin reserves indicates that local governments attach importance to and are adopting cryptocurrencies. Although it is unknown how the Trump administration is currently preparing for this strategy, it may be more reasonable to not act hastily.

Summary

Although the market is facing severe price fluctuations and the spread of panic caused by the largest hacker crisis in history, it is hoped that the gradual improvement of the regulatory environment can melt the regulatory "ice" of the past like a faint spring breeze, and inject new vitality into the market. As for the current downward trend, the author also suggests that everyone should wait and see for a while.