Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.8 trillion, with BTC accounting for 59.74%, which is $1.68 trillion. The stablecoin market capitalization is $224.1 billion, with a recent 7-day decline of 0.77%, of which USDT accounts for 63.6%.

This week, the price of BTC has shown a downward trend, with the current price at $84,020; ETH has also shown a downward trend, with the current price at $2,226.

CoinMarketCap shows that most of the top 200 projects have declined, with a few exceptions: RAY has a 7-day decline of 45.22%, TAO has a 7-day decline of 27.15%, MELANIA has a 7-day decline of 32.18%, PNUT has a 7-day increase of 72.44%, and VANA has a 7-day increase of 41.04%.

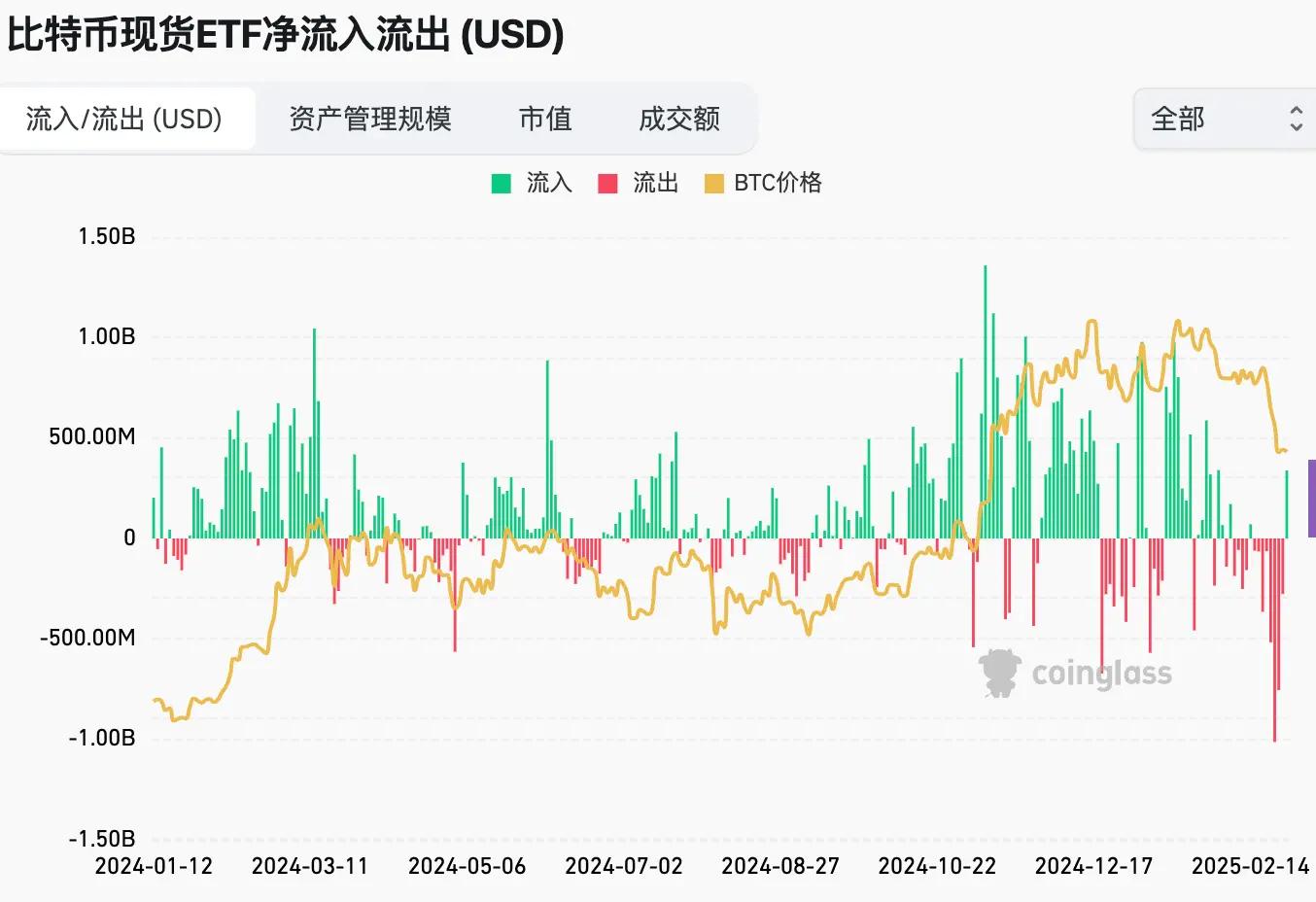

This week, the US Bitcoin spot ETF had a net outflow of $2.146 billion, and the US Ethereum spot ETF had a net outflow of $305.3 million.

On February 28, the "Fear & Greed Index" was 20 (lower than the previous week), with the market sentiment being 3 days of extreme fear, 2 days of fear, and 2 days of neutral.

Market Forecast: This week, the market experienced a significant decline, mainly due to the impact of celebrity coin fraud, US tariff increases, the $140 million theft from Bybit, and the upcoming large-scale unlocking of SOL by institutions. Stablecoins have seen negative growth, and US spot ETFs have seen the largest weekly outflows, with the fear index dropping to 10, a level last seen during the Luna collapse in 2022. However, even in the midst of extreme market fear, crypto whales like Bitdeer have continued to increase their BTC holdings. More positive news includes: 5 states rejecting, 7 states passing, and 18 states considering strategic Bitcoin reserve bills in the US; the US PCE price index for January meeting expectations; the SEC reaching settlements with multiple crypto companies; and an over 81.2% chance of the Fed cutting rates in June. From these, we can infer that the bull market still exists, and we can still expect BTC to reach new highs this year.

Understanding the Present

Review of the Week's Major Events

1. On February 23, Slow Mist founder Yu Xuan stated that the hacker behind the CEX theft incident was the North Korean Lazarus Group, and their attack methods have been revealed;

2. On February 25, the crypto research firm Bernstein released an analysis report stating that "the crypto market has been forced to shift towards 'useless' meme coins to avoid regulatory crackdowns on utility tokens and NFT projects, but with the Trump administration relaxing regulations, analysts expect liquidity to return to DeFi, GameFi, and NFT-driven tracks";

3. On February 25, according to Bloomberg, the traditional finance giant Citadel Securities, with a market capitalization of $65 billion, the largest market maker on the New York Stock Exchange, plans to enter the crypto currency market-making field, betting that President Trump's support for the crypto industry will bring market prosperity;

4. On February 26, according to the WSJ, the US SEC has abandoned its investigation into the DeFi company Uniswap Labs;

5. On February 26, Aya Miyaguchi, the Executive Director of the Ethereum Foundation, was promoted to become the Chairperson of the Ethereum Foundation. Aya Miyaguchi stated that she will uphold the values of Ethereum, advocate for diversity, and expand the influence of Ethereum's vision and culture, committed to making Ethereum's technology and social innovation serve human values. In 2013, Aya Miyaguchi was responsible for the Japanese region's operations at the trading platform Kraken. In February 2018, Aya Miyaguchi joined the Ethereum Foundation as Executive Director, primarily responsible for coordinating and organizing the Foundation's various activities, including internal affairs and community member collaboration, such as conducting education and hosting events;

6. On February 26, according to Cointelegraph, the "Strategic Bitcoin Reserve Act" in the US state of Ohio has passed the committee review stage and is one step closer to approval;

7. On February 26, according to Cointelegraph, the Solana SIMD-0228 proposal is now open, aiming to shift the SOL issuance towards a market-driven model. Voting is expected to take place in about 10 days. The proposal sets a 50% target staking rate to enhance the network's security and decentralization. If over 50% of SOL is staked, the issuance will decrease to suppress further staking; if less than 50% of SOL is staked, the issuance will increase to raise the yield and encourage staking. The minimum inflation rate will be 0%, and the maximum inflation rate will be determined based on Solana's current issuance curve;

8. On February 26, according to Cointelegraph, the "Strategic Bitcoin Reserve Act" in the US state of Ohio has passed the committee review stage and is one step closer to approval;

9. On February 27, US President Trump stated that the US will soon announce tariffs on the European Union. The tariffs may be 25% and will apply to automobiles and all other items;

10. On February 27, according to market news, the strategic Bitcoin reserve bill in the US state of Texas has passed the review stage of the Business and Commerce Committee and will be submitted to the Senate for consideration;

11. On February 27, BRN analyst Valentin Fournier stated that "US President Donald Trump's announcement of a possible 25% tariff on European goods has once again ignited investors' fears, causing the crypto Fear & Greed Index to drop to 10, in the extreme fear zone. While some are concerned about the start of a bear market, history shows that a 25% correction is common in a bull market cycle, and the US's efforts to establish a national crypto currency reserve remain an important long-term catalyst. We maintain a bullish stance and expect the market to rebound before the end of this week. We continue to increase our Solana holdings and remain neutral on BTC and ETH";

12. On February 28, according to Spot on Chain monitoring, the Bybit hacker has successfully laundered 50% of the stolen ETH. Over the past 5.5 days, the Bybit hacker has laundered a total of 266,309 ETH (about $614 million), accounting for 53.3% of the 490,000 ETH stolen, at an average of 48,420 ETH per day, mostly through conversion to BTC on THORChain. At the current pace, the remaining 233,086 ETH may be fully laundered in just 5 days;

13. On February 28, according to Reuters, Trump clarified the timing of the implementation of punitive tariffs on goods from Canada and Mexico: starting March 4, a 25% tariff will be imposed on goods from Mexico and Canada, while the April tariff adjustment involves an "equivalent tariff" policy. In addition, Trump threatened to further increase tariffs on Chinese goods by 10%;

14. On February 28, Unison Advisors' head Nir Kaissar believes that Trump may force the Fed to lower interest rates through fiscal tightening;

15. On February 28, according to market news, the US SEC has announced the termination of its civil enforcement action against Coinbase.

Macroeconomics

1. On February 18, the Reserve Bank of Australia lowered the benchmark interest rate by 25 basis points to 4.10%, the first rate cut since November 2020, reaching a new low since October 2023, in line with market expectations. The AUD/USD exchange rate rose nearly 20 points in the short term, currently trading at 0.6346;

2. On February 27, according to CoinDesk, the US SEC, the Tron Foundation, and Justin Sun filed a joint motion on Wednesday requesting a federal judge to stay the litigation against Justin Sun and his company Tron. This motion is similar to the SEC's request for a stay in the Coinbase and Binance cases, and the three parties stated that they are working to seek potential resolutions;

3. On February 28, the US January core PCE price index year-on-year was 2.6%, in line with expectations, compared to the previous value of 2.8%;

4. On February 28, the US SEC's Division of Corporation Finance issued guidance on memecoins, stating that they are not securities but rather similar to collectibles;

5. On February 28, according to Reuters, the Chicago Mercantile Exchange will launch Solana (SOL) futures and micro-sized SOL futures on March 17, providing investors with a regulated exposure to Solana;

6. On February 28, according to market information, the US SEC announced that it has terminated the civil enforcement action against Coinbase;

7. On March 1, according to the SEC's website, the US SEC has delayed the approval of the Fidelity spot Ethereum ETF option.

ETF

According to statistics, during the period from February 24 to February 28, the net outflow of US Bitcoin spot ETFs was $2.146 billion; as of February 28, GBTC (Grayscale) had a total outflow of $22.249 billion, currently holding $16.567 billion, and IBIT (BlackRock) currently holds $48.728 billion. The total market value of US Bitcoin spot ETFs is $99.12 billion.

The net outflow of US Ethereum spot ETFs was $305.3 million.

Foresee the Future

Event Preview

1. ETHDenver 2025 will be held from February 23 to March 2, 2025 in Denver, USA;

2. Crypto Expo Europe will be held from March 2 to 3, 2025 in Bucharest, Romania;

3. Digital Asset Summit 2025 will be held from March 18 to 20, 2025 in New York, USA;

4. Southeast Asia Blockchain Week 2025 will be held from March 30 to April 5, 2025 in Bangkok, Thailand;

5. The 2025 Hong Kong Web3 Carnival will be held from April 6 to 9, 2025 in Hall 5BCDE of the Hong Kong Convention and Exhibition Centre.

Project Progress

1. The airdrop claim deadline for the AI intelligence layer Rivalz Network is March 5;

2. The Ethereum testnet Sepolia is planned to activate the Pectra upgrade on March 5, and if the public testnet upgrade goes smoothly, Pectra will be launched on the Ethereum mainnet on April 8;

3. The AI-based cryptocurrency data analysis platform Kaito Al has announced that it has opened the ANIME claim for eligible ANIME yapprs and Kaito Genesis NFT holders, and the claim will be open until March 9.

Important Events

1. The 11.2 million SOL auctioned by FTX will be unlocked on March 1, worth about $2.06 billion. FTX had previously sold 41 million SOL in three auctions, with the top three buyers and auction prices as follows: Galaxy (average price of $64 for 25.52 million SOL, return rate of 187%), Pantera and other buyers (average price of $95 for 13.67 million SOL, return rate of 93%), Figure and other buyers (average price of $102 for 1.8 million SOL, return rate of 80%);

2. A Chinese dual national of Saint Kitts and Nevis involved in a $73.6 million crypto pig-butchering scam will be sentenced in the US on March 3, 2025;

3. All customer accounts and custodial assets of DMM Bitcoin will be transferred to the crypto exchange SBI VC Trade on March 8. Previously, DMM Bitcoin was attacked in May 2024, losing $304 million.

Token Unlocks

1. Sui (SUI) will unlock 22.97 million tokens on March 1 at 8:00, worth about $78.77 million, accounting for 0.74% of the circulating supply;

2. ZetaChain (ZETA) will unlock 44.26 million tokens on March 1 at 8:00, worth about $14.73 million, accounting for 6.48% of the circulating supply;

3. Alchemy Pay (ACH) will unlock 116 million tokens on March 7, worth about $3.74 million, accounting for 1.17% of the circulating supply.

About Us

Hotcoin Research, as the core investment and research hub of the Hotcoin ecosystem, is dedicated to providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a three-in-one service system of "trend judgment + value mining + real-time tracking", through in-depth analysis of crypto industry trends, multi-dimensional evaluation of potential projects, and 24/7 market volatility monitoring, combined with weekly double updates of "Hotcoin Selections" strategy live broadcasts and daily "Blockchain Headlines" news digests, to provide precise market interpretation and practical strategies for investors at different levels. Relying on advanced data analysis models and industry resource networks, we continuously empower novice investors to establish a cognitive framework, and assist professional institutions in capturing alpha returns, together grasping the value growth opportunities in the Web3 era.

Risk Warning

The crypto currency market is highly volatile and investing itself carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.