Author: Wuzi

Image source: Generated by Wuji AI

The explosive DeepSeek has already opened up the commercial closed loop.

Source: DeepSeek

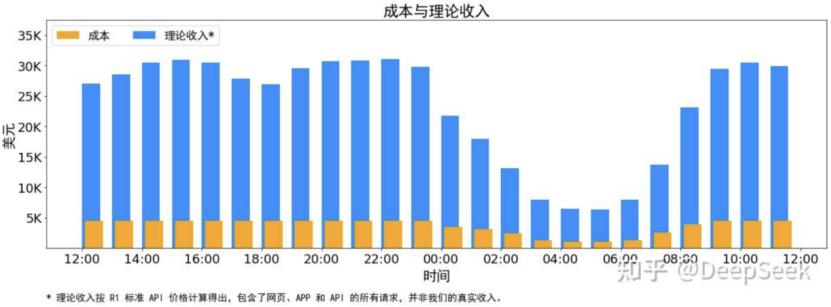

On March 1, 2025, DeepSeek released a technical article stating that from 24:00 on February 27 to 24:00 on February 28, the GPU rental cost was calculated at $2/hour, the platform's average daily cost was $87,072 (about RMB 630,000); all input/output Tokens are priced according to R1, the platform's daily revenue was $562,027 (about RMB 4.09 million), with a net profit of $474,955 (about RMB 3.46 million), and a cost-profit ratio as high as 545%.

However, it should be noted that the financial data displayed by DeepSeek is only the result of highly simplified and idealized processing, and there is a large deviation from the complex situation in actual operations. DeepSeek admits that due to the lower pricing of V3 and the charging of only part of the services, as well as discounts during non-peak periods, the company's actual revenue is not as much.

Source: WeChat

Perhaps because they see the huge commercial imagination contained in DeepSeek's large models, many technology companies have been vigorously promoting their products that are connected to DeepSeek recently. For example, on February 16, Baidu Search officially announced the full integration of DeepSeek and Wenxin's latest deep search function. On February 27, Tencent's new product "Yuanbao" was settled in the life service section of WeChat.

In fact, the explosive DeepSeek cannot hide the embarrassment of the limited commercial capabilities of AI large models. Since the ChatGPT craze in November 2022, AI large models have not found an ideal commercial landing scenario, and most AI large model companies are still mired in losses.

Due to the difficulty in charging for C-end products and the need for continuous marketing expenses, the commercialization of C-end AI large model products faces great challenges.

One possible commercial path is the commercialization of AI search.

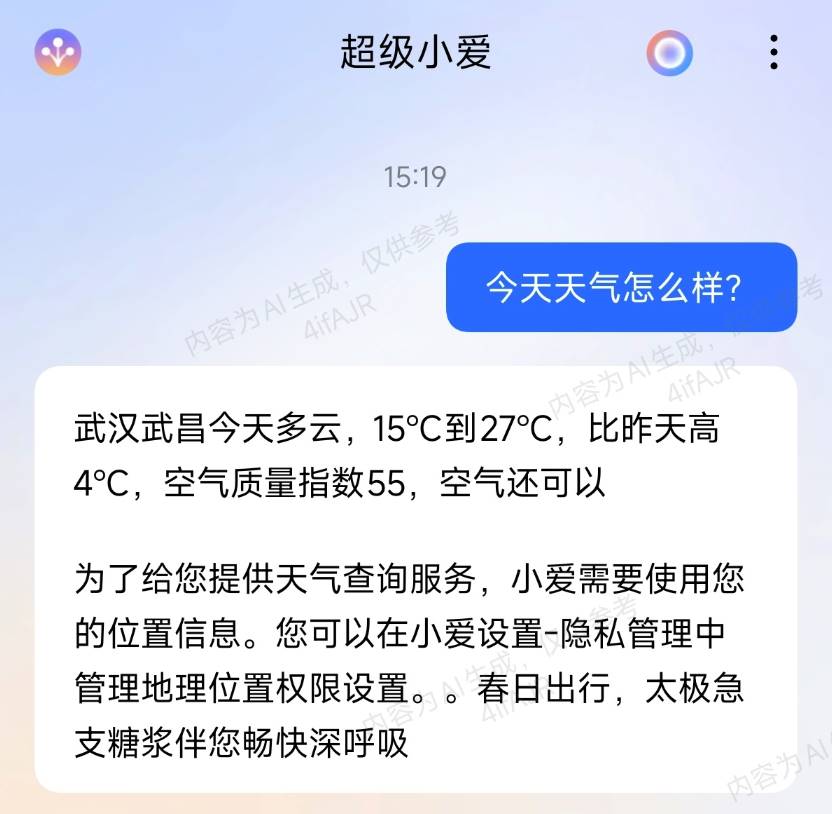

For example, some netizens recently found that when Xiaomi Super Xiaomi answered the question "What's the weather like today?", it added a commercial advertisement at the end.

Source: Weibo

On February 25, 2025, Yuezhanmian underwent industrial and commercial changes, adding "Internet Drug Information Services", which is suspected to be preparing for the launch of pharmaceutical advertisements on Kimi.

In the Q4 2024 earnings call, Baidu stated that "We expect our advertising revenue to gradually increase, thanks to our efforts to monetize the results of our AI transformation".

However, since the results provided by AI search have strong uniqueness, the richest advertisers may not be able to provide the best solutions. On the contrary, due to the need to balance the high marketing costs, the solutions provided by advertisers may lack cost-effectiveness, and even harm the interests of consumers. After asking people around, Dujiao Spicy found that many people are cautious about AI search adding advertisements, worrying that the fairness of AI search will be lost after the addition of advertisements.

Another commercial path is for technology companies to act as "water sellers" and generate revenue by providing AI infrastructure to B-end customers. For example, on February 20, iFLYTEK launched the Xinghuode DeepSeek Tower All-in-One and Xinghuode DeepSeek All-in-One two full-stack domestic AI infrastructure products, committed to providing downstream customers with efficient and reliable large model deployment solutions.

However, not all technology companies have the technical foundation to support the "water seller" business story. Referring to the experience of the PC and mobile Internet industries, if AI large models want to open up the commercial closed loop, they should delve into user needs, create new interaction methods and transaction scenarios, rather than making micro-innovations along the existing business models.

The reason why DeepSeek has swept the technology industry recently is of course because it adheres to the spirit of openness and is completely open-source, but its more efficient reasoning and lower cost are also inseparable. Official information shows that the reasoning cost of DeepSeek-R1 is only 17% of that of GPT-4 Turbo.

After DeepSeek was open-sourced, technology companies no longer need to spend a lot of money to build closed-source models, and can directly access DeepSeek-R1 to obtain first-class AI large model capabilities at a lower cost, naturally welcoming it with open arms.

However, it should be noted that although DeepSeek's reasoning cost is very low, it is not completely free. As more and more downstream users come in, many companies that cannot open up the commercial closed loop have begun to fall into the "scale trap".

Source: Liang Bin's Weibo

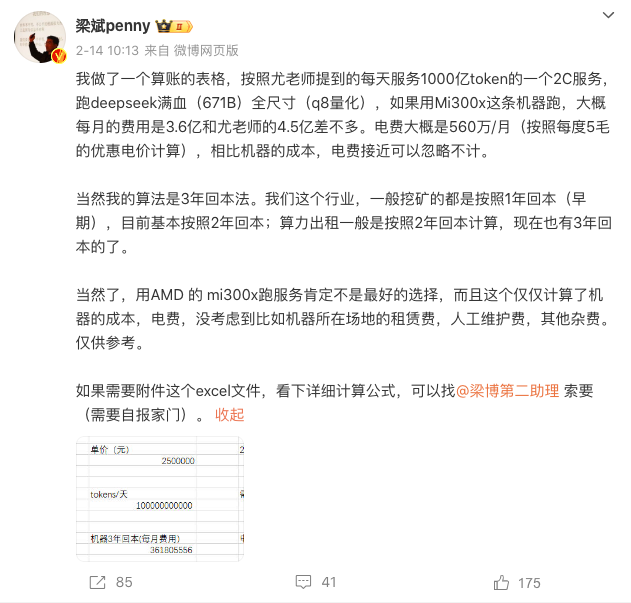

On February 14, 2025, Liang Bin, chairman and CEO of Beijing Bayou Technology Co., Ltd., posted on a social media platform that a 2C service running a full-blood version of DeepSeek, if using AMD MI300X to provide 100 billion Tokens output per day, the total monthly cost would be about 360 million yuan.

An AI practitioner told Dujiao Spicy that since the cost is proportional to the computing power, current AI products, unlike traditional Internet businesses, do not have obvious marginal effects, "but the better the product effect, the higher the subsequent cost."

Given that most of the products connected to DeepSeek have not expanded their revenue channels, the AI-related businesses of most companies are actually still mired in losses.

For example, the WeChat public account "Consensus Crusher" revealed that in order to support WeChat's AI search, Tencent has added 100,000 to 200,000 H20s, with a hardware cost alone of up to $2 billion.

Perhaps due to the extremely high upstream costs, the commercial capabilities of AI search results are limited by the WeChat ecosystem, and to this day, WeChat has not opened the AI search function to all users.

Against this backdrop, Tencent is committed to promoting the full-blood version of DeepSeek that can search across the entire network, Tencent Yuanbao.

Benefiting from the large amount of traffic on platforms such as WeChat, Bilibili, and Zhihu, on February 22, the daily download volume of Tencent Yuanbao exceeded that of Douban, ranking second in the free App download ranking on the App Store in China.

Likewise, because of the awareness of the huge imagination contained in AI large model technology, in 2024, 360 also started to increase its AI-related business, successively launching 360 AI Search, 360 Children's Watch A9 AI Red Dress Edition, AI Assistant and other products.

Source: 360 Q1-Q3 2024 financial report

Unfortunately, due to the high R&D and operating costs of AI-related technologies, and the difficulty in "open-sourcing" downstream, 360's performance has been deteriorating. The financial report shows that in the first three quarters of 2024, 360's operating costs were 2.608 billion yuan, an increase of 31.92% year-on-year. During the same period, 360's revenue was 5.609 billion yuan, a decrease of 16.76% year-on-year; net loss was 579 million yuan.

In stark contrast to the Internet companies that face users directly, the performance of upstream chip manufacturers, cloud service providers and other "water sellers" in the AI industry is steadily improving.

Source: NVIDIA Q3 FY2025 financial report

Take NVIDIA as an example. In the third quarter of fiscal year 2025, its data center business revenue reached $30.8 billion, a year-on-year increase of 112%, hitting a new high. As a result, NVIDIA's net profit reached $19.309 billion, an increase of 109% year-on-year; its gross profit margin was 74.6%, an increase of 0.6 percentage points year-on-year.

The main reason is that NVIDIA's AI chips have unparalleled performance and strong irreplaceability. With the booming AI industry, NVIDIA can charge a premium to downstream customers.

Regarding this, Louis Navellier, founder of market consulting firm Navellier & Associates, said that he would never sell NVIDIA's stock, because "I have never seen a stock with such strong monopoly and such powerful influence."

Not only the top of the pyramid NVIDIA, the relatively downstream Alibaba Cloud, Baidu Cloud and other cloud service providers have also walked out of the loss quagmire with the help of AI technology.

Source: Alibaba's Q3 FY2025 financial report

Alibaba's Q3 FY2025 financial report shows that Alibaba Cloud's revenue was 31.742 Bit, up 13% year-over-year; adjusted EBITA was 3.138 Bit, up 33% year-over-year, mainly benefiting from "the growth of public cloud revenue driven by AI-related products".

Recently, Morgan Stanley also stated in a research report that Baidu Cloud's profitability and profit margin will improve starting from Q4 2024, and the trend should be sustainable. In Q1 2025, Baidu Cloud's business revenue will grow 20% year-over-year.

Due to the promising prospects of AI technology, Alibaba Cloud is committed to increasing its AI-related investments. On February 24, 2025, Alibaba Group CEO Wu Yongming announced that over the next three years, Alibaba will invest more than 380 Bit to build cloud and AI hardware infrastructure, with a total investment exceeding the sum of the past decade.

Wu Yongming stated, "The AI explosion has exceeded expectations, and the domestic technology industry is thriving with great potential. Alibaba will spare no effort to accelerate the construction of cloud and AI hardware infrastructure to promote the development of the entire industry ecosystem."

As Xpeng Motors Chairman He Xiaopeng said, "Language large models basically can't make money, except for Nvidia, or Microsoft, and Microsoft hasn't really made money either. Companies like OpenAI have raised money, not made money, including Xiaochuan." Reviewing the commercialization process of the AI large model industry, Dujiao Spicy found that the commercial progress of upstream and downstream companies in the AI large model industry varies significantly, and the further downstream and closer to the user, the more difficult it is to make money.

Since AI large model technology has become a major trend in the technology industry, many downstream companies are rushing to layout the related technologies, and the upstream chip manufacturers and cloud service providers, the "water sellers", whose computing power infrastructure is in high demand, can generate revenue by providing computing power to downstream customers, thus early establishing a commercial closed loop.

Although the core products of many downstream To C companies have integrated AI large models, due to the inability to simultaneously expand their revenue channels and the need to bear huge operating costs, they are mostly "losing money while making a fuss".

For the upstream "water sellers", it is indeed worth celebrating that they have first established a commercial closed loop, but the healthy operation of the industry chain is based on the fact that both upstream and downstream companies have positive cash flow. The difficulty of downstream AI large model companies to achieve commercialization also determines that the commercial story of the upstream "water sellers" is just a tree without roots.

Due to the strong comparative advantage of AI large models in information retrieval, not only can they generate content, but they also focus on semantic understanding and personalized recommendations, and the commercialization capability of traditional search engines has been verified, so many Internet companies are increasing their investment in AI search, trying to achieve commercial breakthrough through search functions.

In this regard, Minsheng Securities stated in a research report that AI search is expected to become the first commercially landed C-end super application, "the first ray of light for the commercial landing of large models".

As a result, Internet giants such as 360, Baidu, and iFlytek, as well as newcomers such as Yuezhianmian, Zhipuqingyan, and Mitaoke Technology, have all started to compete in the AI search market.

Source: AI Product Ranking

In fact, AI search products have indeed become the vanguard of AI technology landing, as they have hit the user's needs. In the top 20 websites of the AI Product Ranking in January 2025, AI search products occupied three seats, namely New Bing, Nano AI Search, and Perplexity AI. During the same period, AI search products occupied four seats in the top 20 of the domestic overall ranking, namely Nano AI Search, Mitaoke AI Search, Zhihu Direct Answer, and C Zhidao.

A typical representative among them is Nano AI Search. As a "veteran" in the Internet industry, 360 entered the search market as early as 2012 and launched a comprehensive search business in an attempt to divert Baidu's influence. However, due to limited search capabilities and brand awareness, 360's search business has never been able to open up the market.

With the maturity of AI technology, 360 has decisively increased its investment in AI search and launched Nano AI Search. Currently, this product has become the industry leader. The AI Product Ranking - Domestic Edition shows that in January 2025, the web traffic of Nano AI Search was 308 million, ranking first.

In step with the expansion of market influence, a number of AI search companies have also begun to explore commercialization. Dujiao Spicy's analysis found that the current commercial directions of AI search companies are mainly subscription, advertising, and API sales.

As one of the first players to enter the AI search business, Perplexity AI's first step in commercialization was the subscription model. If users want to get more professional search times, use customized AI models, and analyze files, they need to subscribe to the Pro version, which costs $20 per month.

The Information reported that by 2025, Perplexity AI is expected to have 550,000 premium subscribers, with an annualized revenue of $127 million. Even so, Perplexity AI still finds it difficult to turn a profit. In its official blog, Perplexity AI stated that "the current subscription fee of $20 per month or $200 per year is not enough to support our ambitious goals and the growing revenue-sharing plans with publishers."

Yue Zhianmian founder Yang Zhilin believes that "charging based on the number of users is unable to create greater commercial value as the product evolves, and subscription will not be the ultimate business model."

Given the strong payment habits of European and American users, AI search companies have found it difficult to turn a profit through the subscription model. In the Chinese market, due to the lack of consumer payment habits, AI search products naturally find it difficult to establish a commercial closed loop through the subscription model.

Source: Perplexity AI

Consequently, in November 2024, Perplexity AI launched an advertising strategy. When users use Perplexity AI to search for questions, the "Follow-up Questions" column at the bottom of the search results page will display sponsored ads provided by advertisers.

In fact, many AI search companies in China are also aiming at the advertising model.

However, it should be noted that unlike traditional search engines, which can sequentially feedback massive content and rank the top content through bidding, AI search has the ability to integrate information, and the displayed results are extremely accurate. If companies pursue commercialization excessively, it may conflict with the interests of users.

For example, if a user searches for medical-related questions, and AI search places expensive advertisements from Putian-system hospitals at the top of the results, it is likely to trigger a "Wei Zexi incident".

In fact, this is also the key factor that prevents Internet companies from rashly allowing the advertising business of AI search to enter the deep waters of commercialization. At the end of 2024, 360 Group founder Zhou Hongyi publicly stated, "In fact, we are also very painful in doing AI search. We also have self-disruption, and we can't find a place to put ads for the time being."

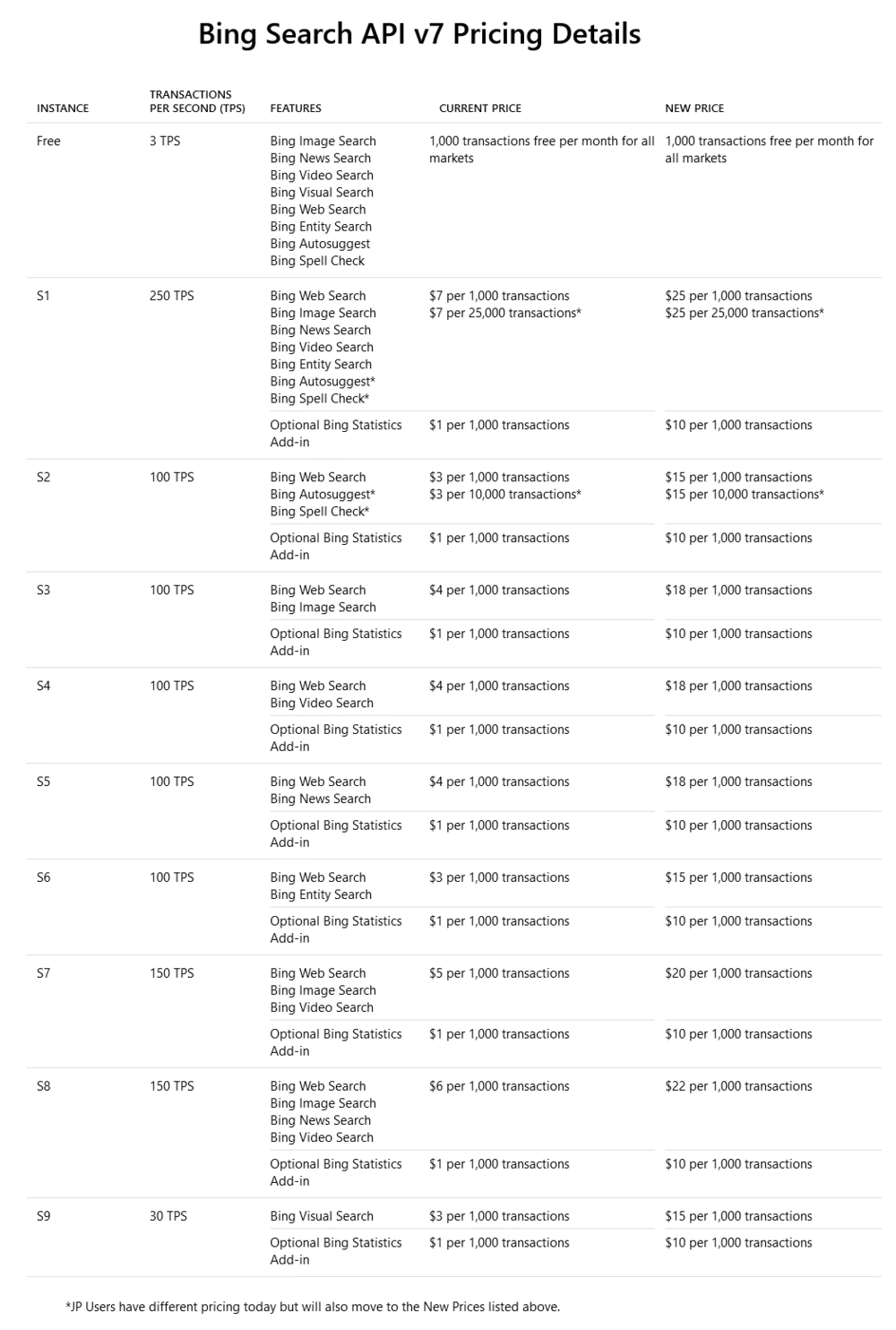

In addition to subscription and advertising revenue models related to C-end users, AI search can also generate revenue by selling APIs to B-end customers. For example, Bing provides the Bing Search API to enterprise customers, allowing them to integrate search functionality into their own user experiences.

Source: Bing

However, due to the high cost of AI large models, the usage cost of the Bing Search API is not low. In May 2023, Microsoft raised the pricing of the Bing Search API, with the price of the Bing API supporting ChatGPT being $28 per 1,000 requests for less than 100 million requests per day, and $200 per 1,000 requests for more than 100 million requests per day. Microsoft stated that "the new pricing model more accurately reflects the ongoing technical investments Bing is making to improve search."

Due to the high usage cost, in April 2023, Brave Search disconnected all connections with the Bing API and used its own index to display search results, and plans to launch its own Brave Search API.

Given that DeepSeek has already been open-sourced, and any organization can freely access it, it is difficult for AI search to convince downstream customers with certain technical capabilities to pay higher costs and choose their own API.

Regarding this, in May 2024, Baichuan Intelligence founder and CEO Wang Xiaochen stated, "API revenue and the revenue of large models themselves are not the sexiest business models, and they are not what we want to chase and emulate."

In summary, due to the completely different user needs, technical routes, and result presentation from traditional search engines, the current three commercial directions of AI search - subscription, advertising, and API sales - all face considerable challenges, and the relevant companies find it difficult to become the search giants of the AI era overnight.

In fact, the problem of sluggish commercialization faced by AI large models is not an isolated case. In the early stages of the PC and mobile Internet, a number of Internet companies also faced similar challenges.

Take Tencent as an example. The book "Tencent Biography" written by Wu Xiaobo records that by the end of 1999, the registered users of OICQ had exceeded 1 million. Due to the huge daily cost of OICQ and the difficulty in making money, Tencent's account once had only 10,000 yuan in cash, on the verge of bankruptcy. Helplessly, Tencent's founder Ma Huateng planned to sell the company for 3 million yuan.

However, Ma Huateng visited many companies, but none of the sales of Tencent were finalized. Most companies calculated based on tangible assets and only gave Tencent a valuation of tens of thousands of yuan. The author of "Fifteen Years of Boiling" Lin Jun recalled that OICQ might be a project that seemed to be growing very fast, "but no one in the world knew how to make money from it".

The subsequent story is already well-known to many people. Based on the brand-new IM interaction mode, QQ created the usage scenario of online chatting, and extended to businesses such as advertising, QQ Show, and QQ games, making Tencent earn a lot of money.

Xiao Peng believes that after the interaction revolution, the scenario will also undergo a revolution, and this process will bring huge commercial opportunities. Products such as QQ, Didi, and Meituan under the PC and mobile Internet have improved efficiency and created more user value through brand-new interaction methods and transaction scenarios, thereby completing the commercial closed loop.

Unlike the transition from PC Internet to mobile Internet, where only the content carrier has changed, AI large models may involve a complete revolution in interaction carriers, methods, and scenarios, and the commercial model may be quite different from the traditional Internet.

Regarding the commercial prospects of AI in the automotive field, Xiao Peng is full of expectations, believing that "if L4 is achieved, it will certainly greatly increase the software revenue or ecological revenue of the car. For example, your car automatically washes, which is one of the ecological revenues; automatic parking is the second ecology; automatic charging is the third ecology."

Of course, smart cars are just one vertical scenario for the application of AI technology. Beyond that, AI has more imagination space. For example, Meta's chief scientist Yang Liankun believes that as the technology gradually matures, AI glasses may integrate AI Agent functions, allowing users to handle daily affairs through a pair of AI glasses, greatly improving work efficiency, creativity and productivity.

In this process, AI glasses may usher in an "iPhone moment", and AI technology may also explore new commercial models as the application scenarios expand, such as shopping, navigation, and watching immersive videos through AI glasses.

It is self-evident that if we look at AI large models with a developmental perspective, we can find that they are similar to the previous Internet and mobile apps, facing the challenge of commercial model ambiguity when they first emerge.

Fortunately, user needs are certain, and a group of Internet giants and startups are actively innovating functions and interactions based on user needs. Once they explore new usage scenarios, AI large models may be able to complete the commercial closed loop.