Background of the Event and Market Shockwaves

On the evening of March 2, 2025, former President Trump issued a major statement through social media, announcing that cryptocurrencies such as XRP, SOL, and ADA would be included in the U.S. strategic reserve, and promised to promote regulatory relaxation through a presidential executive order. After the news was released, the price of Bitcoin soared from $85,000 to over $95,000 in just 3 hours, setting a record of a $10,000 increase in 3 hours and a daily gain of 11.76%.

Behind this epic market movement, anomalies were observed in multiple dimensions, including spot, futures, and on-chain data, forming a classic case of a tug-of-war between bulls and bears.

Capital Flow Mapping: Four-Dimensional Data Reveals the Logic Behind the Surge

Spot Market: The Scramble Between Institutions and Retail Investors

Surge in Net Inflows to Exchanges: Major compliant exchanges (Binance, Coinbase, Kraken) recorded a single-day net inflow of 13,000 BTC, equivalent to nearly $1.1 billion in capital influx. 85% of the buy orders were concentrated in the first 3 hours after the news release, exhibiting typical FOMO (Fear of Missing Out) characteristics.

Changes in Stablecoin Reserves: The on-chain reserves of USDT and USDC decreased by $580 million within 24 hours, and the trading volume ratio of the USDT/BTC and USDC/BTC trading pairs surged from 32% to 67%, indicating a large amount of capital shifted from stablecoins to risky assets.

Futures Market: The Frenzy and Concerns of Leveraged Capital

Bitcoin Futures Driving the Spot Market: The total open interest in the Bitcoin futures market exceeded $53.8 billion, with the CME market accounting for 26.5% of the total, or $14.3 billion. In contrast, the open interest on Binance changed by -0.2% in the past 24 hours, indicating that the majority of the increased contract positions were on CME and Bybit.

Bitcoin Futures Driving the Spot Market: The total open interest in the Bitcoin futures market exceeded $53.8 billion, with the CME market accounting for 26.5% of the total, or $14.3 billion. In contrast, the open interest on Binance changed by -0.2% in the past 24 hours, indicating that the majority of the increased contract positions were on CME and Bybit.

Compared to the futures market, the spot market trading volume was not significant. For example, the 24-hour Bitcoin trading volume on Binance was only 65,000 BTC, with a trading volume of $59.7 billion USDT. In comparison, on November 6, 2024, when Bitcoin price increased by $7,000, the trading volume reached 104,000 BTC, or $77 billion USDT.This suggests that the main driver for Bitcoin's surge to $95,000 in just 3 hours was the significant increase in futures market trading, which in turn drove the spot market.

Accumulation of Short Positions in the Futures Market and the Liquidation Mechanism

Bearish Positioning in the Previous Market Sentiment Downturn

In late February, Bitcoin price experienced a significant correction, dropping from a high of $109,000 to $78,179, leading the market sentiment to a three-year low. During this time, short positions were quickly accumulated, with some investors betting that the price would further decline to $72,000 or even lower.This pessimistic expectation was reflected in the large short positions in the futures contracts.

The short positions were forced to be closed due to insufficient margin. The forced buying of spot positions by the shorts to hedge their positions further pushed up the price, forming a positive feedback loop of a "short squeeze".

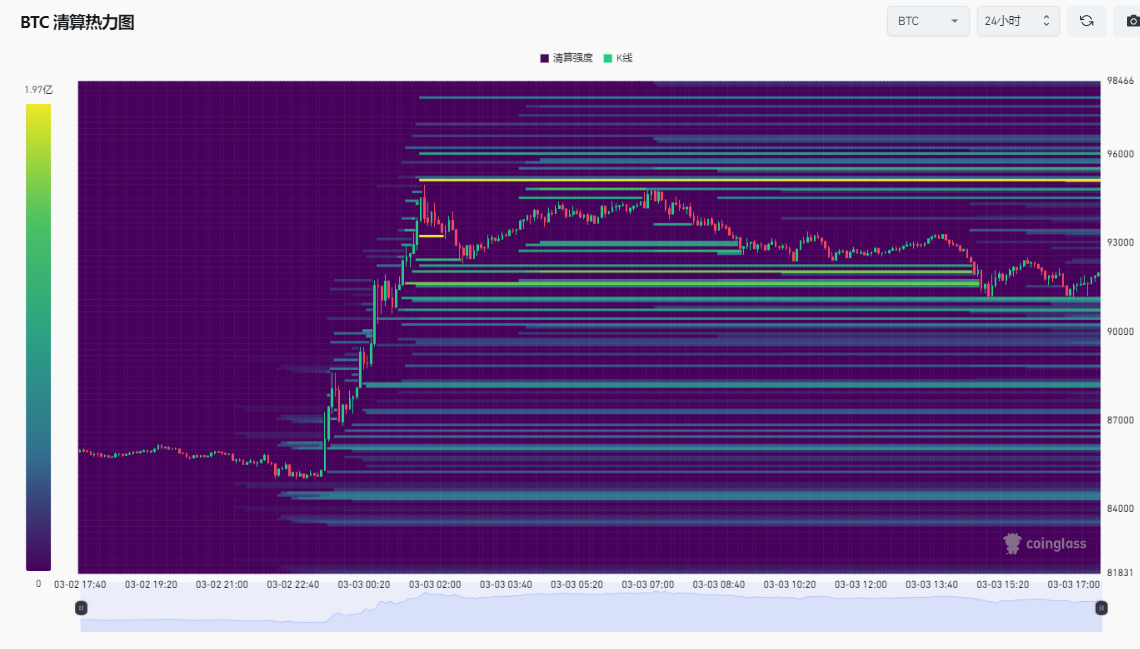

Cascading Short Liquidations: The Bitcoin liquidation heatmap shows that when Bitcoin surged to $88,000, the first wave of short liquidations was triggered, with $90 million in liquidations. When Bitcoin broke through $91,500, the second wave of liquidations was triggered, with $160 million in liquidations. Finally, when Bitcoin broke through $93,200, the third wave of liquidations was triggered, with $195 million in liquidations.

The cumulative Bitcoin short liquidations reached $445 million, setting a new record since November 6, 2024.

On-Chain Data: The Chess Game Between Whales and Miners

Whale Address Activities: Addresses holding 1,000+ BTC increased their holdings by 42,000 BTC during the event window, with 3 anonymous addresses each receiving over 10,000 BTC in a single transaction. On-chain analysis shows that these funds mainly came from cold wallet activations and exchange withdrawals, exhibiting the characteristics of "smart money" positioning in advance.

Miner Holdings Changes: The total miner balance decreased by 18,000 BTC, but the Miner Position Index (MPI) dropped from 6.2 to 3.8, indicating that miners slowed the pace of their sell-offs to take advantage of the favorable conditions. Notably, top mining pools like Antpool took the opposite approach, using the futures market to lock in profits above $95,000.

Impact on Market Structure

Liquidity Tightening and Concentrated Buy Orders

According to CryptoQuant data, the stablecoin reserves on exchanges like Binance have been continuously declining, leading to tightened market liquidity. When the shorts were collectively closed, the limited liquidity was unable to absorb the large buy orders, amplifying the price fluctuations and ultimately breaking through the $95,000 psychological barrier.

Technical Indicators and Sentiment Synchronization

The RSI indicator rebounded from the oversold region, coupled with the Fear and Greed Index rising from 10 (extreme fear) to 26, forming a dual reversal signal in both the technical and sentiment aspects. In this context, the short positions in the futures market became the "fuel" for the price increase.

Deconstructing the Deeper Logic: How Policies Can Leverage Market Gears

1. Paradigm Shift in Regulatory Expectations

The core breakthrough of Trump's policy is to include cryptocurrencies in the national strategic reserve system, effectively granting "quasi-sovereign currency" status to tokens like XRP and SOL. The data shows that the named ADA and XRP surged 73% and 37% respectively in the 24 hours after the event, far exceeding Bitcoin's gain, creating a significant policy arbitrage opportunity.

The expected regulatory relaxation directly reduced compliance costs, and the market-making depth of exchanges like Coinbase increased by 37% after the policy announcement, significantly improving market liquidity.

2. Structural Changes in Institutional Behavior

While traditional asset management giants saw net outflows, new institutions exhibited differentiated positioning:

- Miner Hedging Strategies: Listed mining companies like Marathon Digital bought $95,000 put options on the CME futures market while increasing their spot holdings, forming a "spot + protective put" combination to enjoy the upside while mitigating policy implementation risks.

- Market Maker Inventory Management: Top market makers like Jump Trading increased their BTC inventory turnover rate from 2.1 to 5.7, capturing volatility premiums through high-frequency trading, with their daily trading volume accounting for 19% of the entire market.

- Sovereign Wealth Fund Exploratory Involvement: On-chain tracking found that an address suspected to belong to a UAE sovereign wealth fund bought 12,000 BTC during the event period, and the entry of such long-term capital altered the market's chip distribution structure.

Future Outlook

Looking ahead, the White House Cryptocurrency Summit on March 7 will be a key milestone. If the Trump team discloses the specific implementation plan for the strategic reserve (such as the Treasury's purchase plan), it may drive Bitcoin to break through the current $95,000 psychological barrier; conversely, if the policy details remain vague, the currently overcrowded trading structure may trigger a deep correction.