Author: Rukawa Kaede Original text: Number Go Up / The currency is undoubtedly rising

Zeke Faux is an investigative reporter for Bloomberg Businessweek and Bloomberg News. He is the recipient of the Gerald Loeb Award and the American Bar Association Silver Gavel Award and was a finalist for the National Magazine Awards. He, his wife and three children live in Brooklyn: September 12, 2023

This is another story that makes my blood boil after "FTX: Going Infinite" ...

The core of the book "Number Go Up" revolves around Tether/USDt , and investigating this company becomes the main thread throughout the story. Here are some shocking discoveries I made after reading this book, which I would like to share with you.

January 2021: The story begins in the context of COVID-19

The author of this book, Zeke Faux , became extremely curious about cryptocurrency because a friend of his made $500 by investing only $10 in Dogecoin . So, while working at Bloomberg , Zeke decided to write a report about cryptocurrencies and began investigating Tether .

During the investigation, Zeke discovered that Tether had assets of up to $55 billion , which would be enough to rank among the top 50 banks in the United States if calculated by bank size. However, Tether’s official website shows that the company’s director is actually an Italian plastic surgeon who later switched to become an electronic product importer and was even sued for selling pirated Microsoft software . This person is Giancarlo Devasini, the core figure of Tether.

Born in 1964 in Turin, Italy, Giancarlo Devasini is richer than Piero Ferrari, even more than Piero Ferrari, son of Enzo Ferrari, vice president of the luxury sports car company, with a net worth of about $9.2 billion.

In June 2022, Zeke decided to fly to Miami in person to attend the Bitcoin 2021 Conference. Novelist Carl Hiaasen once described Miami like this:

“All the bad scumbags, corrupt politicians, and heroin dealers in America are going to Miami.”

This sentence also reveals the financial backers behind Miami's booming development .

Zeke The author met Brock Pierce, an early co-founder of Tether, in Miami. Brock Pierce: The concept of stablecoin was conceived as early as 2013, and it was an innovation that could change the course of history. Their original project was called Realcoin . At that time , Phil Potter of offshore exchange Bitfinex was also developing a similar concept. The two sides collaborated and eventually named it Tether .

The most controversial point about Tether at the time was that USDt violated almost every regulation in the banking industry . At the time, other developers who proposed similar concepts were almost all arrested , such as Hawaii Congressman Ron Paul, who was arrested for money laundering for his electronic token (E-Gold) , but Tether escaped regulatory scrutiny at the time .

Brock Pierce decided to abandon the project in 2015 because there were too few USDt users . He said: " If you get sued once, you will go to jail. "

However, Bitfinex was very interested in Tether's development and business , so Phil Potter told Bitfinex's boss Giancarlo Devasini about the idea of Tether, and Giancarlo immediately accepted the idea . Giancarlo then purchased the remaining shares from Brock Pierce and ultimately held 40% of Tether .

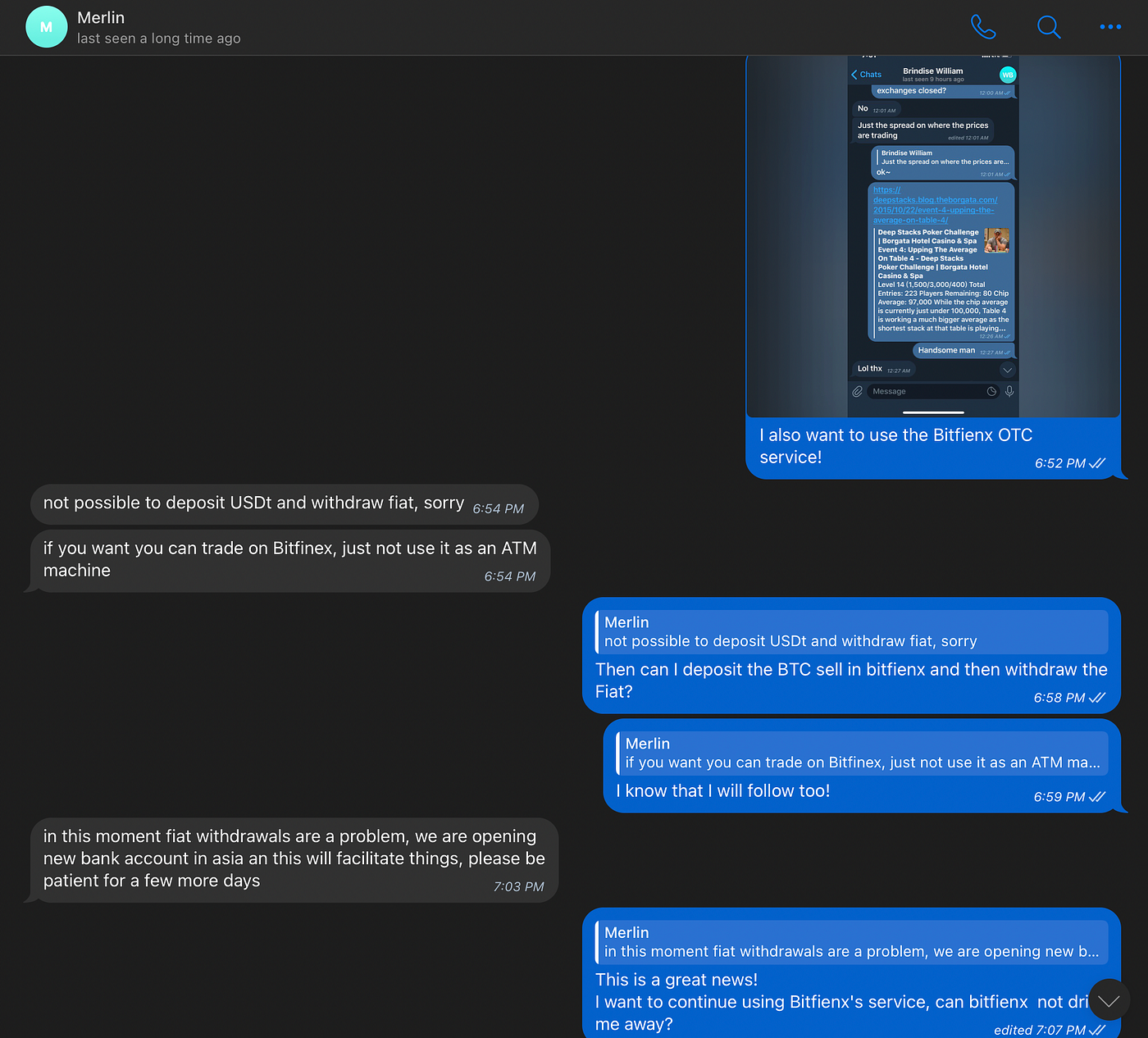

At that time, all customers who wanted to trade with Tether would send messages directly to Giancarlo himself .

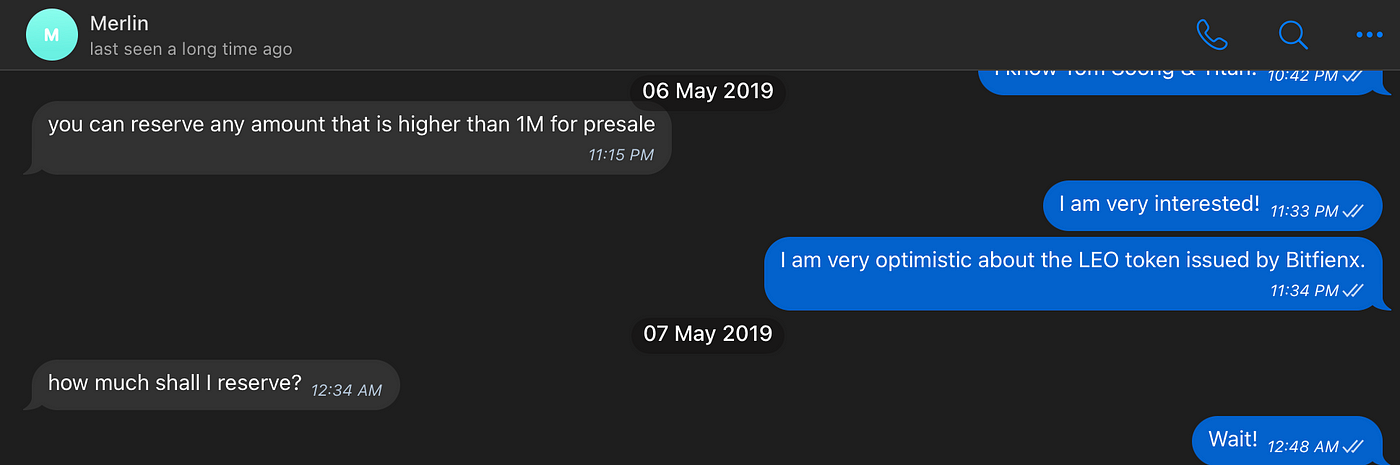

I also sent a message to Giancarlo via Telegram in February 2019 when I wanted to do an OTC (over-the-counter) trade with Bitfinex .

I had a Telegram conversation with Giancarlo Devasini back then/I used the anonymous name Merlin because Devasini's appearance and facial features were very similar to his.

Brock Pierce finally added:

“Giancarlo Devasini has taken great personal and financial risks for the development of the cryptocurrency industry.”

Book a flight to Milan, Italy to explore

Zeke The author wanted to know more about Tether boss Giancarlo Devasini, so he went to Milan, Italy to find more information. Devasini used to be a plastic surgeon. His classmates and colleagues described him as a brave and adventurous person. Devasini found that he was not suitable to be a plastic surgeon, so he turned to buying and selling software and pornographic DVDs and built an electronics factory in Italy, but it was burned down in a fire in 2008...

Devasini once wrote in his blog:

"He looked down on those who worked from nine to five and admired those who took risks with him."

Devasini also admired Bernard Madoff (the mastermind of the largest Ponzi scheme in the history of American finance) , until one day in 2012, Devasini read the Bitcoin white paper...

In November 2012, Devasini wrote on his blog: "Just type Bitcoin into Google and you will discover an amazing new world. I stumbled upon this a few months ago and it changed my world."

Bitcoin: A Peer-to-Peer Electronic Cash System www.bitcoin.org

After the factory closed down, Devasini posted on the Bitcointalk forum : "Selling 20 million CDs/DVDs in exchange for Bitcoin." The Bitcoin that Devasini exchanged is now worth more than 3 billion US dollars . This is how he became rich.

Around the same time, Devasini invested in an exchange, Bitfinex . The founder of Bitfinex is a young Frenchman who copied the code of Bitcoinica for development. Soon after, Devasini became the de facto head . In February 2014, Devasini responded to other customers on the Bitcointalk forum : "Our operations are transparent, which does not mean we need to spend time refuting meaningless accusations."

It can be seen that Devasini has a very strong personality and hates those idiots on the Internet...

2016 Bitfinex hack (The biggest money laundering heist: The cryptocurrency heist)

The biggest trouble Bitfinex encountered was that hackers stole 119,756 bitcoins (worth about 72 million U.S. dollars at the time), which was equivalent to more than half of the exchange's cryptocurrencies... If it were in the traditional financial industry, Bitfinex should have declared bankruptcy. But what Bitfinex did was to cut 36% of the account balances of all customers (including those whose Bitcoins were not stolen), and then issue an IOU - BFX Token ...

Devasini took very strong measures and learned a lesson: "Even if he changes the rules of the game, it won't matter."

The ICO bubble in 2017-2018 allowed Bitfinex to quickly make up for the losses stolen by hackers , and also led to a sharp increase in USDt demand . The ICO craze in 2017 brought Bitfinex $326 million in profits , and Devasini's holdings alone amounted to more than $100 million .

Initially, USDt could only be traded on Bitfinex, limiting its usability . Later, Poloniex exchange began to accept USDt transactions. By the end of 2017, USDt's liquidity had reached US$1 billion .

Netflix's new film "The Biggest Heist Ever"

In the 2021 cryptocurrency heist, Devasini stated that all losses of users on Bitfinex have been returned. Bitfinex considers itself the "only victim" and has submitted a victim statement, which has been supported by its parent company iFinex.

Devasini is eager to recover billions of dollars from this incident...

Bitfinex/Tether faces banking pressure

In 2017, Tether deposited funds in several banks in Taiwan (Huatai Commercial Bank, KGI Bank, First Commercial Bank, Taishin Bank, Kaohsiung Bank, and Shin Kong Bank). Taiwanese banks need to rely on correspondent banks as intermediaries to transfer funds from Taiwan to customer accounts in other countries. However, these correspondent banks did not recognize cryptocurrencies and cut off services to Bitfinex one by one, with the last one being Wells Fargo , which eventually resulted in Tether funds being trapped in Taiwan and unable to be transferred overseas . Devasini even considered chartering a plane to fly the cash overseas (similar to SBF's mindset).

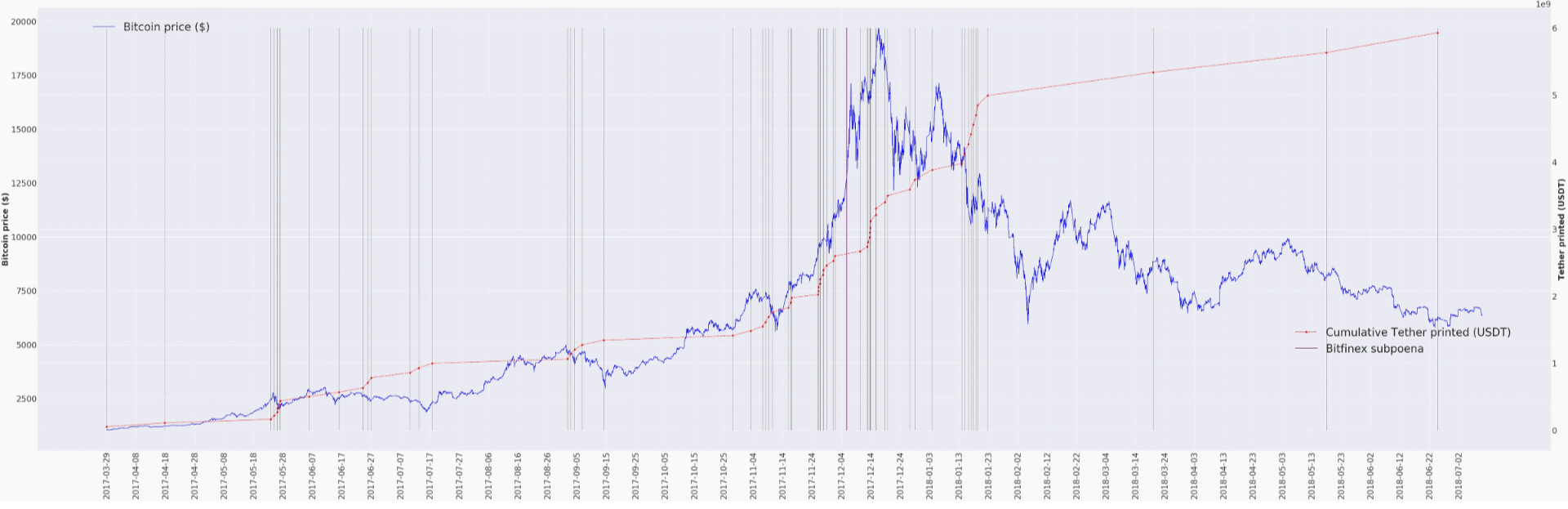

What’s even more strange is that during the period when Tether filed the lawsuit , Tether still printed $200 million USDt on the Omni chain (USDt was first issued on Bitcoin’s Omni Layer). At this point, Tether no longer has any operating bank accounts , so the question is: Did anyone really transfer $200 million to Tether?

A researcher named Bitfinex'ed found in court documents that Tether itself admitted that it had no access to the banking system . Bitfinex'ed further research into the lawsuit between Tether and Wells Fargo and was surprised to find that Tether is not backed by any bank or cash at all…

Zeke was contacted by the author and met with Bitfinex in Miami Beach. Bitfinex'ed said:

“Devasini can easily print USDt and use it to buy billions of dollars of Bitcoin to make the company look asset-backed.”

During this period, the huge trading volume of Bitcoin and USDt was almost entirely concentrated on Bitfinex...

Statistical analysis of Bitcoin price manipulation by Tether issuance in late 2017

In June 2018, finance professor John M. Griffin published a paper titled “Is Bitcoin Really Untethered?” , proving that under the market environment at the time, USDt could be arbitrarily over-issued and used to purchase Bitcoin as collateral, thereby artificially pushing up the price of Bitcoin…

Devasini is determined to embezzle customer funds

Until Devasini found Noble Bank International in Puerto Rico , where Tether had deposited billions of dollars. Zeke contacted the bank's founder John Betts , but in 2018 , Tether fell out with Noble Bank International because Devasini insisted on investing customer funds in yielding bonds to increase the company's revenue , but John Betts refused because it would increase the risk of customer funds.

Devasini said bluntly: "We need to invest our clients' money in bonds. We need more income and we don't need to answer to critics."

Tether’s business model itself presents a conflict of interest : any investment gains belong to Devasini and shareholders , but any losses are borne by USDt holders . If Tether incurs investment losses, it is more likely to conceal the facts rather than disclose them proactively, which would lead to the risk of a run .

Noble Bank International collapsed soon after Devasini withdrew the funds...

The bank run storm is finally here...

Bitfinex has been using Panama-based remittance service Crypto Capital to transfer funds and store some of its funds.

However, Crypto Capital president Ivan Manuel Molina Lee maintained a deposit account for Bitfinex at a bank (Bank Spółdzielczy) in the Polish town of Skierniewice, but the funds were ultimately used for money laundering .

In the summer of 2018, Bitfinex deposited $1 billion in Crypto Capital , but Crypto Capital suddenly suspended withdrawals for Bitfinex customers . Devasini sent emails to Oz Yosef, the Israeli head of Crypto Capital, several times in a row. The content is as follows:

“Please understand that the current situation may have serious consequences for the entire cryptocurrency industry. If we do not act quickly, Bitcoin may fall below $1,000…”

Three days later, Devasini continued:

"Too much money is stuck with you. We may trigger a crisis at any time."

Then, Devasini became increasingly anxious and sent another email:

"I'm not your enemy, I'm here to help you. I've been keeping my composure so far, but you have to stop with your bullshit. Tell me what's going on!"

Finally, the main mastermind of the Crypto Capital money laundering case, Reggie Fowler, was arrested in the United States .

At that time, I also tried to withdraw US dollars from Bitfinex , but the bank transfer remitters I received were all messy company numbers . Bitfinex executives and employees used their own bank accounts to transfer funds to Bitfinex customers' bank accounts to cope with withdrawal pressure .

In 2019, New York Attorney General John Castiglione began investigating Bitfinex and was shocked to discover that Bitfinex had more than $850 million in funds stuck in Crypto Capital. Bitfinex had secretly misappropriated Tether's reserves to fill the funding gap of Bitfinex customers.

At the time, USDt did not actually have a 1:1 USD reserve . After the incident was exposed, Tether immediately deleted the "1:1 US dollar reserve" statement on its official website. This is ridiculous!

Tether’s website changes at the time sparked new concerns about the company’s reserve policies

When John Castiglione was reviewing the fund transfers between Bitfinex and Tether, he tried to find out who was responsible for approving the flow of funds...It turned out that the person who agreed to Tether providing a $900 million credit line to Bitfinex was Giancarlo Devasini.

The incident broke out in 2019 and the market began to panic. How will Giancarlo Devasini fill this $900 million funding gap? Since we can’t continue to print USDt out of thin air, let’s just issue our own platform currency (Unus Sed Leo, LEO)! Bitfinex quickly raised about $1 billion through LEO, all of which were sold to cryptocurrency giants at the time, including Alameda Research, EOS Foundation, etc.

When I discussed the LEO presale with Devasini, the minimum subscription threshold was at least $1 million worth of LEO tokens.

In 2019, I was talking to Giancarlo Devasini

In February 2021, Tether agreed to pay $18.5 million to settle with New York State. In October 2021, the U.S. Commodity Futures Trading Commission (CFTC) fined Tether $42.5 million.

Brock Pierce said: “Tether/USDt is covering up a huge lie, and many people think that Tether/USDt is the last hope for the crypto industry.”

Buying Luxury Homes in the Bahamas

In the summer of 2021 , Zeke successfully contacted Jean Chalopin, Chairman of Deltec Bank & Trust Limited . Jean Chalopin and Giancarlo Devasini are from the same town in Italy , and the locals call them Cugion (Italian: cousins).

Tether funds ($15 billion) are stored in Deltec Bank , and Devasini decided to buy a villa next to Jean Chalopin’s Bahamas mansion as a sign of trust between business partners .

Zeke tried to find big Tether users. At that time, SBF, the founder of FTX exchange, was the main trader of Tether. SBF said: Tether has always remained extremely mysterious. At that time, SBF purchased USDt from Tether through wire transfer, and then exchanged it back to US dollars through Tether. “Tether’s wire transfer path typically traverses three different jurisdictions and moves funds through multiple intermediaries in the banking system,” SBF said.

SBF shook his feet and said: "Tether may have 90% cash reserves, but in the financial market, even if you sell all your assets, the market may not be able to pay for it all..." SBF doesn't care whether USDt is a huge scam or not . He only cares about: Are there more gamblers entering FTX every day? Is FTX trading leverage increasing? In SBF's eyes, the ultimate rival in the cryptocurrency world is Binance. At that time, competition among perpetual contract exchanges was extremely fierce, and all perpetual contracts on the market were priced in USDt. Zeke continued to interview SBF, while SBF just stared at six screens, with his feet crossed…

Promising an 18% annual interest rate, isn’t this a scam?

Alex Mashinsky, CEO of Celsius Network

Zeke suddenly received a dramatic turn of events. Tether had provided a $1 billion USDt loan to Celsius (Celsius Network), but required Celsius to provide over-collateralization, that is, $1 USDt required $1.5 of Bitcoin as collateral. Even more shockingly, Tether even invested directly in Celsius , a company that later went bankrupt.

How does Celsius earn 18% interest for users?

Celsius CEO Alexander Mashinsky is a complete layman in virtual currency. His DeFi business is run by Jason Stone, who promises users an annual interest rate of 18%. Jason Stone, smoking marijuana while managing $1 billion in funds, explained to Zeke that the first DeFi platform he invested in was CREAM Finance - yes, it was Huang Licheng's (Machi Big Brother) CREAM Finance, which had been hacked at least three times, which was absurd...

Cream Finance is valued at over $18 million.

Celsius, managed by Jason Stone, continued to accumulate 18% debt and finally filed for bankruptcy on July 13, 2022.

Before going bankrupt, Celsius sought financial assistance from its largest investor, Tether, but Giancarlo Devasini cold-bloodedly refused and even demanded repayment of outstanding loans from Celsius. Tether finally used $150 million in Bitcoin and other collateral to ensure that Tether would not be affected by Celsius' bankruptcy before Christmas 2022.

Finally met Bitfinex CEO Jean-Louis van der Velde, but he is just a puppet

“Why wasn’t there a Tether representative present when Tether was one of the main sponsors of the Bahamas Crypto Conference?” Zeke asked Jean Chalopin at the event hosted by Deltec Bank & Trust Limited.

Jean Chalopin replied: “In fact, the representative sent by Tether is their CEO, Jean-Louis Van der Velde.”

Bitfinex CEO Jean-Louis Van der Velde (Photographer: Chen Zongyi)

Born in 1964, 59-year-old Dutchman, Fang Junzhe lives in Hong Kong. Fang Junzhe had almost no weight when he was CEO because he still had to obey the real boss, Giancarlo Devasini.

When Zeke was about to meet with Fang Junzhe in the Bahamas to chat, Jean Chalopin sent a text message to Zeke, describing it as " imagining them as animals that have been brutally beaten and injured. You need to approach them slowly and don't scare Fang Junzhe."

After much hard work, Zeke finally got closer to the answer to the mystery of Tether and was going to meet with the Bitfinex CEO to have a chat. They were in an empty bar at a Bahamas resort. Fang Junzhe ordered a glass of sparkling water and folded his glasses and put them in the glasses case.

Opening remarks!

Fang Junzhe: “I hate casinos.”

He went on to say: "The reason why I avoided the media and avoided speaking in front of the public was because I was worried about the safety of my family, not because I was deliberately hiding something..."

Fang Junzhe looked into the distance and continued, “If there was no Tether today, the cryptocurrency industry as we know it would not exist. Tether provided a way to obtain funds when banks were unwilling to handle funds for exchanges, but Tether also paid a price for this, and it was a painful price…”

Zeke asked Fang Junzhe: "If Tether has paid a heavy price, why not just tell everyone where the funds are? How does Tether work? Let more people know about USDt , just like SBF, who is very open and transparent about his FTX business."

Fang Junzhe seemed very annoyed after hearing this. He hinted that there were some things about Tether that he could not reveal... Then he said: "You have not been injured on the battlefield, so you can look at the wounds and pain easily... Tether saved the entire industry, and we had to shoulder a heavy burden. SBF can start from scratch like a blank sheet of paper and never have to deal with these burdens... Do you understand?"

Fang Junzhe told me that he didn’t care about money, and he repeated it three times. He turned around, pointed at the young people at the Bahamas party, and said, "Those young people only think about making their first million and then buying a Ferrari... It makes me sad when I think about it..." He shook his head and sighed.

But he continued to assure Zeke that Tether was safe without providing any additional evidence. Zeke told Fang Junzhe that he wanted to talk to Giancarlo Devasini… Fang Junzhe turned away and said, “I don’t think Giancarlo Devasini wants to meet with you.”

Giancarlo Devasini finally showed up at his girlfriend’s art exhibition in Switzerland.

Giancarlo Devasini has always had a much younger artist girlfriend, Valentina Picozzi. Her works are full of topics about inflation, Bitcoin and the US dollar. The "Satoshi Nakamoto" statue in Lugano, Switzerland is her artistic creation.

Michael Saylor tweeted on January 4 that Valentina Picozzi was the creator of this artwork

Valentina Picozzi presents artwork to Nayib Bukele on March 2, 2023

In August 2022, Zeke saw on Twitter that Valentina was about to hold an exhibition in Lugano, Switzerland.

Zeke decided to fly to Lugano, Switzerland to explore the mystery of Devasini. At noon, 58-year-old Devasini finally showed up at the art exhibition. He was tall and dressed like an old rock musician, but he was followed by two dark and sturdy men - these two men from New York were instructed "not to talk to anyone" ... Yes, they were Devasini's bodyguards!

Zeke had been chasing Devasini for several years and finally met him in person. Of course he rushed forward, but was stopped by the bodyguard... Devasini said in English with an Italian accent: "I hope your book will sell well."

Zeke was ultimately unable to meet with Devasini to talk face to face about the mysterious company Tether/USDt, to delve into his plastic surgery career, his divorce, his past blog content, or to dig into the inside story of Tether’s reserves. What Zeke wanted to tell Devasini the most was that USDt was used for money laundering, drug trafficking, fraud, and even human trafficking in Cambodia and Southeast Asia... I wonder if Devasini understands the role USDt plays in different corners of the world...

Zeke still didn't give up. He sent a message to Devasini via Telegram: "I want to hear your story. It's very important. I'll be waiting for you at Bar Laura near the venue..."

At 12:38 am, Devasini still hadn’t shown up…

Zeke was lying in bed, feeling disappointed, when he received a message from Devasini: "Bees don't waste their time explaining to flies that honey is better than shit... "

Giancarlo Devasini is thinking bigger.

On November 16, 2022, a few days after FTX collapsed, Devasini appeared in El Salvador and took a photo with President Nayib Bukele because he was working with El Salvador on plans to issue $1 billion in “Bitcoin Bonds/Volcano Bonds”.

NayibBukele (sixth from left) Giancarlo Devasini (fifth from left) Paolo Ardoino (seventh from left) Max Keiser (first from left) Valentina Picozzi (third from left) Stacy Herbert (fourth from left)

Devasini certainly had reason to be so happy. In 2022, the Federal Reserve continued to raise interest rates to fight inflation, and by December, interest rates had risen to 4%. Tether does not have to pay interest to USDt holders, and all the income generated by the large amount of US Treasury bonds held by Tether flows into Devasini's pocket , which is almost pure profit!

In 2022, the chain reaction of the bankruptcies of Voyager Digital, Celsius, BlockFi, Three Arrows Capital (3AC), FTX, Luna, etc. caused the entire crypto market to plummet from a market value of $3 trillion to less than $1 trillion. As the centralized stablecoin with the largest transaction volume , USDt seems to be completely out of the picture ...

This reminds me of a sentence Devasini once wrote in his blog:

"Either I'm a genius, or everyone else is insulting your intelligence."

Finally, my thoughts on Tether and Giancarlo Devasini

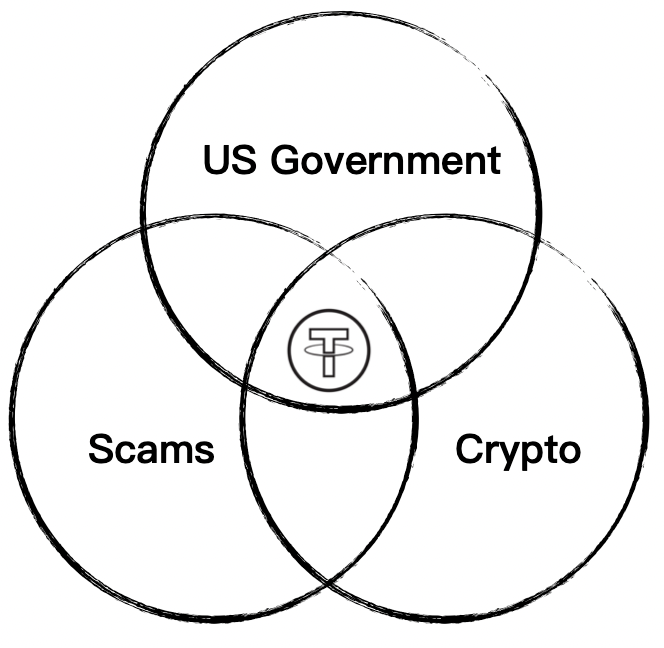

Tether's triangular relationship with the US government's Southeast Asian fraud virtual currency market

I will use this picture to explain my views on the company Tether.

US Government

1. The US government needs to maintain the huge lie of the US dollar, and Tether plays a very important role, allowing USDt to circulate in developing countries (Vietnam, Cambodia, Thailand, El Salvador, etc.), so that the lie of the US dollar can continue...

2. Tether holds up to $113 billion in U.S. Treasury bonds, which is exactly what the U.S. government wants to see.

Cryptocurrency Market (Crypto)

1. High-leverage exchanges such as Binance, FTX, and Bybit all rely on a large amount of USDt as the transaction settlement unit.

2. The DeFi ecosystem also relies on USDt as infrastructure to build more protocols on top of it.

Scams in Southeast Asia

A large number of telecommunications frauds in Southeast Asia rely on USDt for fund transfers, including money laundering, drug trafficking, fraud, human trafficking , etc. Many people who want to hide their assets and evade taxes also like to use USDt because it can quickly transfer funds and can be easily exchanged for fiat currencies in other countries through OTC transactions in Southeast Asia.

In the Web3 world, only the US dollar stablecoin is needed, not the stablecoins of other countries.

In the future Internet world, no matter which country you come from, everyone will only use "USD Stablecoin" .

People are not used to settling accounts in RMB, Euro or Yen . Judging from Tether’s data, the trading liquidity of CNHt, EURt, and MXNt is extremely low , which speaks volumes.

It's like the richest people in the world only buy real estate in Manhattan, New York , because there is high transaction liquidity, a mature market, and global indicator significance. Real estate in other countries basically belongs only to the local people.

Tether official website USDt CNHt EURt MXNt Total issuance

The Taiwan market does not need a cryptocurrency exchange at all, USDt is enough!

You will find that on Taiwan's cryptocurrency exchanges, the largest trading volume is always USDt/TWD .

As long as you have USDt, you can freely buy and sell various cryptocurrencies on offshore exchanges. Regardless of the type of transaction, USDt has the best liquidity and depth.

Tether (USDt) can be said to be a game-changing innovation that has completely disrupted the business model of many people.

Is Giancarlo Devasini saving the industry or satisfying his own desires?

My answer is: Desire...

The rest is up to you who are using USDt to imagine...