Author: Ashley

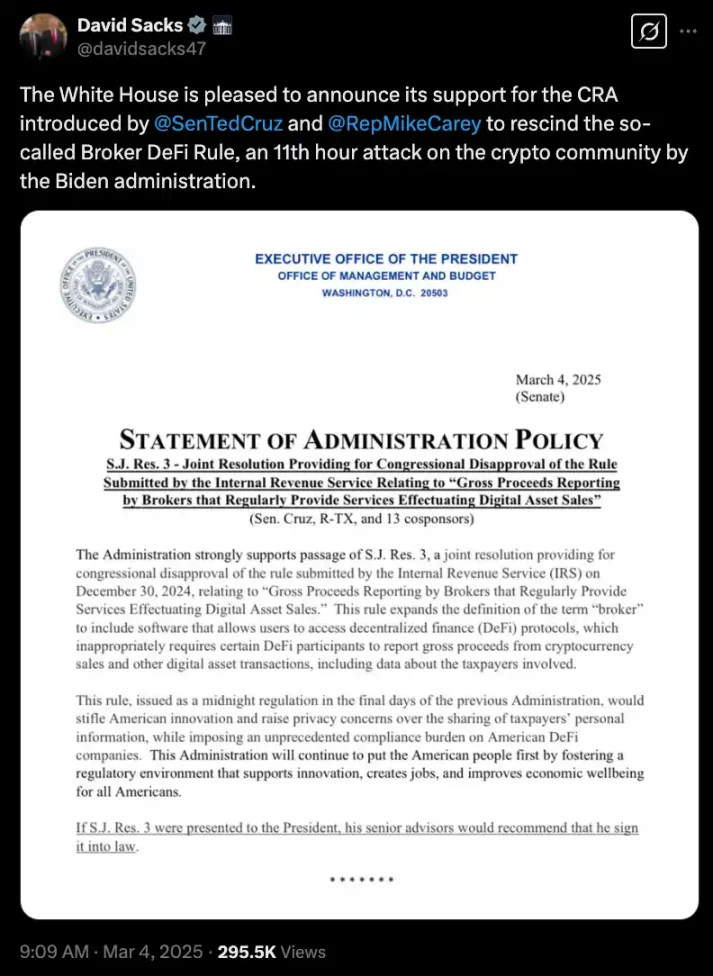

After Trump took office in the White House, the crypto market has seen frequent favorable policy announcements. On March 4, local time in the US, the Senate passed the resolution to revoke the "DeFi Broker Rule" by a vote of 70 to 27. David Sacks, the White House's AI and Cryptocurrency Supervisor, posted on social media that "the White House is pleased to announce its support for the Congressional Review Act (CRA) introduced by Senator Ted Cruz and Congressman Mike Carey to revoke the so-called 'DeFi Broker Rule' - the Biden administration's last-minute attack on the crypto community."

However, the resolution still needs to be passed by the House of Representatives, and then President Trump can sign it into law. Once completed, not only will the rule be completely abolished, but the IRS will also be prohibited from implementing similar policies in the future. The White House stated that the President may quickly sign this resolution.

The Blockchain Association, representing well-known cryptocurrency companies such as Coinbase, Kraken, and Uniswap Labs, supports the abolition of this rule, stating that it will prevent unnecessary restrictions on DeFi innovation. The DeFi Education Fund called the Senate's vote "the first of many historic milestones in the regulation of digital assets in America."

Why revoke the "DeFi Broker Rule"?

The DeFi Broker Rule is a regulatory framework for decentralized finance (DeFi) intermediary service providers (such as trading platforms, lending protocols, etc.) that came into effect on January 1, 2025, aiming to ensure compliance, user protection, and risk management. The core content includes anti-money laundering (AML), know-your-customer (KYC), smart contract audits, fund security, and transparency requirements. According to the professional interpretation of TaxDAO, this rule has a certain positive effect on anti-money laundering, anti-terrorism, and anti-tax evasion.

In fact, the DeFi Broker Rule had already sparked considerable controversy in the industry even before its implementation. Since decentralized platforms do not hold funds or store customer data like traditional financial institutions, many critics believe the rule is unrealistic and a case of "over-regulation." The digital asset think tank Coin Center called the proposal "technically infeasible".

The main reason is that the DeFi Broker Rule attempts to regulate DeFi using the TradFi mindset, without keeping up with the logic and characteristics of Crypto's development, ignoring the decentralization and anonymity of DeFi, and fundamentally misunderstanding the technology it seeks to regulate. The DeFi Broker Rule raises higher compliance management requirements, requiring practitioners to strictly fulfill tax reporting obligations and mandatorily implement the KYC mechanism. Taking the 1099-DA form reporting standard as an example, this regulation clearly requires brokers to submit investors' digital wallet addresses and transaction volumes, which will substantially change the existing transaction model: on the one hand, the KYC mechanism will lose the anonymity of DeFi, leading to a significant reduction in privacy protection; on the other hand, the collection, processing, and reporting of user data will significantly increase operating costs and compliance pressure.

This TradFi regulatory approach may have a more far-reaching impact on the development of DeFi: first, the addition of manual review steps will interfere with the automated execution of smart contracts, affecting the efficiency of decentralized governance mechanisms; second, the information disclosure obligations are fundamentally in conflict with the core principles of the DeFi ecosystem. If the regulation continues to strengthen transparency requirements and weaken the anonymity feature, it not only will change the trading behavior patterns of the user community, but may also seriously constrain the market competitiveness and innovation vitality of the decentralized financial system.

Senator Ted Cruz, the initiator of the repeal of the DeFi Broker Rule, stated in his pre-vote speech in the Senate: "DeFi is a microcosm of the crypto currency revolution." He called this rule "incoherent" federal overreach. He believes that the rule of treating software developers as brokers (and forcing them to disclose user data and personal information) is meaningless, "as their software has never held or controlled user funds."

Michele Korver, the regulatory head of a16z Crypto, has also written that the new broker reporting rule released by the US Treasury Department yesterday poses a direct threat to the vision for DeFi development and may impede the future of DeFi innovation in the US. To this end, a16z Crypto supports the Blockchain Association, DeFi Education Fund, and Texas Blockchain Council in filing a lawsuit accusing the IRS and Treasury Department of exceeding their statutory authority, violating the Administrative Procedure Act (APA), and even being unconstitutional.

Under Trump, "Crypto Deregulation", DeFi at the Forefront

The proposal was passed by an overwhelming vote of 70 to 27, indicating that not only the Republicans, but also many Democrats support the development of Crypto. A similar situation occurred in the previous Congress when the vote to repeal the SEC's cryptocurrency accounting rules, showing that the bipartisan support for Crypto development is continuously strengthening, continuing the trend of cooperation on crypto legislation, which may bring good news for this year's stablecoin legislation and other crypto bills.

With Trump back in power, the most crypto-friendly US Congress in history has emerged. Although the performance of President Coin, First Lady Coin, and Trump's recent emphasis on "Crypto Strategic Reserves" has left many disappointed, the policy shift is indeed beneficial to the crypto market. On the third day after returning to the White House, on January 23, 2025, Trump signed an executive order establishing a cryptocurrency working group, with the task of proposing new digital asset regulatory recommendations and exploring the establishment of a national cryptocurrency reserve. The order explicitly prohibits the creation of a central bank digital currency (CBDC) in the United States, avoiding competition between government-issued digital currencies and existing cryptocurrencies.

As the core component of the crypto world, DeFi has been at the forefront of regulatory pressure and jurisdiction from agencies like the SEC in the early years. But recently, various regulatory favorable signals have emerged in the DeFi field, indicating a clear shift in the regulatory attitude. From the SEC's announcement to withdraw the Kraken lawsuit; close the investigation into Gemini; terminate the three-year investigation into Uniswap Labs without taking any enforcement action; the two market maker giants Wintermute and Citadel Securities begin to enter the US market; the Tornado Cash founder Alexey Pertsev was temporarily released...

In addition, the SEC has revoked the accounting guidance that required listed companies to record third-party crypto assets as both assets and liabilities, and announced the establishment of a crypto task force to develop a comprehensive and clear regulatory framework, and stated that it will reduce the intensity of crypto enforcement and reallocate more than 50 dedicated lawyers and staff to ease the regulatory pressure on the industry. Furthermore, last month the SEC confirmed the crypto ETF applications of several major US traditional giants, and concentrated on withdrawing lawsuits and investigations against crypto projects such as Coinbase, Robinhood, and Uniswap. These measures indicate that the SEC's attitude towards crypto assets is shifting from "strict regulation" to "friendly".

In the future, under the regulatory policy relaxation environment represented by the revocation of the "DeFi Broker Rule", the crypto market may welcome not only good news. In a relaxed regulatory environment, how to crack down on money laundering and other illegal activities, how to ensure tax fairness and market order? Against the backdrop of the rapid development of the crypto industry, how to find a balance between encouraging innovation and strengthening regulation? This "Crypto President", how will he fulfill his promise to make America the world's crypto capital? All of this still needs to be answered through the continuous exploration and reconciliation of the crypto market and regulatory policies.