I. Lightning Decision-Making in the Face of Technical Crisis: Holesky Testnet Downtime and Community Consensus Reconstruction

1. A "Non-War Offense" Technical Failure

On February 24, 2025, the Holesky testnet, a critical testnet for the Ethereum Pectra upgrade, experienced a severe disruption, leading to widespread validator node disconnections and block synchronization stalls. Although the incident was not related to the core Pectra protocol, but rather caused by configuration conflicts in client software (such as Geth and Lighthouse), its destructive power far exceeded expectations - the originally scheduled testing for early March was forced to be postponed to the end of the month, directly disrupting the development roadmap. This incident exposed the fragility of Ethereum's multi-client architecture: the seemingly redundant design has become an amplifier of systemic risk in extreme scenarios.

2. Shadow Forks: "Surgical" Repairs in Crisis

To catch up with the schedule, on the evening of March 6th, the Ethereum Foundation and core developers urgently launched a "shadow fork" of Holesky. This plan involves copying the mainnet state to an independent chain, allowing developers to verify the repair solutions in an isolated environment, while not affecting the recovery process of the main testnet. This strategy was successfully applied in the 2023 Merge upgrade, but this fork is more challenging: it needs to maintain the testnet compatibility for the future Fusaka upgrade while fixing the vulnerabilities.

3. The "Unexpected Gain" of the Failure: Stress Testing the Staking Mechanism

The Holesky disruption unexpectedly became a "stress test field" for the staking mechanism. Testnet data shows that when more than 15% of the validator nodes are offline, the automation efficiency of network penalties (Slashing) decreases by 40%, exposing governance blind spots in large-scale staking scenarios. This finding has prompted developers to accelerate the integration testing of EIP-7251 (increasing the single validator staking limit to 2048 ETH) and EIP-7002 (execution layer triggered exit), paving the way for ETF-level capital.

II. The "Arms Race" in the Staking Landscape: ETF Compliance and the Institutional Capital Positioning Battle

1. SEC's "Opening the Gate" Signal: The Compliance Gambit of 21Shares and Grayscale

In February 2025, the SEC received revised Ethereum ETF staking applications from 21Shares and Grayscale (Grayscale). Unlike earlier proposals, the new plans avoid regulatory risks through "non-custodial staking" - assets are held by compliant custodians like Coinbase, and profit distribution is automated through smart contracts, avoiding commingling of funds. The SEC's feedback documents show a shift from "staking as securities" to "conditional compliance", requiring issuers to set up risk reserve funds (e.g., 2% of AUM) to address slashing losses.

2. The "Life-or-Death Line" of Yields: The Covert Battle Logic of ETF Issuers

According to Bitwise's estimates, if U.S. Ethereum ETFs adopt staking, the annualized yield can reach 3.2%-4.5%, almost offsetting the 0.25%-0.4% management fees. To compete for market share, industry giants like BlackRock and Fidelity are negotiating with Coinbase and Figment, demanding that staking service fees be compressed to below 8% of the yield (the current market price is around 12%).

Grayscale, on the other hand, is taking a different path, proposing rule changes on the New York Stock Exchange to allow its Ethereum trust (ETHE) to participate in staking directly, reducing the cut of intermediaries - if successful, its capital outflow trend may be reversed (ETHE has recently lost $4 billion).

3. The "Counterattack" of Liquid Staking: Lido's Compliance Overhaul and stETH Hegemony

Facing ETF competition, Lido has urgently launched the V3 upgrade, introducing customized institutional products stVaults: allowing ETF issuers to create independent staking pools, with node operators designated by institutions like BlackRock, and yields distributed after zero-knowledge proof (ZK Proof) verification. This solution meets the SEC's transparency requirements while retaining Lido's liquidity advantages (stETH accounts for 35% of the market share). Analysts predict that mainstream ETFs may adopt a "50% native staking + 50% stETH" hybrid model to balance yield and liquidity.

III. Reconstruction of the Token Economy: From Technical Upgrades to the Vortex Effect of Billions in Capital

1. The "Atomic Bomb-Level" Boon of the Pectra Upgrade: Staking Throughput Leaps 64-Fold

Renowned analyst max states that the deterministic staking/unstaking time is key to the normal operation of the capital market, and the current Ethereum dynamic queuing is not good.

The implementation of EIP-7251 will fundamentally rewrite the staking rules - the single validator staking limit will be raised from 32 ETH to 2048 ETH, and the staking/unstaking queue throughput will surge 64-fold. For ETFs, this means:

- Efficiency of capital entry: The entry time for $800 million (4 million ETH) will be compressed from 69 days to 1.08 days;

- Redemption crisis mitigation: In extreme redemption scenarios, the queuing period will be shortened from 34 days to 10 hours.

- This directly breaks down the SEC's concerns about liquidity risk, clearing the biggest obstacle for ETF approval.

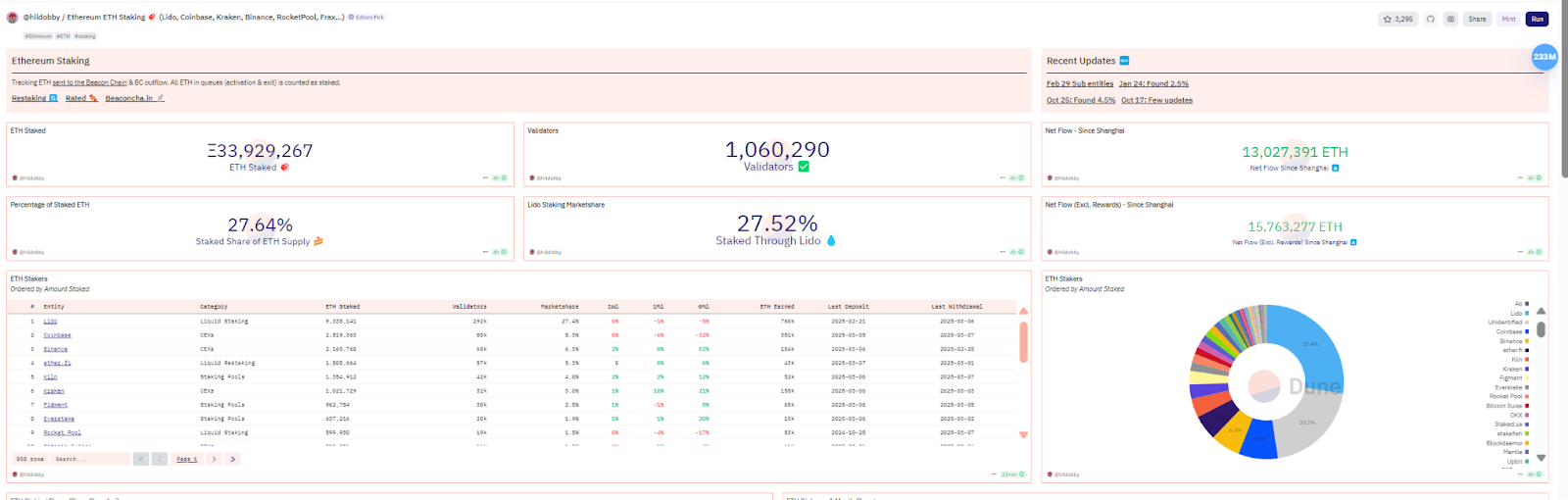

2. The "Powder Keg" of Supply-Demand Imbalance: Staking Lockup and Deflationary Spiral

Dune data shows that the current Ethereum circulating supply is about 120 million, with a staking rate of 27.64%. If Ethereum ETFs are approved for staking, the staking rate is expected to rise to 50%, coupled with the existing lockup of protocols like Lido, the actual circulating supply will be reduced by more than 20%. Meanwhile, the Pectra upgrade will introduce EIP-7623 to reduce storage costs, driving up Gas consumption - the annual inflation rate may shift from 0.5% to a net deflation of 1.2%.

Historical data shows that for every 1% increase in the staking rate, the coin price corresponds to a 0.7% increase.

3. The "Critical Point" of Institutional FOMO: A $19 Billion Incremental Capital Countdown

Currently, the U.S. Ethereum ETF AUM is only 52% of the Bitcoin ETF, mainly constrained by the lack of staking functionality. After the Pectra upgrade, analysts estimate that compliant staking ETFs will attract $19 billion in incremental capital (about 8 million ETH), driving the ETH/BTC market cap ratio from 15% to 30%. More importantly, the staking yield (3%-4.5%) will cause ETH to break away from the "digital commodity" valuation framework and shift to an income asset model - if benchmarked to the 15x PE of the S&P 500, the fair price of ETH will exceed $6,000.

IV. Risk Warning: The "Unexploded Bomb" Under the Upgrade Dividend

1. The "Regulatory Tightening" of Staking Centralization

EIP-7251 may accelerate the centralization of node operators (such as Lido and Coinbase). The SEC has hinted that it may set a "20% share limit", and if exceeded, will require ETFs to forcibly diversify staking service providers. This may trigger a sell-off panic on Lido (its token LDO has a 30% valuation dependent on institutional expectations).

2. The "Nuclear Button" of Post-Upgrade Profit-Taking

After the Pectra launch, the potential selling pressure from early stakers (cost around $1,500) could reach $6 billion. But on-chain data shows that over 70% of the staked ETH is controlled by long-term holders, and institutions like BlackRock have promised "at least 6 months of lockup", so the short-term selling pressure is manageable.

V. Conclusion: The Triumvirate of Technology, Regulation, and Capital

The Holesky downtime incident has unexpectedly become a key turning point in Ethereum's evolutionary history - it has forced the community to confront the governance challenges of large-scale staking, and given birth to EIP-7251, the "ETF adapter". As the SEC's regulatory hurdles to staking are gradually cleared, Ethereum is transforming from a "developer's paradise" to an "institutional-grade income asset", and its valuation logic will be completely reconstructed.