Dynamic TAO has been online for 23 days, and this article aims to find the current trends and gameplay of the Bittensor ecosystem from the current market data.

TL; DR

- Benefiting from the Dynamic TAO mechanism, the previously criticized "mine-withdraw-sell" situation of Bittensor has been significantly suppressed, with the new issuance of TAO being almost equal to the amount of TAO staked, thereby suppressing the decline in the TAO token price;

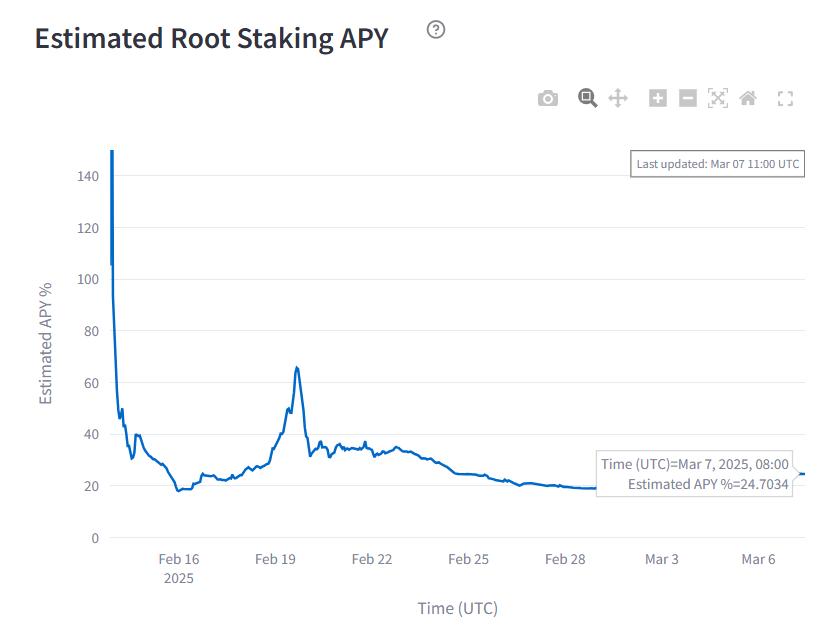

- For TAO Holders, direct staking on the Root is an excellent low-risk financial choice, with the current Staking APY reaching 24.7%; even for non-TAO Holders, purchasing TAO and participating in Root staking is also a good financial choice given that the TAO price is at a historical low;

- In the case of higher risk tolerance, to obtain excess returns, one can look for those Subnets where the teams are working hard, while the Alpha token price has not yet reached a certain height, as the team's investment is likely to be reflected in their price (the top 3 gainers in the past 24 hours have all exceeded 100%).

- As a member of the 0xai first Bittensor Subnet incubation program, Tensorplex announced on March 7 that it had received investment from YZi labs; as Binance's first investment in the Bittensor ecosystem, it symbolizes that the Bittensor sub-ecosystem will gradually enter a prosperous new stage.

TAO Bull and Bear Changes: From Mine-Withdraw-Sell to a New Market Pattern

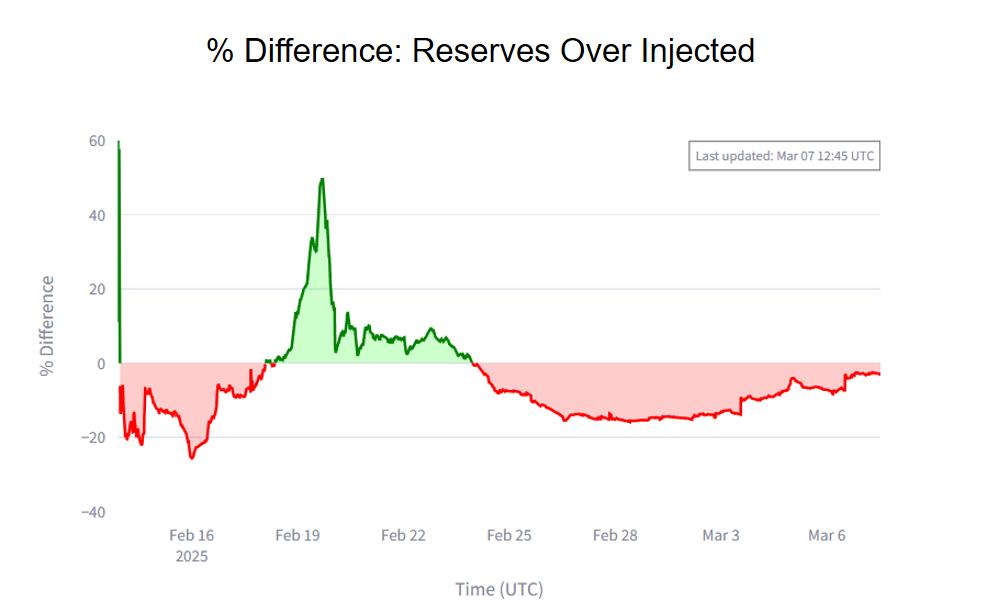

Putting aside the changes in the Dynamic TAO mechanism, the most direct market data changes can already explain some of the market:

- After the launch of Dynamic TAO on February 12, the amount of Staked TAO has shown a significant upward trend, with the speed even exceeding the new issuance of TAO at certain times, which proves that the "mine-withdraw-sell" situation in the TAO ecosystem has been significantly suppressed in the current situation;

Combining the mechanism changes of Dynamic TAO, we have reason to believe that "mine-withdraw-sell" will disappear for a period of time:

- Whether it is Subnet Owner, Miner or Validator, they all need to maintain a certain competitiveness of the Alpha Token Price to continue to obtain Emission;

- Without considering the entry of external buying power, the TAO increment brought by Emission to the Alpha Token Pool is slow, which means that these participants will not execute "mine-withdraw-sell" in large quantities in the early stage, otherwise their future returns will be greatly discounted, and the current operation cannot bring significant returns either.

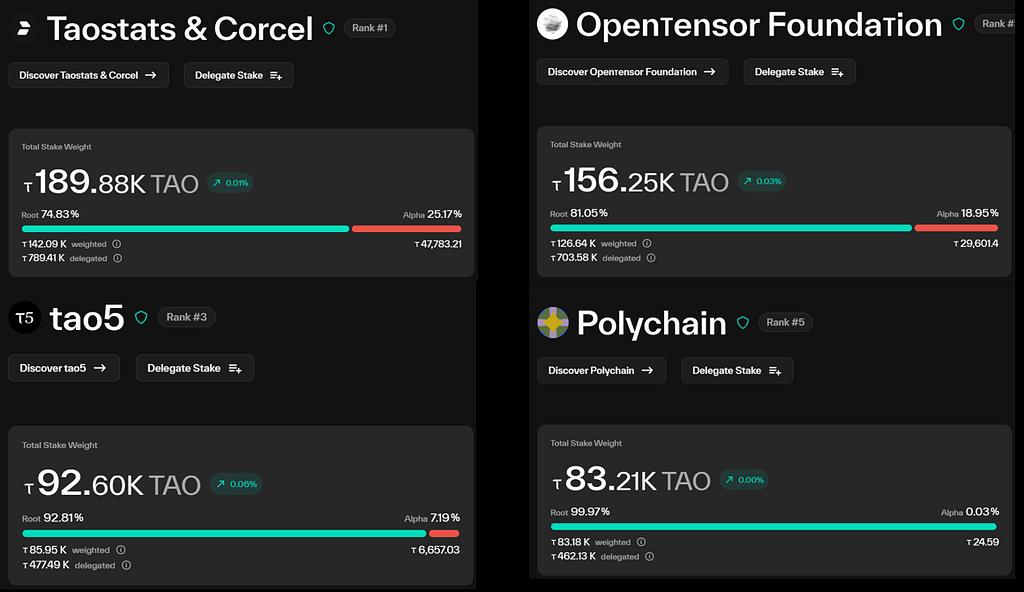

Excellent Financial Strategy: Root Network Staking

As mentioned in our previous article, Root Network Staking is the only risk-free income strategy for TAO Holders in the Bittensor ecosystem (no drawdown of TAO principal, and the Alpha Token obtained from staking can be directly sold to obtain TAO), and the whales in the market have also demonstrated the value of this strategy through their actual actions:

- The top Validators have allocated a very large share to the Root Network, at 74.83%, 81.05%, 92.81%, and Polychain has even staked 99.97% of its TAO to the Root Network.

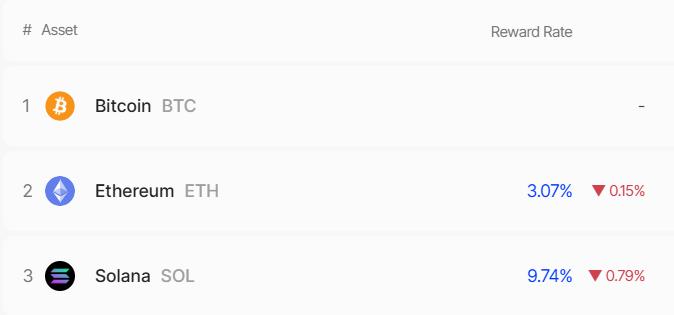

- The current Root Network Staking APY is 24.7%, which is significantly higher than ETH Staking (3.07%) and SOL staking (9.74%).

Combining the discussion in the first paragraph that the TAO price has been at a historical low recently, even for non-TAO holders, purchasing TAO and participating in Root staking is also a good financial choice.

Excess Returns: Continuously Built but Not Yet Pumped Alpha Tokens

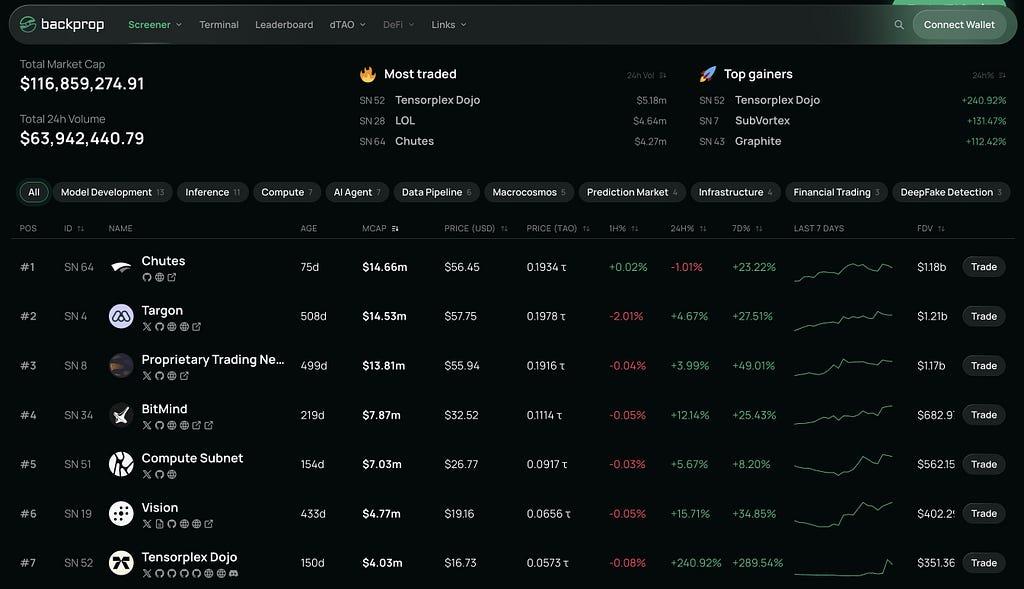

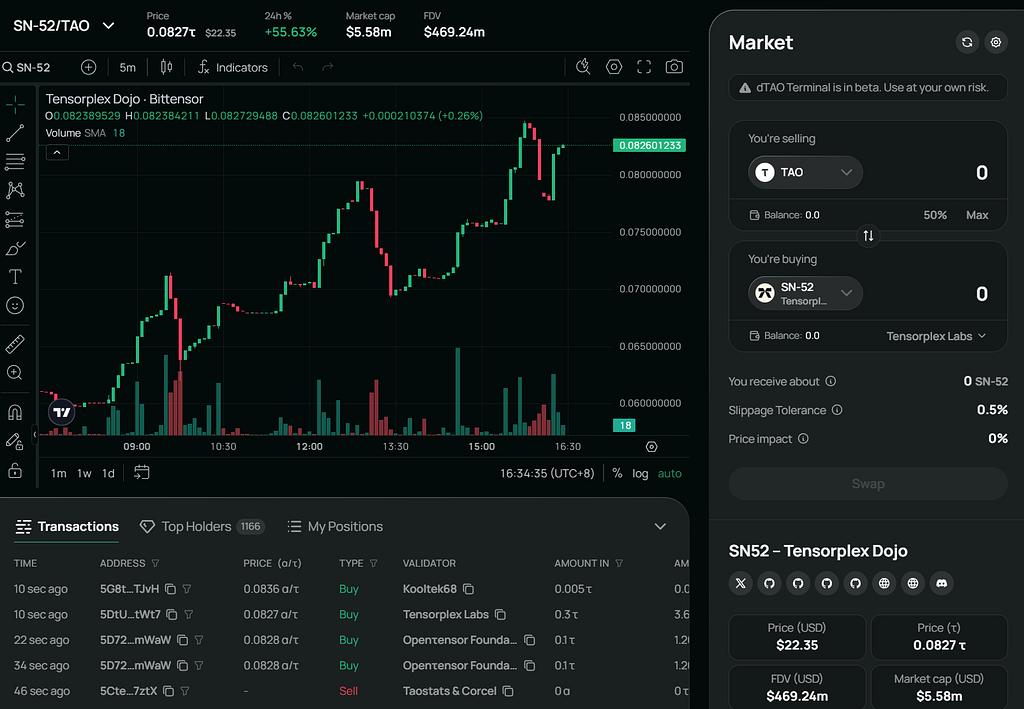

Referring to the data in the top right corner of the figure (top gainers), even in the relatively cold market, the 24-hour gains of the top three Bittensor Subnet alpha tokens can exceed 100%, with Tensorplex even reaching 240%.

Referring to the content in the first paragraph, as long as the Subnet is not directly abandoned, whether it is the Subnet Owner, Validator or Miner, their strategy is most likely to work hard on building and raising the Alpha Token Price over a period of time in order to obtain continuous TAO Emission, rather than selling out in the short term, causing the Alpha Token Price to plummet.

The price trend of the Subnet's Alpha Token is likely to have a similar clear price steadily rising stage in the initial 10 days as the head Subnet Alpha Token Price:

- The Alpha Token of Subnet 4 Targon increased by 99.14% in the first week;

- The Alpha Token of Subnet 51 Compute Subnet increased by 139.78% in the first week.

Based on the above logic, find those Subnets in the community that are working hard on construction, while the Alpha Token Price has not yet been significantly pulled up, as they have a high probability of obtaining excess returns, after all, the Subnet participants have invested a lot of manpower in the construction, and raising the Alpha Token Price to obtain more Emission is just a matter of time.

Tensorplex: Data Labeling + dTao Trading Tools + Validator & LST

YZi Labs announced the investment in Tensorplex on March 7, 2024, signifying that the value of the Bittensor ecosystem sub-project has been more widely recognized.

As a deep participant in the Bittensor ecosystem, Tensorplex's business has already presented a certain matrix form, mainly consisting of the following three parts:

Dojo Subnet (Data Labeling)

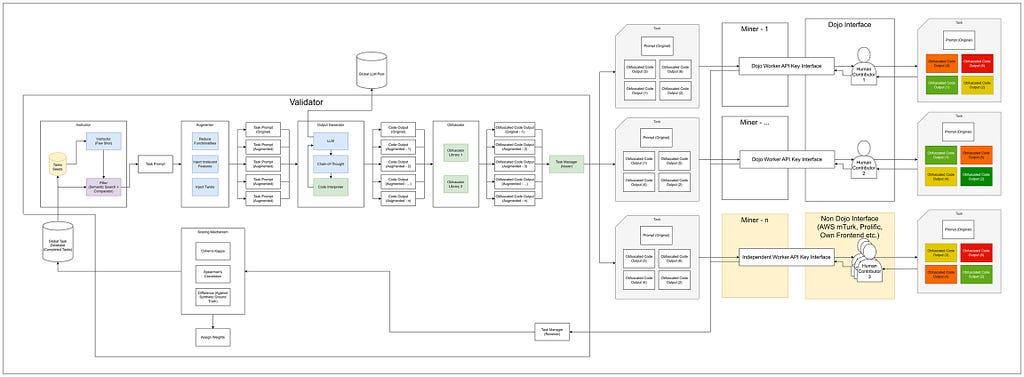

Dojo, as a Bittensor subnet, aims to create an open platform for collecting human wisdom for AI/ML development.

With YZi Labs' investment in Tensorplex, the price of its Bittensor subnet Alpha token surged more than 240% in a single day;

The core goal of the Dojo Subnet is to provide high-quality human data (also known as Data Labeling) for AI:

- Validator: Generates tasks for Miners based on the orders of synthetic tasks or external native requests, verifies the output of Miners, calculates scores, and sets rewards;

- Miner: Obtains rewards by completing the tasks distributed by the Validator; in order to meet production needs, they need to gather and manage a pool of human contributors to generate data;

- Human Contributor: The core data source in Dojo's business, these participants need to solve specific Data Labeling Tasks, mainly human contributors; this is the biggest difference between Dojo and other subnets that only have Miner & Validator participants.

Backprop.finance (dTao Trading Tools)

Backprop.finance is similar to GMGN, not only providing various dimensional data (with extremely high real-time) of each Subnet alpha token, but also providing one-click trading functionality, greatly optimizing the user's trading experience.

Compared to taostats/taomarketcap and other front-end platforms, the UI/UX of the current trading interface is more close to trading habits and information needs.

Tensorplex Labs (Validator & LST)

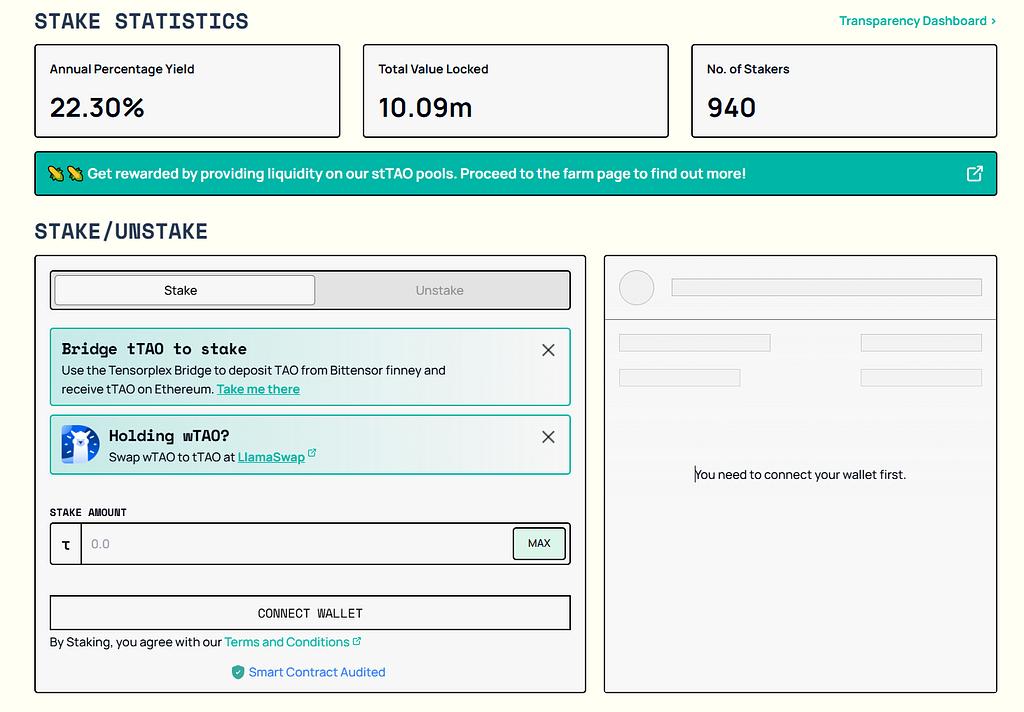

Compared to other Validators, when staking on Tensorplex Labs, users can also receive a 1:1 tTAO (LST Token, issued on Ethereum), helping users not only earn staking rewards (currently 22.3% APY), but also further unlock the value of their token liquidity, e.g. using tTAO to participate in DeFi to generate more value.

Review of the 0xai Bittensor 1st Incubation Program

In February 2024, 0xai officially launched its first Bittensor Subnet incubation program, a 8-week incentive plan that injected new vitality into the blockchain ecosystem. After rigorous screening, 20 outstanding developers and project teams joined this journey.

During the incubation program, with the sharing and support of 0xai, the participants quickly demonstrated strong creativity and execution. Eventually, after multiple rounds of communication with the community, three projects stood out and achieved remarkable results: Myshell and Kaito successfully launched their Bittensor Subnet, while Tensorplex completed the test subnet launch and subsequently went on to launch the Dojo Subnet.

The above three projects have also achieved impressive results in the capital market, with Myshell and Kaito both realizing Binance Listings, and Tensorplex receiving investment from YZi Labs. The success of Myshell, Kaito and Tensorplex not only affirms the capabilities of the participants, but also serves as a powerful proof of the future development of the Bittensor ecosystem.