Over the weekend, a shocking news broke: Binance suddenly froze the accounts of the market maker Web3Port, and the two projects it operated, GoPlus (GPS) and Myshell (SHELL), experienced a near-identical plunge after being listed on Binance. The price trend charts exposed the severity of the issues:

GoPlus (GPS): After being listed on Binance, the token price plummeted from $0.14 to $0.04, a 60% drop, with trading liquidity nearly drying up during the period;

MyShell (SHELL): The price fell from $2.3 to $0.3, a market value evaporation of nearly 60%.

The two similar parabolic curves are like precisely harvested wheat fields by the same sickle, drawing market attention to a long-brewing undercurrent.

What happened?

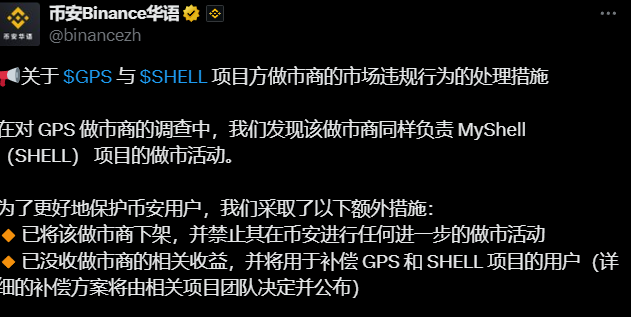

On March 9th, Binance's official Chinese account (@binancezh) announced that during the investigation of the market maker for GoPlus (GPS), it was discovered that the same market maker was also providing services for MyShell (SHELL), and there were serious market violations. Binance reacted swiftly: it removed the market maker from the platform, banned it from any future market-making activities on Binance, and confiscated its illegal gains to compensate users of GPS and SHELL. Although the announcement did not name the entity, industry rumors pointed to Web3Port - a team from Shanghai, whose Binance account has been frozen, and the passive market maker GSR may also be involved.

The fates of GPS and SHELL were identical: the prices plummeted rapidly after being listed, with retail investors lamenting. Someone on X angrily shouted: "No wonder these two tokens crashed so badly!" Others called for Binance to publicly disclose the identity of the market maker and shame them in the industry. The community also uncovered the core figures behind Web3Port - May Liu (Piaopiao) and Ken. This duo was mockingly dubbed the "Sickle Queen", building a "bloody industrial chain" from deceiving VCs to harvesting retail investors. From the early days of Spark Digital Capital luring institutional investors, to later establishing the Web3Port incubator and Whisper market maker, they constructed a complete "blood-sucking" model through project packaging, Binance listing, and market manipulation. This ban seems to have burst the bubble of this false prosperity.

What do market makers do? The "two-faced role" in the market

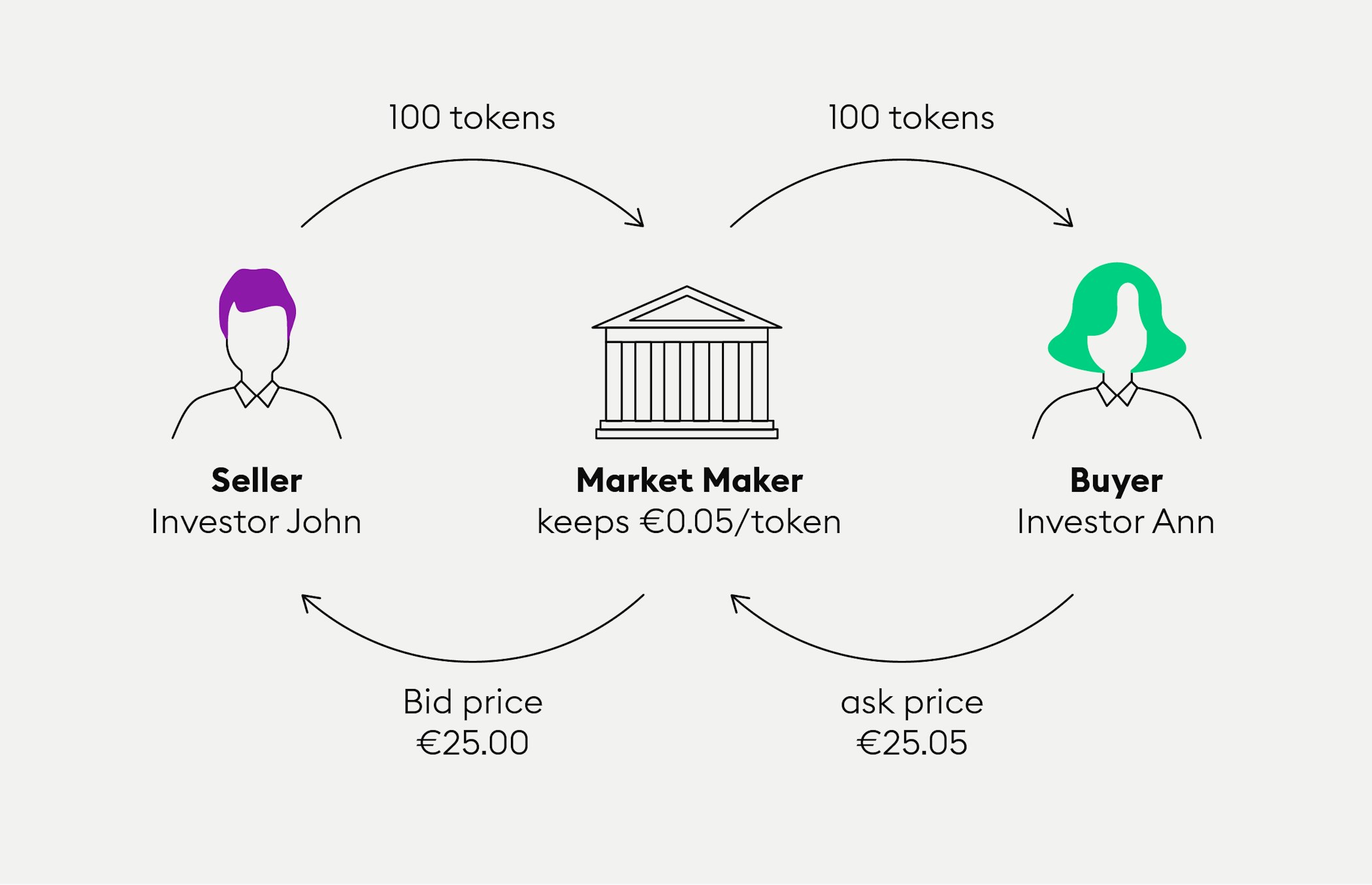

Market makers are often misunderstood as the "great manipulators of the market", but their essence is more like the "order placers" in the market. By providing two-way quotes, they maintain liquidity and price stability. In cryptocurrency exchanges, market makers will post buy and sell orders to ensure the order book has sufficient depth, making transactions smoother.

There are two types of market makers in the crypto market:

- Passive market makers: They mainly provide liquidity, cooperating with project parties through "Token Loan" (borrowing model) or "Retainer" (monthly fee model), earning spreads and option income, theoretically maintaining neutrality.

- Active market makers: They may "manipulate the market" with project parties, earning spreads through pumping or dumping, and even harvesting retail investors. This model is high-risk and non-compliant, but is often seen as a "lifesaver" by project parties during market downturns.

It is not easy for market makers to profit, with their core income coming from bid-ask spreads and option income. However, if the market experiences a unidirectional decline (like the selling pressure on GPS and SHELL after listing), they may be forced to buy at low prices, accumulating "unrealized losses". When the price collapse is too fast, they may not even have time to adjust the quotes, leading to severe losses. This also prompts some unscrupulous market makers to "do evil" - such as clearing the borrowed tokens at the open, dumping to the bottom and then repurchasing at low prices to reap huge profits. Although this behavior is unethical, it reflects the survival dilemma in a bear market.

Web3Port's past: Who was pulling the strings behind the scenes?

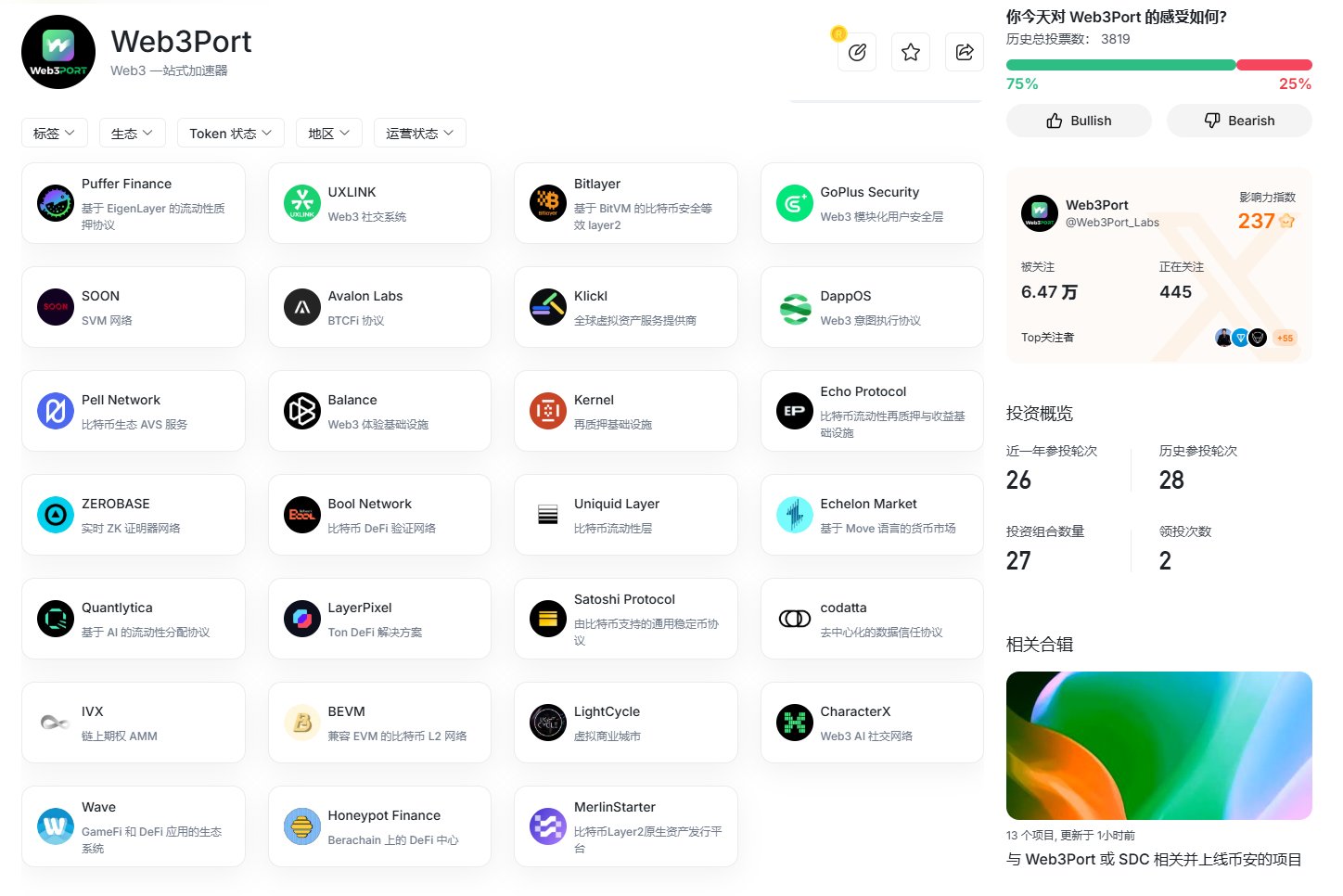

Web3Port, as the focus of the incident, has an intriguing history. According to community leaks, Web3Port is led by May Liu (Piaopiao) and Ken, backed by Spark Digital Capital in Shanghai. This company has been active in the crypto industry since 2017, initially operating as a VC to attract institutional investment, but its main business was actually market outsourcing and FA services, "harvesting the leeks" through free tokens. As the VC market became increasingly competitive in 2021 and 2022, they transformed and established Web3Port, positioning it as a Web3 project incubator, providing packaging, guidance and VC connections for early-stage projects, and charging 1-3% of free tokens.

The incubator is just a facade, Web3Port also set up the market maker Whisper, under the guise of providing liquidity, to find an exit window for its own free tokens. According to public information, Web3Port has provided market-making services for multiple projects, in addition to GPS and SHELL, including:

- Aethir: A decentralized cloud computing platform focused on AI and gaming, with promising market prospects.

- dappOS: A Web3 operating system aimed at simplifying dApp development and user experience.

- Lumoz: A Layer2 solution based on zkRollup, improving Ethereum scalability.

- Mind Network: A decentralized AI network focused on data privacy and computation.

- Movement: A high-performance Layer2 network, featuring low-cost transactions.

- Puffer: A liquid staking protocol, optimizing DeFi yields.

- Polyhedra: A cross-chain interoperability protocol, supporting multi-chain asset transfers.

- Uxlink: A Web3 social platform, connecting users and dApps.

The rise of Web3Port was no coincidence. May Liu (Piaopiao), known as the "Sickle Queen", is skilled at leveraging information asymmetry and market sentiment to build a complete chain from project packaging to market manipulation and profit-taking. Spark Digital Capital initially attracted capital under the guise of VC, but profited through free tokens and service fees. After the VC market became saturated, they shifted to Web3Port, targeting the Web3 hype, not only providing incubation services, but also controlling liquidity through Whisper, forming a one-stop harvesting model. Project parties accepted harsh conditions for Binance listings, while retail investors became the sacrificial lambs in the market dumps. This model thrived during the wild growth period of the crypto market, but as regulation strengthens and the market matures, its survival space is being rapidly compressed.

Impact on the industry: Is the bear market cloud looming?

Binance's ban on the market maker has triggered a chain reaction, deeply impacting liquidity, project confidence, and retail investor confidence:

- Liquidity panic Market makers are the pillars of market liquidity. If they withdraw from Binance due to concerns about being blocked, the platform's depth may plummet. The current bear market signs are starting to emerge, and the liquidity of mid-cap tokens (with a market capitalization of hundreds of millions to tens of billions) is already thin. Without the support of market makers, the slippage may increase sharply, and volatility may intensify. In 2024-2025, although BTC will be strong, the buying demand for mid-cap and long-tail tokens may dry up, and the shrinking liquidity may push the market into a deeper winter.

- Market makers "fleeing" or operating in stealth Facing regulatory pressure, non-compliant market makers may "withdraw their money and flee," move to other exchanges, or operate through multiple accounts in stealth. This will exacerbate market distrust and may prompt regulators to tighten their grip. The freezing of Web3Port is just the tip of the iceberg. If the "malicious" model spreads, the industry's compliance costs will rise, and confidence will further decline.

- Project prices under pressure Projects that rely on market makers may face disasters. At this stage, retail investors are no longer willing to buy new tokens, and the selling pressure after listing far exceeds the buying demand. When liquidity is insufficient, the withdrawal of market makers may lead to a price crash. Lessons from the cases of GPS and SHELL show that many mid-cap tokens may fall below their VC prices or even drop to zero, exacerbating the bear market expectations.

Conclusion: Insights from the turbulence

Binance's blocking of market makers is like a huge stone thrown into a lake. In the short term, the withdrawal of liquidity and the resulting confidence crisis may make the market even colder, and the bear market clouds may be looming. However, this may also be the beginning of the industry's self-cleansing. The demise of Web3Port announces the end of the era of savage growth, and compliance and transparency are becoming the new trend. Project teams need to choose reliable partners and enhance their intrinsic value to cope with the risks, while investors should maintain rationality and avoid blind chasing of high prices. Whether the bear market will arrive remains to be seen. But regardless of how the market evolves, trust and norms will always be the foundation of the crypto world. In this turbulence, by observing calmly, we may witness the industry finding a new balance through the challenges.