Introduction

In recent years, the crypto industry has seen a surge in the tokenization of traditional financial assets, with the tokenization of US stocks being one of the most notable new developments. BackedFi was the first to bring Coinbase ($COIN) stock to the Base chain in a tokenized form, quickly sparking industry discussions. Meanwhile, the Nasdaq, the second-largest securities exchange in the US, announced on March 7 that it has applied to the Securities and Exchange Commission (SEC) to extend its stock market trading hours to 5 days a week, 24 hours a day, with plans to implement this by the second half of 2026.

This plan aims to meet the demands of global investors, especially those in Asia, and echoes the trend of US stock tokenization breaking down time and geographical barriers. The dual transformation of US stocks moving on-chain and traditional exchanges extending trading hours not only showcases the potential for blockchain technology and traditional finance to converge, but also prompts deeper reflections: Will they further drain liquidity from the crypto market? And how will these innovations reshape the boundaries between the crypto world and traditional finance?

Background of BackedFi's Collaboration with Coinbase

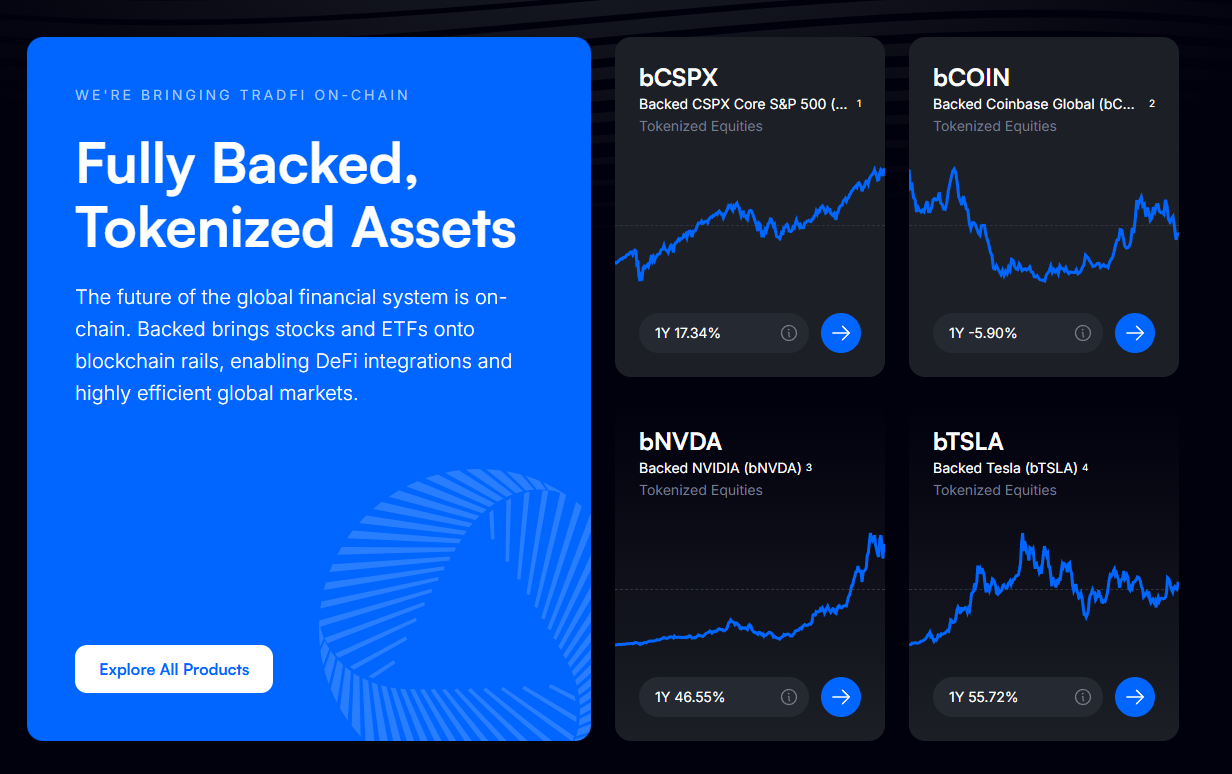

BackedFi is a tokenization securities issuer headquartered in Zurich, Switzerland, focusing on converting real-world assets (such as stocks and US Treasuries) into ERC-20 tokens through full collateralization. Its product offerings include tokenized stocks of companies like Tesla, NVIDIA, Coinbase, MicroStrategy, and the S&P 500 ETF, as well as fixed-income tokens pegged to BlackRock's short-term US Treasuries. These tokens are built on Chainlink's "Tokenized RWA Infrastructure" (including price oracles, reserve proofs, and cross-chain protocols) to ensure on-chain prices are linked to the market and to verify the authenticity of the underlying assets, laying the technical foundation for US stock tokenization.

BackedFi's collaboration with Coinbase has deep roots. Jesse, the head of the Coinbase Wallet and Base chain, has used BackedFi as an example to discuss the tokenization of $COIN, indicating the close relationship between the two. This collaboration not only propelled BackedFi's early-mover advantage, but also suggests that the integration of traditional finance and the crypto world is accelerating.

The Allure of Tokenizing US Stocks

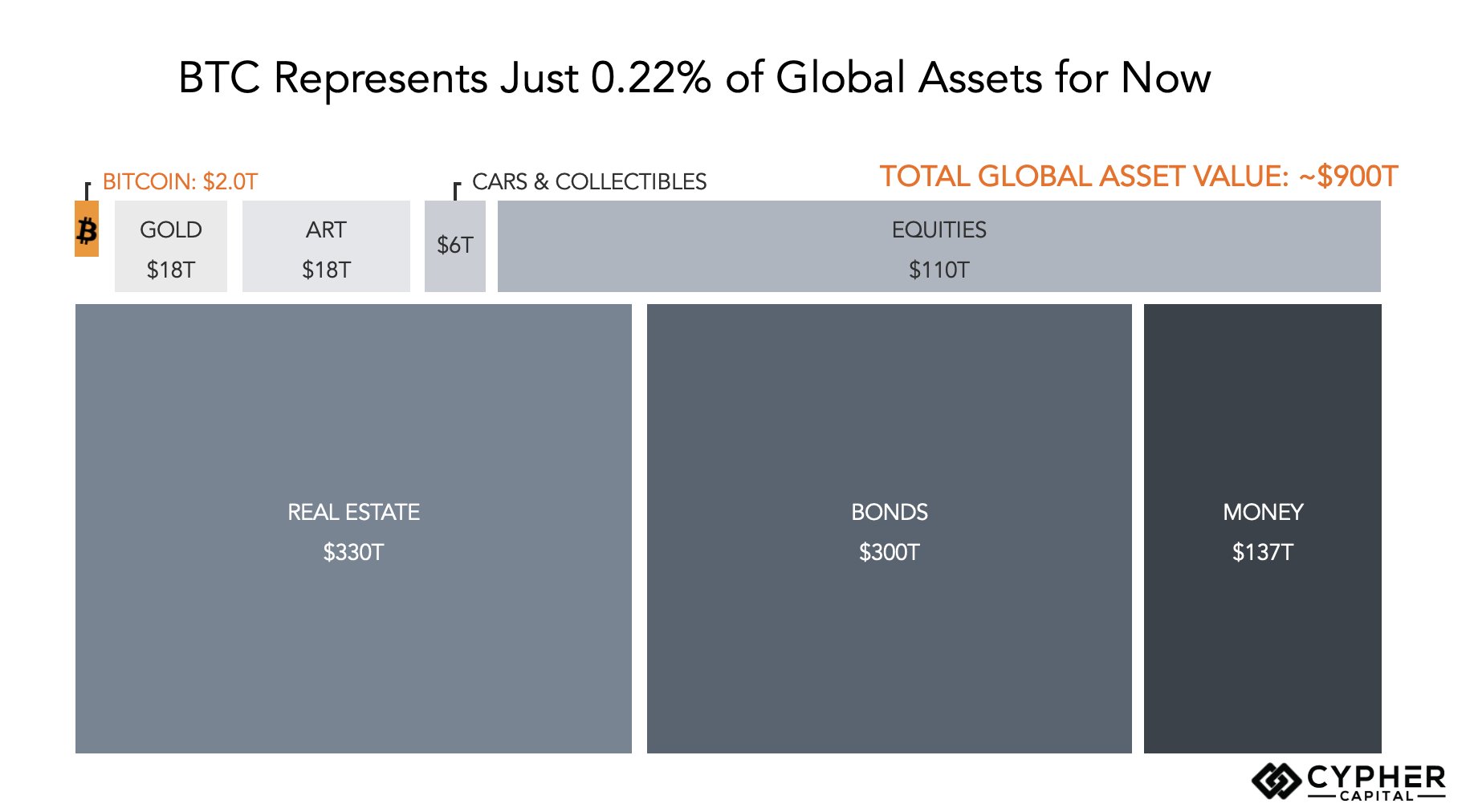

The biggest appeal of tokenizing US stocks is that it introduces "Real-World Assets" (RWAs) into the blockchain ecosystem, diversifying the range of on-chain assets. The total market capitalization of US stocks is a staggering $110 trillion, which, although only a small fraction of the global $900 trillion in assets, is one of the most attractive financial sectors globally. Compared to the crypto market's reliance on native tokens, stablecoins, or Non-Fungible Tokens (NFTs), the tokenization of US stocks injects new vitality and stability into the on-chain economy.

For users who cannot directly invest in US stocks, tokenization provides a convenient channel. BackedFi's $wbCOIN is pegged 1:1 to USDC, allowing Coinbase stock to be traded on-chain 24/7, bypassing KYC, tax, or cross-border payment barriers, and enabling non-US residents to participate. This "US stocks going global" model not only attracts global capital, but may also draw traditional investors into the crypto ecosystem. Furthermore, the asset backing and market foundation of US stock tokenization may compel crypto projects to shift from speculative narratives to value creation.

Trends and Challenges of Convergence

The tokenization of US stocks is not just about asset digitization, but may also be the starting point for a deeper integration of traditional finance and the crypto world. If exchanges like the NYSE and Nasdaq achieve 24/7 on-chain trading, users may be able to stake US stock tokens, participate in liquidity mining, or even create new applications by combining with meme culture on-chain. BackedFi's $bCSPX (an S&P 500 ETF token) has already integrated liquidity through Balancer, enabling global trading without KYC, breaking down geographical and time constraints, and demonstrating both improved accessibility and liquidity.

However, challenges are also significant. Regulatory risks are at the forefront: BackedFi restricts US residents from purchasing $wbCOIN to avoid compliance issues, but the complexity of cross-border regulations still poses hidden dangers, especially in the US and EU markets, with no clear consensus on balancing innovation and protection. Technical aspects cannot be overlooked either: the on-chain price of $wbCOIN (223 USD) is higher than the after-hours broker price (217 USD), which may be due to oracle deviations or arbitrage opportunities; its "one-way valve" design (allowing only USDC purchases, not the sale of actual stocks) is more likely to raise trust issues.

According to data from RWA.xyz, as of March 10, the total market value of tokenized RWAs reached $17.9 billion, a 92.5% year-over-year increase. Among them, the market value of tokenized stocks is only $15.92 million, but has grown 157.9%, indicating huge potential. BackedFi's bTokens account for over 90% of this segment, with $bCSPX leading the pack at $7.388 million in market value, but liquidity is concentrated on platforms like Gnosis, and cross-chain scalability remains to be improved.

Balancing Liquidity and Ecosystem

Will the tokenization of US stocks drain liquidity from the crypto market? The answer is both complex and full of possibilities. In the short term, speculative capital may flow towards high-quality tokenized assets, but this is not necessarily a bad thing. However, BackedFi's model exposes a key limitation: its tokenization mechanism is akin to a "one-way valve" - users can only purchase tokens (such as $wbCOIN) using on-chain assets like USDC, which are then operated by BackedFi, while the actual US stocks (such as Coinbase shares) held in the real world cannot be directly sold on-chain. This design strictly confines liquidity within the crypto ecosystem, preventing traditional US stock holders from participating, which may mitigate the direct impact on crypto liquidity. However, once US stock tokenization truly matures and tokens backed by real assets become mainstream, who will still want to trade those "air tokens" without any underlying foundation? The tokenization of US stocks may compel crypto projects to move away from speculative narratives and towards value-driven models.

In the long run, the tokenization of US stocks not only has the potential to attract traditional investors, but also to strengthen the resilience of the ecosystem by diversifying the range of on-chain assets. For example, BackedFi's integration with Balancer to lower entry barriers may inject new vitality into the crypto world. Crypto is reshaping the global $900 trillion asset landscape: from BTC as a proxy for gold, USDT as a proxy for currency, to the current tokenization of US stocks, blockchain is gradually covering traditional finance. As a top-tier asset, the tokenization of US stocks may be a milestone in bridging traditional finance. However, the crypto ecosystem needs to maintain innovation to avoid losing its original dynamism by over-relying on traditional assets.

Conclusion

The tokenization of US stocks is an experiment full of imagination, both intriguing and deeply meaningful. Despite facing regulatory, technical, and liquidity challenges, the prospects are promising. BackedFi's $bCSPX and $wbCOIN are just the beginning, and if more US stocks are tokenized and integrated with DeFi and meme culture, the financial market may exhibit unprecedented diversity. Ultimately, whether it drains crypto liquidity depends on how the ecosystem balances innovation and stability. Regardless of the outcome, this transformation will leave a lasting mark in the annals of global finance.