When market panic sentiment is pervasive, ETH briefly fell below $2,000, and many believe the bull market is still far away. However, smart money is quietly in action: whale holdings have increased against the trend, exchanges have withdrawn coins on a large scale, and on-chain indicators are releasing signals that the market is about to reverse. More importantly, Ethereum is about to welcome one of the most important technical upgrades in its history - the Pectra Upgrade, institutional investors are rushing into the ETF market, and the macroeconomic environment is also turning towards loose liquidity.

All signs indicate that we are standing at the starting point of a new bull market. Not only is ETH expected to return to $3,000, but it is also likely to hit $4,000 or even higher by the end of 2025. Now is the time to re-examine the huge opportunities brought by this technological and financial revolution!

I. Signals of Market Bottom Emerge: Divergence between On-chain Data and Capital Flows

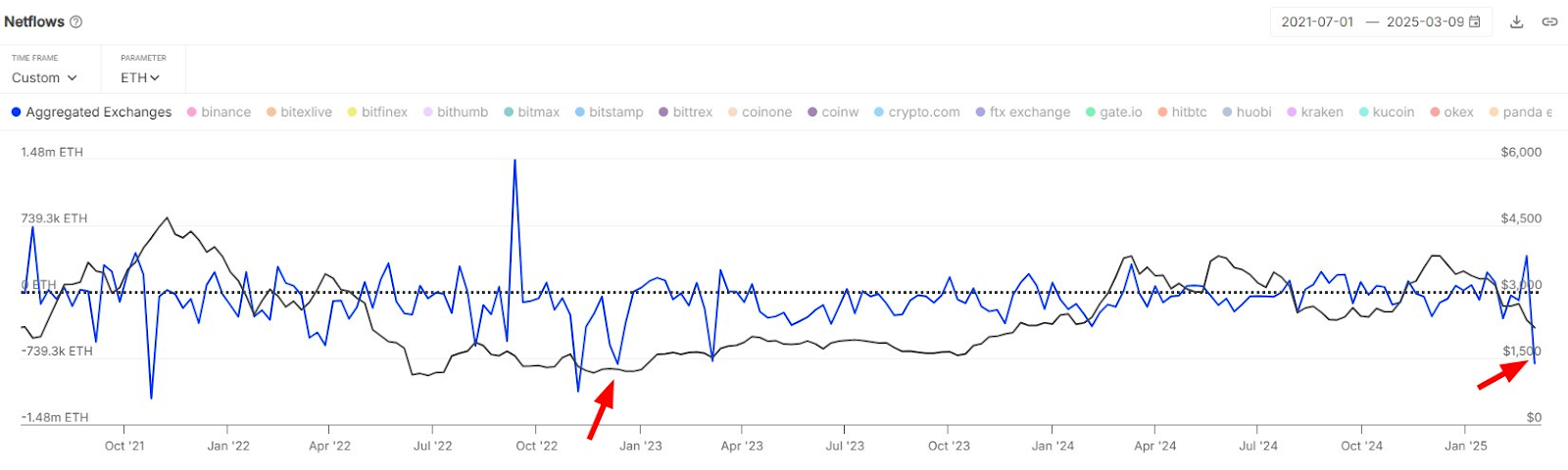

According to IntoTheBlock data, the net outflow from exchanges reached $1.8 billion in the first week of March 2025, the highest record since December 2022.

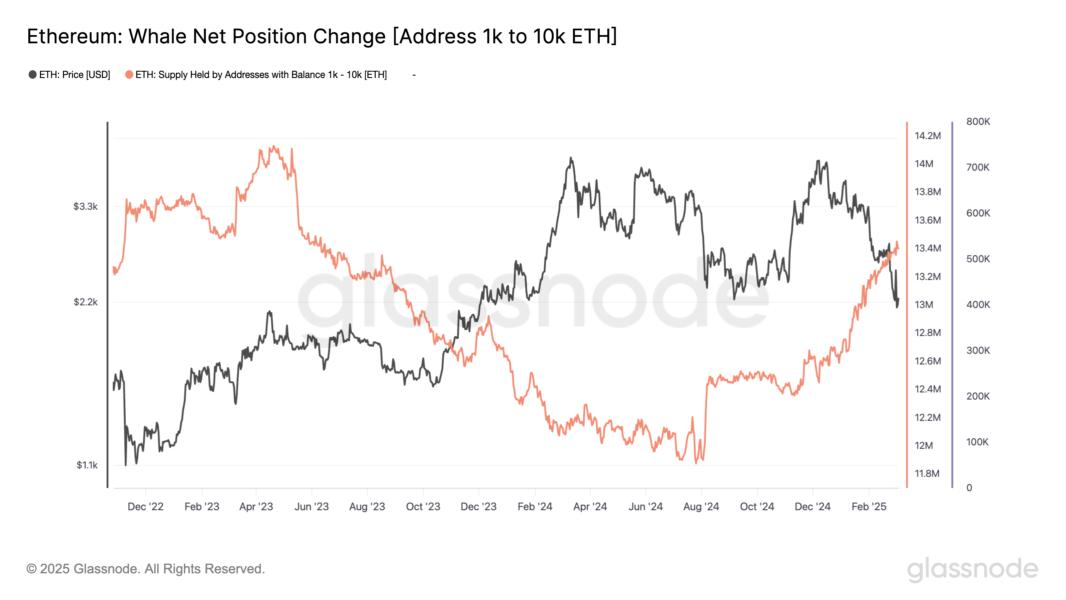

This phenomenon is in stark contrast to the current market sentiment: although the ETH price briefly fell below $2,000 (reaching a low of $1,989), the holdings of whale addresses have grown by 3.2% against the trend, and the number of addresses holding 1K-10K ETH has reached a peak since 2024. This "exchange withdrawal wave" often signals the formation of a market bottom, and similar situations occurred in March 2020 (the 312 crash) and November 2022 (after the FTX collapse), followed by rallies of over 200%.

From the MVRV-Z score perspective, the current indicator has fallen to -0.87, the lowest level in 17 months. This indicator, which compares the deviation between the market value and realized value of ETH, shows that the asset is severely undervalued. It is worth noting that when this indicator reached a similar low in October 2023, ETH subsequently launched a 160% upward trend. On-chain activity is also releasing positive signals: the number of daily active Ethereum addresses has stabilized above 420,000, and the proportion of smart contract interactions in gas fees has risen to 68%, indicating that the demand for ecosystem applications has not shrunk due to the price decline.

II. Technical Revolution Gathers Strength: Pectra Upgrade Reconstructs the Value Foundation

The Pectra Upgrade, scheduled to launch on the mainnet in April 2025, is the largest-scale technical innovation in Ethereum after the "Merge". Its core improvements include:

1. Performance Leap: Through EIP-7691, the Blob capacity will be increased to 9 per Block (double the Dencun Upgrade), reducing Layer2 transaction costs by another 80%, and the theoretical TPS will break through 100,000;

2. Staking Revolution: EIP-7251 will raise the single validator staking limit from 32 ETH to 2048 ETH, expected to reduce the number of nodes by 30%, and the annualized staking yield is expected to stabilize at 3.5%-4.2%;

3. Account Abstraction: EIP-7702 supports batch transactions and gas fee payment for EOA accounts, allowing users to pay fees directly with USDC, reducing the entry barrier by 70%.

This upgrade has already driven a surge in developer activity, with a 43% year-on-year increase in GitHub code submissions and a 217% increase in smart contract deployments on the testnet after the launch. Historical experience shows that the average price increase in the 3-6 months after a major upgrade is 85%, and key milestones such as the 2016 DAO fork and the 2022 Merge have all been the starting points of bull markets.

III. Accelerated Institutional Participation: ETF Capital Flows and Staking Yields in Sync

After initial capital outflows, the US spot ETH ETF saw a net inflow of $337 million in the first week of March 2025, and BlackRock's ETHA had a single-day inflow of $118 million, a record high. Unlike Bitcoin ETFs, ETH ETFs are exploring staking yield models - the 21Shares proposal allows at least 50% of assets to be used for staking, with an estimated annualized yield of 3.2%-4.5%, almost covering the 0.25% management fee. If the SEC approves this plan in Q2, based on the European ETN market experience, the scale of institutional capital inflows could triple.

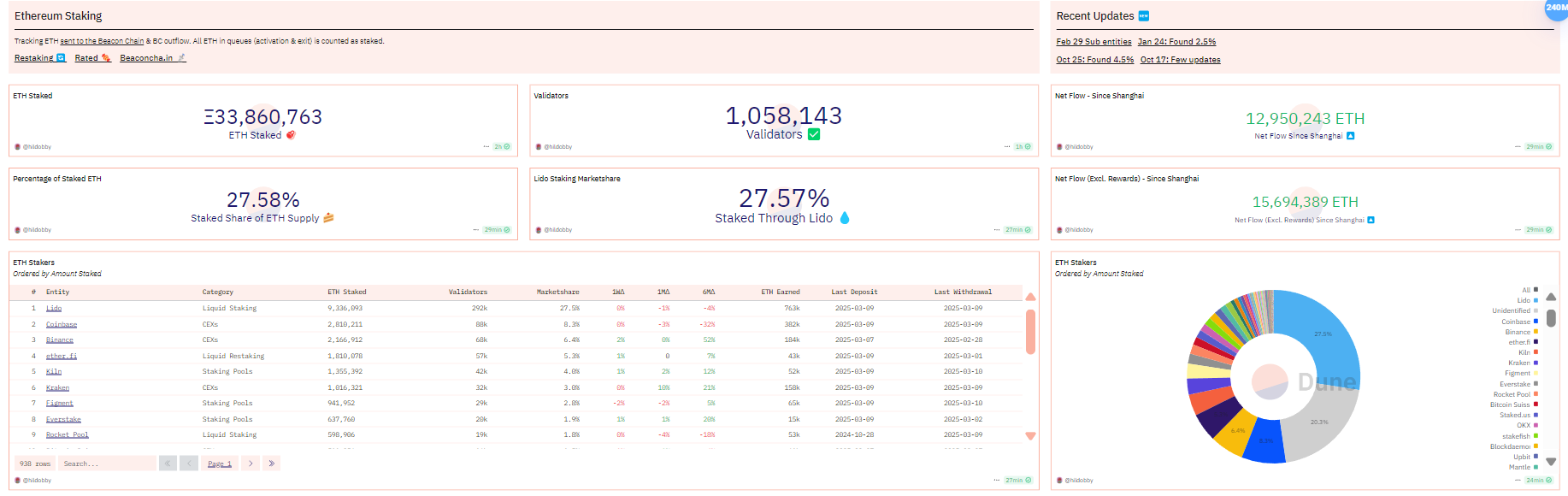

The current ETH staking rate has reached 27.58%, with a locked asset value exceeding $68 billion.

After the Pectra Upgrade, the unstaking period will be shortened from 27 days to 6 days, and the market capitalization of liquid staking tokens (LST) is expected to increase from 35% to over 50%. This "asset-ization of yield" trend is changing the token economics of ETH - based on the current staking yield, 72% of newly issued ETH will be re-locked, and the actual circulating supply growth rate will drop to a historical low of 0.8%.

IV. Technical Formation and Cyclical Patterns: Reappearance of Historical Bottoms

Observing the weekly chart, ETH/USDT has formed a triple bottom structure around $2,000: June 2024 (post-Shanghai Upgrade pullback), January 2025 (ETF approval delay), and March 2025 (macroeconomic liquidity shock). This position precisely corresponds to:

• Fibonacci 0.618 retracement level ($1,975)

• 200-week moving average support ($2,018)

• Historical accumulation zone ($1,980-$2,030)

The MACD indicator shows that the weekly chart has experienced 5 consecutive weeks of bottom divergence, a signal that has previously led to 580% and 120% rallies in December 2018 and November 2022, respectively. Combining the Bitcoin halving cycle pattern, ETH typically reaches its cycle peak 9-12 months after the halving, and based on the April 2024 halving, Q1-Q2 2025 is the optimal window for positioning.

V. Macroeconomic Environment Turning: Expectations of Loose Liquidity Strengthening

The unexpected weakness in the US February non-farm payroll data (143,000 new jobs vs. 170,000 expected), with the unemployment rate rising to 4.1%, coupled with CPI falling to 2.9%, has increased market expectations for Fed rate cuts. CME interest rate futures show the probability of a June rate cut has risen from 45% to 68%, with a full-year estimated rate cut of 75 basis points. Historical data shows that within 180 days of the start of a rate cut cycle, ETH has averaged a 214% gain, far outpacing the Nasdaq's 35% performance.

More notably, the US Treasury plans to issue $850 billion in short-term Treasuries in Q2, the largest since 2020. This "fiscal monetization" operation may force the Fed to restart quantitative easing, significantly enhancing the allocation value of cryptocurrencies as "anti-inflation assets". Goldman Sachs' model shows that for every $1 trillion in liquidity injection, the price sensitivity of ETH is 0.38, higher than gold's 0.29.

VI. Upward Price Path Projection: Targeting $4,000 Timeline

Based on the above multi-dimensional factors, ETH prices may achieve breakthroughs at the following nodes:

1. April 2025: Pectra Upgrade mainnet launch, technical benefits realized, target price $2,500-$2,800;

2. June 2025: First Fed rate cut implemented, coupled with ETF staking function approval, aiming for $3,200;

3. Q3 2025: Layer2 TVL exceeds $50 billion, ecosystem project explosion drives valuation rerating, targeting $4,000.

Risks to watch out for include: upgrade technical failures, ETF staking approval delays, and resurgent macroeconomic inflation. But the current $2,000 level has already fully reflected the pessimistic expectations, and cost basis analysis shows that 78% of addresses are in an unrealized loss position, with the market cleansing degree comparable to historical major bottoms.

Conclusion

While the market is immersed in the panic of falling below $2,000, smart money is quietly positioning. From technical revolution, institutional allocation to macroeconomic turnaround, all signals point to the same conclusion: we are standing at the starting point of a new bull market. Those investors who hold on in fear will ultimately reap the rewards when Ethereum breaks through $4,000. As Vitalik said, "The value of blockchain is not in avoiding declines, but in seizing every opportunity to rebuild the financial system." This time, ETH is writing a new legend.