The Blackstone Group is buying $BTC

El Salvador is buying $BTC

The White House is buying $BTC

However, $BTC is declining, and $ETH has fallen to $1K

I analyzed the confidential report, and the results shocked me...

This is why #cryptocurrencies are selling off, and how Trump has been deceiving you.

During this sell-off, I will share $6,000 with my followers

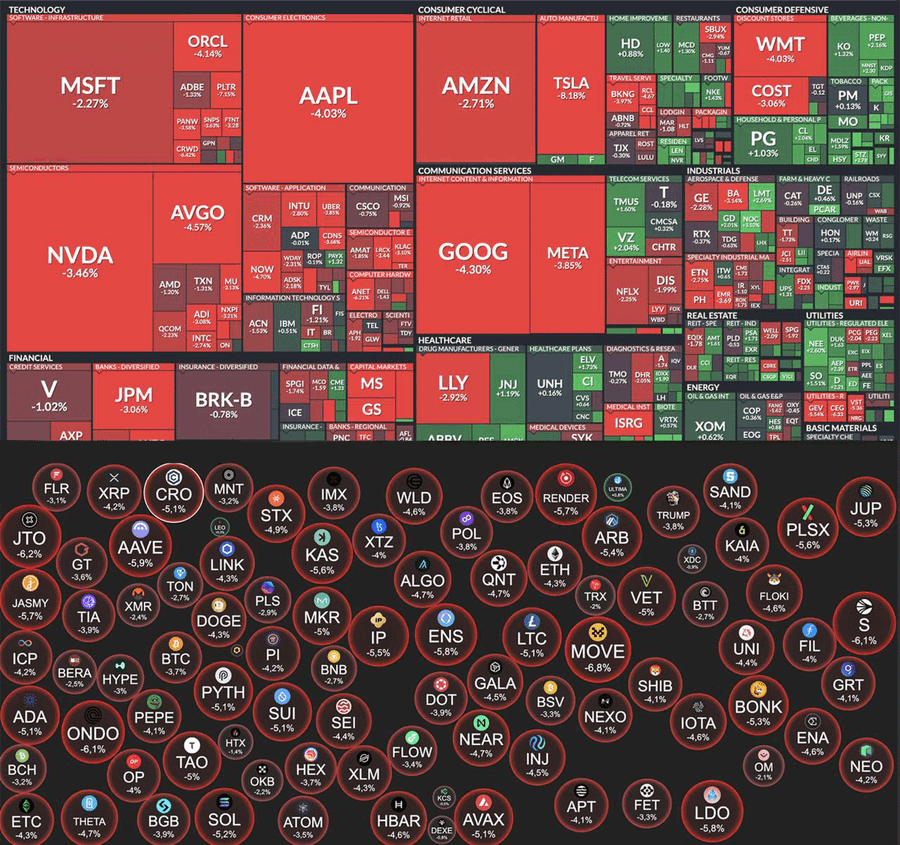

✜ The market is experiencing record declines since the FTX collapse.

✜ Public confidence in growth is gradually waning every day - most believe the bear market cycle has already begun.

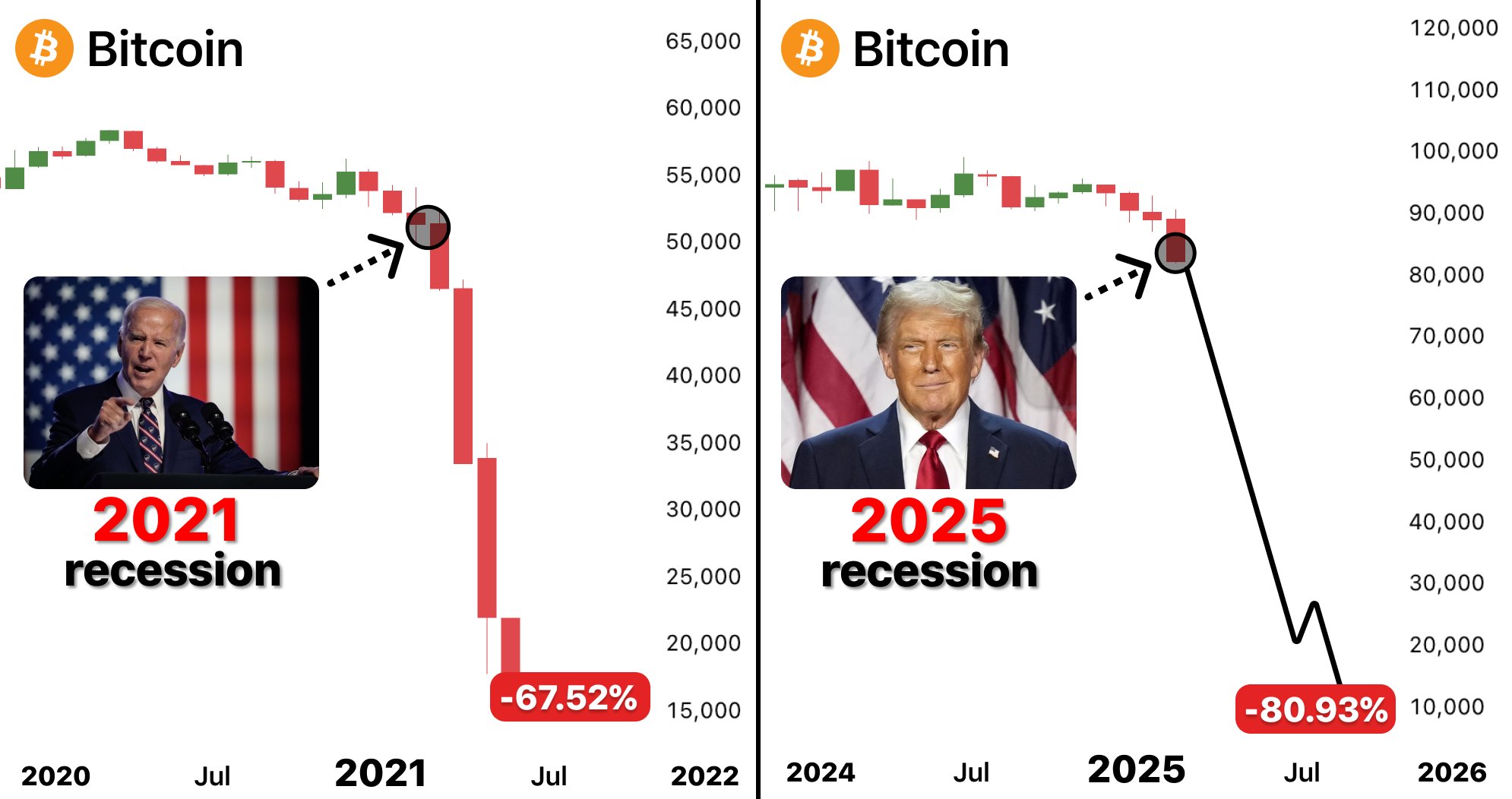

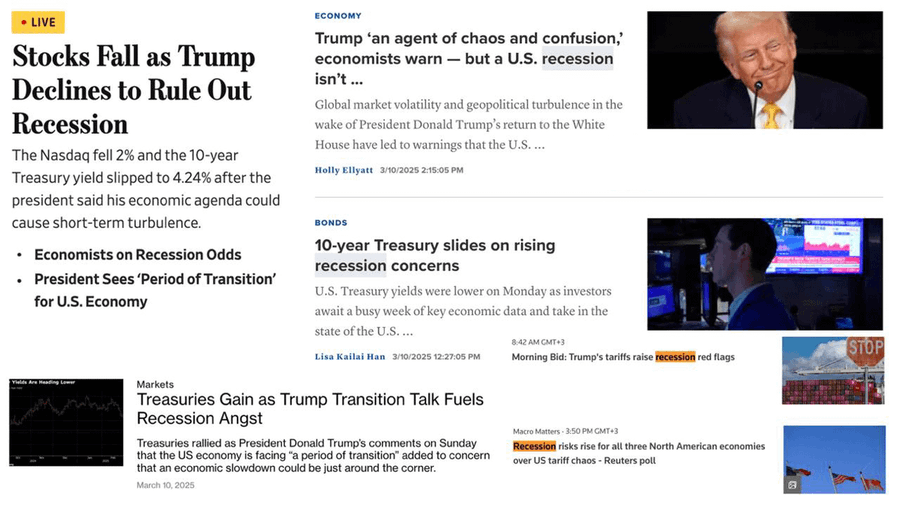

✜ Trump is approaching a man-made recession, and all signs point to the scenario of 2021.

✜ First, you should view Trump as a financier accustomed to using debt.

✜ He clearly will not take harsh austerity measures, but will finance through cheap credit.

✜ As history has taught, if you want to be a great president - just print money.

✜ In this case, Trump exacerbating the recession to force the Fed to act is beneficial.

✜ This is exactly what he is actively doing - imposing tariffs on imported goods has already begun to slow economic growth.

✜ Due to recession risks, the stock market and crypto market have already begun to decline.

✜ The foundation of the US economy is credit, and a recession will trigger a wave of defaults, forcing the Fed to rescue the system:

- Lowering rates to 0

- Printing and injecting money into the market

✜ For this, Musk's new DOGE division may get involved, and layoffs have also exacerbated the economic plight.

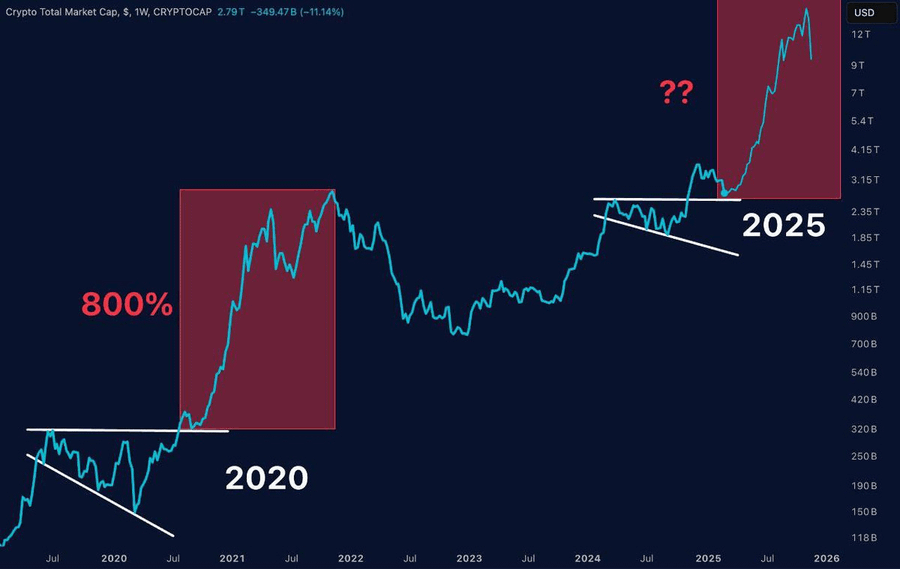

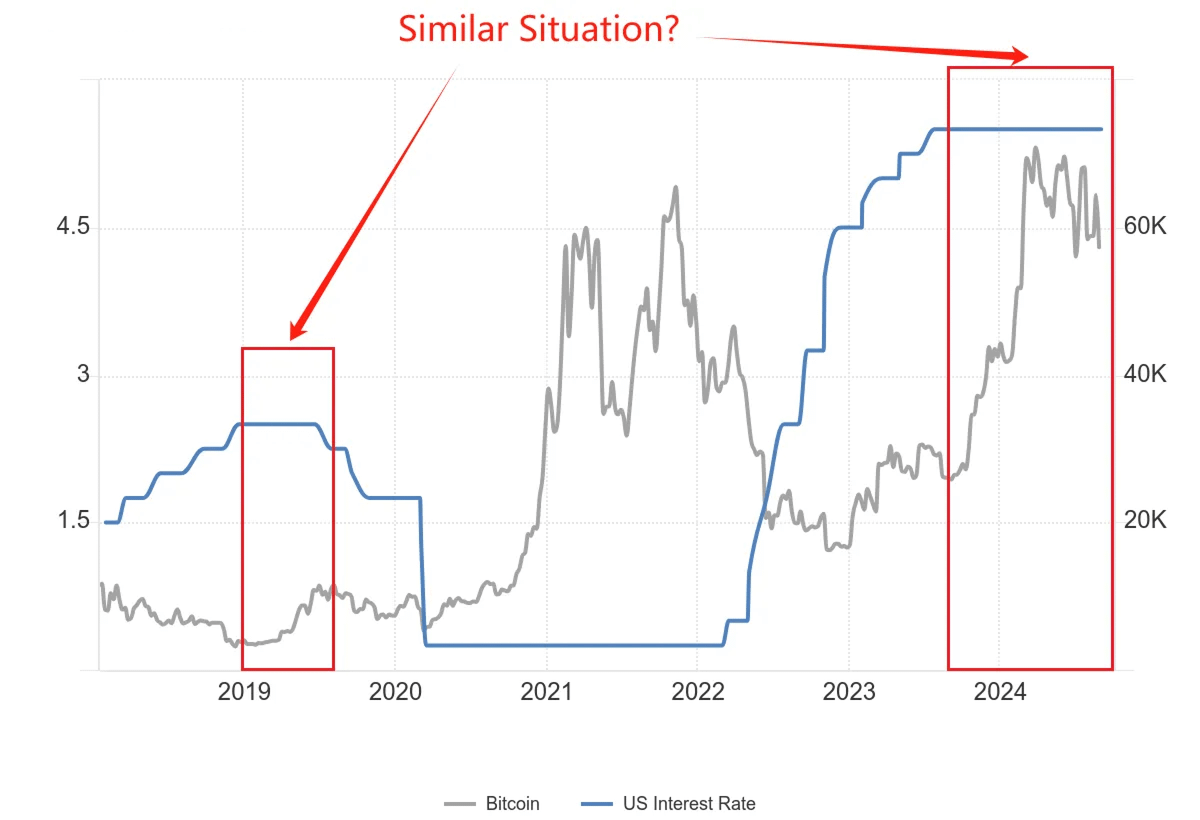

✜ In 2021, during the COVID collapse, the market also crashed due to the actual recession.

✜ As a result, we saw a massive single-day sell-off and immediate Fed intervention.

✜ At the time, the market was injected with $4 trillion, and $BTC rose 24-fold.

✜ Now the situation is repeating, but this time, Trump is manufacturing a man-made recession.

✜ Even so, the economy will begin to contract, forcing the Fed to act:

- Stop balance sheet reduction (+$540 billion)

- Resume quantitative easing and relax bank regulation

- Cut rates (-0.25% ≈ +$100 billion in liquidity)

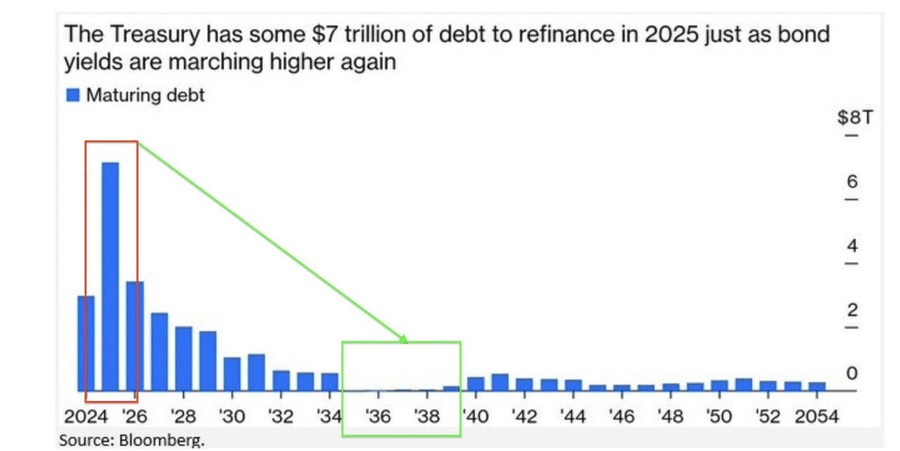

✜ In addition, Trump will benefit from the market collapse by any means necessary, as he must repay $7 trillion in debt over the next six months.

✜ If he doesn't, debt refinancing will be at unfavorable rates.

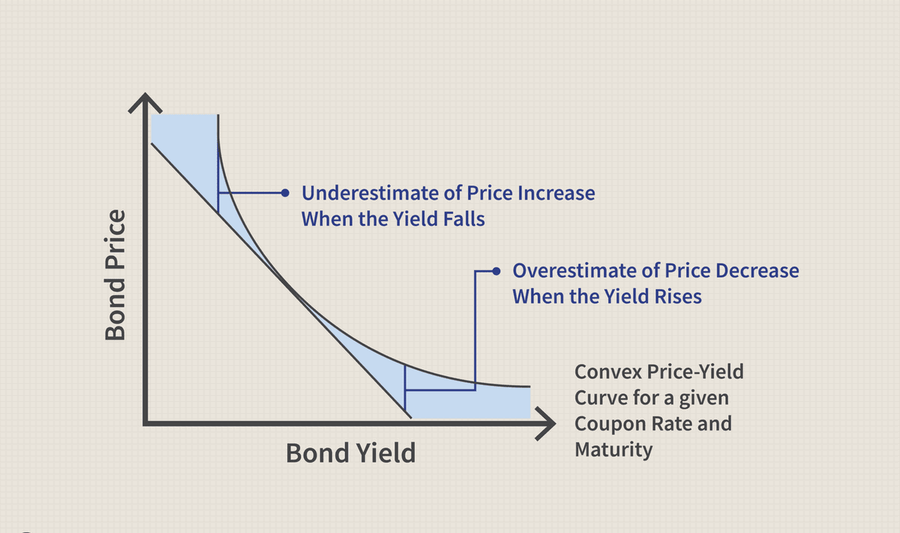

✜ Trump doesn't want to refinance debt at over 4% interest, but wants to lower bond yields.

✜ By creating expectations of slowing economic growth (recession), bond yields can be lowered.

✜ Fear drives investors into safe-haven assets, thereby lowering their yields.

✜ In this way, Trump achieves two goals at once - making the cost of servicing government debt lower, and paving the way for a crypto rally, just like in 2021.

✜ Due to all these manipulations, there may be $2.5 to $3 trillion injected into the system, and considering all factors, this could easily lead to a 5-to-7-fold increase in $BTC.

✜ In my view, Trump's strategy will weaken the dollar, increase inflation, and boost liquidity.

✜ In turn, this will become the catalyst for a new bull market cycle.