Preface

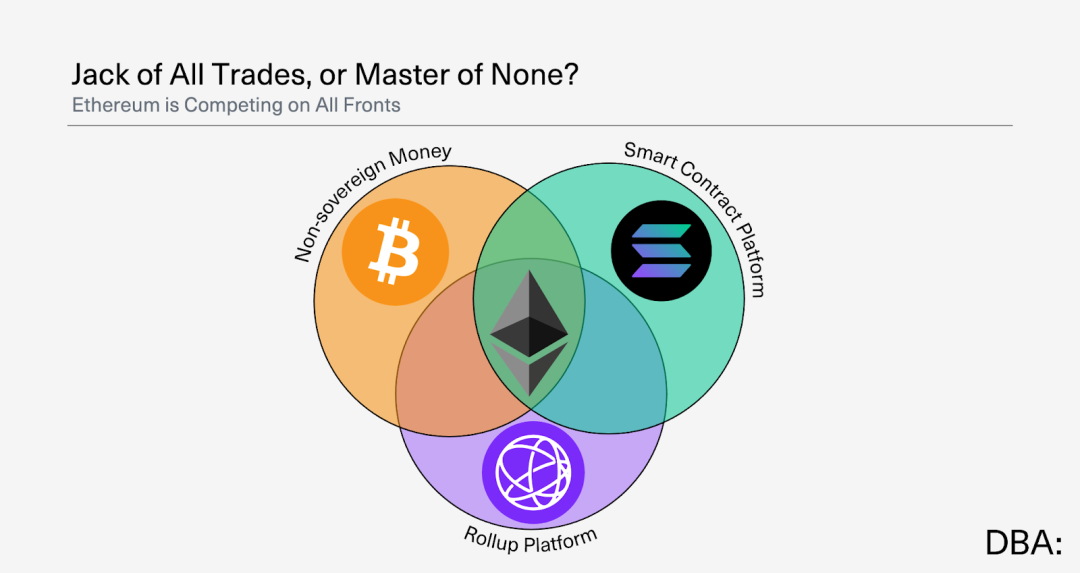

▲ Source: Jon Charbonneau

dba co-founder Jon Charbonneau published an article titled "Etherum's North Star" at the end of last year, pointing out that Ethereum lacks a clear "North Star" goal. Jon also pointed out in an earlier tweet that even within Ethereum, there is no consensus on its core product.

This cycle has seen ongoing discussions in the community about Ethereum's poor price performance. In summary, the ETH price is not only a reflection of market sentiment, but also a key factor in whether Ethereum can unify the community's vision, balance decentralization and performance, and consolidate its position as the leading smart contract platform.

Inspired by the above article, this article will discuss some of the issues that the author believes Ethereum is facing.

ETH price - It does mean something

In this cycle, we have seen the ETH/BTC exchange rate reach a multi-year low, and the SOL/ETH ratio continue to hit new highs, becoming a major factor criticized by the community about Ethereum.

The technical geeks of the EF are averse to the community's dissatisfaction with the ETH price, believing them to be a bunch of short-term speculators. Indeed, protocol design should not be price-driven, but excessive avoidance of price discussion is also a poor performance. This section discusses the importance of the ETH price.

#ETH price is directly related to EF's runway

From the EF's 2024 report, as of October 2024, EF's total assets are about $970.2 million, of which $788.7 million are cryptocurrency assets (99.45% ETH); $181.5 million are non-cryptocurrency assets.

Maintaining a burn rate of $130 million per year and a stable ETH price, the current treasury can last about 7.5 years. A drop in the ETH price will shorten the actual runway, and vice versa.

$130 million burn rate is an exaggerated figure. Previously, the community also criticized the EF's staffing redundancy (about 200 people), with only 35% being technical personnel. Aave founder Stani Kulechov proposed to cut the burn rate to $30 million and downsize to 80 people.

#Protocol security

The ETH price directly affects the cost of attacks under the PoS consensus. Of course, the actual attack also needs to consider the geographic distribution of validator nodes and the Slashing mechanism, but the price is still a key factor.

After Ethereum adopted the PoS mechanism, the ETH price directly affects the stakers' returns. A drop in the ETH price will also shrink the actual returns, which may lead to the exit of staking nodes and a decline in network security. Currently, Lido's TVL is about $20 billion, down nearly 50% from the high of $40 billion in December last year. The SOL/ETH trading pair reached a peak of over 3 times last year, and the SOL staking yield is still about 2 times that of ETH, which may drive many stakers to shift from Ethereum to Solana in the next cycle.

#Confidence of ecosystem participants

Needless to say, the price is the result of the "vote with their feet" by ecosystem participants (developers, users, investors, and other roles). In this cycle, when mainstream public opinion is generally pessimistic about Ethereum, poor price performance may trigger a negative feedback loop.

eric.eth, an early Ethereum developer and co-author of EIP-1559, also wrote that as Vitalik steps back, the EF is gradually disconnecting from the community, and opacity is increasing. Facing the expansion of competitors like Solana and the EF's "anti-competitive" attitude, he has received many questions from early Ethereum developers "why they persist in staying in this ecosystem".

The ETH price is a mirror and should receive the attention and emphasis of the EF.

Decentralization is a spectrum, and competition is too

Different people, from different positions, will inevitably have different understandings of decentralization. Solana's memecoin traders don't need a blockchain that can withstand nation-state level attacks, as the memecoin's token distribution, dev run, and rug pull addresses can be seen on-chain, which is enough for them.

▲ Source: dba

Similarly, competition and non-competition are also relative relationships. The author believes that the main competition Ethereum faces is as follows.

As a store of value asset

In the author's previous Ethereum staking report, it was mentioned that ETH serves as a reserve asset for the DAO treasuries of various protocols, collateral for CeFi and DeFi, as well as a unit of account for NFT transactions, MEV calculation, and token trading pairs, and its value exists continuously in time and space, and should be considered a store of value asset.

But this is only within the Ethereum ecosystem. In a broader sense, looking outside the ecosystem, the store of value attribute of ETH is still significantly weaker than Bitcoin.

For example, from a positioning perspective, since its inception, people have started to build narratives around "digital gold" and "scarce anti-inflationary assets" for Bitcoin, and the core function of Bitcoin has been clearly defined as a store of value, making it easier for the mainstream market and the general public to understand.

Ethereum, as a smart contract platform, derives its value from Gas, staking rewards, and the applications built on the chain. This complexity dilutes its store of value attribute, and the general public is more inclined to view it as a "technical token" or "utility token" rather than a pure store of value tool.

In terms of supply, Bitcoin has a fixed total of 21 million, with the inflation rate gradually reduced to zero through the halving mechanism. The actual inflation rate of ETH may be lower than Bitcoin after the implementation of EIP-1559 and PoS. But recently, due to low network activity, it has gradually returned to inflation and fluctuates with network activity.

Compared to Bitcoin, Ethereum's complex functions and mechanisms require a higher cognitive threshold. In addition, institutional investors (such as MicroStrategy and Tesla) publicly holding Bitcoin as a reserve asset has also strengthened the legitimacy of its store of value.

Therefore, currently, the store of value attribute of ETH is difficult to compete with Bitcoin. Ethereum's core positioning is as a smart contract platform.

As a smart contract platform

As a smart contract platform, Ethereum is facing fierce competition from Layer1s like Solana and Sui. From the data perspective, although Ethereum still dominates in stablecoin issuance and TVL, it has shown a declining trend in key metrics such as daily transaction volume, daily active addresses, and number of transactions.

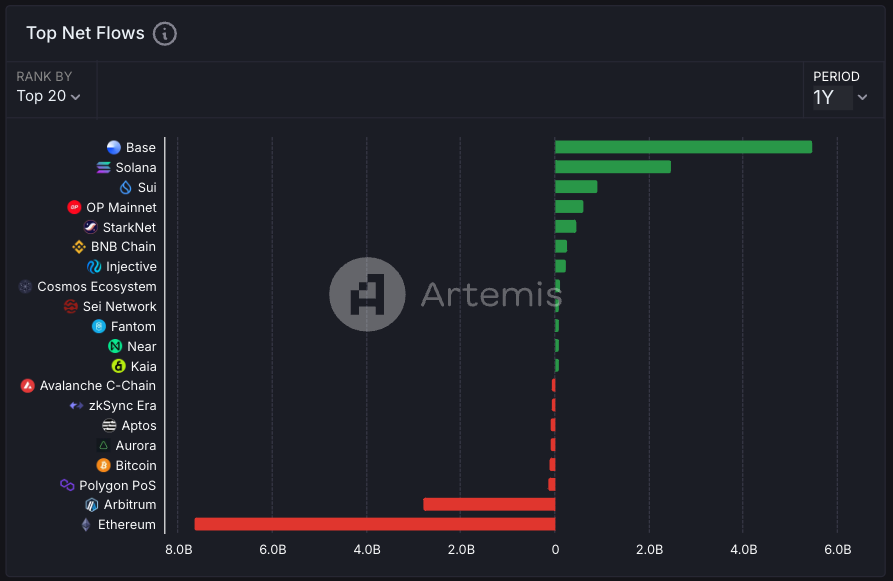

▲ Source: Artemis

Looking at the capital flows over the past year, protocols like Base, Solana, and Sui have captured large inflows, while Ethereum has seen an outflow of nearly $8 billion. Ethereum ecosystem transactions are mostly concentrated on Base and Arbitrum, which is in line with the expectation of the Rollup-centric roadmap, but the low activity of the L1 may somewhat affect the market's pricing of ETH.

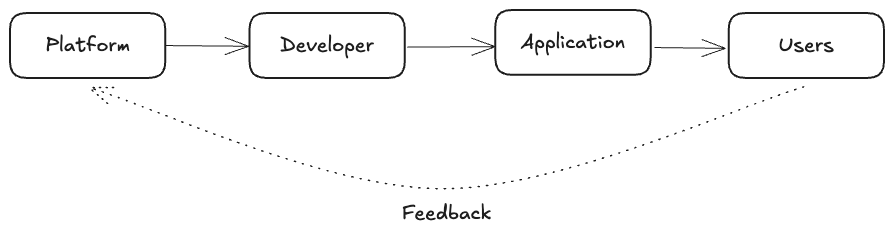

▲ Source: IOSG

Between platforms, developers, applications, and users, a feedback loop mechanism is basically formed as above. A good platform attracts quality developers, developers create good applications, applications attract users, and users promote the prosperity and growth of the platform.

Due to the different technical development paths of Ethereum and Solana, developers often have to choose one of the two platforms. Therefore, at the "smart contract platform" level, the two are in a competitive relationship.

▲ Source: Solana

The solanaroadmap.com webpage is concise with only four words, abbreviated as IBRL. But Solana is not limited to high performance at the moment. In addition to the technical IBRL, Solana's culture and attention capture also have differentiated competitive points.

▲ Source: mert

The author once asked on X why a memecoin was not launched on the Ethereum L2, as L2 also has the characteristics of low cost and high throughput. The answer received was "culture". Summarizing the user profile, it is generally believed that the users on Ethereum are more "old money" who are mining in DeFi, while Solana represents new blood and rapid flow and redistribution of capital.

New things often better capture attention when compared to old things. Among the many founders the author has talked to in this cycle, they have chosen to build consumer applications on Solana, in addition to technical reasons, the word they mostly mention is "attention" - more users in this cycle are focusing on Solana.

In this period when there are abundant projects on the market and attention is extremely scarce, founders will try their best to increase the exposure of their projects, so that the market can discover their products. There is also more hot money on Solana, as well as a smoother user experience, because when you want someone to use your product, every additional step is friction and obstacle.

The Insider's Dilemma - The Choice of the Ethereum Foundation

Is laissez-faire suitable for Ethereum, which is in a highly competitive environment?

The community is divided on Aya's appointment as chairman of the Ethereum Foundation: critics point out that during her 7-year tenure, Ethereum's development progress has been slow, developer support has been insufficient, and the token price has been weak, all of which are directly related to her management; her advocated "reductionist philosophy" and decentralized governance have been criticized as "laissez-faire", causing the EF to fail to actively coordinate ecosystem resources, in stark contrast to the efficient operation of the Solana Foundation.

These evaluations are difficult to clarify in the short term, and are not within the scope of this article, but they do reflect the community's dissatisfaction to some extent, serving as an outlet for the accumulation of emotions.

EF's role has never been to control or own all domains in Ethereum. Instead, our responsibility—our accountability—lies in upholding Ethereum's values. Through both our actions and our non-actions, we are accountable for ensuring that Ethereum remains resilient, not just as a network, but as a broader ecosystem of people, ideas, and values—never reduced to a single organization's product. ——Aya Miyaguchi

On the day of her inauguration, Aya published an article "A new chapter in the infinite garden", stating that the Foundation's role is that of a "gardener" rather than a "controller", supporting the ecosystem through cultivating client diversity, coordinating research and development, and community activities; advocating adaptive growth and decentralized leadership, and opposing corporate expansion; believing that Ethereum needs to maintain its original vision as the "world computer".

The author believes that when discussing values and ideals in a growth cycle is beneficial; but if the system is in a state of decline and unable to generate increments, then this kind of "high-sounding rhetoric" will appear powerless and unable to convince.

The prerequisite, practice and development of the value of becoming the "world computer" is that there are people building on the ecosystem and willing to follow and promote this value. And the prosperity and growth of the ecosystem is a necessary condition.

Han Feizi pointed out in "Five Pests" that the essence of Confucianism's "using culture to disrupt the law" is to talk about benevolence and righteousness while ignoring real contradictions. When resources are limited, talking about benevolence and righteousness will lead to a departure from actual needs, and must rely on practical means such as "law, technique, and power". When Confucius traveled around the states, only the relatively prosperous state of Wei briefly accepted his idealism; in the war-torn states of Song, Chen, and Cai, Confucius' idealism was neglected due to the lack of material basis.

Recently, when the community questioned the EF's continued selling of ETH and not using staking and other financial means to maintain the runway, the EF sold a small amount of ETH on the same day. In the context of the spreading dissatisfaction in the community, this move seems rather poor. Vitalik said that if the Foundation stakes ETH, it may be forced to make an "official choice" in controversial hard fork events, violating the principle of decentralization of Ethereum. This overly vague and unreasonable reason cannot respond to the community's core concerns.

Based on the above discussion, whether from the perspective of the various data indicators of its positioning as a "smart contract platform", or from the perspective of the sluggish price of ETH as a "store of value" currency, Ethereum seems to be somewhat powerless. At this time, choosing to persist in laissez-faire may not be a wise move.

"Ethereum is an ecosystem, not a company"

In a Chinese AMA on February 27, Vitalik emphasized that Ethereum is not a company, but an ecosystem.

I think Ethereum is a decentralized ecosystem, not a company. If Ethereum becomes a company, we will lose most of the meaning of Ethereum's existence. Being a company is the role of a company. ——Vitalik Buterin

The author agrees with the view that Ethereum should not be treated as a company, because corporate operation means a certain degree of profit-seeking, which is in conflict with Ethereum's positioning. However, non-corporate operation orientation leads to the result that it is difficult to establish some indicators to measure the system's work efficiency, and the system's goals are divergent, rather than optimized for a certain point or direction.

The embarrassing thing is that although the EF does not believe that Ethereum is a company, the public's pricing and valuation of Ethereum still tend to be done in the way of a company, referring to indicators such as active address numbers, transaction volume, and protocol revenue, which are difficult to achieve the simplicity of Bitcoin's "totem".

From a series of fundamental data such as protocol revenue, Ethereum no longer has strong momentum. For example, due to the sluggishness of L1 activity, the ETH burn has decreased significantly, and ETH has ended its nearly two-year deflationary cycle and returned to inflation, with an annual inflation rate of 0.72%.

▲ Source: Dankrad

At the level of technical development, Aya wrote in the article: Instead of controlling, we steward All Core Dev calls to create space for technical decisions to emerge through community wisdom. Coordination rather than domination, the starting point is good, but it is inevitably too idealized. The coordinating-dominant approach will encounter many problems in practice, such as inefficiency and high friction. Everyone has their own opinions, and without an overall decision-making, the end result will be difficult to implement.

Of course, this article does not clarify who is right or wrong, nor is it a criticism of the EF's approach, but rather an attempt to state the author's views and logic, and point out the pros and cons. In summary, the author believes that the EF needs to be down-to-earth, face reality, identify problems, listen to the community's opinions, and take action.

Conclusion

Crypto has different mainlines in different cycles. In this cycle dominated by the mainstream narrative of the Bitcoin ETF and the Solana memecoin craze, Ethereum is obviously not favored by the market. Ethereum has very good values and idealism, but these superstructures need real use cases and communities to support them.

While keeping this value unchanged, what can the current Ethereum do?

Accelerate development progress, focus on scaling, and solve the problem of cross-L2 interoperability, making Ethereum technically usable enough. Attract long-term developers, etc.

Education. The multilingual support of ethereum.org has always been very good. Ethereum is unlikely to do much political lobbying, but global education is quite necessary.

The EF needs to reform, achieve governance transparency and community supervision, and balance idealism and market demand.

As a long-time Ethereum enthusiast, I feel regretful about the current situation, but I am also glad to see challengers like Solana shake Ethereum's position - after all, the story of latecomers challenging the established "winners" in Crypto is constantly being repeated, which is equally inspiring.

Hope we can make Ethereum great again.Milady.