Dear readers, last week we conducted some polls on X and LinkedIn, and many of you expressed a desire to see more data/analysis on the current cycle.

So, the focus of this week will be to answer these questions: Will there be a bull market for cryptocurrencies in 2025? Why do I still feel pessimistic despite the many positive factors? How should we think dialectically about the state of the cycle?

Let's go!

Bearish Perspective

Before we start analyzing on-chain data, I want to share some qualitative analysis on how we view the cryptocurrency cycle.

Early Bull Market Phase

Roughly from January 2023 to October 2023.

This is the period of market bottoming and rebounding after the FTX collapse. It's a very quiet period (low trading volume, crypto Twitter almost dormant). Then the market starts to rise again.

Bitcoin price rises from around $16,500 to $33,000.

However, no one calls this a bull market. In the "early bull" phase, most market participants are still in a wait-and-see mode.

Wealth Creation Phase

Roughly from November 2023 to March 2024.

In this phase, we see significant price appreciation and notable wealth creation. For example, SOL rises from $20 to $200. The Jito airdrop (December 2023) creates an amazing wealth effect within the Solana ecosystem and reprices Solana's DeFi projects (like Pyth, Marinade, Raydium, Orca, etc.). The VC market also peaks during this phase.

Bitcoin price rises from $33,000 to $72,000. Ethereum rises from $1,500 to $3,600.

Bonk's market cap rises from $90 million to $2.4 billion (26x). WIF's market cap rises from $60 million to $4.5 billion (75x). This phase also lays the seeds for a larger-scale "Memecoin Season".

But even so, this period is still relatively "quiet". Your "average friend" may not have started asking you about Altcoins yet.

Wealth Distribution Phase

Roughly from March 2024 to January 2025.

This is the "attention peak" phase. We often see "WAGMI", rapid rotation, new hypes (though short-lived), and blind investments that pay off. Celebrities and other "crypto tourists" tend to enter the market during this phase. This phase may see news like "Tesla buys Bit" or "Bit strategic reserves".

Why?

Because new investors will enter the market due to such news. They are afraid of "missing the party".

This is the second wave of the "Memecoin Season", which then evolves into an "AI agent Season". During this phase, the market turns a blind eye to many obvious issues. No one wants to point out problems because everyone is making money.

And then we arrive at the current situation.

Wealth Destruction Phase

We believe this phase arrived shortly after Trump's inauguration.

This is the period the market immediately enters after experiencing a top-side sell-off. The bull market catalysts have become history. Seemingly positive news triggers a bearish price action.

In the current market environment, the political action around "Bit strategic reserves" has not impacted the market - an important signal. In this phase, market rebounds often encounter key resistance levels and ultimately fail (we saw the market's reaction to Trump's tweets about crypto reserves last week).

In the "Wealth Destruction" phase, we will pay extra attention to some signals:

- Liquidations and "panic" events that disrupt the market but still fail to fully awaken it - we saw similar cases in the DeepSeek AI panic and tariff uncertainty.

- Investors still harboring "illusions". We see a lot of discussions today about the US dollar decline and global M2 growth (more on this in the report later).

- "Speculators" entering the market. More people DM us to "check out their projects", more ads circulating in the market, meaningless spending by well-funded projects at major conferences, and a generally "dirtier" atmosphere in the industry. During the "Wealth Destruction" period, bad actors start to emerge.

In this stage, hidden issues gradually surface - usually after liquidations. Last cycle, it started with Terra Luna and then led to the implosion of Three Arrows Capital. Then came the bankruptcies of BlockFi, Celsius, FTX, and ultimately the collapse of Genesis and the sale of CoinDesk.

So far, we haven't seen any blowups. The blowups in this cycle should be fewer - simply because there are fewer CeFi companies, which means the bottom when the market officially bottoms may be higher.

Where will the blowups come from?

No one knows, but I think there are some "suspects" to watch:

- Exchanges: Need to watch for hidden leverage and/or potential fraud in some overseas "B and C-tier" exchanges.

- Stablecoins: We're watching Ethena/USDe - currently it has around $5.5 billion in circulating stablecoins. It maintains its peg and generates yield through cash-and-futures arbitrage trades (holding the spot, shorting the futures) - a model that was a major source of leverage in the last cycle (through Grayscale). Ethena's increased reliance on centralized exchanges adds additional counterparty risk. Additionally, MakerDAO has also invested a portion of its reserves in USDe, further increasing the chain risk in DeFi.

- Protocols: Need to watch out for frequent hacks, as well as potential liquidation cascades triggered by collateralized Altcoin assets on platforms like Aave - Aave still has over $11 billion in active loans (down from a peak of $15 billion).

- Strategy: We think Strategy has done a good job managing its debt prudently, with most of its debt being long-term unsecured debt or convertible bonds (its Bit holdings won't trigger margin calls). That said, if Bit price sees a significant drop, it may force Saylor to sell large amounts of Bit at the worst possible time.

The best time to re-enter the market is towards the end of the Wealth Destruction phase. We don't believe that moment has arrived yet.

Bearish Data

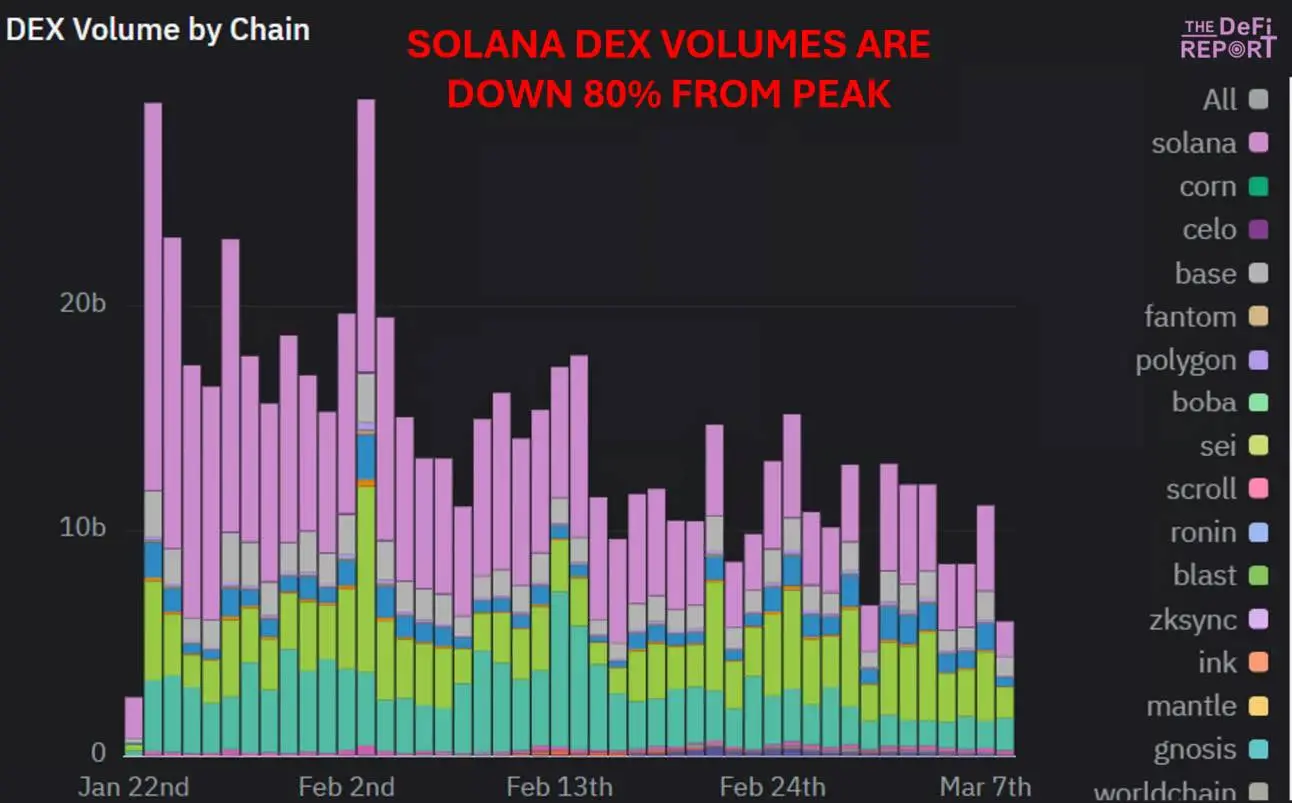

DEX Trading Volume

Trading volume on Solana DEXes has declined by 80% from the peak reached after Trump launched his Memecoin. At the same time, the number of active unique traders has dropped by over 50%. This indicates that the market's speculative fervor is waning.

Data: The DeFi Report, Dune

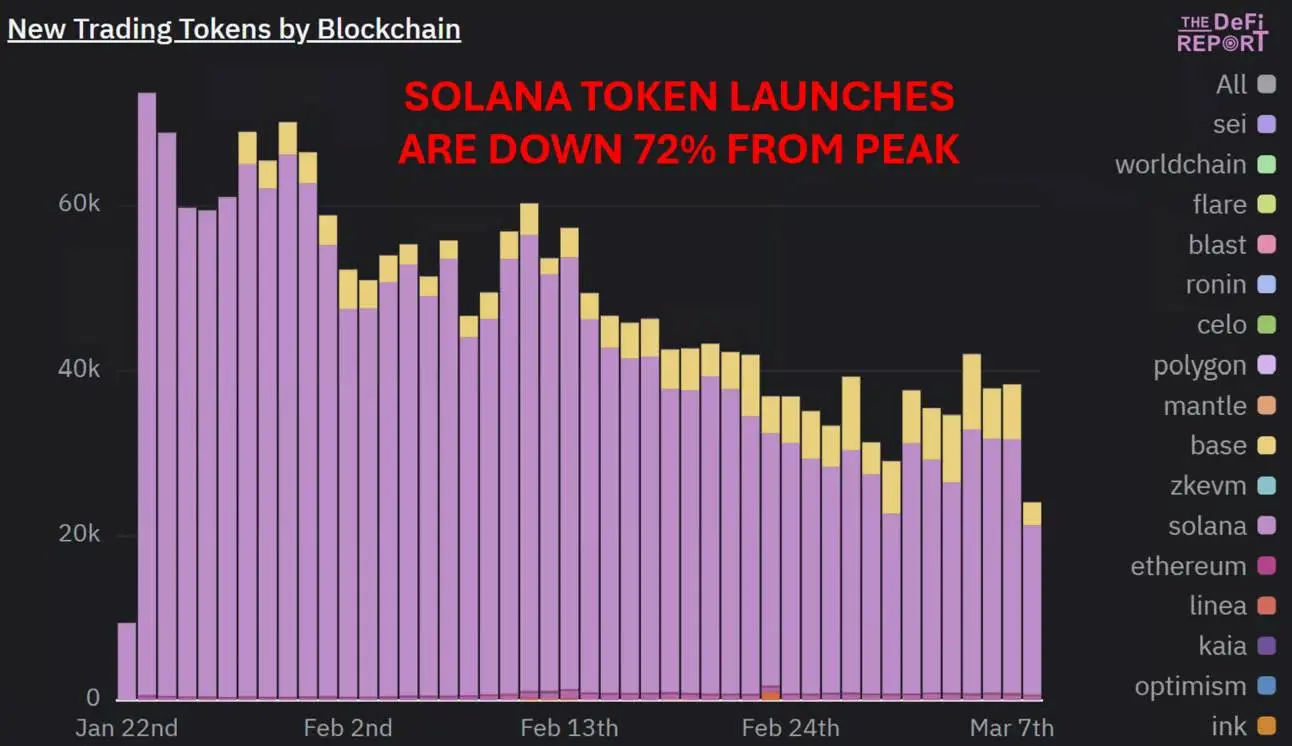

Token Issuance

The number of tokens issued on Solana has declined by 72% from its peak. However, the chain still sees over 20,000 new tokens created per day.

Data: The DeFi Report, Dune

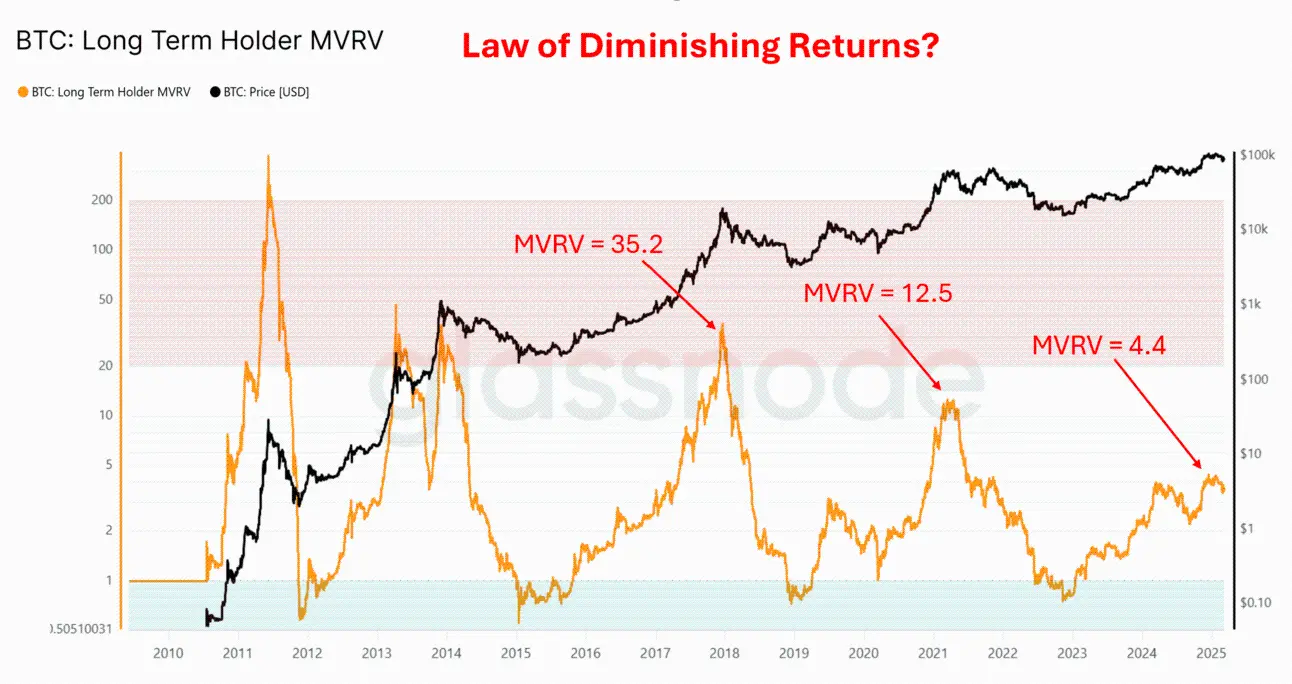

Bit Long-Term Holder MVRV Ratio

Data: Glassnode

The MVRV (Bit's "smart money") of Bit's long-term holders reached a peak of 4.4 last December. This is only 35% of the 2021 cycle peak of 12.5, which in turn was 35% of the 2017 cycle peak.

Bit rose about 80x from bottom to top in the 2017 cycle, about 20x in the 2021 cycle, and about 6.6x in the current cycle.

Here is the English translation of the text, with the specified terms translated as instructed:The realized price of Bitcoin (i.e., the cost basis benchmark for all circulating Bitcoins) reached a peak of $5,403 in the 2017 cycle, which was 15.1 times higher than the peak in the 2013 cycle; in the 2021 cycle, it reached a peak of $24,530, which was 4.5 times higher than the peak in the 2017 cycle. Today, the realized price is $43,240, which is 1.7 times the peak of the 2021 cycle.

Conclusion

- From the data points above, we can observe that the peak values of different cycles exhibit a symmetrical decrease. This data clearly demonstrates that the law of diminishing returns does indeed exist.

- Bitcoin is now a $1.7 trillion asset. Regardless of how bullish the news may be, investors should not expect to see the kind of sustainable parabolic growth seen in the past - the amount of capital required to drive the asset higher is now too large.

- When Bitcoin loses momentum, the rest of the tokens in the market will also be severely impacted.

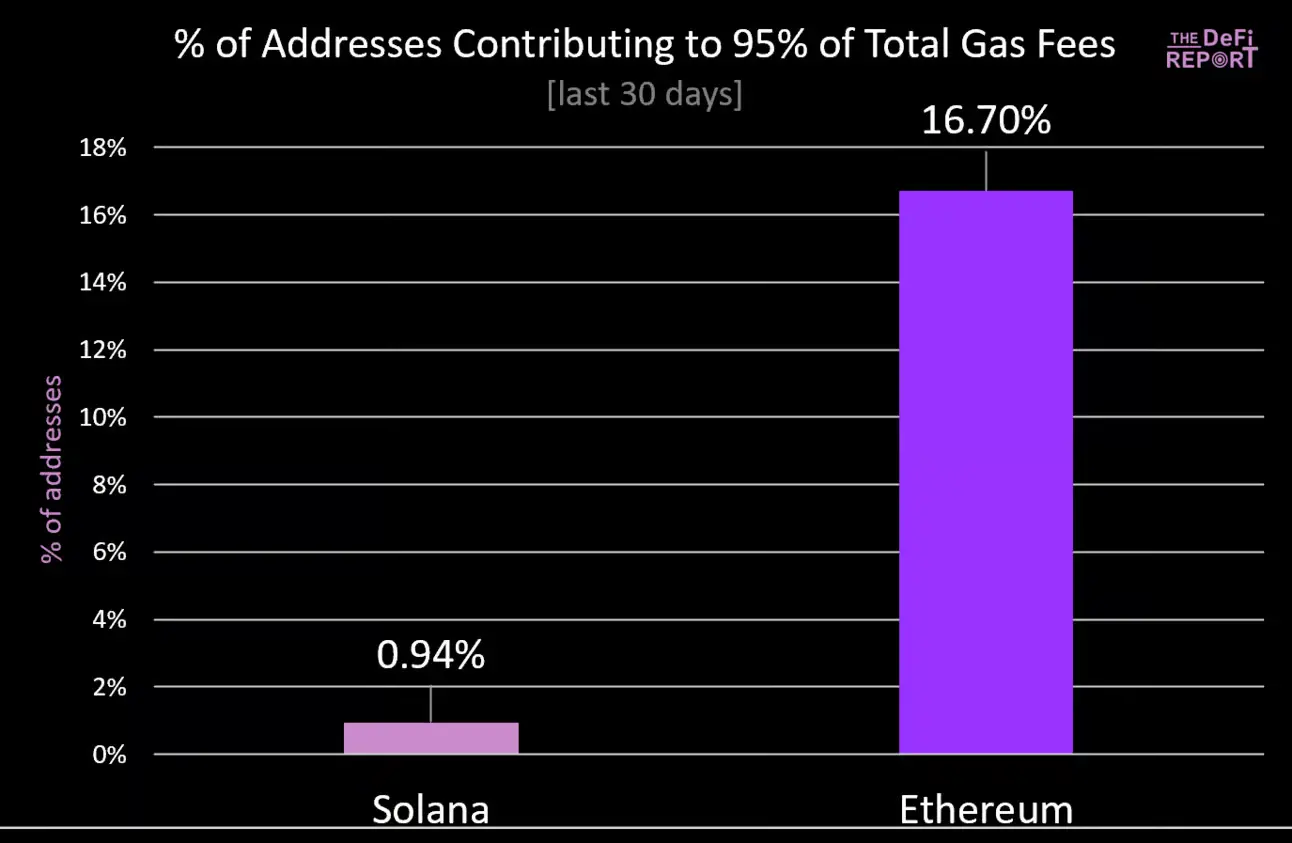

- The speculative fervor around Solana is waning, and given that over 61% of DEX trading volume so far this year has involved Meme coins, we are concerned that Solana's "recovery story" is built on a "house of cards". Additionally, in the past 30 days, less than 1% of Solana users have contributed over 95% of the Gas fees. This is concerning, as it suggests that a small portion of Solana users ("whales") are exploiting the other users ("small fish"). Therefore, if the "small fish" get tired of losing and choose to temporarily exit (which we believe they are doing), we may see Solana's fundamentals deteriorate rapidly.

Data: The DeFi Report, Dune (base + priority fees + Jito tips on Solana)

- Long-term Bitcoin holders have realized profits twice in the past year. Their realized price (i.e., cost basis) is currently around $25,000. Meanwhile, short-term holders who bought at the highs are currently at an average cost basis of $92,000, in a state of loss. We believe that as the market realizes that Bitcoin's top has occurred at $109,000, this segment of short-term holders may continue to sell at lower highs.

Data: Glassnode

When we lay out all the information like this, we believe it is undeniable that the "typical" cycle has been completed, and this is not the "law" at work.

In our view, the best way to handle this information is to accept the reality and assign a probability to the possibility that the cycle has topped out. We believe this probability is clearly above 50%.

After completing the basic analysis, we will try to find the flaws in our arguments and stress-test our views.

Let's get started.

Bullish Perspective

I still see a fair amount of opposition to the short view in the market, and the bulls are not ready to put down their weapons.

This raises the question: Does the bullish view further prove that we have entered the "wealth destruction phase"? Or have we been too bearish and overlooked the possibility of another wave of upside?

In this section, we will explore some of the observed "bullish views".

Global M2/Liquidity

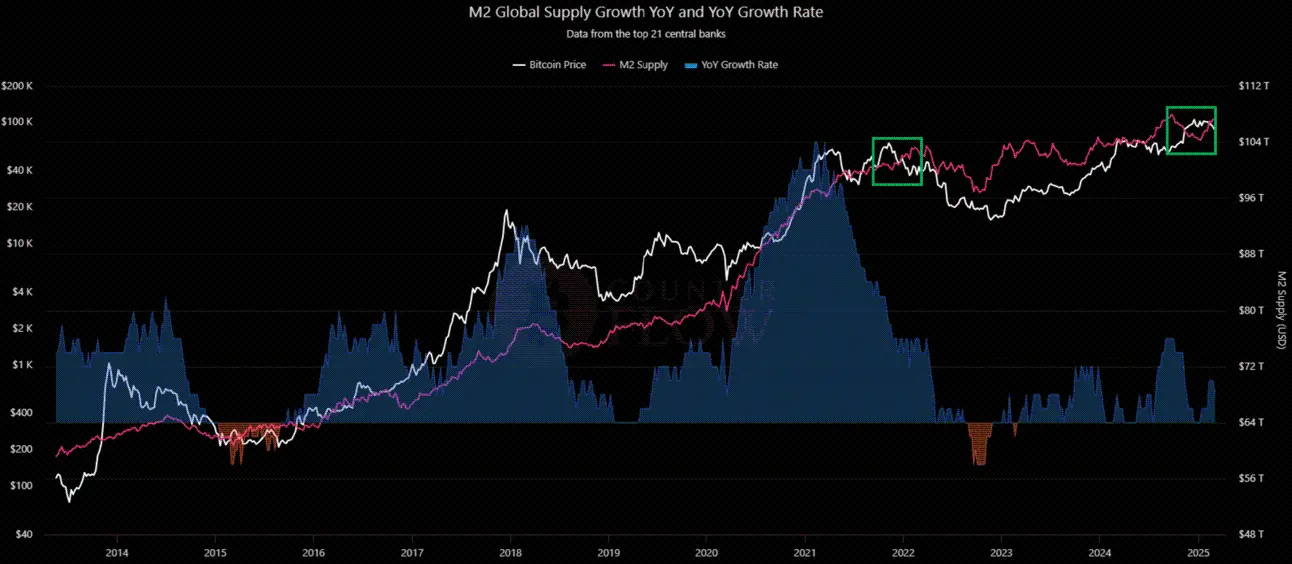

Data: Bitcoin Counter Flow

The green box on the right shows: When global M2 starts to rise, BTC is actually falling. Some have pointed this out and mentioned the correlation between BTC and M2, and the typical 2-3 month lag in BTC's response to M2 changes.

However, the green box on the left shows: A similar dynamic occurred at the end of the previous cycle: M2 rose while BTC fell. In fact, M2 did not peak until early April 2022 - 5 months later than BTC's top.

Since mid-January, global M2 has grown by 1.87%, mainly due to central banks shifting from tightening to easing policies.

This is favorable for liquidity conditions.

However, we also need to consider the following:

- What is driving the growth in M2? We believe this is primarily due to the decline of the US dollar (down 4% since February 28!), which means an increase in foreign currencies denominated in US dollars, thereby driving global M2 growth. Additionally, the reverse repo facility has recently been drained, and China is also stimulating its economy through easing policies.

- Will this trend continue? We believe the US dollar will continue to decline as investors shift capital overseas, but the pace of decline in the coming weeks may not be as rapid as recently. We expect China to continue easing policies against the backdrop of a weakening US dollar. However, the Fed is unlikely to ease in the near term, as they have stated that reserves remain "ample". Furthermore, we believe the Fed remains concerned about inflation.

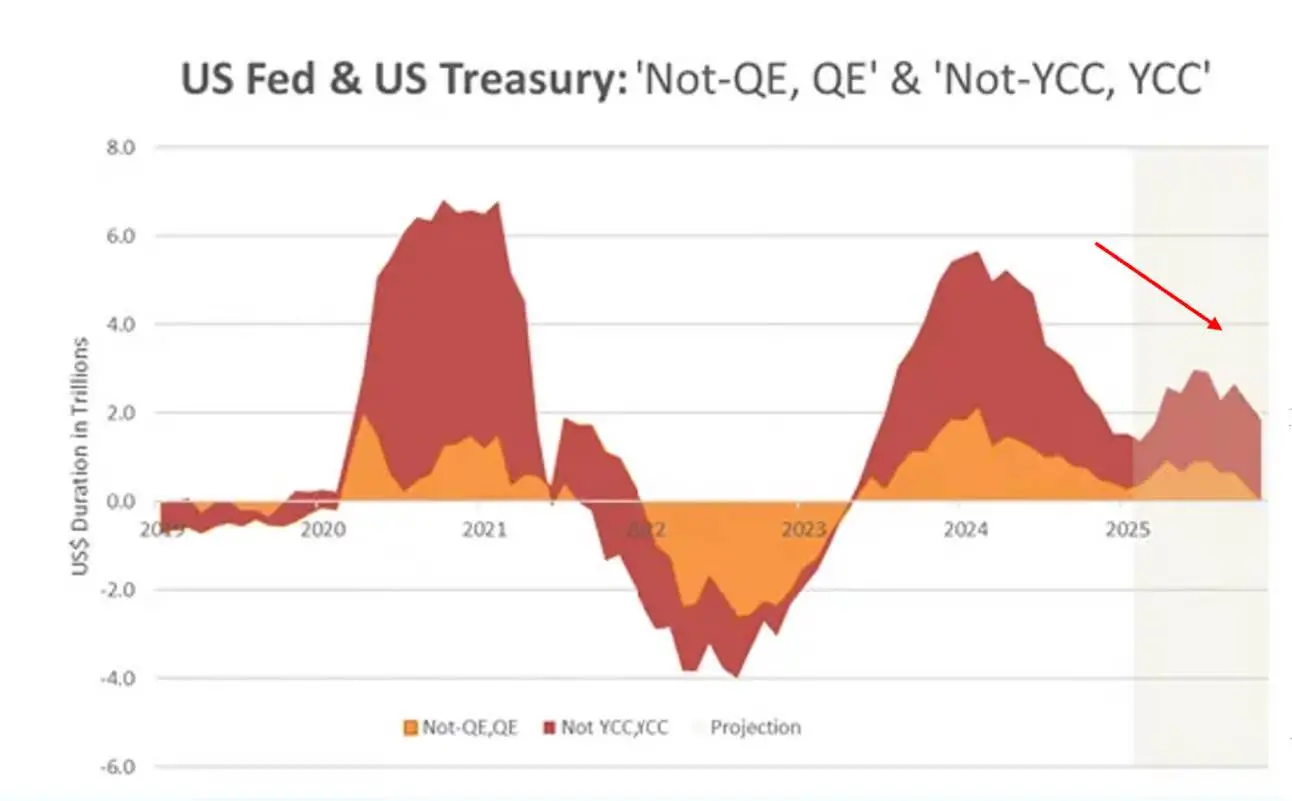

- How do the current liquidity conditions compare to last year? We believe the current liquidity conditions should be viewed as headwinds compared to last year. Remember, it's the rate of change that matters, not just the nominal growth. We strongly believe that the Fed and Treasury last year drove the market through "shadow liquidity" - i.e., "not-QE, QE" and "not Yield Curve Control, Yield Curve Control" - to help Biden/Harris get re-elected. According to Michael Howell of Cross Border Capital, the withdrawal of these policies has had a significant impact on the rate of change.

Data: Cross Border Capital

It is estimated that the above "secret stimulus" added $5.7 trillion to the US market in early 2024, achieved through the depletion of reverse repos + early issuance of new debt in bills.

Finally, we believe investors should closely monitor the comments made by Treasury Secretary Bessent in a CNBC interview last week: "The markets and the economy have become addicted. We've become dependent on this government spending. This is going to require a detox period. This is going to require a detox period."

Business Cycle/ISM

We previously pointed out that ISM data suggests the start of a new business cycle. We have also recorded strong data on capital expenditure (Capex) procurement and small business confidence. We believe these data points are real, but they also clearly show that growth is slowing. The data we observed last month may have been distorted by some manufacturers "front-loading" purchases in anticipation of tariffs. Since then, we have seen some signs of softness in the services sector and new orders data, with the manufacturing PMI reading 50.3 in February, down from 50.9 in January.

Strategic Bitcoin Reserves

Until last Friday, we were still seeing hopeful discussions among crypto natives about strategic cryptocurrency/Bitcoin reserves - although the market has ignored these news multiple times over the past 6 weeks.

I believe we can now conclude that this was a "buy the rumor, sell the news" event.

Flaws in "Cyclical Thinking"?

We should also acknowledge that the current "cycle" is behaving differently from past cycles. For example:

- BTC hit a new all-time high before the halving for the first time.

- This cycle is shorter, with only two years of a bull market.

- The "Altcoin season" has performed very differently, with Bitcoin's dominance steadily increasing since the start of 2023.

- Bitcoin is now fully integrated into the financial system and has the support of the US government.

If "cyclical thinking" is flawed, then perhaps we have not yet reached the top. Instead, we may be in a pause/correction/consolidation phase before the next wave of upside, rather than a year-long bear market with potential 75%-80% price declines like in the past.

We believe the cycle is evolving. However, we still expect the bear market to take 9 to 12 months to fully play out.

Conclusion

Summarizing our views:

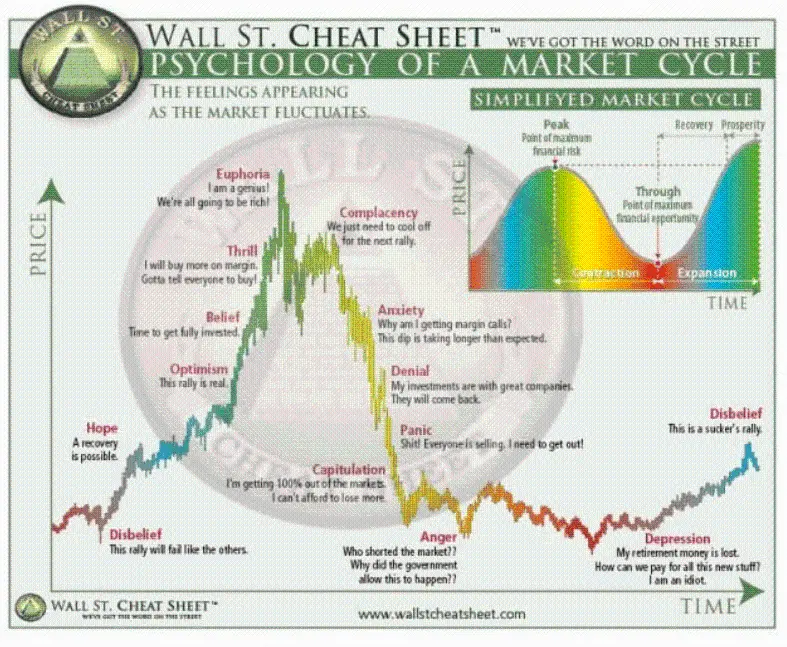

- We believe that we are currently in the "complacency" stage of the cycle shown in the chart above.

- All the bullish catalysts that could be identified a few years ago have already materialized.

- The economy may be heading towards a recession. We believe the stance of the Trump administration is very clear. They are essentially telling us that the economy needs a "detox period". We should believe their stance. This is very similar to the situation in early 2022 when Powell said "pain is coming" before raising interest rates. Our current view is that cryptocurrencies are the canary in the coal mine. The traditional financial markets will slowly decline/oscillate along with it.

- Given the extremely pessimistic market sentiment, we may see a short-term rebound in the market to the low $90,000 range for BTC. However, we believe this rebound will be suppressed by intense selling - this may stifle any hope of a recovery in the bull market structure.

- As always, we remain open to the possibility of being wrong. Our analysis is based on the information we currently have. As new information emerges, we will update our views.

What would make us turn bullish again? We will be watching the following:

- Reversal of fiscal tightening/efforts by the DOGE (Government Efficiency Department).

- Significant interest rate cuts/quantitative easing (QE) by the Federal Reserve.

- Massive influx of global liquidity driven by the Federal Reserve (not just China).

- Major correction/capitulation in the S&P 500 index/Nasdaq.

One concern we have is that the bearish view is becoming a consensus. This gives us pause. But for now, we still need to stick to all the other factors - as there are many signs that the cycle top has formed, and a bear market is imminent.

Of course, from a long-term perspective, there are many reasons to be bullish.

Cryptocurrencies have truly entered their "inflection point" period. The time has finally come to rebuild the financial system on top of public blockchains.

Not to mention, we like bear markets. When the tide goes out, the noise of the past cycles will be more easily filtered out, leaving the true signals - which will prepare us for the next bull market.

This is the time when we do our best work and create the most value for our readers.