Followin' the turbulent shakeup yesterday (11th), the cryptocurrency market today (12th) has a chance to catch its breath, with Bitcoin once again returning to the $83,000 mark, but the upward momentum ultimately lacks the strength to continue. The earlier rebound was just a "small rebound", mainly to correct the market's overly cautious risk-averse sentiment.

VX: TTZS6308

Bitcoin was reported at $81,377 at the time of writing, up 2.3% in the past 24 hours, reaching a high of $83,745 today; Ether, on the other hand, fell slightly by 0.5% to $1,856.

Although the cryptocurrency market has temporarily stopped falling, it still cannot be taken lightly, as this upward trend is more like a technical rebound.

The cryptocurrency market does show signs of recovery, but this is more like a small rebound, rather than a strong rally driven by major positive news. In addition, the US stock market closed slightly lower, without a larger-scale sell-off.

The cryptocurrency market plummeted in sync with the US stock market yesterday, with Bitcoin once dipping below $77,000, and the Dow Jones and S&P 500 indices both recording their biggest single-day declines of the year, leaving investors in a state of panic.

The trigger for this market turmoil was Trump's tariff policy, with the market concerned that this could lead to a new round of trade conflicts, impacting the global economy. To make matters worse, Trump even said that "the US economy may fall into recession during this transition period", making the market even more pessimistic.

3 Main Drivers of the Coin Market Rebound

However, today's price rebound is not without cause, mainly driven by "3 major news":

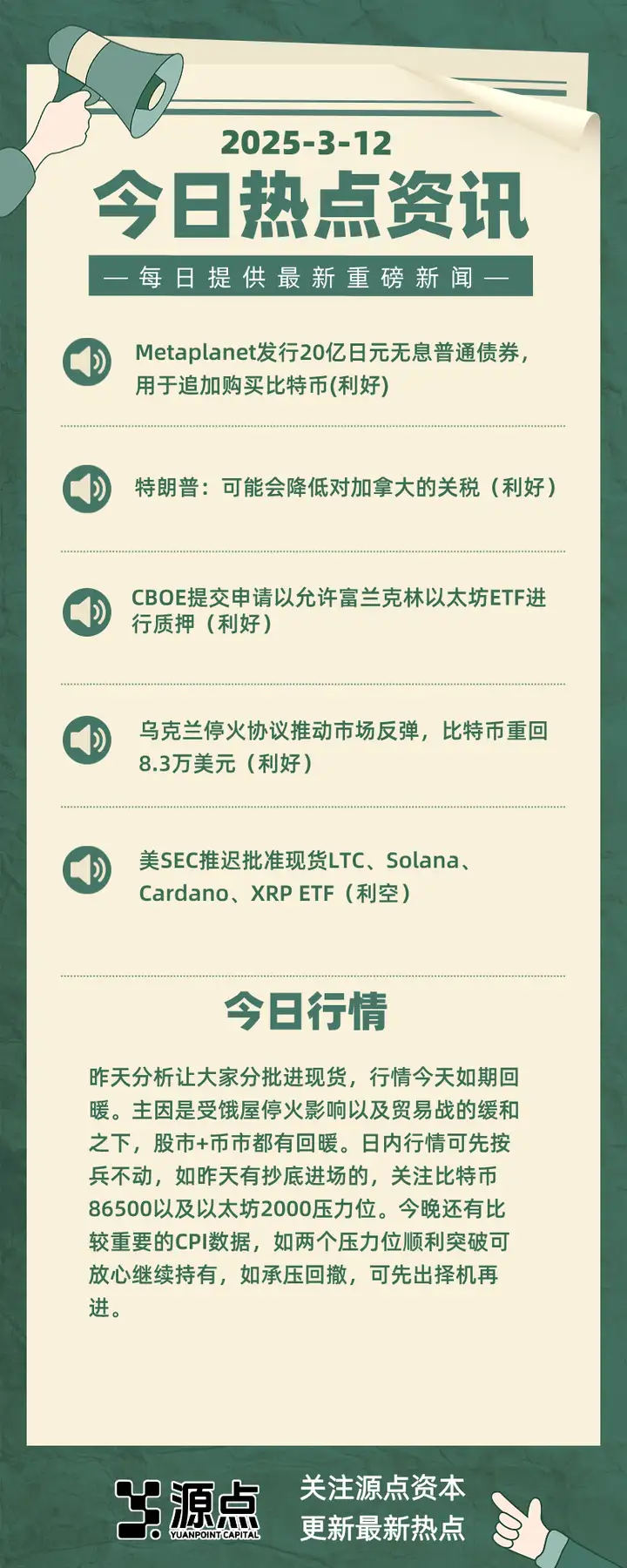

Trump withdraws 50% high tariffs on Canadian steel and aluminum

The tariff policy originally scheduled to take effect on Wednesday has suddenly reversed, with Trump deciding not to impose a 50% tariff on Canadian steel and aluminum, easing market concerns about the escalation of the trade war and driving the recovery of risk assets.

The driver accepts the 30-day ceasefire proposal, and the US and Russia are expected to engage in dialogue

The driver has formally accepted Trump's 30-day ceasefire agreement, and Trump has also said he will further communicate with the Bear to discuss the details and follow-up arrangements of the ceasefire agreement. This development has significantly reduced market concerns about geopolitical risks.

The "Bitcoin Reserve" bill is back on the agenda

A few days after Trump ordered the establishment of a "Bitcoin Strategic Reserve", US Senator Cynthia Lummis has resubmitted a bill proposing the establishment of a "US National Bitcoin Reserve".

Next, closely monitor the release of the US Consumer Price Index (CPI) tonight, as "the CPI data release will be a major event, with the entire market focused on the inflation level and whether the Fed will adjust its policy direction."

In addition, the Federal Open Market Committee (FOMC) will hold a meeting on March 19, where they will discuss the economic situation and decide on the interest rate direction. Currently, the market believes that the probability of the Fed keeping interest rates in the 4.25% to 4.50% range is as high as 96%, meaning that the possibility of a rate cut in the short term is extremely low.

Yesterday's analysis suggested that everyone should buy the dips in batches, and the market has warmed up as expected today. The main reason is the impact of the ceasefire and the easing of the trade war, with both the stock market and the coin market showing signs of recovery. During the day, you can wait and see first. If you bought the dips yesterday, pay attention to the resistance levels of BTC at $86,500 and ETH at $2,000. There is also an important CPI data release tonight. If the two resistance levels are successfully broken through, you can continue to hold with confidence. If they are under pressure and retrace, you can first withdraw and then re-enter at an opportune time.

Due to macroeconomic uncertainties, BTC still faces the risk of further decline in the short term, and it will require a major catalyst to restore its upward trend.

The question now is, which will come first: the recovery of risk assets, or positive news related to BTC, such as sovereign purchase behavior by the US or other countries.

The possibility of the Fed cutting interest rates is still crucial. If the policy change happens faster than expected, it may occur at the Fed's meeting in May, which could stabilize the risk market. Currently, the market's expectation of a rate cut in May has risen from 50% to 75%, increasing the possibility of a policy change, which could be beneficial for BTC.