1. Overview of the Stablecoin Market

1.1 Definition and classification

As a key component of the crypto market, stablecoins aim to achieve relative stability in value by being linked to legal currencies or other assets. This feature makes them stand out in the volatile crypto market and become the preferred tool for investors seeking risk aversion and stable value storage.

1.1.1 Mainstream classification methods: mortgage asset types and issuance methods

Based on the type of collateral assets, stablecoins can be mainly divided into fiat-collateralized, crypto-asset-collateralized, and algorithmic stablecoins. Fiat-collateralized stablecoins, such as USDT and USDC, have a dominant position in the market by virtue of their 1:1 peg to legal currencies such as the U.S. dollar and sufficient fiat currency reserves to ensure currency stability. Crypto-asset-collateralized stablecoins, represented by DAI, use over-collateralization of crypto assets such as Ethereum and smart contracts to achieve decentralized issuance and management, providing users with a different choice of stablecoins. Algorithmic stablecoins, such as FRAX, attempt to adjust the supply and demand relationship through complex algorithms to maintain currency price stability. Although they are still in the exploratory development stage, they have shown innovative potential. [1]

From the perspective of issuance, stablecoins can be divided into two categories: centralized and decentralized. Centralized stablecoins are usually issued by strong companies or institutions, which rely on their strong resource integration capabilities and credit endorsement to ensure the stable operation of stablecoins. Decentralized stablecoins rely on smart contracts and blockchain technology to achieve community autonomy and give users higher transparency and autonomy.

1.1.2 Classification by Stablecoin "Market Map Section"

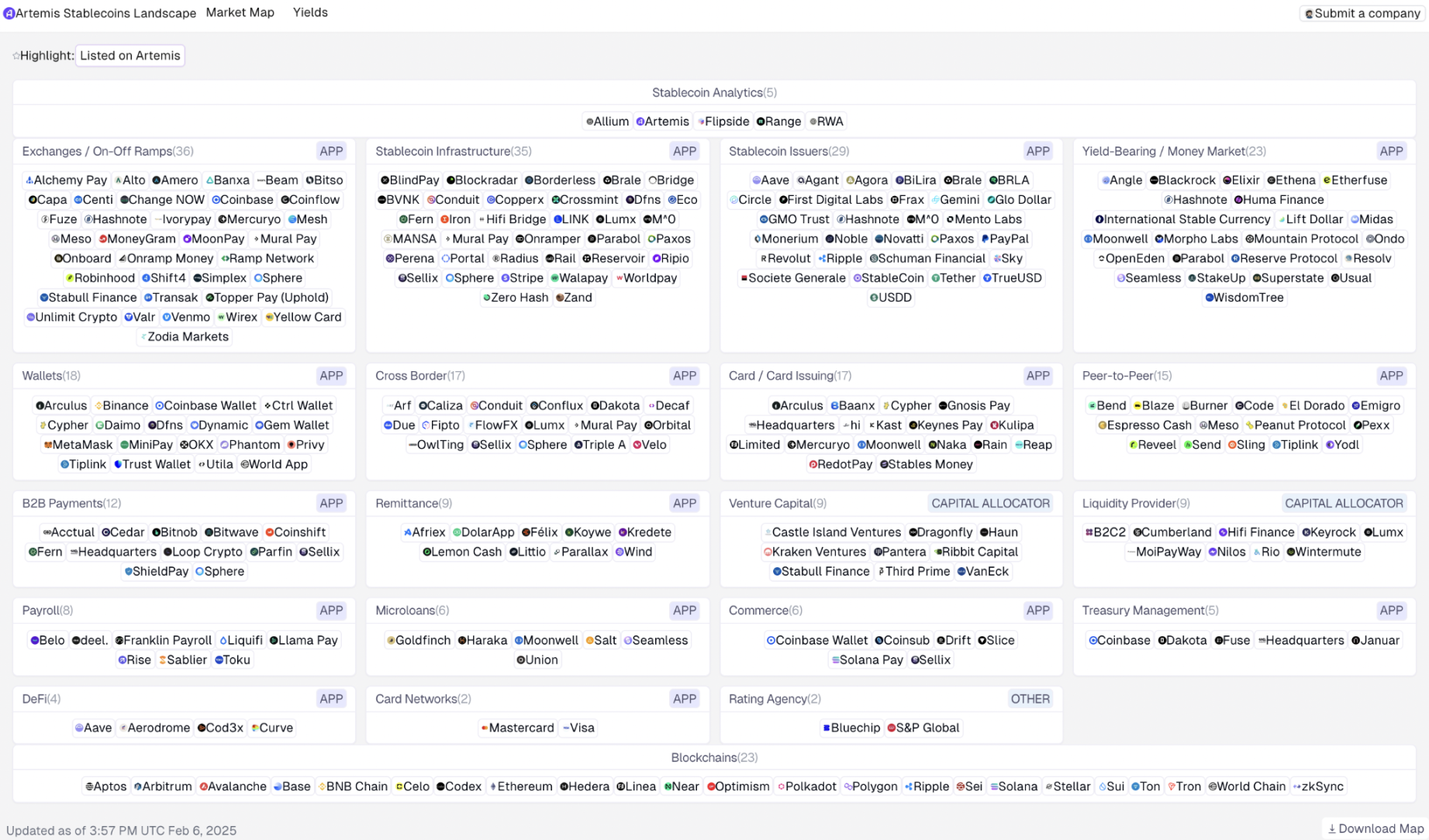

Figure 1: Stablecoin market map of various sectors

Stablecoins can be divided into 20 sectors according to the market map. Each sector represents a different field of the stablecoin market. For example, the sector above contains the names of related companies or projects. The market map clearly shows the ecosystem of the stablecoin market, covering related companies and projects in various links from issuance, trading, infrastructure, application to investment. The sector classification logic of the stablecoin market map is based on the functions and roles of each project in the stablecoin ecosystem. The sectors are closely related and jointly build a complete ecosystem of the stablecoin market. Through the stablecoin market map, we can quickly understand the main participants in the stablecoin market and the layout of various fields.

According to the market map, this classification method comes from Artemis data statistics. The map content captured by the author is the latest data as of February 8, 2025, and the projects or companies included are relatively complete. If there are omissions, you can also submit new company or project information in the upper right corner. The classification and specific situation of the stablecoin market map section are as follows: [2]

- Exchange/Deposit and Withdrawal Channels: This section includes 36 related projects, such as Alchemy Pay, MoonPay, etc., which are mainly responsible for cryptocurrency transactions and fund inflow and outflow operations. It is an important channel for the interaction between stablecoins and traditional financial systems.

- Stablecoin infrastructure: There are 35 projects, such as BlindPay and Blockradar, that provide technical support for the operation of stablecoins, including blockchain underlying technology, data services, etc., which are the basic guarantee for the normal operation of stablecoins.

- Stablecoin issuers: There are 29 projects in total, such as Aave, Tether, etc. These entities are responsible for the issuance of stablecoins and determine the supply of stablecoins in the market.

- Interest-earning/money market: There are 23 projects, such as Angle, Blackrock, etc., that provide users with the opportunity to earn income through stablecoins, involving financial activities such as lending and investing, similar to the money market in traditional finance.

- Wallet: Contains 18 projects, such as Arculus, Binance Wallet, etc., which are used to store and manage stablecoins and other cryptocurrencies. It is a tool for users to hold and use stablecoins.

- Cross-border payments: There are 17 projects, such as Arf and Caliza, which focus on using stablecoins to achieve cross-border payments and capital flows, and solve the problems of high cost and slow speed in traditional cross-border payments.

- Card/Card Issuance: 17 projects, such as Arculus and Baanx, involve the issuance and services of payment cards related to stablecoins, combining stablecoins with traditional payment card business to expand the payment scenarios of stablecoins.

- P2P peer-to-peer: 5 projects, such as Bend, Blaze, etc., support direct stablecoin transactions or related services between users and have the characteristics of decentralization.

- B2B inter-enterprise payments: There are 9 projects, such as Accual and Cedra, which provide stablecoin-based payment solutions for transactions between enterprises, improving enterprise payment efficiency and reducing costs.

- Remittance services: 9 projects, such as Afriex and DolarApp, use stablecoins for remittance services, providing a more convenient and low-cost option for cross-border remittances.

- Venture capital: includes 13 projects, such as Castle Island Ventures, Kraken Ventures, etc. These venture capital institutions invest in stablecoin-related projects to promote the innovation and development of the stablecoin industry.

- Liquidity providers: There are 9 projects, such as B2C2 and Cumberland, that provide liquidity to the stablecoin market, ensuring that market transactions can proceed smoothly and avoiding problems such as insufficient trading depth.

- Salary payment management: 8 projects, such as Belo, deel, etc., involve the use of stablecoins for salary payment and management, providing new salary payment methods for enterprises and employees.

- Microloans: 6 projects, such as Goldfinch and Haraka, carry out microloan business in the cryptocurrency field to provide users with small financial support.

- Commercial applications: 7 projects, such as Coinbase Wallet, Coinsub, etc., mainly involve the application of stablecoins in commercial activities, such as shopping payments and other scenarios.

- Fund management: 5 projects, including Dakota, Fuse, etc. This section focuses on projects or entities related to the management of stablecoin funds. It plays a role in fund coordination and management in the stablecoin ecosystem, including reasonable allocation of stablecoin funds, risk control, and optimized operations.

- Decentralized Finance: 4 projects, such as Aave and Aerodrome, apply stablecoins to the field of decentralized finance to achieve the decentralization of financial functions such as lending, trading, and liquidity mining.

- Card network: 2 projects, namely Mastercard and Visa, traditional card payment networks participate in stablecoin-related businesses, promoting the integration of stablecoins with traditional payment systems.

- Rating agencies: 2 projects, Bluechip and S&P Global, rate stablecoin projects or related entities to provide reference information for market participants.

- Blockchain underlying technology: 23 blockchain projects are listed, such as Aptos, Arbitrum, etc. These blockchains are the underlying technology platforms for the operation of stablecoins. Different stablecoins are issued and operated based on different blockchains.

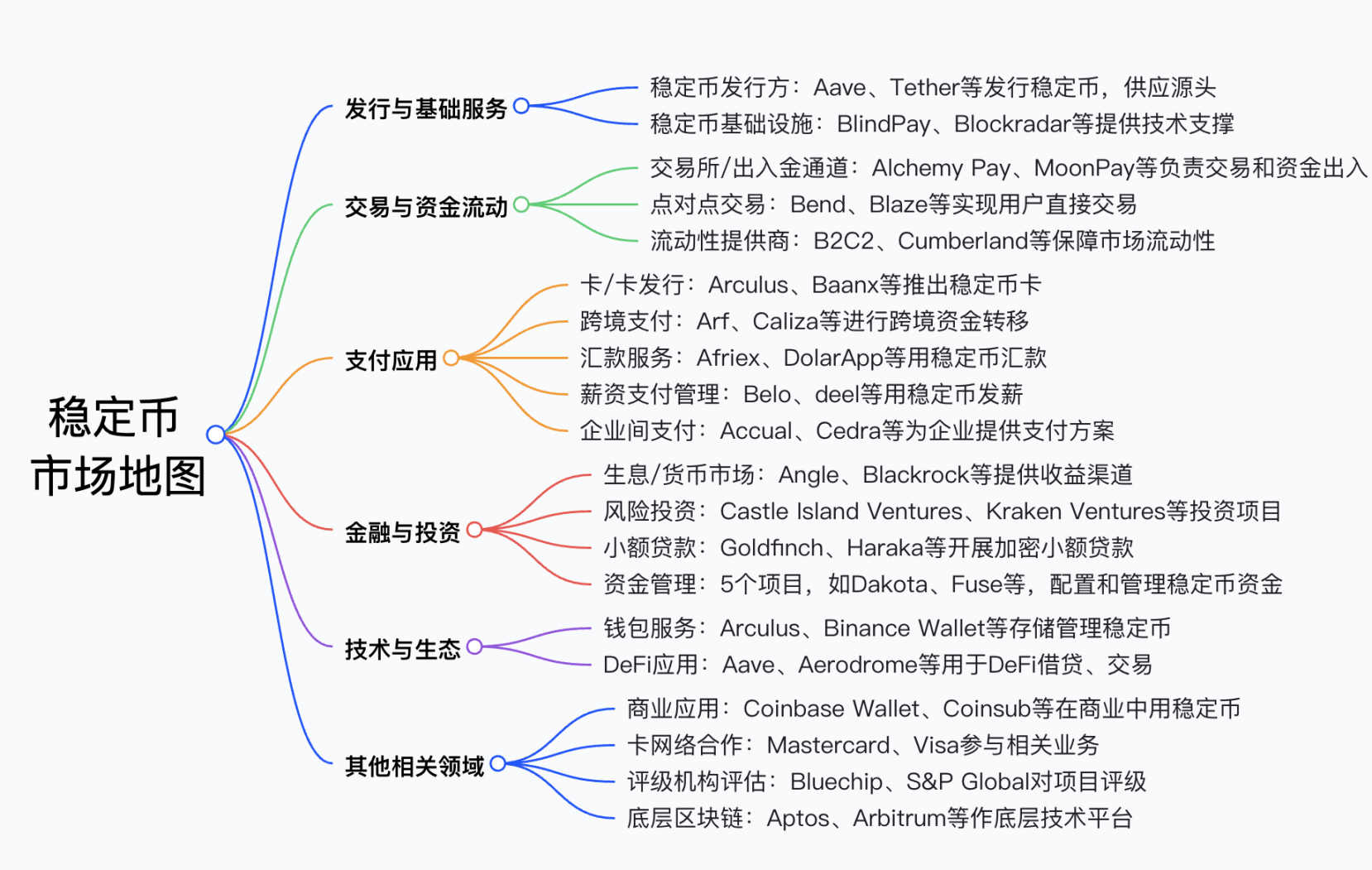

Figure 2: Stablecoin market mind map

In order to help readers read the details of the stablecoin market map more clearly and intuitively, the author also made a mind map of the 20 sub-sectors of the stablecoin market, which is summarized above.

1.2 Review of Development History

1.2.1 Early Exploration (2014-2015)

In 2014, Tether launched Tether (USDT), one of the earliest stablecoins. It adopted a fiat currency collateral model pegged to the US dollar at a 1:1 ratio, introduced a relatively stable trading medium to the cryptocurrency market, and opened the prelude to the development of stablecoins. In 2015, the concept of stablecoins was initially spread in the crypto community. Although the market size was small, it triggered the industry's attention and thinking on the price stabilization mechanism of crypto assets.

1.2.2 Initial development (2016-2017)

In 2016, some decentralized stablecoin projects began to take shape, attempting to use the decentralized nature of blockchain to build a stablecoin system, but the technology was not yet mature and faced many challenges. In 2017, the cryptocurrency bull market arrived, the demand for stablecoins surged, and more stablecoin projects sprang up. Market competition gradually intensified, and the application scenarios of stablecoins also expanded from simple transaction media to payment, investment and other fields.

1.2.3 Market turbulence and adjustment (2018-2019)

In 2018, the cryptocurrency market fell sharply, and some stablecoin projects exposed problems such as insufficient reserves and regulatory compliance, which impacted the market's trust in stablecoins. Regulators began to increase their attention and supervision of stablecoins, prompting the industry to adjust and regulate itself. In 2019, stablecoin projects made more efforts in compliance. Some projects took the initiative to accept audits to enhance transparency, while innovating in technology and mechanisms to improve stability and security.

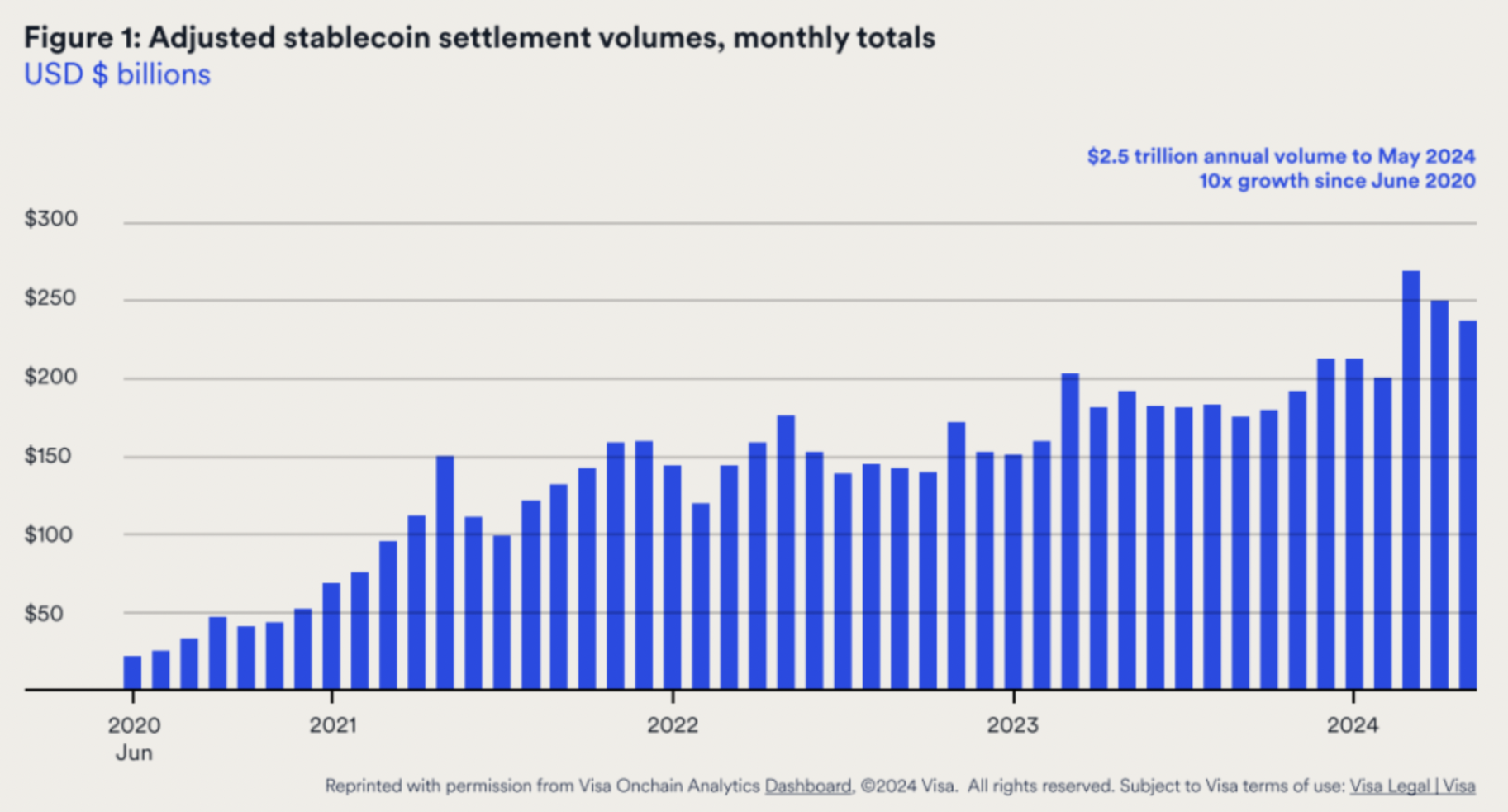

Figure 3: Monthly trend of stablecoin settlement volume from 2020 to date [3]

1.2.4 Rapid Expansion (2020-2021)

In 2020, the DeFi (decentralized finance) craze emerged, and the demand for stablecoins, as an important foundation of the DeFi ecosystem, has exploded. Various decentralized stablecoin projects have been continuously optimized and deeply integrated with DeFi protocols, and the application scenarios have been further enriched, including lending, liquidity mining, etc. Judging from the stablecoin settlement volume data in the above figure, the monthly settlement volume of stablecoins has shown a clear growth trend since June 2020. In 2021, the scale of the stablecoin market continued to expand, and traditional financial institutions and large enterprises also began to get involved in the field of stablecoins, which promoted the compliance and mainstreaming of stablecoins.

1.2.5 Challenges and Changes (2022-2023)

In 2022, the crypto market was turbulent again. The collapse of the algorithmic stablecoin UST caused a shock in the industry, highlighting the risks of algorithmic stablecoins, and leading to higher market requirements for the stability and reliability of stablecoins. Regulatory policies have been further tightened, and supervision of stablecoin issuance, trading and other links has been strengthened globally. In 2023, the stablecoin industry accelerated its transformation, and project parties paid more attention to risk control and compliance operations, exploring new mortgage models and stabilization mechanisms to meet the dual challenges of the market and supervision. At the same time, judging from the data in the above figure, the monthly settlement volume of stablecoins has maintained an upward trend, fluctuating between US$150 billion and US$200 billion, showing the market's continued demand for stablecoins.

1.2.6 Continuous Innovation and Integration (2024 - Present)

Since 2024, stablecoins have continued to advance in technological innovation, application expansion, and integration with traditional finance. More stablecoin projects are exploring the combination with real assets, such as issuing stablecoins with gold, real estate, etc. as collateral. The application in cross-border payments, supply chain finance and other fields continues to deepen, and the cooperation with traditional financial institutions is becoming increasingly close, which promotes the penetration of stablecoins into a wider range of financial fields. As shown in the above figure, as of May 2024, the annual settlement volume of stablecoins reached 2.5 trillion US dollars, a 10-fold increase since June 2020. This data not only reflects the rapid expansion of the stablecoin market size, but also reflects the increasing importance of stablecoins as a payment and settlement tool in the field of cryptocurrency and possible broader financial scenarios. Its growth trend is closely related to factors such as the development of the cryptocurrency market, the prosperity of the DeFi ecosystem, and the acceptance of traditional financial institutions.

2. Stablecoin Market Size and Current Status

2.1 Overall scale growth trend

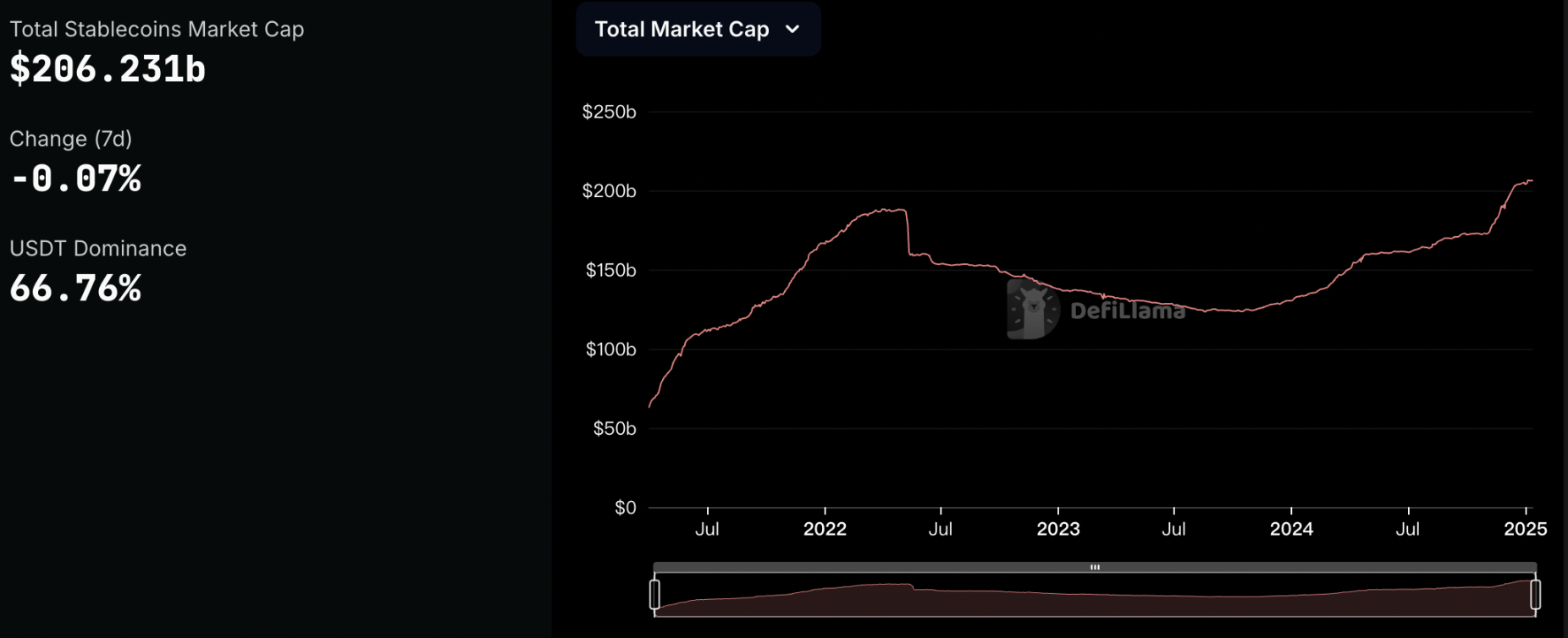

Figure 4: Stablecoin total market value growth trend

In 2017, the stablecoin market was still in its infancy, with a total market value of only a few billion US dollars. Since 2023, the stablecoin market has shown a booming trend, with its total market value and trading volume continuing to rise, demonstrating strong growth momentum. This is mainly due to the overall prosperity of the crypto market in recent years, the surge in investor demand for safe-haven assets, and the widespread penetration of stablecoins in various application scenarios, which has enabled its scale to enter a high-speed growth mode. According to Deflama data (as shown in the figure above), as of January 12, 2025, the total market value of stablecoins has reached US$206.231 billion, a significant leap compared to previous years. [4]

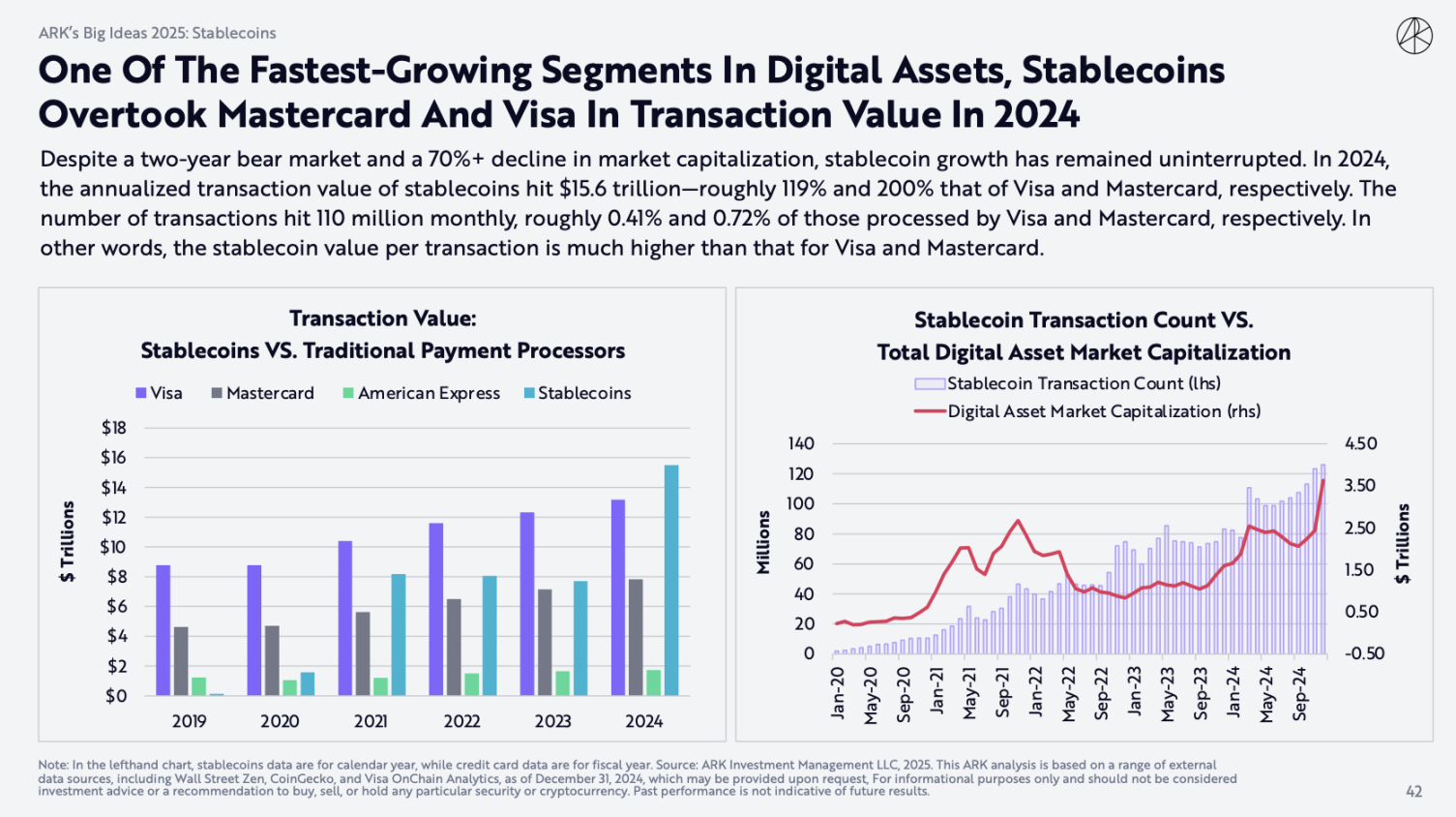

Figure 5: Annualized stablecoin transaction volume in 2024

From the perspective of transaction volume, the average daily transaction volume of stablecoins has also shown a rapid growth momentum. According to the latest news on February 5, ARK Invest reported in the BIG IDEAS 2025 report that the annualized transaction volume of stablecoins will reach 15.6 trillion US dollars in 2024. [5] This fully demonstrates the core position and high-frequency liquidity of stablecoins in the crypto ecosystem. Behind this growth trend is the high recognition of stablecoins as a medium of transaction and a value storage tool by crypto market participants. Its wide application in daily transactions, cross-border payments, DeFi lending and other scenarios continues to drive the increase in transaction volume.

The author deeply analyzed the driving factors of the growth of stablecoin transaction volume and found that the expansion of the crypto market is one of the most critical factors. With the sharp fluctuations and growth of the prices of mainstream cryptocurrencies such as Bitcoin, Ethereum and SOL, investors are eager to buy and sell through stablecoins, which in turn drives up the demand for stablecoins.

Figure 6: Weekly K-line chart of total issuance of Bitcoin and USDT

The author selected the weekly K-line chart of the total issuance of Bitcoin, the leader of the crypto market (Gate.io BTC/USDT weekly K-line chart) and the stablecoin market representative USDT for trend comparison. As shown in the figure above [6], the overall trend of the two is roughly the same, that is, the issuance of USDT increases with the rise of Bitcoin prices, and as Bitcoin prices fall or pull back, the issuance of USDT shows a decline or tends to be stable in a narrow range. Similarly, the overall size of the crypto market is on an upward trend, and the rising demand for purchasing cryptocurrencies has also pushed up the overall upward trend of the total market value of stablecoins.

At the same time, there is another important factor not only in the secondary crypto market but also in the primary crypto market. Since the end of 2020, the booming DeFi ecosystem has injected strong vitality into the stablecoin market. In many scenarios such as DeFi lending, trading, and liquidity mining, stablecoins, as core assets, play a vital role. Taking MakerDAO as an example, its issued DAI stablecoin is widely used in DeFi lending protocols. Users mint DAI by pledging crypto assets and then lend DAI to obtain income. This process has greatly promoted the circulation and demand growth of DAI, and also driven the coordinated development of the entire stablecoin market and the DeFi ecosystem.

In addition, outside the crypto market, the growing demand for safe-haven assets by investors cannot be ignored. Against the backdrop of increasing global economic uncertainty and frequent geopolitical risks, stablecoins provide investors with a relatively safe haven by virtue of their peg mechanism to fiat currencies or other stable assets. Especially in emerging markets, where currency exchange rates fluctuate frequently, local residents and businesses have an increasingly strong demand for stablecoins, further driving the expansion of the stablecoin market.

2.2 Introduction to mainstream stablecoins

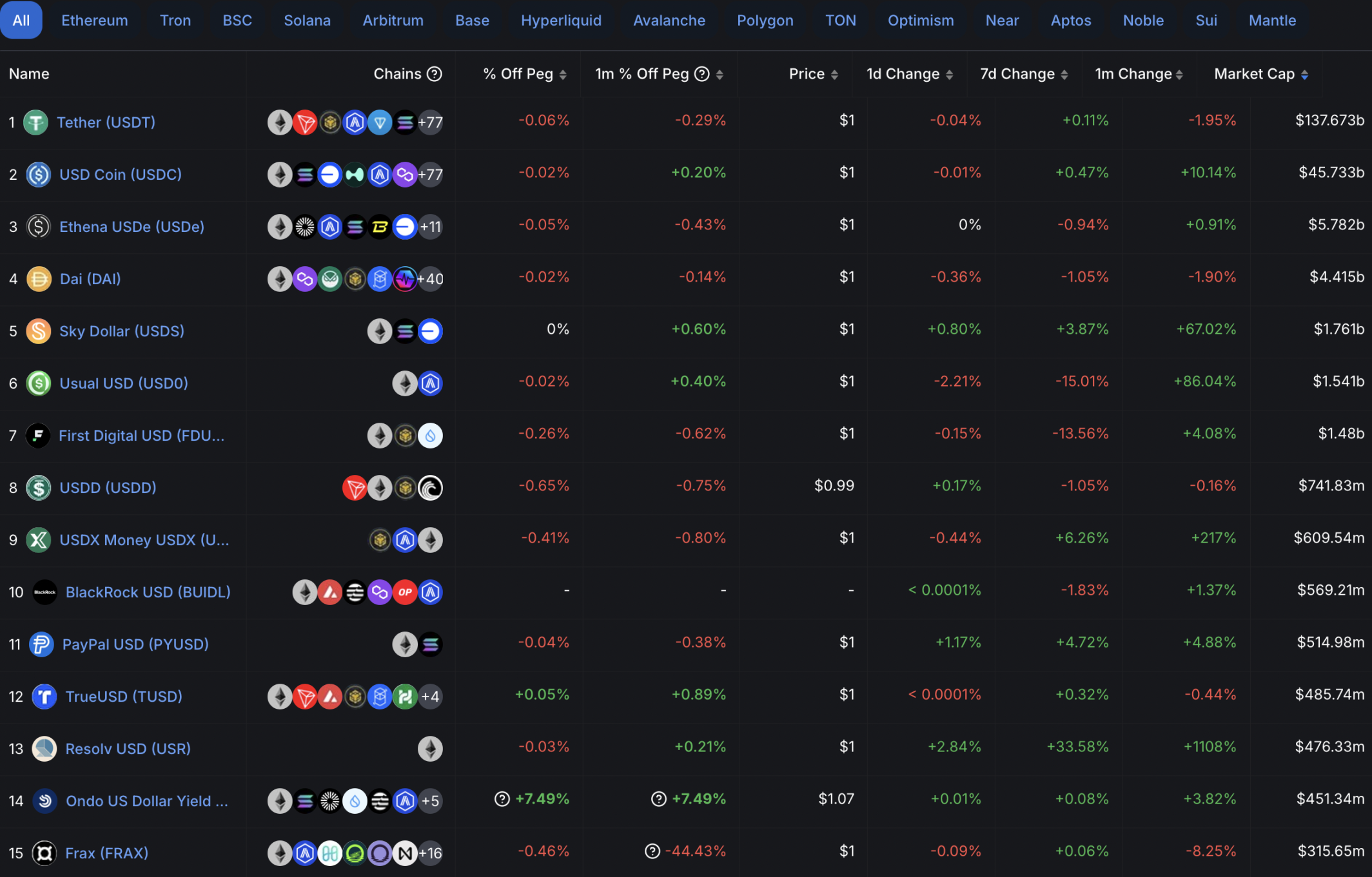

Figure 7: Top 15 stablecoins by market capitalization

According to Defillama data, the top 15 stablecoins by market capitalization are listed above. [7] From the perspective of current mainstream stablecoins, centralized stablecoins collateralized by the US dollar mainly include USDT, USDC, FDUSD, etc., and their broad collateralization rates are basically greater than 100%; DAI is a decentralized crypto-asset collateralized stablecoin; USDe is a synthetic dollar with crypto assets as collateral; FRAX is an algorithmic stablecoin; and PAXG is a stablecoin collateralized by gold.

There are many types of stablecoins, and Deflama has included a total of 209, which cannot be introduced one by one in this article. According to the three types of collateral assets mentioned above, namely, fiat currency collateral, crypto asset collateral and algorithmic stablecoins, as well as the two issuance methods of centralized and decentralized, we have selected six mainstream stablecoins with large market capitalization and representativeness - USDT, USDC, DAI, USDe, FRAX and PAXG, and briefly introduced them.

2.2.1 USDT: The Originator and Leader of Stablecoins

As a pioneer and giant in the field of stablecoins, USDT is issued by Tether. Since its birth in 2014, it has always occupied a pivotal position in the crypto market. Its operating mechanism revolves around users depositing US dollars. When users deposit US dollars into Tether's account, the company will mint the corresponding number of USDT for users on the blockchain at a ratio of 1:1 based on the deposited amount. These USDTs then enter the circulation field and can be freely traded on major cryptocurrency exchanges. In the redemption stage, users only need to return the USDT in their hands to Tether, and the company will destroy the same amount of USDT and return the same amount of US dollars to the user. The whole process is simple and efficient, ensuring the balance of supply and demand and price stability of USDT.

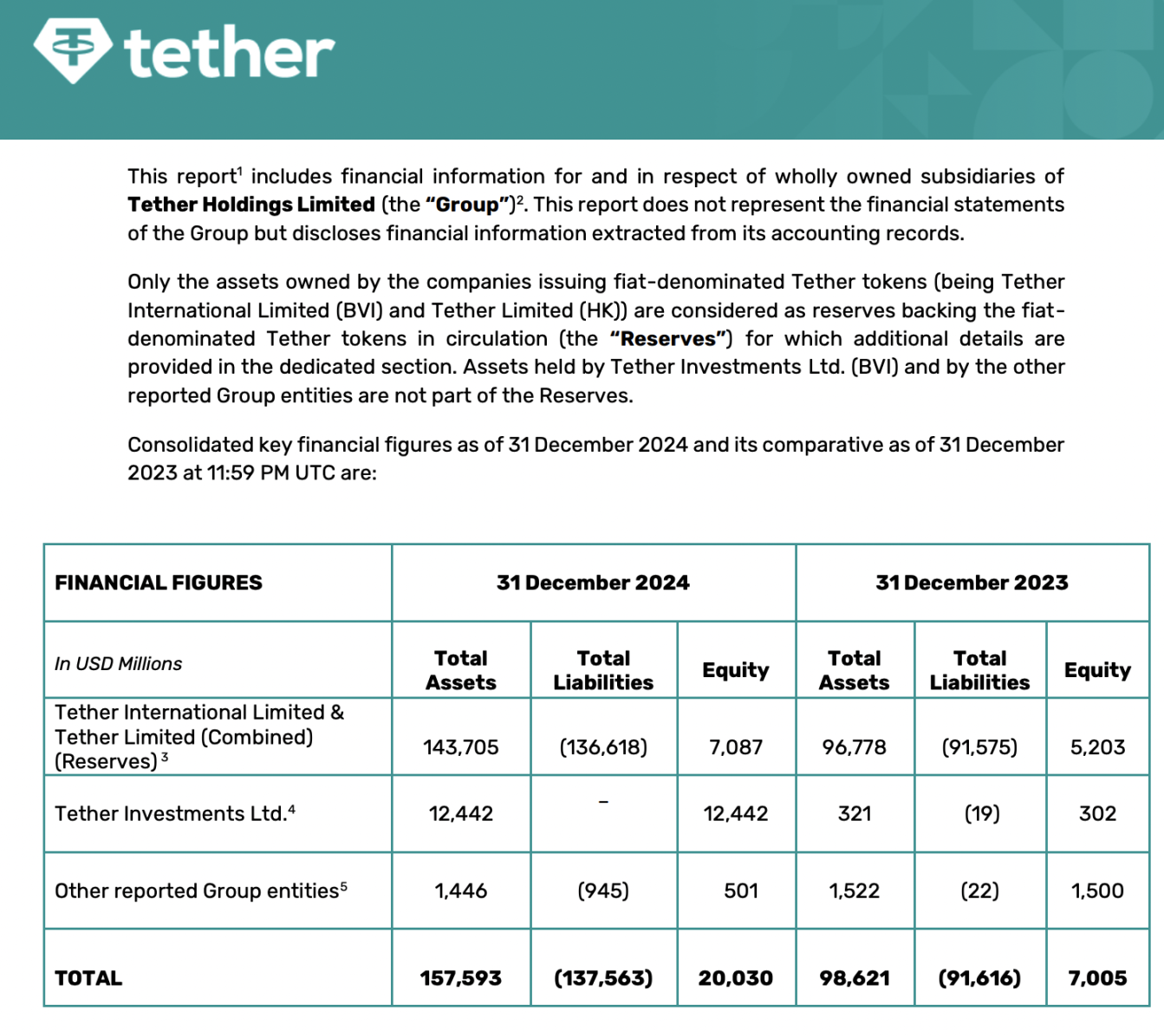

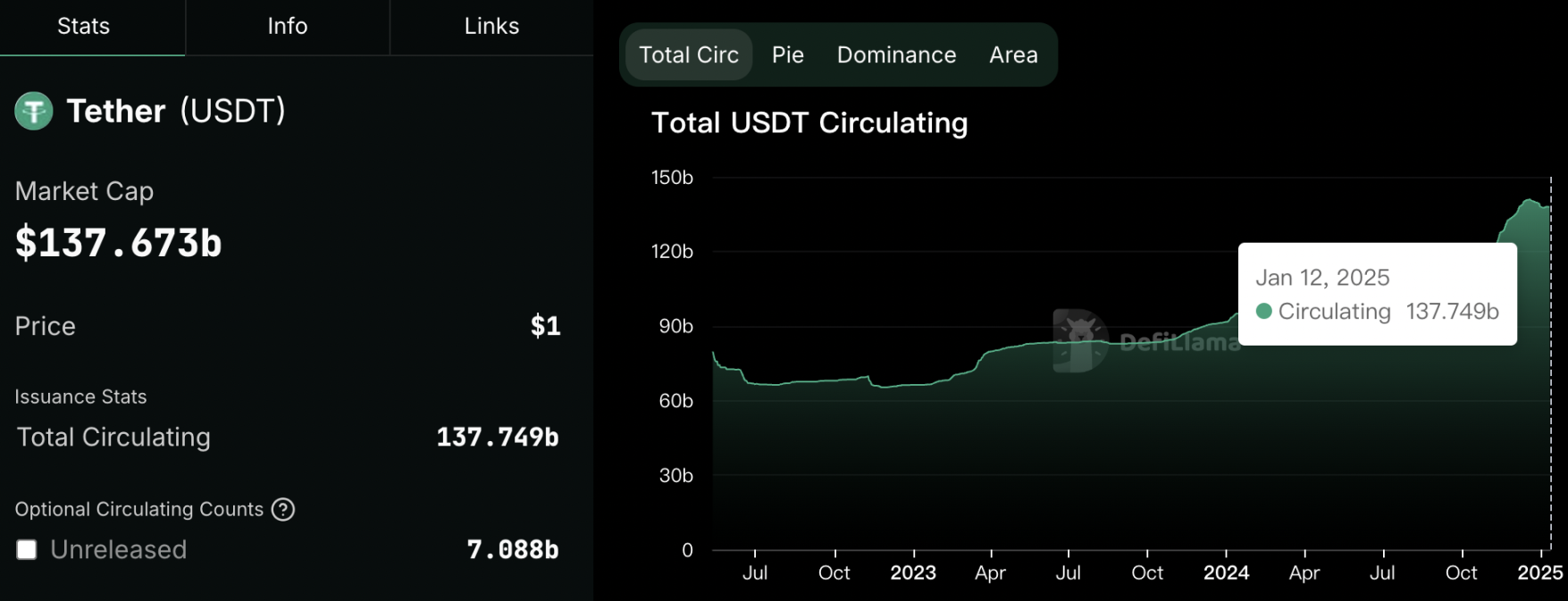

Figure 8: Tether’s USDT issuance in 2024 and 2023

2.2.1.1 Market Data

On February 1, 2025, Tether released its latest 2024 fourth quarter report, in which some changes occurred in the composition of its asset reserves. [8] From the overall data, as of December 31, 2024, the group's total assets reached US$143,704,755,547, and total liabilities were US$136,617,485,006. Assets exceeded liabilities, and the difference between assets and liabilities was approximately US$7.09 billion. This excess reserve has further increased compared to the previous one, providing a more solid backing for the stable operation of USDT.

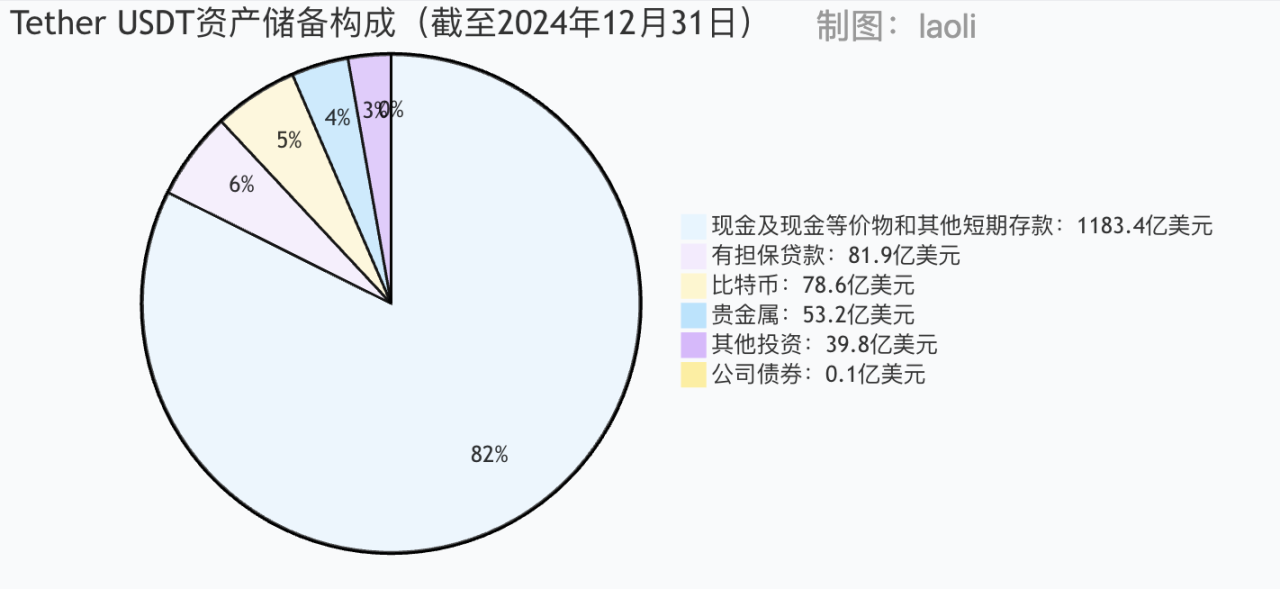

Figure 9: Tether’s USDT asset reserve composition in Q4 2024

2.2.1.2 Composition of asset reserves

In terms of the specific composition of asset reserves [9], cash, cash equivalents and other short-term deposits accounted for 82.35%, as high as US$118.34 billion, of which the amount of US Treasury bonds held directly and indirectly was as high as US$113 billion, making Tether one of the world's largest holders of US Treasury bonds. The high proportion of US Treasury bonds not only provides stable value support for USDT, but also greatly improves its liquidity. In terms of Bitcoin, Tether further increased its holdings in the fourth quarter of 2024, holding nearly 84,000 BTC by the end of the year, worth approximately US$7.86 billion. This investment strategy has enriched the diversity of asset reserves to a certain extent, and may also benefit from the potential gains brought by the fluctuations in Bitcoin prices. In addition, Tether also holds precious metals worth US$5.32 billion, mainly gold. As a traditional safe-haven asset, gold, together with US Treasury bonds and Bitcoin, constitutes a relatively diversified asset reserve portfolio, which helps to maintain the stability of USDT's market value.

2.2.1.3 Profit model

In terms of profit model, USDT's profit model is similar to that of traditional banks, mainly relying on low-cost customer acquisition funds for investment profit. As the leader of stablecoins, it has high market recognition, attracting a large number of users to deposit funds, and the cost of customer acquisition is extremely low. Tether invests these funds in multiple fields, the most important of which is investing in U.S. Treasury bonds. As of July 2024, its U.S. Treasury holdings exceeded US$97.6 billion, and it obtained high interest income by virtue of the huge scale of U.S. Treasury bonds. In addition, it also conducts lending business to collect interest and invests in equity projects. For example, investing in neural implant technology start-ups, etc., expecting to obtain equity appreciation returns. At the same time, although redemption fees and account creation verification fees are also sources of profit, investment income accounts for the largest and most critical part of profit.

Figure 10: USDT market share

2.2.1.4 Market share

In terms of market share, USDT has long been at the top of the list. As of January 12, 2025, its market value reached US$137.673 billion [10], accounting for 66.76% of the market value. In many cryptocurrency exchanges, USDT has become a standard trading pair and is widely used in transactions of mainstream cryptocurrencies such as Bitcoin and Ethereum, providing deep liquidity to the market.

2.2.1.5 Disputes and Compliance

USDT is not without controversy. In terms of regulation, due to the centralized nature of its issuance and operation, transparency has been questioned. In the past, market participants have expressed doubts about whether Tether holds sufficient US dollar reserves. Although the company has improved transparency through measures such as publishing audit reports in recent years, regulatory pressure still lingers. Regulators in some countries have launched investigations into the compliance of USDT and required it to further improve information disclosure to ensure market stability and investor rights.

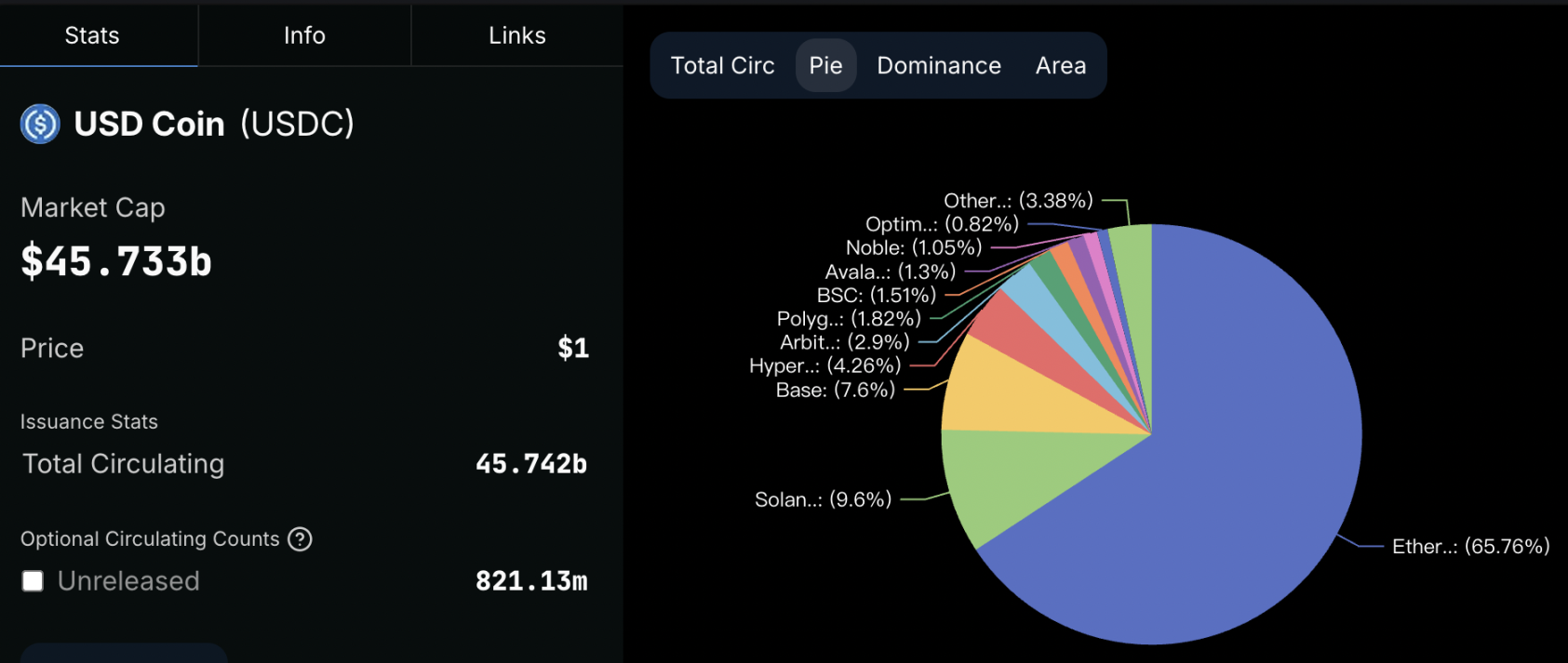

2.2.2 USDC: Stablecoin issued with fiat currency collateral

USDC, jointly issued by Coinbase and Circle, has been on the market since 2018. With its rigorous operating model and compliance advantages, it has quickly emerged in the stablecoin market and become the second largest stablecoin after USDT. [11]

Figure 11: USDC

2.2.2.1 Operational Mode

In terms of operational details, USDC and USDT have many differences. Its asset reserves are mainly short-term treasury bonds and cash, with shorter maturities and significant liquidity advantages. Circle will regularly announce the maturity dates of major treasury assets. In March 2024, the disclosed data showed that the maturity of its treasury assets was within 3 months, with the latest short-term debt due in June, with an overall size of US$11.4 billion. In addition, repurchase agreements and cash reserves totaled US$28.2 billion, with another US$4.2 billion in cash. Almost all assets are deposited in CRF (Circle reserve Fund) registered by BlackRock with the SEC. About 95% of the assets are under SEC supervision. The high degree of regulatory compliance has won market trust for USDC.

2.2.2.2 Supervision and transparency

USDC performs well in terms of regulatory transparency. Circle regularly publishes independent audit reports that detail the matching of USD reserves and the amount of USDC in circulation, allowing investors to have a clear insight into the status of their assets and hold and use USDC with confidence.

2.2.2.3 Market competitiveness

In terms of market competitiveness, relying on the deep resources and extensive influence of Coinbase and Circle in the crypto industry, USDC has quickly gained recognition from many cryptocurrency exchanges and financial institutions, and is widely used in cross-border payments, DeFi lending, corporate fund management and other scenarios. In Visa's cross-border settlement pilot project, Crypto.com selected USDC for global settlement, fully demonstrating its efficiency and stability in the field of large-value payments.

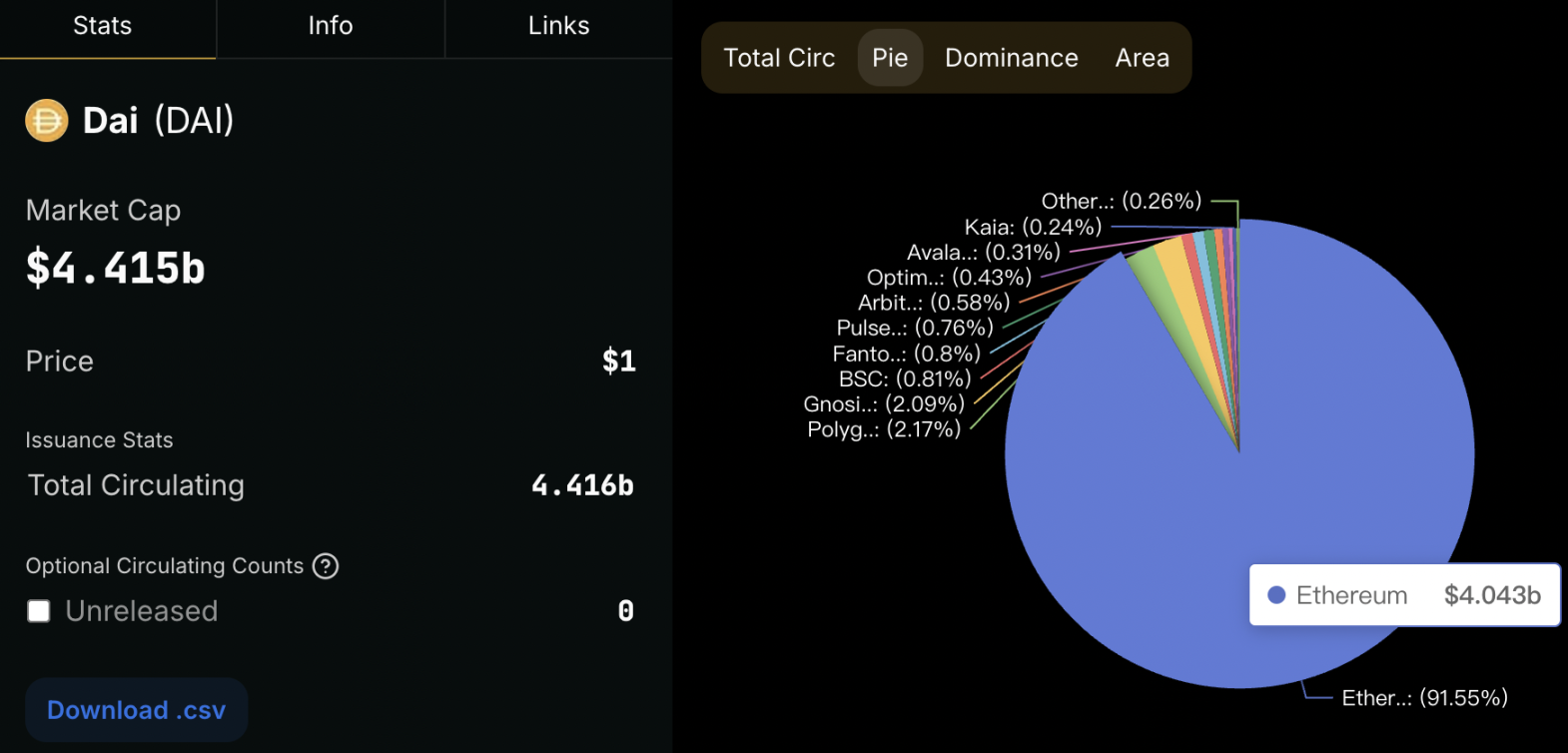

2.2.3 DAI: Decentralization/Crypto-asset collateralized issuance of stablecoins

DAI, issued and managed by the decentralized autonomous organization MakerDAO, serves as a benchmark for decentralized stablecoins and brings a new stablecoin paradigm to the crypto market.

Figure 12: DAI

The birth of DAI stems from users pledging crypto assets through the MakerDAO platform, mainly ETH, which currently accounts for 91.55%. [12] With the help of the automated execution of smart contracts, it is minted according to a certain collateral rate. For example, a user who pledges ETH worth $150 may receive DAI worth $100. This over-collateralization mechanism lays the foundation for the stability of DAI's value.

2.2.3.1 Stabilization mechanism

Price stability and liquidation mechanisms are the core highlights of DAI. In response to the drastic fluctuations in the crypto market, MakerDAO has designed a sophisticated interest rate adjustment and liquidation system. When the DAI market price deviates from $1, the system will automatically adjust the stability rate (equivalent to loan interest) and the DAI deposit rate (DSR), and guide market participants to buy or sell DAI through economic incentives, prompting prices to return to stability. At the same time, if the value of the mortgaged assets drops sharply and reaches the liquidation threshold, the system will initiate a Dutch auction to sell the mortgaged assets at a reasonable price to recover DAI, ensuring the overall stability of the system and avoiding bad debt risks.

2.2.3.2 Role in the DeFi ecosystem

In the DeFi ecosystem, DAI plays an indispensable role. It is widely used in mortgage loans, margin trading, international transfers, supply chain finance and other fields, providing users with decentralized, permissionless financial services. Taking the decentralized lending platform Compound as an example, users can pledge their idle crypto assets to obtain DAI, and then lend DAI to earn interest, thus achieving efficient use of assets. DAI also achieves deep value circulation in the DeFi ecosystem.

As the DeFi market continues to prosper, DAI is expected to attract more users and funds with its unique decentralized advantages, further expand its application boundaries, and become a key force in promoting the maturity of the DeFi ecosystem.

2.2.4 USDe: Semi-centralized stablecoin/synthetic dollar

Figure 13: USDe

USDe is a unique semi-centralized stablecoin launched by Ethena. It is also a typical representative of synthetic dollars. It has played an increasingly important role in the stablecoin market since 2024. According to the data shown in our previous article, it has risen to the third place in the stablecoin market value. It is built on the Ethereum blockchain and is committed to providing a crypto-native currency solution that does not rely on the traditional banking system. This innovative concept makes it stand out among many stablecoins.

2.2.4.1 Attribute composition

From the perspective of its essential attributes, USDe is a fully collateralized semi-centralized stablecoin. There are various ways to classify stablecoins. If we compare them based on the three core indicators of whether they are fully collateralized, whether they are issued without permission, and whether they are de-custodied, USDe and other common stablecoins have some differences in these three attributes. If "decentralization" is defined as satisfying both the "permissionless issuance" and "de-custodied" conditions, then USDe does not meet this standard, so it is reasonable to classify it as a "fully collateralized semi-centralized stablecoin."

2.2.4.2 Value of collateral assets

In terms of collateral value, USDe's collateral is a synthetic asset of crypto assets and corresponding short futures positions. The value of its synthetic assets is composed of the spot value and the short futures position value. In the initial state, if the spot value is X and the futures position value is 0, assuming the basis is Y, the collateral value is X + 0. As time goes by, the spot price and the futures position value change. If the spot price rises by a US dollar after a certain period of time, and the futures position value rises by b US dollars (a and b can be negative), the position value becomes X + a - b = X + (a - b), and the basis becomes Y + ΔY (where ΔY = (a - b)). When ΔY remains unchanged, the intrinsic value of the position will not change; when ΔY is positive, the intrinsic value of the position will rise; otherwise, it will fall. This asset combination of holding spot and short futures is also called "spot-futures arbitrage". According to current data, constructing such an investment portfolio can obtain a low-risk annualized return of about 18%. Currently, USDe's core/narrow collateral ratio is 101.62%. After taking into account ENA's $1.57 billion market capitalization, the broad collateral ratio can reach about 178%, which shows that it has sufficient collateral and the concern of "insolvency" is unfounded.

2.2.4.3 Risks and Challenges

USDe is not risk-free. On the one hand, it faces market capacity risk. At present, the issuance volume of USDe is about 2.04 billion, of which ETH and LST total about 1.24 billion. In the case of full hedging, a short position of 1.24 billion US dollars needs to be opened, and the size of the position is proportional to the size of USDe. At present, Binance's ETH perpetual contract position is about 3 billion US dollars. A large amount of Ethena's reserves are stored in Binance. If a short position is opened on the exchange, its position size has accounted for a certain proportion, which may lead to greater transaction friction, inability to cope with large-scale redemptions in a short period of time, and pushing up the supply of short positions, resulting in a decline in rates and affecting yields. Although some mechanism designs can be used to mitigate risks, such as setting a time-based casting/destruction cap and dynamic rates, or introducing multiple currencies and multiple exchanges to break through the market capacity limit, it still faces huge challenges to surpass USDC and become the second largest stablecoin. On the other hand, there is also custody risk. Although it solves some problems of traditional stablecoins to a certain extent, these risk points also need to be focused on and resolved during its development.

Overall, USDe has occupied a place in the stablecoin market with its unique mechanism and innovative model. Its future development prospects are worthy of attention, but at the same time, it is also necessary to properly deal with various potential risks.

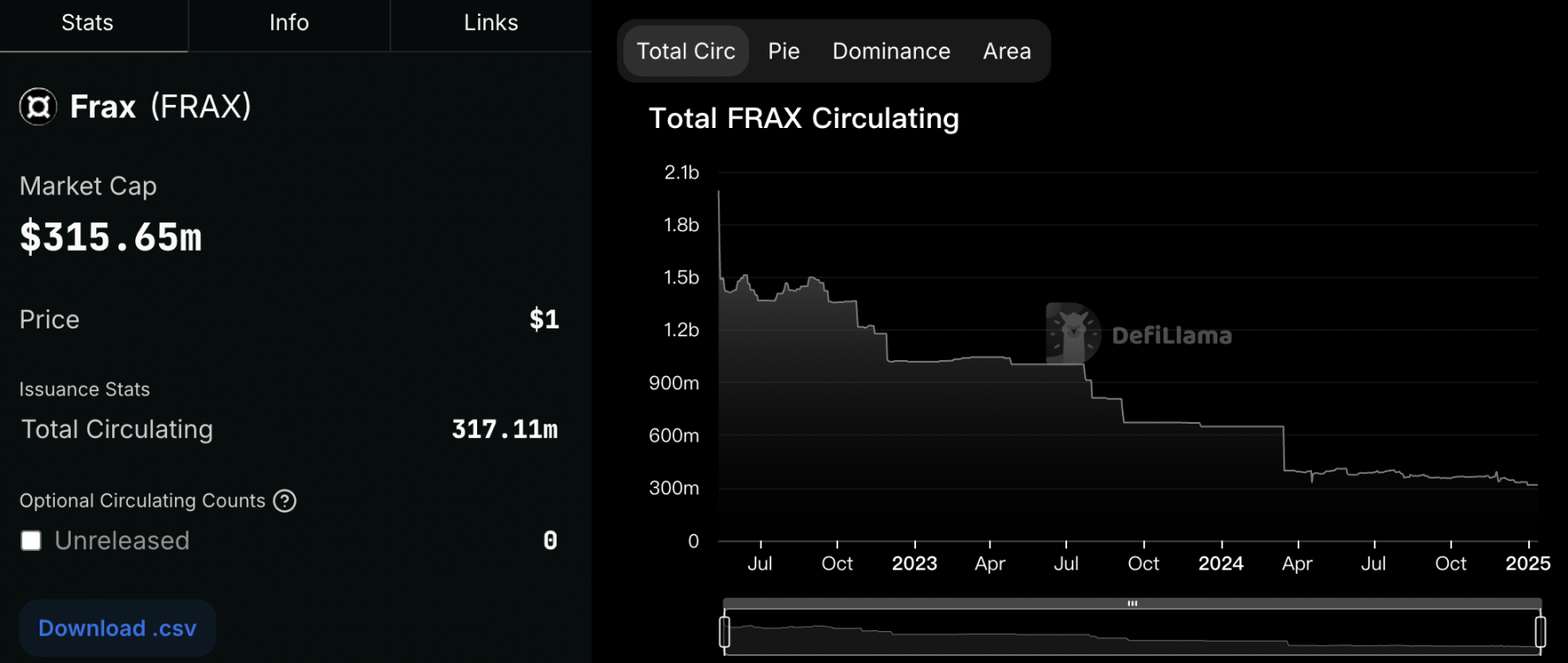

2.2.5 FRAX: Stablecoin issuance based on algorithmic rules

FRAX currently ranks 15th in the market value ranking of all stablecoins. The algorithmic mechanism of FRAX is also representative. However, since 2022, due to the vicious impact of the sudden collapse of UST (Terra LUNA), the leading project in the early stage of algorithmic stablecoins, which once occupied the third largest stablecoin position in market value, algorithmic stablecoins have been questioned, so the overall market value has shown a downward trend [13]. FRAX is a distinctive member in the field of stablecoins. It is the first stablecoin protocol to use a fractional algorithm and occupies a unique position in the stablecoin track.

Figure 14: FRAX

FRAX's core goal is to replace fixed-supply digital assets with a highly scalable, decentralized algorithmic currency that is pegged to the U.S. dollar and is committed to maintaining price stability. The way it achieves price stability relies mainly on two elements: collateral and algorithmic support.

2.2.5.1 Dynamic adjustment of mortgage rate

In terms of collateral, FRAX adopts a flexible collateral mechanism. Unlike traditional fully collateralized or uncollateralized stablecoins, FRAX's collateral ratio is dynamically adjusted according to market conditions. When the price of FRAX is higher than $1, the system will reduce the proportion of collateral and increase the role of the algorithm; conversely, when the price is lower than $1, the proportion of collateral will be increased to ensure that the price returns to $1. This dynamic adjustment mechanism enables FRAX to maintain a relatively stable price in different market environments.

2.2.5.2 Algorithm Design

From the perspective of algorithmic support, FRAX's algorithm is sophisticated and complex. It regulates the supply of FRAX in the market through a series of smart contracts and economic incentive mechanisms. For example, when the price of FRAX is higher than $1, users can cast collateral into FRAX through a specific mechanism, thereby increasing the supply of FRAX in the market and causing the price to fall; when the price is lower than $1, the system will incentivize users to destroy FRAX in exchange for collateral, reduce the supply, and push the price up. This algorithmic mechanism enables FRAX to automatically adjust the supply and demand relationship in a decentralized environment and maintain price stability.

2.2.5.3 Market Application

In terms of market applications, FRAX has gradually emerged in the fields of cryptocurrency trading and DeFi ecology. In cryptocurrency trading, it forms a trading pair with other cryptocurrencies, providing traders with a relatively stable trading medium and reducing trading risks and slippage. In the DeFi field, FRAX is widely used in scenarios such as lending and liquidity mining. Due to its unique mechanism and its peg to the US dollar, it has been favored by many DeFi projects and users.

2.2.5.4 Challenges and risks

FRAX also faces some challenges and risks. On the one hand, the complexity of its algorithmic mechanism may lead to instability in extreme market conditions. For example, panic selling in the market may cause algorithmic regulation failure (UST, the leading project token of algorithmic stablecoins, once represented algorithmic stablecoins. In May 2022, due to algorithmic design defects and market panic, it suffered a serious de-anchoring incident, and its market value plummeted, triggering a crisis of trust in algorithmic stablecoins in the market. This exposes the vulnerability of the algorithm under extreme market conditions. Once market confidence is frustrated, the algorithmic regulation mechanism may fail, leading to an avalanche of currency value). On the other hand, as the regulatory environment continues to change, FRAX, as a decentralized stablecoin, may need to constantly adapt to new compliance requirements to ensure its long-term stable development in the market. But overall, FRAX has occupied a place in the stablecoin market with its innovative fractional algorithm and stablecoin mechanism, providing a new idea and practical case for the development of stablecoins.

2.2.6 PAXG: Physical gold-collateralized stablecoin

PAXG is a unique stablecoin whose biggest feature is that it is backed by physical gold. Each PAXG is backed by one troy ounce of gold in a 400-ounce standard delivery gold bar certified by the London Bullion Market Association (LBMA) and stored in the Brink's vault. This makes PAXG fundamentally different from traditional stablecoins that are backed by fiat currency or crypto assets, and provides investors with a way to digitize gold and trade and circulate it on the blockchain. [14]

Figure 15: PAXG

2.2.6.1 Issuance and Redemption Mechanism

In terms of the issuance and redemption mechanism, Paxos, the issuer of PAXG, will mint a corresponding number of PAXG tokens based on the equivalent amount of US dollars deposited by users and the gold price at that time, and store the corresponding gold in the vault. When users want to redeem, they can return the PAXG tokens, and Paxos will return the equivalent amount of US dollars according to the gold price at the time of redemption, and take out the corresponding gold reserves from the vault. This mechanism ensures that PAXG is closely linked to the value of gold, providing a solid foundation for its value stability.

2.2.6.2 Advantages and convenience

PAXG has certain unique advantages in the market. First, it provides investors with a convenient gold investment channel without the need to actually hold and keep physical gold, reducing storage costs and security risks. At the same time, it uses blockchain technology to achieve 24/7 transactions and improve the liquidity of gold assets. Secondly, for investors who are interested in the cryptocurrency market but want to have physical assets as value support, PAXG is an ideal choice, combining the stability of gold with the convenience of cryptocurrency.

2.2.6.3 Current situation and challenges

PAXG also faces some challenges. On the one hand, its value is affected by the volatility of the gold market. Although gold is generally regarded as a safe-haven asset, in some special market conditions, the price of gold may also fluctuate greatly, thus affecting the price stability of PAXG. On the other hand, compared with other stablecoins, PAXG's market awareness and acceptance need to be improved, and its popularity in cryptocurrency trading and application scenarios is relatively low. However, with the increasing market demand for diversified asset allocation and the recognition of gold digitization, PAXG is expected to occupy a place in the stablecoin market and provide investors with a unique value storage and trading tool.

3. Application scenarios of stablecoins

3.1 Cryptocurrency Market Trading Application

3.1.1 Components of a cryptocurrency trading pair

In the field of cryptocurrency trading, stablecoins play an irreplaceable and key role. Their trading pairs with various cryptocurrencies have injected abundant liquidity into the market and greatly improved trading efficiency. Taking mainstream cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) as examples, their trading pairs with stablecoins such as USDT and USDC cover almost all well-known cryptocurrency exchanges. On many crypto platforms, users can easily use stablecoins as a medium to quickly buy and sell Bitcoin and Ethereum without worrying about excessive price fluctuations. The instant settlement feature of stablecoins significantly shortens the transaction confirmation time, making the transaction process as smooth as silk. The figure below shows the Gate.io trading interface and the specific application scenarios of various trading pairs of the stablecoin USDT. [15]

Figure 16: Application scenarios of various trading pairs of stablecoin USDT

3.1.2 Providing market liquidity

When there is an unexpected market situation, such as a sharp drop in the price of Bitcoin, investors can quickly convert Bitcoin into stablecoins, lock in the value of their assets, and trade again after the market stabilizes. The liquidity buffer function of stablecoins effectively smooths out large market fluctuations and provides investors with valuable decision-making time and operating space.

3.1.3 Arbitrage and risk hedging

Stablecoins also open up new paths for investors to arbitrage and hedge risks. With their keen insight into different cryptocurrency markets and exchanges, investors use stablecoins to capture fleeting arbitrage opportunities. If the price of Bitcoin to USDT on exchange A is slightly lower than that on exchange B, investors can buy Bitcoin on exchange A, convert it to stablecoins, and then sell it on exchange B to earn the difference. This arbitrage operation not only relies on investors' accurate judgment of the market, but also benefits from the universality and convenient transfer characteristics of stablecoins between different platforms.

In terms of risk hedging, the value stability advantage of stablecoins is fully demonstrated. When the overall crypto market is down, or a cryptocurrency faces a major negative news shock, investors can effectively avoid the risk of price plunges by converting their assets into stablecoins, and re-allocate assets when the market recovers. Stablecoins are like a safe haven in the crypto market, protecting investors' assets.

3.2 Cross-border payments and remittances

3.2.1 Comparison of advantages with traditional cross-border remittances

Compared with traditional bank cross-border remittances, stablecoins have significant advantages in the field of cross-border payments and remittances. Traditional cross-border remittances often face pain points such as high fees and slow remittance speeds. The average handling fee rate for international remittances can be around 7%, and it usually takes 2-5 working days for the funds to arrive. The long wait and high costs make users miserable.

Stablecoins rely on blockchain technology to break many of the constraints of the traditional financial system. The transfer fee can be as low as one percent of traditional remittances or even lower, and the funds can be received almost instantly. No matter where the user is in the world, cross-border fund transfers can be completed with just a few clicks of the mouse. For workers working overseas to send money to relatives in China, or for cross-border e-commerce companies to collect and pay for goods, the low-cost and high-efficiency characteristics of stablecoins have greatly improved the efficiency of capital circulation and reduced operating costs. [16]

Figure 17: Comparison of stablecoin and non-bank payment models

3.2.2 Practical application case analysis

In the remittance scenario of emerging markets, many Filipino workers working in Europe and the United States used to transfer money through banks, which not only incurred high handling fees, but also considerable exchange rate losses. Now, with the help of stablecoins, they can quickly remit their wages back to their home country at a very low cost, and their families can receive the money instantly through local exchange points or wallets that support stablecoins. Stablecoins have brought real convenience and benefits to these families.

In the field of cross-border e-commerce settlement, some small cross-border e-commerce sellers face the problem of long payment cycles and high fees in traditional payment channels. After the stablecoin settlement is adopted, the funds can be quickly received after the transaction is completed, and the sellers can replenish inventory and expand their business in time, which greatly improves the efficiency of capital turnover. For example, after a fashion cross-border e-commerce start-up company accessed stablecoin payment, the capital recovery time was shortened from one week to less than one day, and the operating cost was reduced by about 30%, providing strong support for the rapid development of the company.

In the field of cross-border payments, stablecoins are bringing more efficient and low-cost payment experiences to many companies and individuals with their unique advantages. The following are two typical cases:

Cryptocurrency payment platform BitPay: BitPay is a well-known cryptocurrency payment service provider that widely uses stablecoins in cross-border payments. Take a European electronic product manufacturer that has long-term cooperation with Asian suppliers as an example. Traditional bank transfer fees are high, and each payment requires dozens of dollars. In addition, due to the complicated bank clearing process, it takes 3-5 working days to arrive, which affects capital turnover and supply chain efficiency. After using BitPay's stablecoin payment, transactions do not require intermediary banks, and the handling fee is reduced to less than one-tenth of the traditional method. The confirmation time is shortened to a few minutes, and the funds are received in real time, so that companies can arrange production and procurement more flexibly.

Abra, a cross-border remittance platform: Abra focuses on cross-border remittances and reshapes the cross-border remittance landscape with the help of stablecoins. In some African countries, when overseas workers remit money to their home countries, traditional remittance institutions have high fees and opaque exchange rates, and remitters often suffer losses. After Abra introduced stablecoins, the remitter first converts the local currency into stablecoins, sends it to the recipient's account through the blockchain network, and then converts it into local currency. The handling fee is reduced by more than 50% compared to traditional institutions, and the value of stablecoins is stable, avoiding losses from exchange rate fluctuations, ensuring that the remittance is fully received, and improving user experience.

The application of stablecoins in cross-border payments is not smooth sailing, and regulatory compliance challenges are always present. Some countries have strict requirements on the legality, anti-money laundering and anti-terrorist financing of stablecoins, and are worried that they may be used for illegal fund transfers. In response to supervision, stablecoin project parties work closely with compliance service providers to strengthen processes such as user identity authentication and transaction monitoring to ensure that every transaction is legal, compliant and traceable. At the same time, they actively communicate with regulatory agencies in various countries to promote the clarification and improvement of regulatory policies and create a good environment for the long-term development of stablecoin cross-border payments.

3.3 Application in DeFi Ecosystem

3.3.1 Loans and Financial Management

In the booming DeFi ecosystem, stablecoins have become one of the core pillars, especially playing a pivotal role in the lending and financial management sectors. Taking well-known DeFi lending platforms such as MakerDAO, Compound, and AAVE as examples, stablecoins are both popular collateral and popular lending assets. [17]

Figure 18: Well-known DeFi lending platforms

On the MakerDAO platform, users can mint DAI stablecoins by staking crypto assets such as ETH. This process not only revitalizes the crypto assets in the hands of users, but also injects a large amount of DAI liquidity into the market. At the lending rate level, it is adjusted dynamically according to market supply and demand. When the market is tight on funds, the borrowing interest rate rises to attract capital supply; when funds are abundant, the interest rate goes down to stimulate lending demand. This market-based interest rate adjustment mechanism ensures efficient allocation of funds.

Interest-bearing stablecoins have opened up new income channels for users. Some projects have launched interest-bearing stablecoins, such as Compound's cUSDC. Users can get corresponding cUSDC after depositing USDC. The income comes from the platform's loan interest income distribution. The annualized rate of return fluctuates according to market conditions. In the peak season of capital demand, the rate of return can reach 10% or even higher, providing users with attractive passive income opportunities.

3.3.2 Decentralized Exchange (DEX) Trading Medium

In the field of decentralized exchanges (DEX), stablecoins are also an indispensable key element. Taking mainstream DEXs such as Uniswap and SushiSwap as examples, stablecoins, as a trading medium, have greatly promoted the exchange of various crypto assets. When users trade on Uniswap, they do not need to perform complex exchange operations with fiat currency like traditional exchanges. They can directly use stablecoins to quickly trade with other tokens.

The deep liquidity support of stablecoins has greatly reduced the transaction slippage on DEX and significantly saved transaction costs. Even during the peak trading period of the market, large orders can be traded with lower slippage, and the user trading experience is greatly optimized. For high-frequency traders, the instant settlement characteristics of stablecoins allow them to quickly capture market opportunities, flexibly adjust trading strategies, and seize opportunities in the ever-changing crypto market.

4. Competition landscape of stablecoins

4.1 Comparison of competitive advantages and disadvantages of different types of stablecoins

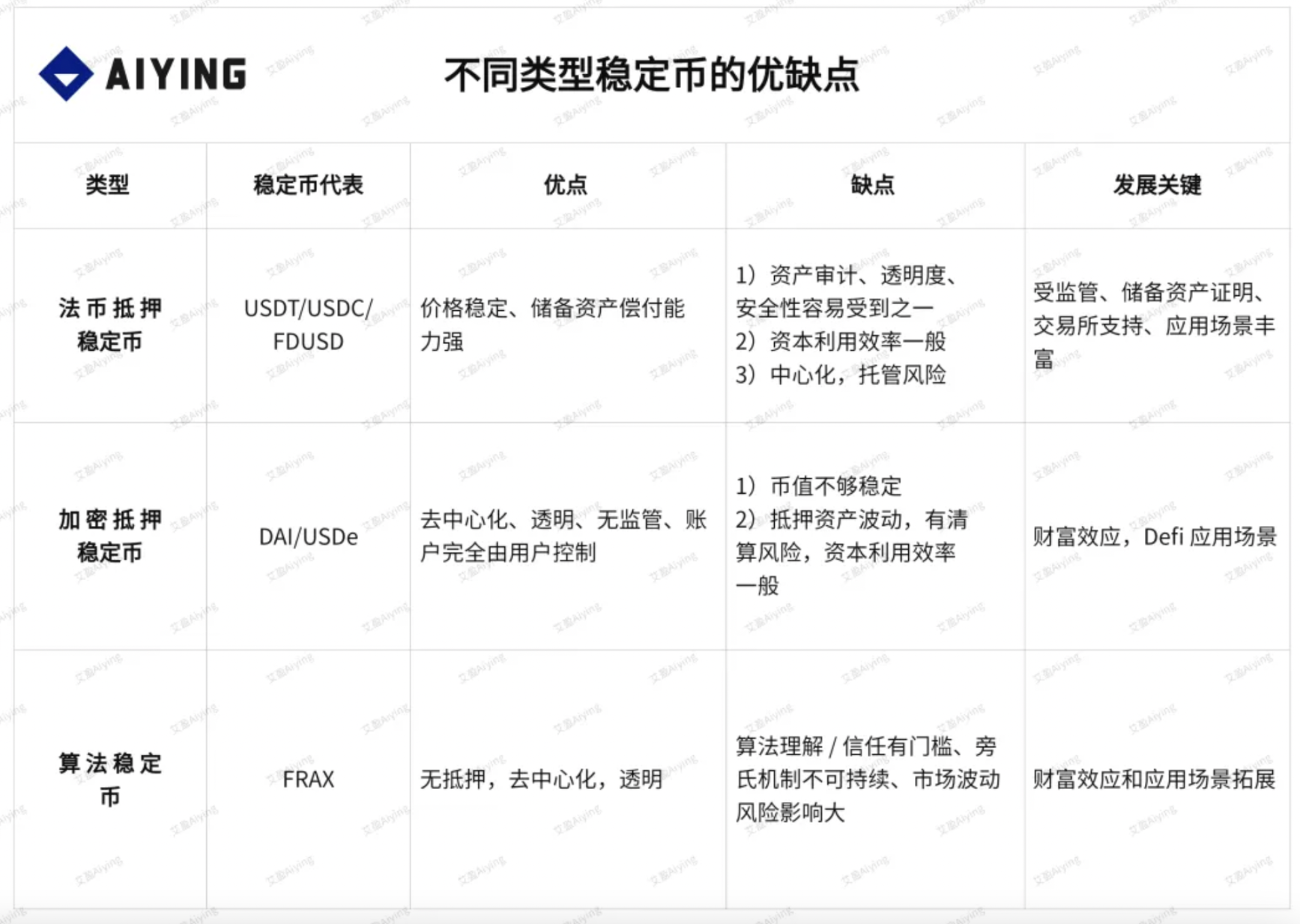

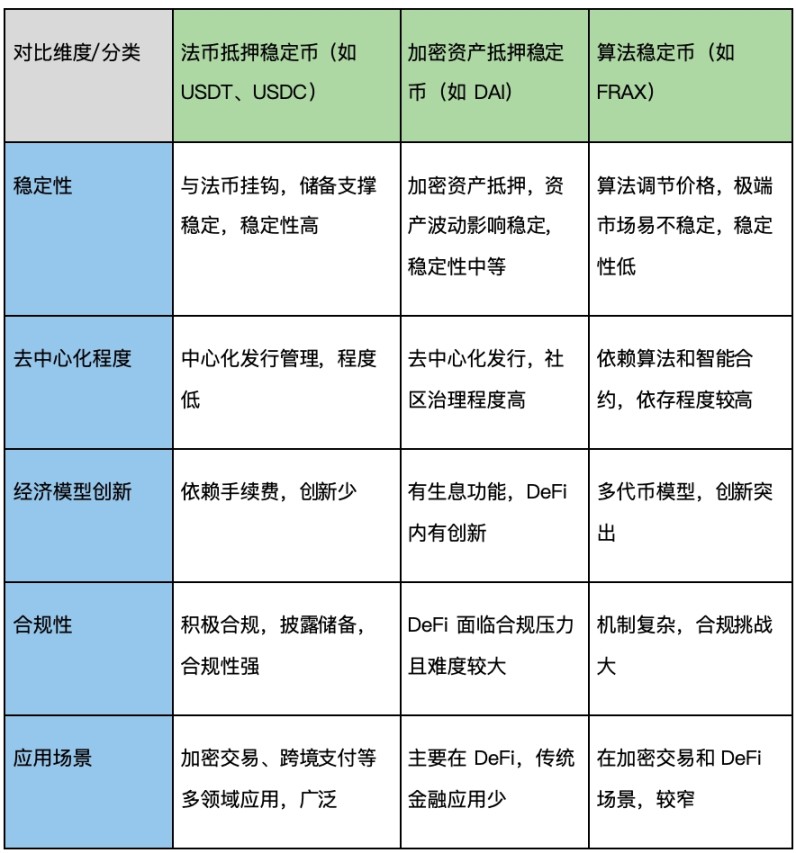

Figure 19: Comparison of competitive advantages and disadvantages of different types of stablecoins

AiYing, a one-stop compliance service provider for crypto institutions This chart shows the advantages, disadvantages and key development factors of different types of stablecoins, and clearly presents the core characteristics, advantages and disadvantages of fiat-collateralized stablecoins, crypto-collateralized stablecoins and algorithmic stablecoins [18], which can help us understand the stablecoin market landscape more clearly and intuitively. Different types of stablecoins differ significantly in their advantages, disadvantages and key development factors: although fiat-collateralized stablecoins have stable prices, they face transparency and custody risks; crypto-collateralized stablecoins have the advantage of decentralization but are plagued by currency fluctuations and liquidation risks; algorithmic stablecoins have outstanding innovations, but algorithm trust and sustainability issues have become obstacles to development.

These characteristics not only affect the performance of various stablecoins in the market, but also shape the competition landscape of the entire stablecoin track. In the current booming stablecoin market, different types of stablecoins compete with each other with their own advantages and disadvantages. Next, we will conduct an in-depth analysis from multiple key dimensions such as stability, degree of decentralization, economic model innovation, compliance, and application scenarios to further reveal their true face in market competition and clarify the position and future direction of various stablecoins in the competition landscape.

4.1.1 Stability

Fiat-collateralized stablecoins (such as USDT and USDC) rely on the strong credit endorsement of fiat currencies, are pegged 1:1 to mainstream fiat currencies such as the US dollar, and ensure currency stability through sufficient fiat currency reserves, and have outstanding performance in terms of stability. As long as the issuer strictly abides by the 1:1 collateral ratio, its value is basically equivalent to the pegged fiat currency, and is less affected by crypto market fluctuations.

Crypto-asset collateralized stablecoins (such as DAI) are issued by pledging crypto assets (such as ETH) and adopt an over-collateralization mechanism. Although this method guarantees stability to a certain extent, due to the large price fluctuations of crypto assets themselves, when the price of collateral assets drops sharply, it may trigger a liquidation mechanism and affect the stability of stablecoins. However, compared with algorithmic stablecoins, its stability is relatively high because it is supported by actual collateral assets.

Algorithmic stablecoins (such as FRAX) attempt to maintain the stability of the currency price by adjusting the supply and demand relationship through algorithms. However, from past experience, such as the collapse of UST, the vulnerability of algorithms under extreme market conditions has been exposed. Once market confidence is frustrated, the algorithmic adjustment mechanism may fail, leading to an avalanche of currency value, so it is relatively weak in terms of stability. Overall, in terms of stability, fiat-collateralized stablecoins > crypto-asset-collateralized stablecoins > algorithmic stablecoins.

4.1.2 Decentralization

Crypto-asset-collateralized stablecoins (such as DAI) are issued and managed by decentralized autonomous organizations. Users pledge crypto assets and use smart contracts to automate the minting process, fully releasing the liquidity of crypto assets. They are deeply embedded in each link of the DeFi ecosystem, giving users greater control over their assets. The community governance model also gives users more participation and decision-making power, and the degree of decentralization is relatively high.

Algorithmic stablecoins (such as FRAX) also rely on smart contracts and blockchain technology to achieve decentralized supply and demand regulation and issuance management, and adopt a hybrid model of mortgage + algorithm, trying to get rid of dependence on centralized institutions. To a certain extent, they also have a high degree of decentralization. However, due to the complexity of the algorithm and its dependence on market signals, its decentralized stability is still facing challenges.

Fiat-collateralized stablecoins (such as USDT and USDC) are issued and managed by centralized companies or institutions. Although the issuer will increase transparency through public audits, key links such as issuance decisions and reserve management are still controlled by centralized institutions. Compared with the former two, the degree of decentralization is lower. Therefore, in terms of decentralization, crypto-asset-collateralized stablecoins ≥ algorithmic stablecoins > fiat-collateralized stablecoins.

4.1.3 Economic Model Innovation

Algorithmic stablecoins (such as FRAX and Basis Cash) have performed outstandingly in economic model innovation. Some projects have introduced dual-token or multi-token models, dynamically adjusting the supply of stablecoins through the incentives and checks and balances of different tokens to achieve the goal of price stability, providing valuable experience for the practice of cryptoeconomic theory. This innovative design has brought new concepts and development directions to the market and is highly innovative.

Crypto-asset collateralized stablecoins (such as DAI) provide users with interest-bearing functions. On DeFi lending platforms such as Compound and Aave, users depositing stablecoins such as DAI can obtain annualized returns ranging from 3% to 10% based on market supply and demand dynamics, which is attractive in the traditional financial environment with low interest rates. At the same time, its in-depth application in the DeFi ecosystem also reflects certain economic model innovations, but compared with algorithmic stablecoins, it is slightly insufficient in terms of token mechanism innovation.

Fiat-collateralized stablecoins (such as USDT and USDC) mainly maintain value stability by being linked to fiat currencies. Their profit model is relatively traditional, and they mainly rely on minting and redemption fees to earn revenue. They are relatively conservative in terms of economic model innovation, and they focus more on compliance and application scenario expansion. Therefore, in terms of economic model innovation, algorithmic stablecoins > crypto-asset-collateralized stablecoins > fiat-collateralized stablecoins.

4.1.4 Compliance

Issuers of fiat-collateralized stablecoins (such as USDT and USDC), such as Circle and Tether, actively cooperate with regulators and follow strict anti-money laundering (AML) and know your customer (KYC) regulations to ensure that the source of funds is legal and transactions are transparent. For example, Circle regularly publishes independent audit reports that detail the matching of US dollar reserves and the number of USDC in circulation. It has a solid compliance foundation and has a great advantage in the connection between traditional finance and the crypto market.

Although crypto-asset collateralized stablecoins (such as DAI) rely on decentralized smart contracts to operate, they are also facing certain compliance pressures as regulators pay more attention to the crypto market. However, since they mainly operate within the DeFi ecosystem and are relatively independent of the traditional financial system, their compliance requirements and responses are different from those of fiat-collateralized stablecoins, and compliance is relatively difficult. However, in certain specific regulatory environments, they can also meet compliance requirements by adjusting their operating models.

Algorithmic stablecoins (such as FRAX) face great challenges in terms of compliance due to the complexity and innovation of their algorithmic mechanisms. Regulators have doubts about the reliability of their algorithms and their risk control capabilities. In the absence of clear regulatory policies, algorithmic stablecoin projects need to invest more energy in exploring compliance paths. Therefore, in terms of compliance, fiat-collateralized stablecoins > crypto-asset-collateralized stablecoins > algorithmic stablecoins.

4.1.5 Application Scenarios

With its high stability and wide market recognition, the fiat-collateralized stablecoin has become the preferred paired asset in cryptocurrency transactions, injecting ample liquidity into the market and greatly improving transaction efficiency. At the same time, it has also been widely used in areas closely related to traditional finance, such as cross-border payments and institutional fund custody. Its application scenarios cover both the crypto market and the traditional financial market, and its application range is the widest.

Crypto-asset collateralized stablecoins play a key role in the DeFi ecosystem, and are deeply embedded in various links such as lending, trading, and liquidity mining. For example, on the MakerDAO platform, users mint DAI by staking ETH, which activates crypto assets; on the decentralized exchange Uniswap, DAI, as an important trading medium, reduces transaction slippage and improves user trading experience. However, its application in the traditional financial field is relatively small, and its application scenarios are mainly concentrated in the DeFi ecosystem.

Algorithmic stablecoins are gradually emerging in cryptocurrency trading and DeFi ecosystems. For example, FRAX provides traders with a relatively stable trading medium in cryptocurrency trading, and is also used in DeFi scenarios such as lending and liquidity mining. However, due to its stability issues and market trust that needs to be improved, the expansion of application scenarios is relatively limited and the scope of application is relatively narrow. Therefore, in terms of the breadth of application scenarios, fiat-collateralized stablecoins > crypto-asset-collateralized stablecoins > algorithmic stablecoins.

4.1.6 Comparison Summary

Based on the above content and five major comparison dimensions including stability, degree of decentralization, economic model innovation, compliance and application scenarios, we have compiled a table as shown above.

4.2 Challenges and opportunities of emerging stablecoin projects

4.2.1 Case analysis of innovation mechanism (taking BenFen as an example)

As an emerging stablecoin project, BenFen breaks the traditional model with its innovative global collateral mechanism. The underlying blockchain is built based on the Move language, supports complex smart contracts, and has built-in stablecoins pegged to the US dollar, Japanese yen, euro, etc., expanding cross-border application scenarios. Its global collateral of more than 50% of BFC (the project's native token) ensures the stability of the exchange value between each stablecoin and BFC. At the same time, the on-chain automatic pledge market-making mechanism reduces dependence on centralized prices and liquidity, and improves system stability and decentralization. The following chart is the project popularization content officially released by BenFen on Phoenix Finance. [19]