Author: Ryan Watkins Translator: LlamaC

Main Text

In Q4 2024, Syncracy established a significant position in HYPE. In Q1 2025, as the Hyperliquid story accelerated beyond expectations, our conviction strengthened, and Syncracy further increased its position.

We believe Hyperliquid has a unique revenue engine, blending an exchange and a smart contract platform, which positions it to become the blockchain generating the highest fees in the crypto economy. Moreover, its vertically integrated design, unifying these two businesses through a single interface, gives Hyperliquid a structural advantage to more effectively aggregate users than any of its peers to date, in service of its ambition to host all the world's finance.

The exchange alone has the potential to disrupt Binance's position long-term, offering superior performance compared to decentralized peers and structural advantages over centralized exchanges in terms of cost, accessibility, auditability, composability, security, and asset availability. Meanwhile, its smart contract platform has the potential to become one of the leading application ecosystems, leveraging Hyperliquid's exchange and inherent trader base as a growth foundation.

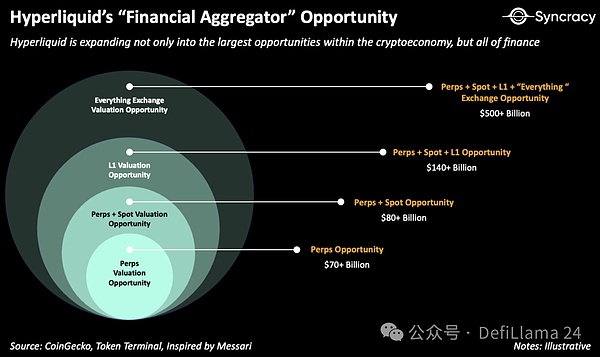

We estimate the combined market opportunity of its exchange and smart contract platform - what we call the "financial aggregator" opportunity - to be worth tens of billions of dollars in the coming years.

Now, let's share our thesis.

Note: Inspired by Frictionless Capital

The Art of Progressive Decentralization

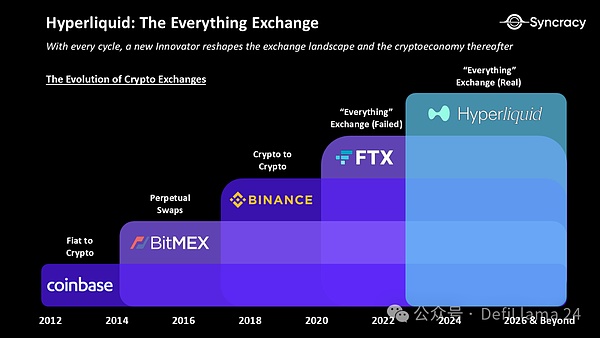

Trading has been one of the most tangible killer apps in the crypto economy to date, yet most trading still occurs in centralized venues. Could a decentralized exchange be built in the mold of Bitcoin's origins? This is the question that Hyperliquid co-founder Jeff Yan sought to answer when he set out to build a new exchange from the ashes of FTX in 2022.

After finding success in quantitative trading at Hudson River Trading, Jeff found himself in a comfortable position to take the entrepreneurial plunge, co-founding Hyperliquid with his Harvard classmate and co-founder Iliensinc. Notably, the team did not take any outside venture capital funding, opting instead to fully self-direct the entire project. This was a key decision that allowed the team to focus on building the product they believed in, free from external pressures, and ultimately allocating the majority of ownership to the community.

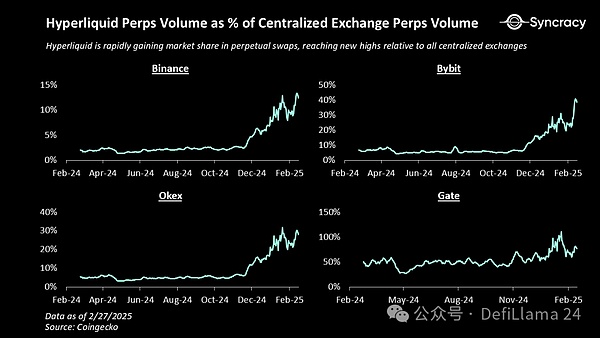

Two years later, Hyperliquid has become one of the fastest-growing projects in the crypto economy, capturing over 60% market share in the on-chain perpetual contract market. In the process, it has played a pivotal role in driving the shift to on-chain perpetual contract trading, which now accounts for 12% of global trading volume.

What has been the key to Hyperliquid's success?

It all starts with the team's product-first mindset. They did not prioritize ideological purity, such as pursuing maximum decentralization from the outset, but rather focused on delivering the best on-chain trading experience. This strategy is best understood as progressive decentralization - a pragmatic approach to building successful projects in crypto, involving the team first finding the product-market fit, then gradually ceding control over time.

The key insight they grasped is that while decentralization and open-source software are crucial for long-term reduction of counterparty risk and greater product scalability, most users prioritize performance and usability over strict adherence to cypherpunk principles. Thus, for two years prior to the HYPE token launch, the team relentlessly refined the platform through direct interaction with traders.

This feedback loop proved invaluable, as the Hyperliquid team was able to implement feature requests and bug fixes within hours, building deep trust within the community. It also drove the development of key product features, such as order cancellation priority for traders to enable tighter market making spreads, and the Hyperliquid Vault, allowing the exchange to rapidly onboard new trading pairs with liquidity. The result is a high-performance chain with an embedded order book (CLOB) capable of handling 100,000 transactions per second (tps) and sub-second finality - an order of magnitude performance improvement over peer products.

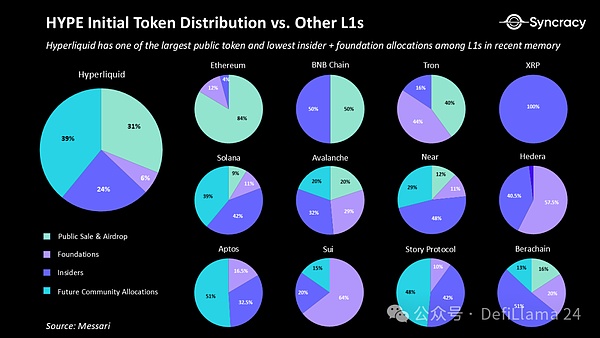

As trading volumes grew exponentially by the end of 2024, the Hyperliquid team executed their most ambitious move yet - airdropping 31% of the token supply to their user base. This airdrop was overwhelmingly successful, as Hyperliquid had already proven product-market fit - in stark contrast to most projects that go public with their tokens prematurely.

Crucially, the HYPE token also has clear intrinsic value, with the annualized fee rate at the time reaching $228 million. This not only provided recipients with a strong hold-rather-than-sell incentive, but also created powerful buy-side pressure for HYPE, as these fees drove large-scale buybacks. Moreover, with no pre-allocation to any insiders beyond the core team, the airdrop created a situation where any large buyer seeking exposure had to purchase on the open market. This was a strategic masterstroke, as it not only forced these participants to directly onboard to Hyperliquid, synergistically increasing trading volume, but also highlighted Hyperliquid's evolution beyond a simple derivatives exchange, starting with the spot market.

The All-in-One Exchange

Exchanges are winner-take-all markets, with liquidity network effects, scale efficiencies, brand value, and regulatory moats concentrating trading activity in the hands of a few dominant players. This model has shaped financial markets for centuries, entrenching the leadership of incumbents like CME in derivatives, the New York Stock Exchange and Nasdaq in equities, and Binance in centralized crypto. Yet, despite their scale, no exchange has ever been able to fully unify the liquidity of multiple asset classes on a single global ledger - a concept we call the "all-in-one" exchange.

Bridging this gap requires more than just dominating a single market - it requires infrastructure that can seamlessly integrate multiple asset classes, unify liquidity, and scale globally. This is where Hyperliquid's design differs from traditional exchanges, offering a vertically integrated system running on its own high-performance blockchain, while integrating the liquidity of both spot and derivatives markets.

Here is the English translation of the text, with the specified terms translated as instructed:Blockchain-based exchanges offer structural advantages in terms of auditability, efficiency, security, composability, and accessibility. Users do not need to entrust their assets to opaque centralized entities, but can self-custody their assets and use autonomous smart contracts as intermediaries to trade in a global, 24/7, near-instant settlement market.

These benefits are not just theoretical. They have already been driving the growth in on-chain trading volume. This trend can be observed not only in the data, but also reflected in the strategies of the two major exchanges - Binance and Coinbase - which have respectively launched their own blockchains - Binance Smart Chain (BSC) and Base - to get ahead of this transition.

Hyperliquid has recognized this opportunity and has taken the first step by expanding into the cryptocurrency spot market. This solution first allows users to deposit native assets of blockchains like BTC, ETH and Solana through a standardized interface onto Hyperliquid. This is pioneering for on-chain exchanges, as historically all exchanges have been either single-chain or only spot trading. Hyperliquid will become the only on-chain central limit order book exchange that offers both multi-chain spot and derivatives markets, replicating the experience of centralized exchanges on-chain for the first time.

Currently, Hyperliquid's spot market only supports two large-cap assets, HYPE and BTC, and it has already become a top 10 DEX globally by DEX trading volume and top 5 by chain. We expect that as it introduces the largest assets in the crypto economy for trading, it will quickly climb the rankings, and assuming spot trading volume reaches 30% of its perpetual contract trading volume (a typical proportion for exchanges serving both markets), it could generate nine-figure revenues in its first year after launch.

Hyperliquid should continue to outperform its centralized competitors by virtue of the following advantages:

Cost - Significantly lower trading fees and operating expenses compared to centralized exchanges like Binance

Accessibility - Easier for users to join due to its global, permissionless nature

Auditability - Easy to verify using the inherent public-key cryptography of blockchains

Composability - Facilitates third-party development on top of it (e.g. builder code)

Security - Self-custody, with increasing decentralization over time

Asset availability - Faster and more transparent asset listing process

Furthermore, these advantages position Hyperliquid to eventually expand beyond blockchain-native assets. As tokenization efforts accelerate, Hyperliquid's opportunity may encompass all global assets, including currencies, equities, bonds, commodities, real estate, and even specialized markets like sports betting and prediction markets. In fact, we believe this transition is almost inevitable. As wallets become ubiquitous, asset issuers will have increasing incentives to list on public blockchains to leverage a global investor base for broader distribution and the lowest cost of capital.

Taking a broader perspective, we estimate the current opportunity within the crypto economy to be over $140 billion. Furthermore, we estimate the opportunity beyond the crypto economy, encompassing all global asset classes and exchanges, to be at least $500 billion. This does not even include private exchanges, exotic assets, or large over-the-counter markets like foreign exchange. If those are included, the market opportunity easily reaches the trillions. Again, we believe blockchain-based exchanges have greatly expanded the opportunity for exchanges.

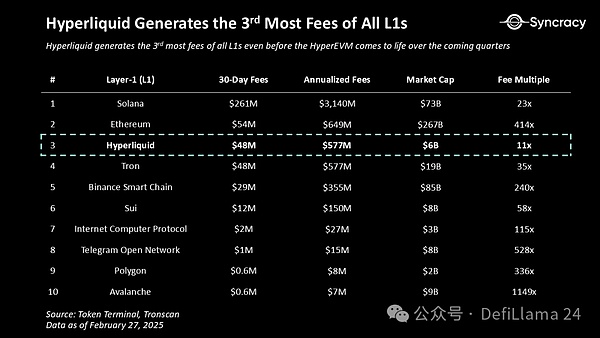

In its brief history, Hyperliquid has already achieved $577 million in annualized revenue solely from its perpetual contract exchange and early spot market. If any of the above forecasts come to fruition within the next 12-24 months, we expect revenues to grow exponentially, potentially catapulting Hyperliquid to the top of crypto's on-chain revenue (it is already #3).

The opportunity of the "exchange of everything" alone provides an exciting enough potential, with a total addressable market in the trillions of dollars. Is there perhaps even more to be excited about?

In the previous section, we mentioned that Binance and Coinbase have respectively launched BSC and Base. These two chains are separate entities from the exchanges, with independent equity structures and profit/loss statements. But what if, for example, Binance and BSC were to merge? What if you essentially combined the two most profitable businesses in crypto history: the exchange and the smart contract platform? And what if you further enabled access to both through a single interface? This is the opportunity that Hyperliquid is facing with the recent launch of its HyperEVM, a EVM-compatible virtual machine running in parallel with its order book exchange.

We believe that with its exchange as a killer app that directly owns the user order flow, Hyperliquid is well-positioned to become one of the earliest aggregators in the crypto economy. Essentially, by tightly integrating its interface, exchange, and smart contract platform into a cohesive experience, Hyperliquid can onboard users at scale and create unparalleled leverage over developers and asset issuers compared to its peers.

This is a big deal, because historically these three elements have been disparate in the crypto economy. For example, Base is Ethereum's most successful scaling solution, but it is largely decoupled from the broader Coinbase product suite, primarily accessed through third-party interfaces. Uniswap has vertically integrated the wallet, interface, order router, exchange, and scaling solution, but has inherited technical debt from Ethereum's modular roadmap. Solana is the most widely used blockchain in the crypto economy, but has outsourced the user experience to external developers like Pump and Jupiter, some of which have even forked and launched their own chains.

Here is the English translation of the text, with the specified terms preserved and not translated: Compared to others, Hyperliquid has integrated the entire technology stack, only partially modularizing its application and interface layers - this design choice creates potential strategic advantages. Unlike ecosystems that rely entirely on third-party applications and interfaces, Hyperliquid's self-hosted exchange is both an anchor and a distribution center, reinforcing its network effects. The exchange acts as a funnel top, allowing third-party developers to build applications and issue assets that can directly integrate with the Hyperliquid flagship interface that aggregates users. This creates a powerful feedback loop. The more users on the exchange, the greater the liquidity available to applications. The more liquidity available to applications, the more useful the applications become. The more useful the applications, the stickier the Hyperliquid ecosystem becomes, and the more valuable Hyperliquid becomes over time. Considering these factors, the shared state between the Hyperliquid exchange and HyperEVM may bring a series of synergies and product innovations, such as: - Advanced Collateral Management - A premium brokerage application that allows traders to easily maximize the capital efficiency of their collateral - for example, by lending out liquidity-staked HYPE through protocols like Aave, selling the interest through yield markets like Pendle, while using that position as collateral for derivative trades. - On-Chain Structured Products - An asset management application that leverages Hyperliquid's vaults and derivatives to create on-chain structured products akin to Ethena. - Social Trading - Social trading applications can expand their group trading strategies through Hyperliquid's vaults, or allow traders to automatically capture a portion of the copy trading fees by coding their own strategies. - Advanced Money Markets - A money market protocol that integrates Hyperliquid's derivatives exchange to hedge collateral risks, and uses spot trading for settlement, ultimately allowing it to offer borrowers higher loan-to-value (LTV). - Private Transactions - A privacy protocol similar to Tornado Cash, which can be implemented on the Hyperliquid exchange to enable anonymous order placement (dark pool trading). These examples are just the tip of the iceberg - the deep integration between Hyperliquid's trading interface, order book, and smart contract ecosystem provides fertile ground for a new wave of on-chain financial infrastructure. Hyperliquid has several important levers to guide the development of its ecosystem - a key competitive advantage in the increasingly saturated smart contract platform landscape. These levers revolve around its loyal user-owner community and its generous incentive treasury. - Existing Trading User Base - Unlike most emerging smart contract platforms, Hyperliquid already has a large and highly active user base. This solves the cold start problem faced by ecosystems outside of Ethereum, Solana, and Base, providing developers with an instant product market. - Incentive Treasury - At genesis, Hyperliquid allocated 39% of its supply (around $9 billion today) for community rewards and incentives, enabling it to kickstart a multi-year, multi-billion dollar program to attract users and developers. - Treasury Buybacks - Hyperliquid has announced that it will begin using its treasury to buy back ecosystem tokens, to spur on-chain activity and support its community. Developers in the HyperEVM ecosystem are keenly aware of these advantages and have tailored their market entry strategies accordingly. Many have been inspired by Jeff and are highly aligned with HYPE holders, which may lead to many developers airdropping their token supplies to Hyperliquid users and HYPE stakers. This dynamic can be analogized to Binance's launchpad - one of the biggest demand drivers for BNB (second only to its exchange revenues), even today, despite BSC being nearly dead, BNB still has a $90 billion valuation. Furthermore, some projects have committed to allocating a portion of their funds to HYPE, which may create additional demand for HYPE as they grow their revenues. This could be important in developing the narrative of HYPE as a quasi-sovereign store of value, akin to ETH and SOL, which are also reserve assets of their ecosystems. As HYPE's adoption scales on HyperEVM, its role as a fuel, collateral, and quote currency will further this narrative, potentially earning HYPE a valuation far exceeding what MEV and execution fees alone could justify. This will cement its status as a core asset in the crypto economy, alongside BTC, ETH, and SOL. Hyperfunctionalization Entering the exchange or smart contract platform markets has become increasingly challenging over time. Both are network-effect driven businesses, dominated by entrenched global leaders, and may gradually consolidate into power-law market structures. Competing in these domains, without a unique and compelling value proposition, is not just difficult - it's foolish. We believe Hyperliquid is one of those rare new entrants that can meaningfully impact both of these markets. Its vertically integrated design, combined with a product-first ethos, has made it one of the fastest-growing projects in crypto history. More importantly, Hyperliquid has a unique revenue engine, poised to become the highest-earning blockchain globally by simultaneously capturing exchange and smart contract platform fees - an advantage that no other smart contract platform or exchange can claim. Of course, this argument is not without risks. Beyond the inherent execution risks of any early-stage startup, there are risks associated with: - Centralization - Hyperliquid may be unable to globally distribute its validator cluster, currently composed of 16 co-located servers in Tokyo, without compromising performance; additionally, its lack of decentralization may introduce regulatory risks. - Developer Ecosystem Building - Hyperliquid has been primarily developed by the core team, with little external contribution; as much of the codebase remains closed-source, and HyperEVM is still in its early stages, it may require long-term effort to build a robust ecosystem of third-party contributors.Here is the English translation:Protocol Solidification - Whether it is reasonable to solidify all the underlying infrastructure required for a running order book exchange on-chain is an open question, especially when it comes to perpetual swap products. Such products require an insurance fund owned by the protocol to prevent insolvency - a risk that Ethereum and Solana do not undertake, as they outsource solvency risk to third-party exchanges built on their platforms

Bridge Hacking - If Hyperliquid is unable to convincingly decentralize its bridge infrastructure, its spot market may be compromised; additionally, the lack of native stablecoin support will introduce unnecessary counterparty risk

Business Cyclicality - Exchanges are cyclical businesses, and a decline in interest in asset classes will lead to reduced trading volume and fee income

Despite these risks, Hyperliquid's track record speaks for itself. The team has demonstrated world-class execution time and time again, with no signs of slowing down. Given that Hyperliquid is still in the early stages of its lifecycle, this may be the most important factor.

Founders operating at this level are hard to come by. Rarer still are those building in the two largest crypto markets simultaneously. Our experience tells us that when faced with an opportunity of this scale, it is worth betting big and betting boldly.

The crypto economy is evolving from its old guard of ideological dreamers to a new generation of commercially-minded builders who will bring blockchain to the masses.

The boundaries between financial markets are dissolving, coalescing into a single, composable, hyper-liquid financial system. Over time, the old financial world composed of siloed ledgers, intermediaries, and clearinghouses will give way to a unified, real-time, programmable economic ecosystem.

We are excited to back Hyperliquid as it marches towards this vision. The path to Hyperfinance is unfolding.