The cryptocurrency trading platform Hyperliquid (HYPE) is under investigation. Several high-leverage trades in Bitcoin (BTC) and Ethereum (ETH) have raised the possibility of money laundering activities.

Analysts have noted a pattern of abnormally large and frequent leverage trades executed with near-perfect timing. This has raised questions about the source of the funds and the identity of the traders.

Spotchain Identifies High-Risk Trades

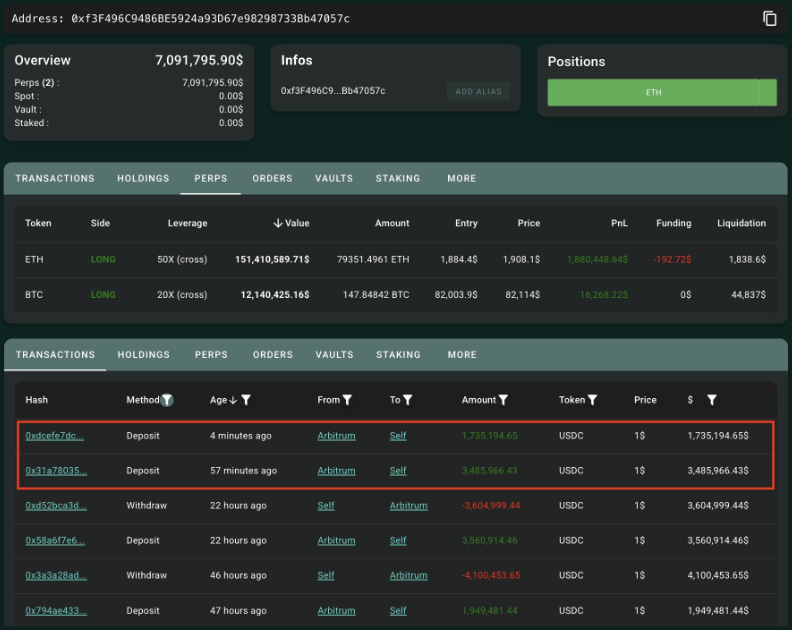

Blockchain analysis platform Spotchain reported on a series of significant leverage trades executed on the Hyperliquid platform. According to the analysis, a well-capitalized trader deposited $5.22 million on the platform to open highly leveraged long positions in BTC and Ethereum.

This trader set up a 50x leveraged long position on ETH with an entry price of $1,884.4 and a liquidation price of $1,838.2. They also opened a 20x leveraged long position on BTC, entering at $82,003.9 and setting a liquidation price of $61,182.

Spotchain also revealed that this trader has a history of executing short-term leveraged trades with a 100% win rate. They reportedly made $2.2 million in profits within just two days.

Spotchain said, "Over the past two days, this whale has quickly liquidated two Ethereum long positions with a 100% win rate, making $2.2 million in profits."

The consistency of these trades has led to speculation that this activity is not random market speculation, but rather a sophisticated money laundering operation or insider trading scheme.

Cryptocurrency market analyst AB Quai Dong speculated that the funds used in these Hyperliquid trades may be associated with North Korean hackers. The analyst noted that North Korean cybercriminals are known to test high-frequency trading strategies on cryptocurrency platforms as part of money laundering efforts.

The analyst suggested that this could be an attempt to launder illicit funds obtained through hacking, based on the anonymity and fast execution speeds of Hyperliquid trades.

"I'm very curious about the large anonymous orders on Hyperliquid. Given the previous news about North Korean hackers testing Hyperliquid, could these frequent, large 50x orders all be grey market funds for money laundering?" the analyst raised the question.

Another analyst known as Ai on X backed up this hypothesis by pointing to previous research on high-leverage profits on Hyperliquid. In early March, Ai reported that three addresses had generated $2.53 million in profits through high-leverage trades on GMX.

Gambling or Insider Trading? Experts Weigh In

These addresses were linked to gambling platforms like Roobet and Alphapo, as well as the preferred exchange of hackers, ChangeNow. Ai speculated that these traders were likely professional gamblers using stolen funds for high-risk trades, rather than insiders.

"Insider or the best gambler? Closer to the latter, actually," the analyst said.

Cryptocurrency analyst Adolyb, citing research from Coinbase's Conor Grogan, presented additional evidence of potential illicit activity.

"Coinbase employees found that this address is a phishing address with a 4-layer jump + gambling players," Adolyb said.

According to Grogan, some of the suspicious hyper-liquid trades were conducted through cryptocurrency wallets that had received funds from phishing attacks. He described this account as the "Roobet whale," suggesting the trader had a history of high-stakes gambling on platforms associated with illicit fund flows.

Grogan noted that this individual had previously liquidated long positions just before important market events, indicating that their trades were not based on insider knowledge, but rather the use of stolen funds for gambling.

This report has reignited concerns about the use of high-leverage trading platforms for illicit financial activities. Leverage allows traders to amplify their positions, but it also enables criminals to quickly move and obscure large sums of money.

The anonymity provided by decentralized and offshore exchanges further complicates efforts to track and regulate such activities. Regulatory authorities and blockchain forensics firms are likely to intensify investigations into similar activities, as more evidence emerges linking Hyperliquid's high-leverage trades to potentially illicit origins.

According to BeinCrypto data, the price of the Hyperliquid token has dropped nearly 8% since the start of the Wednesday session. At the time of writing, HYPE is trading at $ 13.35.