Followin' must be translated into 'Followin'.

Following the content released by the JuCoin Labs Crypto Research Institute:

On March 7, U.S. President Trump signed an executive order to establish a Bitcoin strategic reserve. The reserve is allocated from the seized Bitcoin, and the government will not make additional purchases. In addition, the U.S. prohibits the sale of the currently held 198,109 BTC, and Bitcoin will be used as a means of value storage. It is worth noting that the $ETH, $SOL, $XRP and $ADA mentioned earlier by Trump are not included in the strategic reserve.

After the announcement of the Bitcoin strategic reserve, the market believes that this is merely the storage of Bitcoin and there is no additional inflow of funds, so the market performance is very negative. BTC fell below $86,000, and Coinglass data shows that Bitcoin whales are still maintaining a reduction strategy, and the total BTC held by whales has dropped to the lowest level since 2019. However, the recent World Liberty Fi project has been continuously increasing its holdings, and the top five projects in the current World Liberty Fi holdings, apart from the stablecoins USDT and USDC, are ETH, BTC, TRX, MOVE, and ONDO.

From the on-chain data, the token holdings of World Liberty Fi, apart from the relatively stable ETH, BTC, and TRX, the proportions of other token holdings are also constantly changing, among which MOVE is a project that has been recently increased.

1. $MOVE

$MOVE is one of the projects that World Liberty Fi has recently increased its holdings in. The core team members of $MOVE mainly come from Biconomy, Sui/Mysten Labs, Fluid Finance, etc. They have a deep blockchain technology background and industry insight. The original intention of $MOVE is to promote the Move language developed by Facebook (now Meta) in the Libra/Diem project as the standard for blockchain smart contracts, and to build a secure, efficient, and highly scalable blockchain infrastructure.

In terms of token distribution, the ecosystem and community distribution accounts for 40%, mainly for incentives, liquidity, and ecosystem funds; the initial debt distribution accounts for 10%, mainly for airdrops and rewards; the foundation distribution accounts for 10%, mainly for project development and governance; the early contributors distribution accounts for 17.5%, mainly for the development team, marketing, and operations; the early supporters distribution accounts for 22.5%, mainly for investors and strategic cooperation. In terms of token functions, $MOVE is mainly used for staking, gas fees, governance, and liquidity support.

Recently, $MOVE has also held an AI hackathon event, and continues to support its ecosystem projects in the fields of DeFAI, social, consumption, and security. According to Movement Explorer data, the total transaction volume so far is 104,744. It should be noted that the $MOVE mainnet is not yet fully mature, and the actual DeFi transaction capacity remains to be verified.

The $MOVE token was launched in September 2024, with a historical high price of $1.45 and a current price of $0.49, a 65.8% drop from the high. The current number of $MOVE token holders is 17,608, and the market capitalization is $1.18 billion.

✅ Comprehensive rating: B+ (great development potential)

2. $ONDO

$ONDO is a project that World Liberty Fi has been holding. The founder of $ONDO, Pinku Surana, was previously the vice president of Aave, and the other team members come from financial institutions on Wall Street such as BlackRock and JPMorgan Chase, with rich experience in financial markets, as well as blockchain technology developers. $ONDO is also a leading project in the field of real-world assets (RWA). It has received investment from well-known venture capitalists such as Polychain Capital, Pantera Capital, and Coinbase Ventures.

The main assets of $ONDO include OUSD (Ondo USD), which is a yield-stable coin based on U.S. Treasuries with an annualized yield of about 4-5%; OTB (Ondo Treasury Bill), which is a token mainly used for direct investment in short-term U.S. Treasuries, providing transparent yields; and OFM (Ondo Fund Management), which is a fund management product that allows institutional investors to invest in high-quality bond funds in global markets.

In terms of token distribution, the total supply of $ONDO tokens is 1 billion, with 45% allocated to the ecosystem and community, 25% to the team and advisors, 20% to investors, and 10% to the treasury reserve. The initial circulating supply is 22%, and the remaining tokens will be gradually released through a linear unlocking mechanism. In terms of token functions, $ONDO is mainly used for governance, yield distribution, and ecosystem development.

Recently, $ONDO has launched the Ondo Chain, which is a Layer 1 blockchain built specifically for institutional-grade RWA, further driving the development of the ecosystem. The Ondo ecosystem has established partnerships with leading companies such as BlackRock, PayPal, and Morgan Stanley. The total TVL of the Ondo ecosystem exceeds $250 million, mainly in the form of tokenized U.S. Treasuries and money market funds.

The $ONDO token was launched in February 2024, with a historical high price of $2.14 and a current price of $0.96, a 54.8% drop from the high. Currently, the number of $ONDO token holders is 118,532, and the market capitalization is $3.05 billion.

✅ Comprehensive rating: A (great long-term growth potential, suitable for conservative DeFi investors)

3. $AAVE

$AAVE is a project previously held by World Liberty Fi and is a leading project in the DeFi lending sector. On March 4, $AAVE launched a buyback proposal, which also includes revenue redistribution mechanisms, $AAVE token buyback and distribution plans, Umbrella security mechanisms, and the retirement of LEND tokens. The community believes that the new $AAVE buyback proposal will reshape the token economic model of $AAVE and may trigger DeFi dividends.

The $AAVE team members have a strong development background, and its founder Stani Kulechov has rich experience in finance and technology, and has received investments from well-known venture capitalists such as Blockchain Capital, ParaFi Capital, and Three Arrows Capital. The total supply of $AAVE tokens is 16 million, which have been fully issued with no additional issuance. The main functions of $AAVE tokens are governance tokens, fee discounts, staking, and yield.

Data shows that the current TVL of AAVE V3 is about $8.5 billion, the TVL of AAVE V2 is about $2.2 billion, and the total TVL of $AAVE exceeds $10.7 billion, making it one of the largest lending protocols in the DeFi field. As of the time of writing, the total deposits of $AAVE are about $5.5 billion, the total borrowings are about $4 billion, and the number of user addresses exceeds 1.5 million. Currently, $AAVE has integrated with SonicLabs, and the TVL has reached $1 million per hour since its launch.

The $AAVE token was launched in January 2020, with a historical high price of $666 and a current price of $191, a 71.3% drop from the high. Currently, the number of $AAVE token holders exceeds 182,534, mainly concentrated on the Ethereum chain, and the current market capitalization is $2.9 billion.

✅ Comprehensive rating: A+ (long-term stable growth, core asset in the DeFi sector)

4. $SUI

$SUI is developed by Mysten Labs, and the core team members are mostly from Facebook (Meta). The team has a strong technical background and has been deeply involved in distributed computing and programming language security, making Sui one of the most prominent Layer 1 blockchains in the Move ecosystem.

The total supply of $SUI tokens is 10 billion, with an initial circulating supply of about 1.3 billion. In terms of token distribution, 50% is allocated to the token community and ecosystem incentives, 20% to investors, 20% to the Mysten Labs team, and 10% to the Sui Foundation. In terms of token functions, they mainly include transaction fees, staking, governance, and storage funds.

According to suiexplorer data, the current TVL of $SUI is about $650 million, the total number of transactions exceeds 1 billion, the number of active wallets is about 1.2 million, and the number of on-chain DApps exceeds 300+, covering areas such as DeFi, NFT, and GameFi. In addition, the number of Sui mainnet nodes exceeds 140+ active validator nodes, and the Sui Staking fund exceeds $1.4 billion. On March 6, World Liberty Fi will include SUI in its strategic token reserve and begin more exploration.

The $SUI token was launched in January 2020, with a historical high price of $5.35 and a current price of $2.6, a 51.28% drop from the high. Currently, there are 703,800 $SUI token holders, and the market capitalization is $8.25 billion.

✅ Overall rating: A- (great growth potential, focus on ecosystem expansion)

5. $ENA

$ENA is based on ETH and is committed to creating a crypto-native, yield-bearing stablecoin called USDe, aiming to drive the integration of DeFi, CeFi, and TradFi. The founder of $ENA previously worked at a $60 billion hedge fund, with rich investment experience in areas such as credit, private equity, and real estate. Other team members come from well-known institutions like Cerberus, AAVE, Blockdaemon, and Kaiko.

The core product of $ENA is the synthetic US dollar stablecoin USDe, which features yield-bearing assets, transparency, decentralization, and independence from the traditional banking system. Its token economic model is primarily based on a collateralization mechanism, where each USDe is backed by an equivalent amount of ETH as collateral, using a combination of spot long ETH and futures short ETH to hedge ETH price fluctuations. The main sources of revenue are spot long staking yields and futures short funding rates.

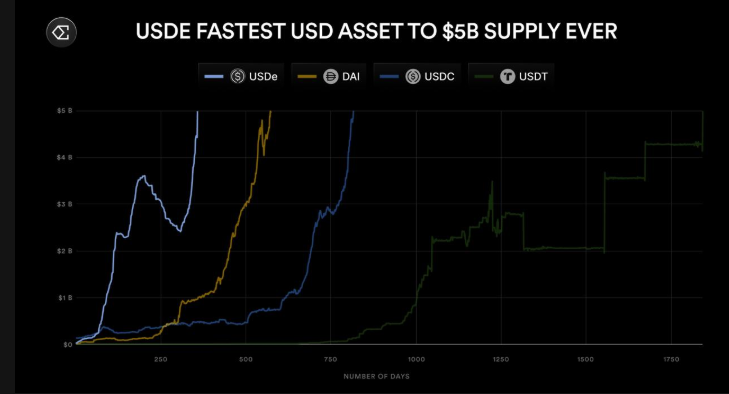

In terms of token distribution, the total supply of $ENA is 15 billion, with an initial circulating supply of 1.425 billion. The token allocation is 15% for the foundation, 25% for investors, 30% for the ecosystem fund, and 30% for core contributors. Currently, the USDe supply is around $6 billion, with over 350,000 users, and the annualized yield on USDe is 67.2%, with a daily revenue of over $6.8 million. $ENA is projected to have 85% on-chain asset growth by 2024, second only to USDT and USDC.

The $ENA token was launched in April 2024, with a historical high price of $1.52 and a current price of $0.44, a 70.79% drop from the high. Currently, there are 59,837 $ENA token holders, and the market capitalization is $1.42 billion.

✅ Overall rating: B- (innovative stablecoin, Ethereum-based synthetic USD protocol)

Note: The above content is for information sharing only and not investment advice. DYOR.