Here is the English translation of the text, with the specified terms retained and not translated:

The Editor's Note: The author discusses the poor public image of cryptocurrencies due to fraud, speculation, and negative media coverage, analyzing their low trust among the general public, and points out that although their original intention was to revolutionize the financial system, meme coins and the short-term profit-seeking culture have obscured this vision. The author proposes measures such as self-regulation of bad actors, emphasizing utility over speculation, and reshaping the narratives of Bitcoin and Ethereum, to improve the perception of cryptocurrencies and ultimately achieve a more open and fair ecosystem.

The text below is the original content (edited for easier reading understanding):

Cryptocurrencies were meant to be revolutionary, but they are seen as a scam. Can we fix this?

Surprisingly, cryptocurrencies have such a small impact on the lives of those outside our crypto community. Unless you actively try to engage with cryptocurrencies, you can almost completely avoid them in your daily life.

However, the problem is that when this "minimal contact with cryptocurrencies" does affect people, it is almost always negative. You watch "Squid Game" on Netflix, and a crypto influencer who scammed fans appears. He is inseparable from crypto prices, demanding his phone back. In this regard, I can relate.

When you browse the news, you see the following (almost always negative) headlines:

· North Korea steals $1.5 billion, completing the largest hacking case in history

· "A mockery": Trump's new meme coin sparks outrage in the crypto world

· Man charged for woman's £154,000 loss in Bitcoin scam

· Crypto trader commits suicide during live stream

Fraud, scams, pump and dumps. You name it, it's there. The public image of cryptocurrencies is abysmal. To be fair, even we crypto natives know that cryptocurrencies are full of garbage.

But we also know why we are here: to get rich by revolutionizing the outdated financial system. Yes, the desire for quick wealth is often the reason we are disliked, but I cannot deny that it is a fact. Everyone who invests in anything wants to make money.

However, cryptocurrencies are one of the few industries where it is still possible to build wealth from scratch. In today's economy, it is very challenging to achieve wealth slowly through a middle-class salary. The Gen Z generation, realizing this, is quietly opting out of the job market.

If only they knew what cryptocurrencies could do for their lives...

However, I believe cryptocurrencies have done a very poor job of emphasizing our mission, why we need cryptocurrencies, and why getting rich through cryptocurrencies is not evil. Here is a popular comment on the Financial Times, summarizing the views of crypto skeptics:

If you read Reddit, you'll know how much the general public hates cryptocurrencies, but I want to see more positive crypto imagery in the mainstream media. To be fair, the Financial Times has been skeptical of cryptocurrencies, but Bloomberg's coverage has improved over the years, providing great insights. Interestingly, in an seemingly innocuous Bloomberg article "Meet the 7 Top Personal Finance Influencers in America," a crypto influencer was mentioned. He mainly focuses on meme coins and promotes his meme coin Telegram group, so while I'm glad Bloomberg wants to incorporate crypto elements, I'm surprised they featured @cryptomasun.

People Really Hate Cryptocurrencies

Since this is still a "research" blog, here are some noteworthy research data on crypto sentiment. Many surveys show that non-investors view cryptocurrencies as high-risk speculation, not legitimate finance. In the UK, 64% of surveyed consumers who are aware of cryptocurrencies believe that "investing in cryptocurrencies is essentially gambling."

A 2024 Pew survey found that 75% of Americans do not trust their reliability and security due to fraud and market volatility.

In the 2023 Edelman global survey, cryptocurrencies are distrusted across all age groups, with trust levels even lower than the banks we are trying to revolutionize.

Of course, the FTX debacle in 2023 damaged the reputation of cryptocurrencies, but this year's meme coins haven't helped either.

The excellent ConsenSys annual research report shows the decline of the "future of money" crypto narrative. Sentiments of speculation, fraud, phishing, crime, and money laundering are as prevalent with cryptocurrencies as "alternatives to traditional finance."

The message is clear: outside the crypto community, there is widespread skepticism about whether digital assets can be trusted as a secure financial tool.

As I was writing this blog, I saw the following tweet that nicely summarizes the public sentiment towards cryptocurrencies:

Why Crypto Culture Matters

Our public image may seem unimportant, as the general public "just doesn't understand." They are afraid of being rescued from the 9-to-5, influenced by the mainstream media's anti-crypto propaganda.

Nevertheless, perceptions are changing, with more people willing to buy cryptocurrencies than ever before. I believe that the evolving crypto perceptions can add millions of new members to our community.

I believe we can and should do better. We need to make people believe in the vision and mission of cryptocurrencies.

Cryptocurrencies envisioned a decentralized financial system where individuals have full control over their assets, unencumbered by intermediaries like banks or governments. It aims to create a borderless, censorship-resistant, trust-minimized ecosystem where anyone can transact, store value, and build economic systems without relying on centralized authorities.

Our vision is being drowned out by the noise of meme coins and speculation.

Worse, the public no longer sees cryptocurrencies as a revolutionary way to improve the financial system. As stated: "The Bitcoin ecosystem has become just like everything you despise." Wealth and power are concentrated in the hands of a few, extracting wealth from the economically desperate.

Furthermore, due to Trump's public endorsement, people now associate cryptocurrencies with the MAGA movement, which is unpopular outside its circle. Unsurprisingly, the EU sees Trump's support for cryptocurrencies as a threat to European monetary sovereignty.

Make no mistake - the regulatory pause under the previous US administration was bullish. However, the crypto industry is walking on thin ice under the current Trump government.

How to Change the Perception of Cryptocurrencies

The reputation of cryptocurrencies will not fix itself. If we want mainstream adoption, we need to reshape the narrative.

Easier said than done, but it must start from within: even crypto natives have lost hope in cryptocurrencies.

I believe we need to focus on three key points:

1. Make Cryptocurrencies Great Again

In previous cycles, new crypto entrants could make money. However, meme coins have been distorted and exploited by small groups and venture capital-backed low-liquidity, high FDV projects, leaving no upside for newcomers.

This cycle, we've managed to resist low-liquidity, high FDV, but have fallen into the trap of meme coin cliques.

Here is the English translation of the text, with the specified terms retained:

Legion and Echo have made progress by adopting a more equitable financing model, but they are still too exclusive. We need to create and promote games that create value rather than destroy it, so that early entrants can all benefit. Kyle provides a detailed plan in "First Principles" on how to emerge stronger from market chaos.

However, due to extreme short-termism, a culture of maximum extraction, and low-integrity individuals, we have fallen into a self-perpetuating cycle of financial nihilism. When everyone thinks "I can get out before he scams" is a good idea, the collective decision is to continue blindly investing in random scammers' coins.

We need to self-regulate bad actors. The industry must do more work to expose scams and hold influencers accountable for their misleading promotions. ZachXBT has done this, but the level of criminality has spiraled out of control, and even he has ultimately dumped the meme coins given to him.

I also need to do better in this regard, staying away from value extraction activities. People need to actually make money while expanding the crypto pie. Now, newcomers are ultimately financially devastated. Or worse.

2. Shift the narrative from speculation to utility

Cryptocurrencies are not just gambling - they provide real-world benefits. We need to focus on use cases like remittances, financial inclusion, and transparent governance, rather than meme coin culture.

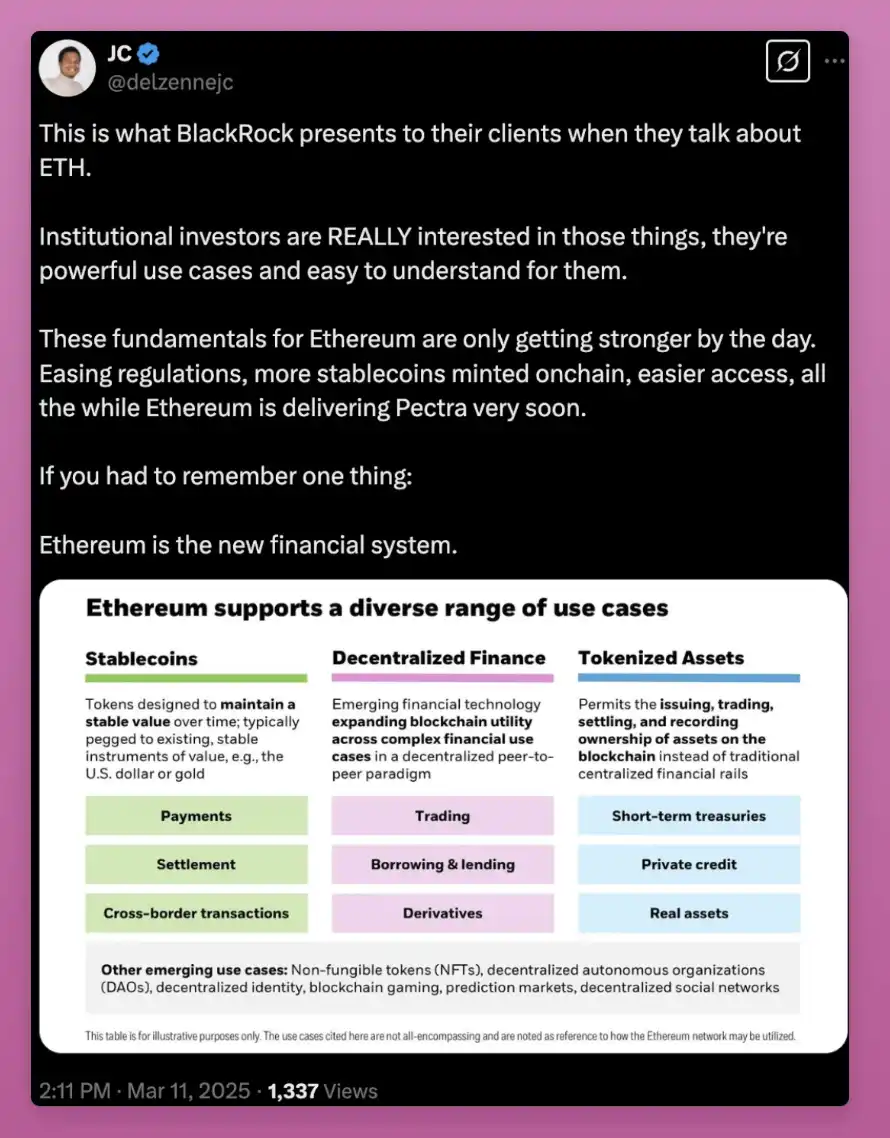

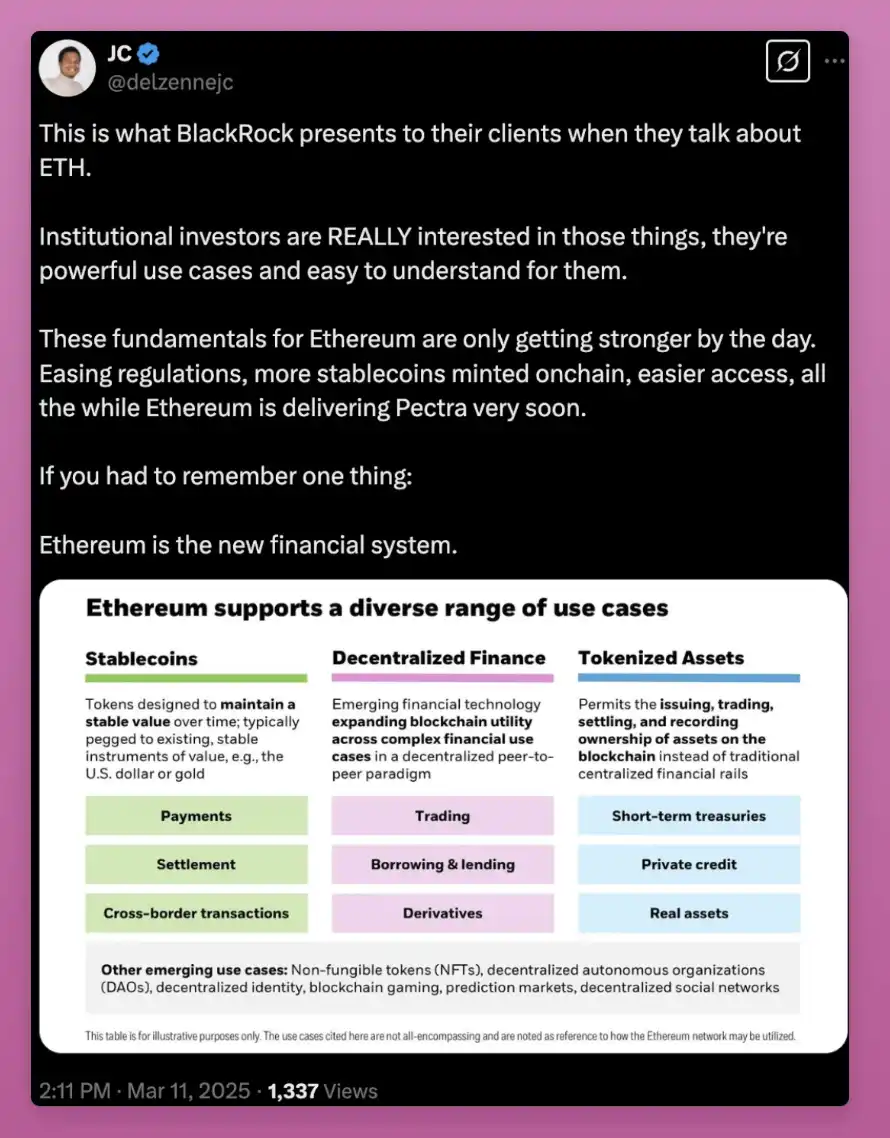

DeFi is expanding, and new social networks like Lens, Abstract, and Farcaster are emerging with innovative monetization models. Additionally, the increasing adoption of stablecoins and real-world assets (RWA) helps preserve and grow wealth, rather than destroy it.

KOLs on X may not care about these, but Crypto X is just a small part of the broader crypto culture.

I'm glad to see Bitcoin performing well as "digital gold," but Ethereum and Solana are viewed as speculative chains, rather than foundational platforms for an open digital economy.

If we promote meme coins as the face of crypto culture, I'd bet Pudgy Penguins is the strongest Web3 export to Web2, rather than meme coins (Doge, Pepe, etc.) imported from Web2.

3. Reclaim the narratives of Bitcoin and Ethereum

Cryptocurrencies are not a single, unified culture, but contain multiple subcultures. The most prominent of these are Bitcoin and Ethereum.

The view that Bitcoin "has become what it was supposed to destroy" frustrates me. Only those who store BTC in cold wallets truly understand the peace of mind that comes with self-custody and being outside the system.

ETFs benefit our wallets, but they are a double-edged sword, as ETF buyers won't experience the freedom that self-custody brings.

I also hope Bitcoin can distance itself from the MAGA movement. Bitcoin is global and should be neutral.

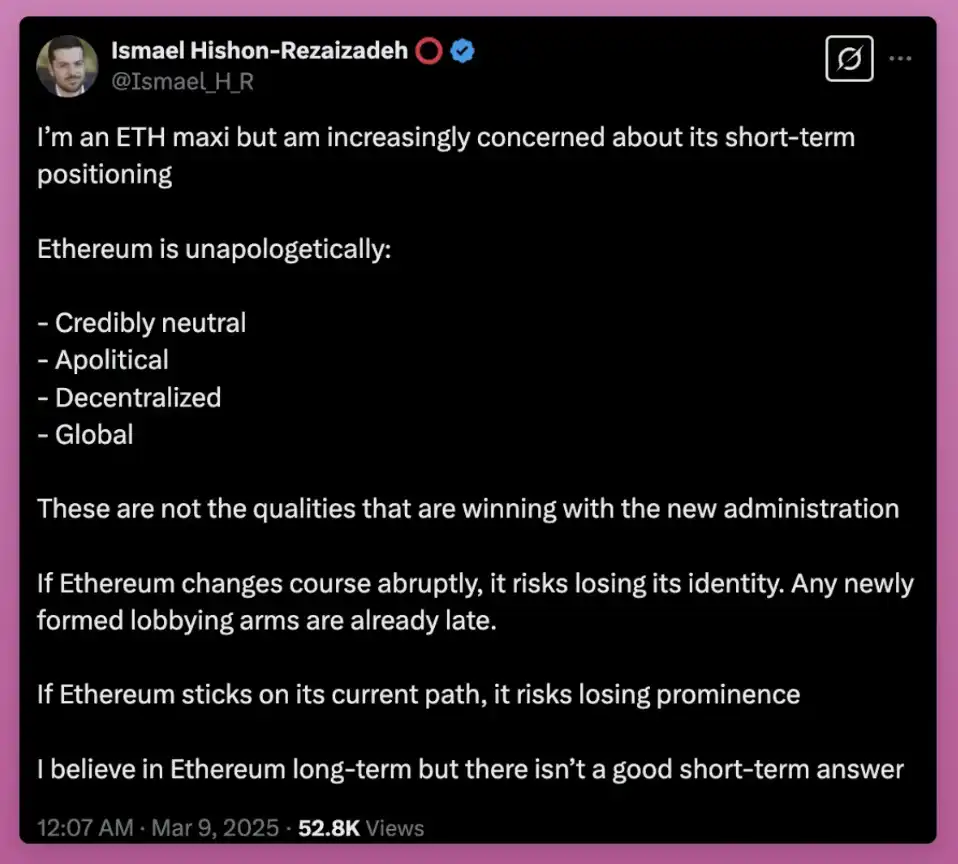

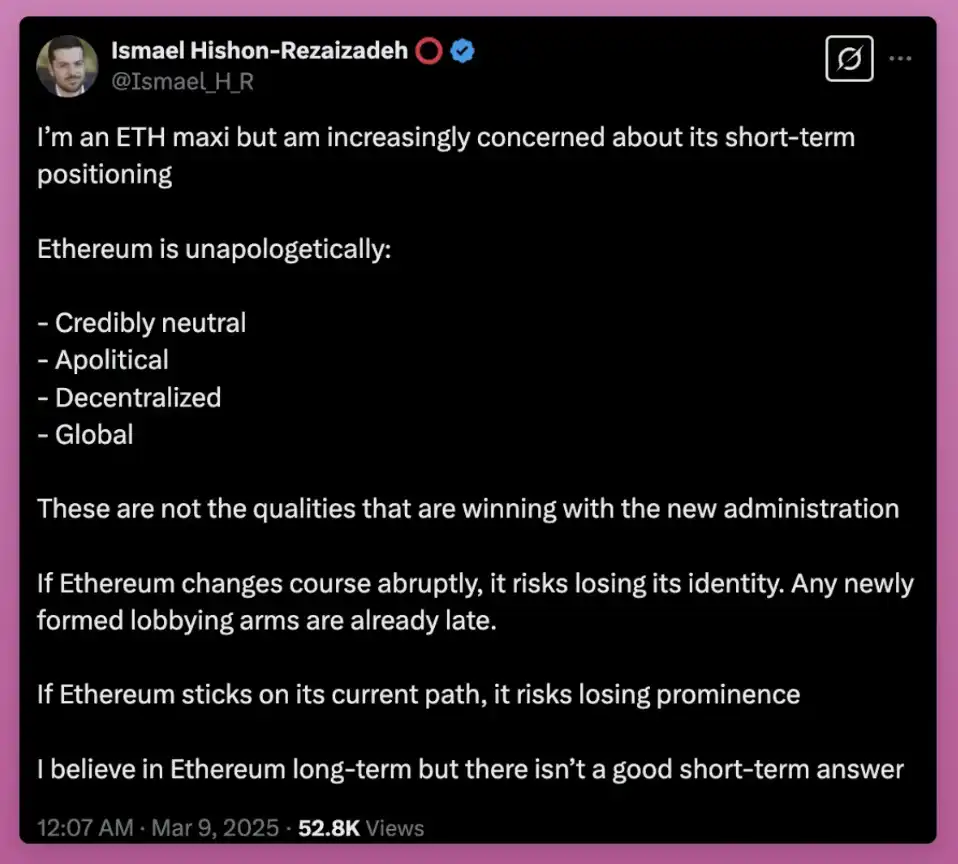

This is why I like Ethereum. Many criticize the Ethereum Foundation for not cozying up to the Trump team, but in the long run, this will prove to be a winning strategy.

In a world where privacy and democracy are eroding, AI blurs reality and illusion, and digital ownership is not guaranteed, Ethereum provides a safe haven.

Ethereum is unapologetically:

· Trustlessly neutral

· Apolitical

· Decentralized

· Globalized

Those outside of cryptocurrencies don't know this, so our job is to spread this message and build products that truly showcase Ethereum's value.

An Optimistic Future

Today, the entire crypto market cap has just reached $2.7 trillion. But do we deserve it?

Since Vitalik's post in 2017, cryptocurrencies have evolved, and it's not all speculation and negative games.

As I wrote in my previous post, 1.4 billion people globally are unbanked. Even in the US, this ratio is 4.5%. The Federal Reserve's own research found that high-income individuals view cryptocurrencies as investments, but poorer people use them for transactions. 60% of those who use them for transactions have an annual income below $50,000, and 13% are unbanked.

Venezuela ranked 40th in the 2023 Chainalysis Crypto Adoption Index. Stablecoins are a lifeline against hyperinflation. Similar to Argentina, as the national currency plummets, stablecoin purchase volumes have surged - a sign of widespread crypto adoption.

It's not just inflation, cryptocurrencies are also being used to fight oppressive regimes. During the COVID-19 pandemic, cryptocurrencies were used to directly aid Venezuelan doctors and nurses, without interference from the corrupt government. Ukraine raised $225 million in crypto donations at the start of the war.

DeFi's TVL has reached $88 billion! DEXes are now challenging CEXes, and Maker and other projects are bringing RWA onto the chain.

Non-speculative, decentralized social apps are also seeing growing adoption. Farcaster and Polymarket have thousands of users per day, and the numbers are growing. We now have real dApps to use.

But all this progress seems to have gotten lost in the X timeline, and we've done a terrible job at spreading this mission.

Nevertheless, I believe this market downturn will help the crypto industry heal, and progress will continue. We need to clean up our own mess first, before focusing on projecting the positive side of cryptocurrencies.