Recently, Base - an Ethereum Layer 2 network incubated by Coinbase - has been attracting significant market attention with its rapid growth. Funds and users are continuously pouring in, significantly increasing the activity in the ecosystem, with trading volume and total value locked (TVL) steadily rising, hinting at the possibility of an impending "big event." Industry insiders refer to this as the "Base Season," and this wave of enthusiasm may become a highlight of the crypto market in 2025. This article will delve into the latest data, analyze the logic behind Base's growth, discuss why capital is flocking to it, and recommend a few investment opportunities worth considering, providing investors with forward-looking insights.

The Growth Landscape Depicted by the Data

Base's recent performance can be described as "explosive growth," with multiple key indicators pointing to the potential for a "big event."

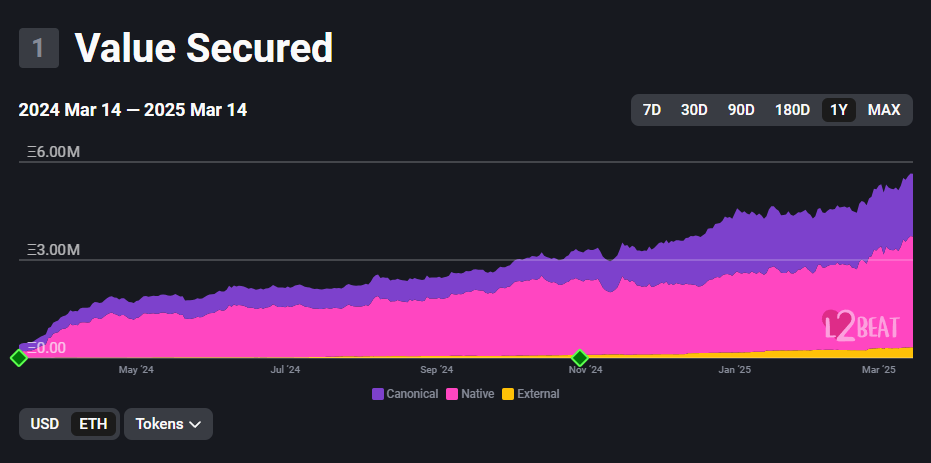

- Rapid Growth in TVL: Base's total value locked (TVL) has skyrocketed from $518 million at the beginning of 2024 to over $4 billion currently, surpassing Arbitrum and Optimism at one point to become the leader in the Layer 2 space. This indicates that capital is accelerating its inflow, significantly enhancing Base's ecosystem appeal.

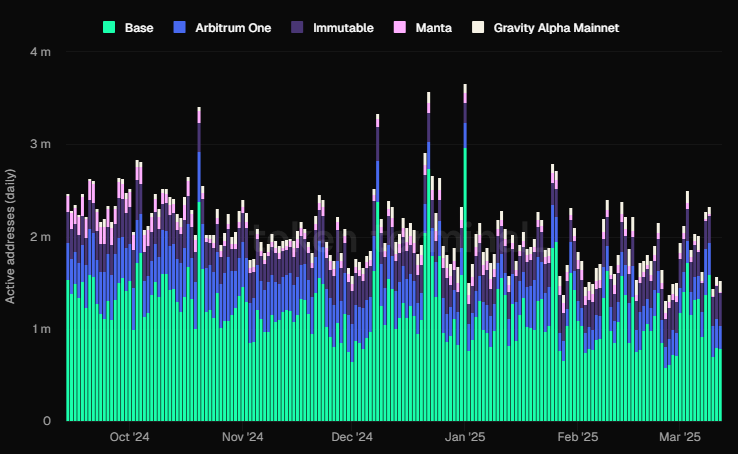

- Active Addresses: Base has consistently maintained the top position in L2 in terms of daily active addresses, with a recent daily average of 796,000 active addresses, far exceeding Arbitrum One (243,500), Immutable (121,500), and other networks like Manta and Gravity Alpha Mainnet (around 10,000 each). The total active addresses have surpassed 1.5 million, indicating a rapid increase in user participation, particularly during recent peak periods, when the address count has repeatedly exceeded 3.5 million, highlighting the vibrant vitality of the Base ecosystem.

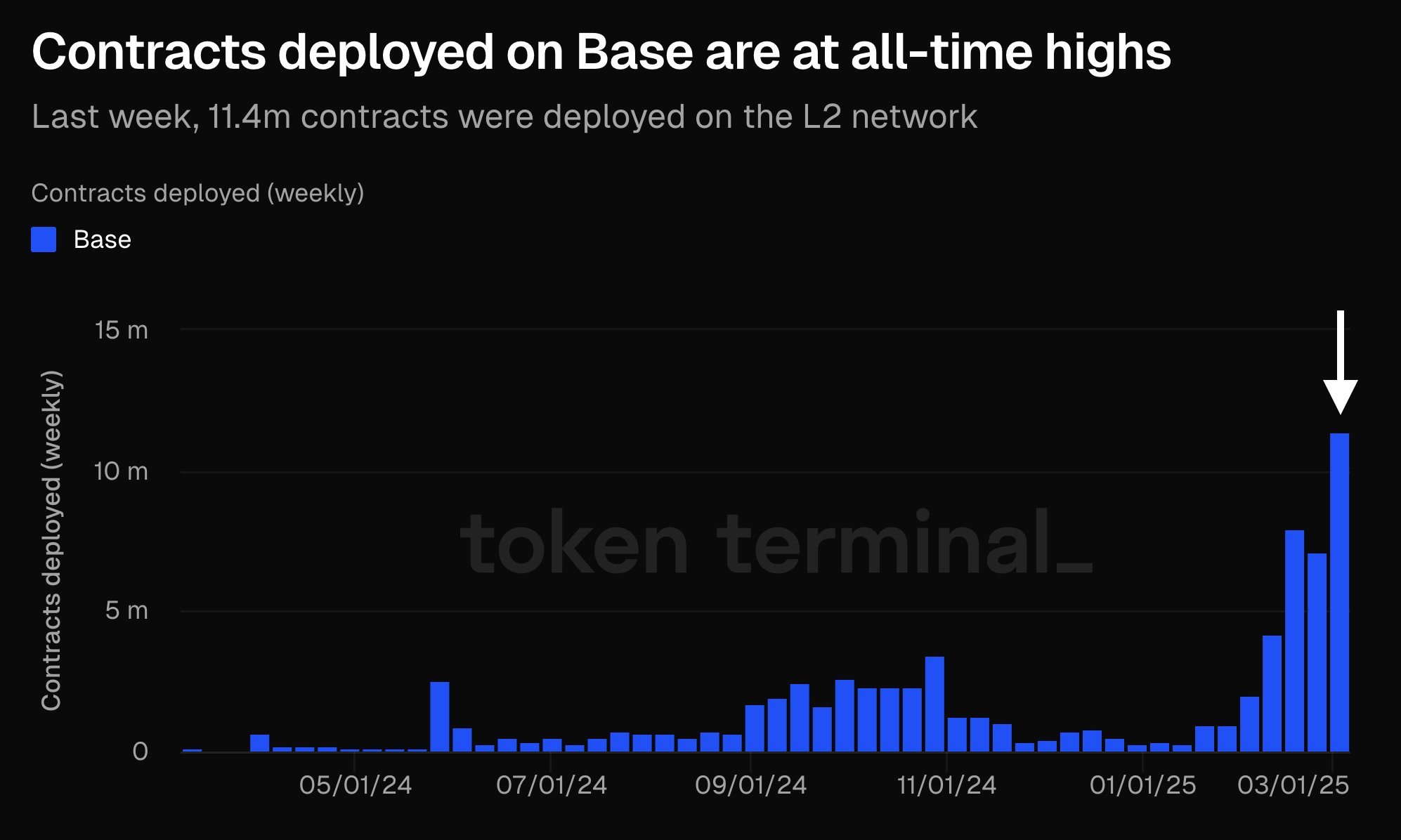

- Contract Deployments Reach a Historic High: On March 14, 2025, Token Terminal disclosed that the Base network deployed 11.4 million contracts last week, setting a new record. This figure demonstrates developers' preference for the Base technology stack, and the ecosystem's rapidly increasing diversity and innovation capabilities.

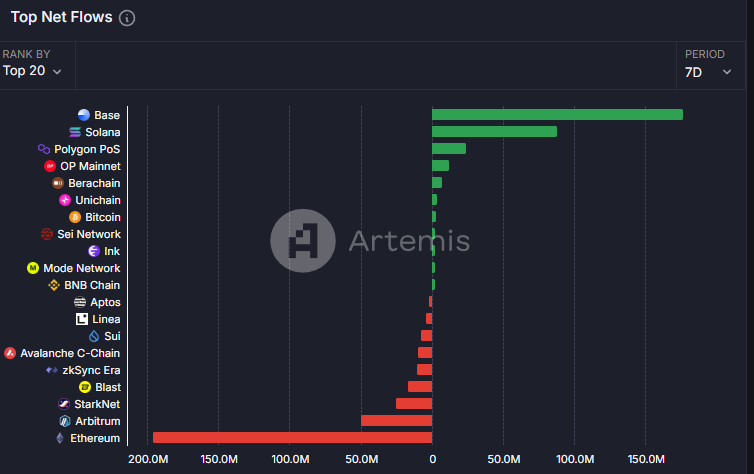

- Astonishing Pace of Capital Inflow: According to the latest data from Artemis, in the past 7 days, Base ranked first in net capital inflows, with over $20 billion, far exceeding the second-place Solana (around $15 billion) and other networks like Polygon, OP Mainnet, and Berachain.

Underlying these data points are the meme coin craze and the thriving DeFi ecosystem on Base. The high activity has not only attracted speculative capital but also provided fertile ground for developers. However, the rapid growth in TVL may be intertwined with speculative elements, and the occasional network rollback issues under high trading volumes serve as a reminder that Base's infrastructure still needs refinement. Nevertheless, these signals collectively paint a picture of Base potentially experiencing a significant turning point, perhaps with the official unveiling of the "Base Season" in the second quarter of 2025.

Why is Capital Drawn to Base?

Base's ability to attract so much capital is inseparable from Coinbase's strategic support. As the first crypto exchange to go public in the US, Coinbase has endowed Base with a powerful brand effect and a solid user base. Its collaboration with Stripe, which introduced USDC support, has made Base an ideal choice for low-cost cross-border payments, allowing traditional capital to enter the market easily. Furthermore, there are market rumors that Base may be spun off from Coinbase and issue its own token, further igniting the enthusiasm of early users.

On the technical front, Base is built on Optimism's OP Stack, and the recently launched Flashblocks technology has reduced block times to 200 milliseconds, even surpassing Solana's transaction speed. The transaction fees of less than $0.01, in contrast to Solana's high costs and Ethereum's congestion, have been a key factor in attracting capital. Additionally, Base's ecosystem covers popular areas such as DeFi, meme coins, and SocialFi, and the surge in trading volume is driven by speculative capital. Some have joked on X that market makers may find Solana's costs too high and have turned their attention to Base's low-threshold, high-return opportunities.

The macroeconomic environment has also played a catalyzing role. 2025 marks the early stage of former President Trump's new term, and the uncertainty surrounding his policies may prompt capital to seek refuge in the crypto market, with Base, as a Coinbase-led Layer 2, becoming the preferred choice due to its compliance and stability.

Investment Opportunities Worth Noting

B3

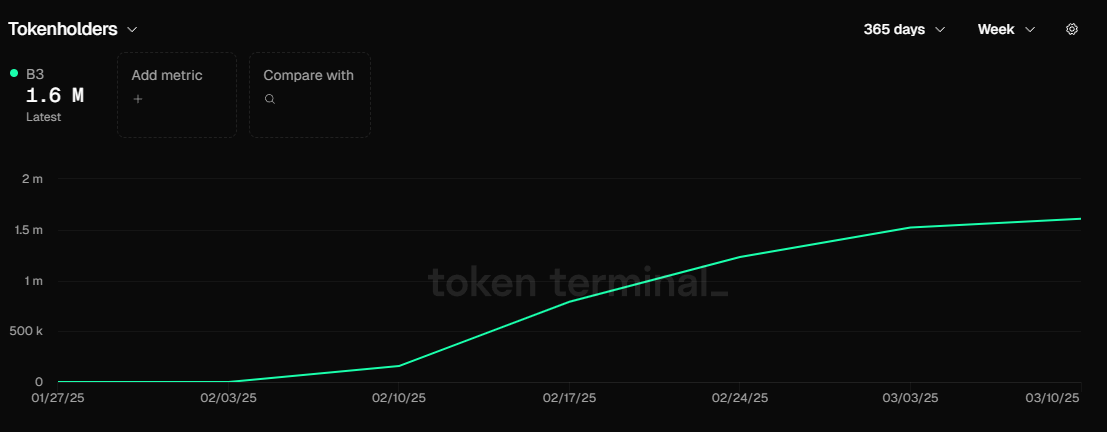

Amidst the wave of the Base ecosystem, a few projects have stood out and deserve investors' attention. First is $B3, a token representing Base's Layer 3 ambitions, primarily serving the gaming sector. After its launch on Coinbase and Bybit in February 2025, the $B3 price surged by 50%. Although the price has since retreated due to market influences, the number of token holders has remained steadily growing, indicating the market's recognition of its potential. The Flashblocks technology and the expansion of the Layer 3 application chain may bring new growth opportunities for gaming projects, although their success will still depend on user acquisition and ecosystem integration.

Recommended reading: B3 Token Surges 4x in 3 Days: A Farmers' Carnival or a New Pasture for Capital?

CLANKER

Another highlight is CLANKER. This token, launched by the AI-driven @Clanker tool, has deployed around 4,700 tokens and reached a market capitalization of $113.8 million. Discussions on X suggest that CLANKER is undervalued, particularly as it has outperformed other tokens during the rebound, potentially due to the Coinbase listing anticipation.

Additionally, Aerodrome in the DeFi sector should not be overlooked. As Base's largest decentralized exchange, its TVL exceeds $1 billion, accounting for half of the ecosystem's total locked value. The yield farming and liquidity incentive mechanisms have attracted the attention of institutions and retail investors, and despite the fierce competition in the DeFi arena, its growth potential remains promising.

Investment Recommendations and Conclusion

The arrival of the "Base Season" is driven by the explosive growth in TVL and trading volume, Coinbase's strategic support, and the synergy between technological innovation and the meme coin craze. Capital is flowing from Solana and Bitcoin to Base, reflecting the market's recognition of its low-cost and high-potential attributes. However, centralization risks, technical bottlenecks, and regulatory uncertainties serve as reminders for investors to remain cautious.

For investors, in the short term, it may be worth considering $CLANKER and $B3 to capture the speculative opportunities in meme coins and Layer 3. The key is to control position sizes and avoid the losses from high volatility, while closely following Coinbase's official updates to grasp the market rhythm. Base's growth is not without challenges, and its future will depend on technological upgrades and the continued prosperity of its ecosystem. In this potential wealth feast, data-driven insights and a balanced risk management approach may be the keys to success.