- Massive losses worth over $800 million USD per day of Bitcoin could mark a highly likely bottom

- Overall demand remains negative, with BTC ETFs losing over $5 billion

Bitcoin [BTC] held below $85,000 after a slight dip to $76,000 - a move that analysts from the Bitfinex exchange believe could signal stability.

According to the weekly market report, analysts said traders have witnessed actual losses of up to $818 million per day, a liquidation event in the market often preceding a potential bottom.

This broad Capitulation typically precedes market stabilization, although geopolitical and macroeconomic concerns remain significant threats.

Will BTC recover?

However, short-term holders (STHs) have sold BTC at a loss for the first time since October 2024. This is a trend that, if continued, could complicate reversal efforts, the analysts added.

Source: Bitfinex

They cited the Bitcoin Spent Output Profit Ratio (SOPR), tracking the profitability of traders, has dropped below 1. This indicates holders have been selling at a loss.

The short-term holder SOPR recorded its 2nd largest negative reading in this cycle at 0.95, suggesting new market entrants are Capitulating.

To shift towards recovery, the Bitfinex analysts stated that SOPR needs to rise above 1 again, which would imply 'renewed accumulation' and 'continued price appreciation'.

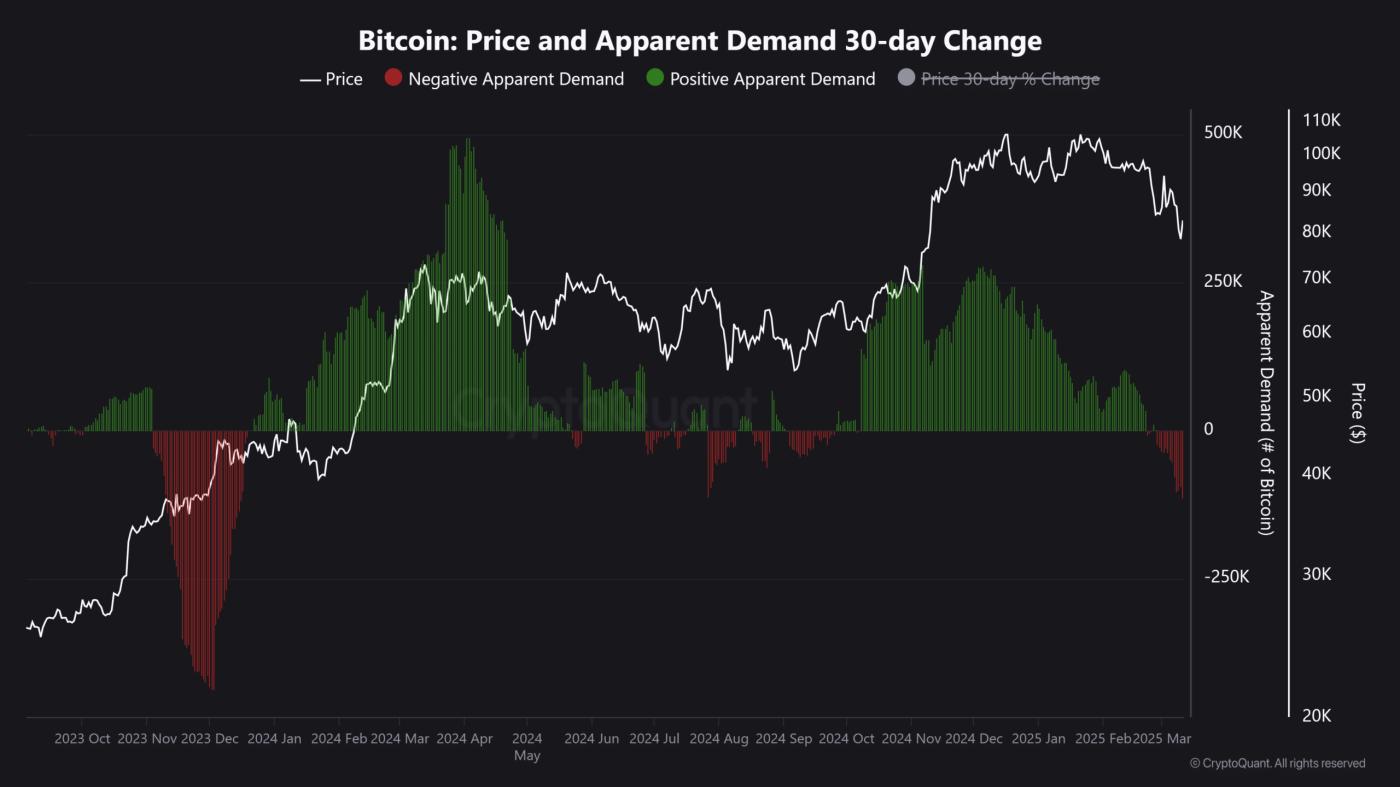

The weak demand for BTC has validated Bitfinex's warning. In fact, according to CryptoQuant data, crypto demand has remained negative since late February.

Source: CryptoQuant

US Bitcoin ETFs have lost $1.5 billion in the first half of March. In February alone, the products saw $3.56 billion in outflows, according to Soso Value. Over the past 6 weeks, over $5 billion has been withdrawn.

The Bitfinex analysts also warned that US macroeconomic indicators could continue to negatively impact crypto markets. While Trump's trade war is ongoing, the US CPI data for February came in cooler than expected.

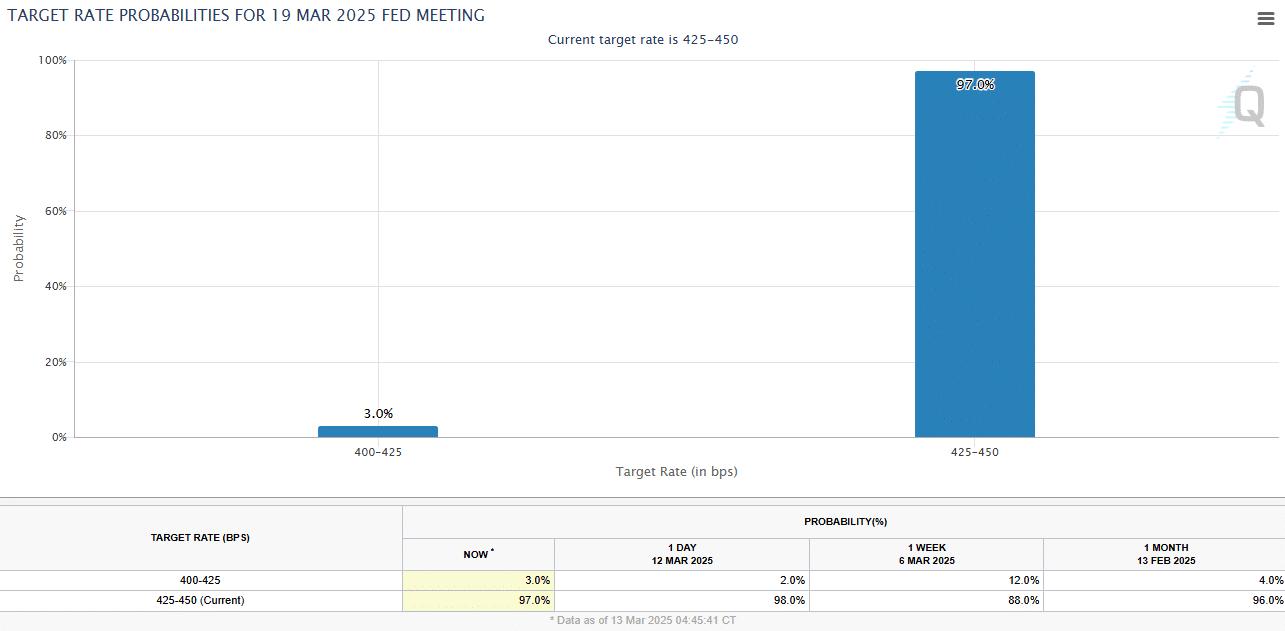

Unfortunately, the market does not expect any rate cuts from the Fed at the upcoming FOMC meeting on March 19. Interested investors have priced in a 97% probability that the Fed will hold rates in the current 4.25%-4.50% range.

Source: CME FedWatch Tool

There is only a 3% chance of a 25 basis point rate cut at the upcoming FOMC meeting. Therefore, BTC may continue to face challenges in the short term.