Project Background: DeFi Ambitions under Political Aura

The decentralized finance project World Liberty Financial (WLFI) backed by the family of former US President Donald Trump has been attracting political attention and crypto market focus since its launch in September 2024. Its core narrative directly addresses two main themes: "Defending the global status of the US dollar stablecoin" and "Challenging the hegemony of the traditional banking system". The project website clearly states that WLFI will promote "financial freedom without central bank digital currency (CBDC)" by building a lending protocol based on Ethereum.

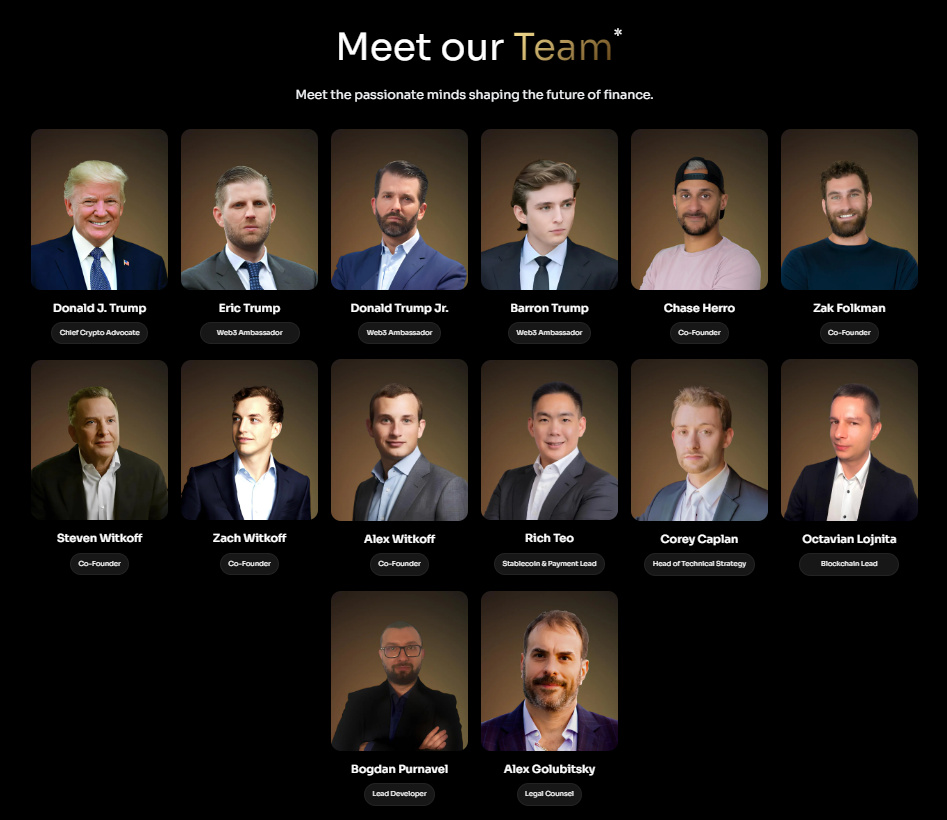

Although the whitepaper emphasizes that the Trump family "does not own or manage the project", the website lists Trump as the "Chief Crypto Advocate", with his three sons Eric, Donald Jr., and Barron serving as "Web3 Ambassadors".

This ambiguous relationship not only avoids legal risks but also successfully leverages Trump's influence among conservative voters - especially after Trump's victory in the 2024 presidential election, which led to an explosive growth in WLFI's token sales.

Furthermore, the actual operators of the project have gradually emerged: Zach Witkoff, Steven Witkoff, Zak Folkman, and Chase Herro are all co-founders of WLFI, while Richmond Teo is the head of WLFI's stablecoin and payment division, as well as the co-founder and former Asia CEO of Paxos. Richmond has over a decade of experience analyzing and investing in fintech companies, with a deep understanding of market structure, stock and commodity exchanges, and clearing houses.

Financing Landscape: The Sales Strategy behind $550 Million

1. Total Funding and Stage Breakdown

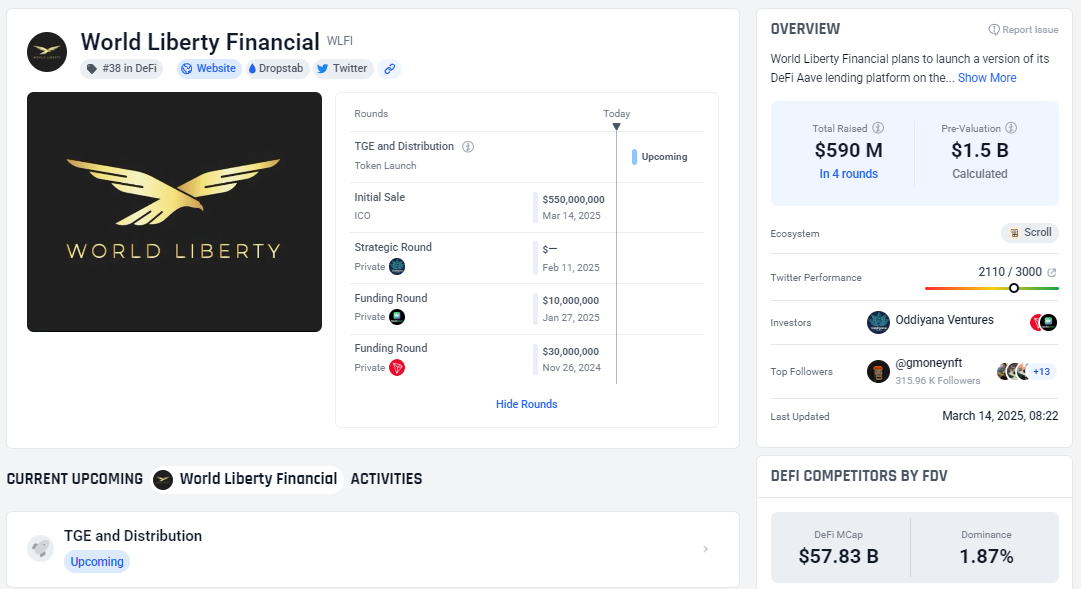

According to ICO Drop data, as of March 14, 2025, WLFI has raised a total of $590 million through multiple token sales (including private placements). The recent second round contributed $250 million, while the first public sale round raised $300 million. The private funding rounds saw TRON and Web3Port invest $30 million and $10 million, respectively.

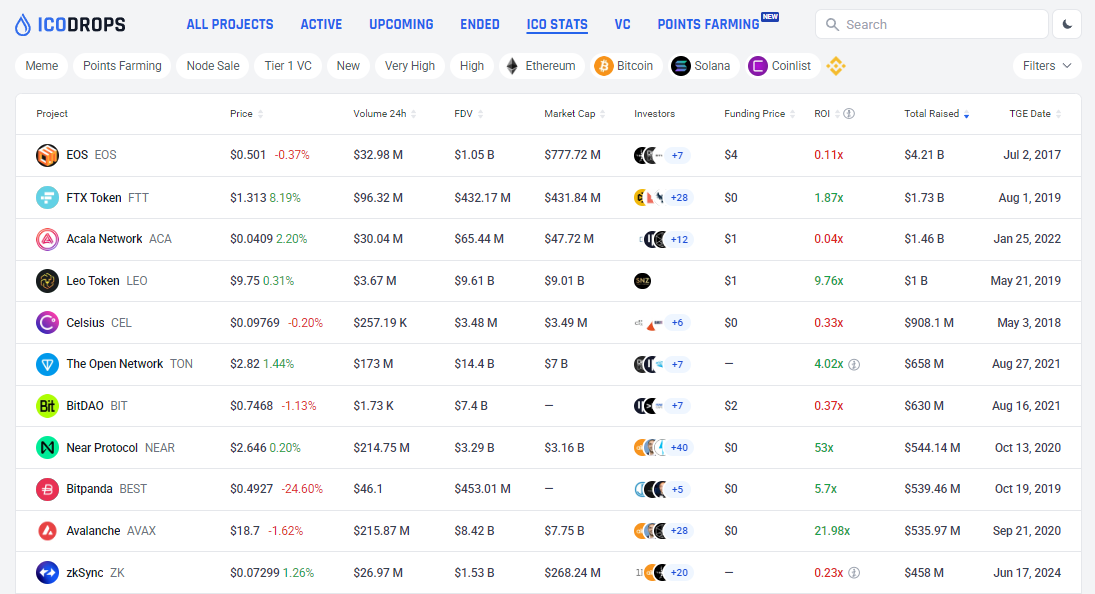

WLFI's total funding of $590 million ranks it 8th on the all-time crypto fundraising leaderboard, making it one of the top 10 token fundraising projects in history.

The specific sales trajectory shows a clear wave pattern:

- First round met with cold reception (October 2024): The original plan was to sell 20 billion tokens (20% of the total supply) at $0.015 per token, but only 766 million tokens were sold on the first day, raising $11 million, forcing the target to be lowered from $300 million to $30 million.

- Trump effect turning point (November 2024 - January 2025): With Trump's election victory, WLFI gained significant attention, and by January 20, 2025, the first 20% token tranche was sold out at $0.015 per token, raising $300 million.

- Premium additional issuance (January-March 2025): As the official TRUMP token and MELANIA emoji token gained popularity, market attention for WLFI soared. The team seized the opportunity to launch an additional 50 billion tokens at $0.05 per token, ultimately selling out and raising $250 million, becoming the main fundraising force.

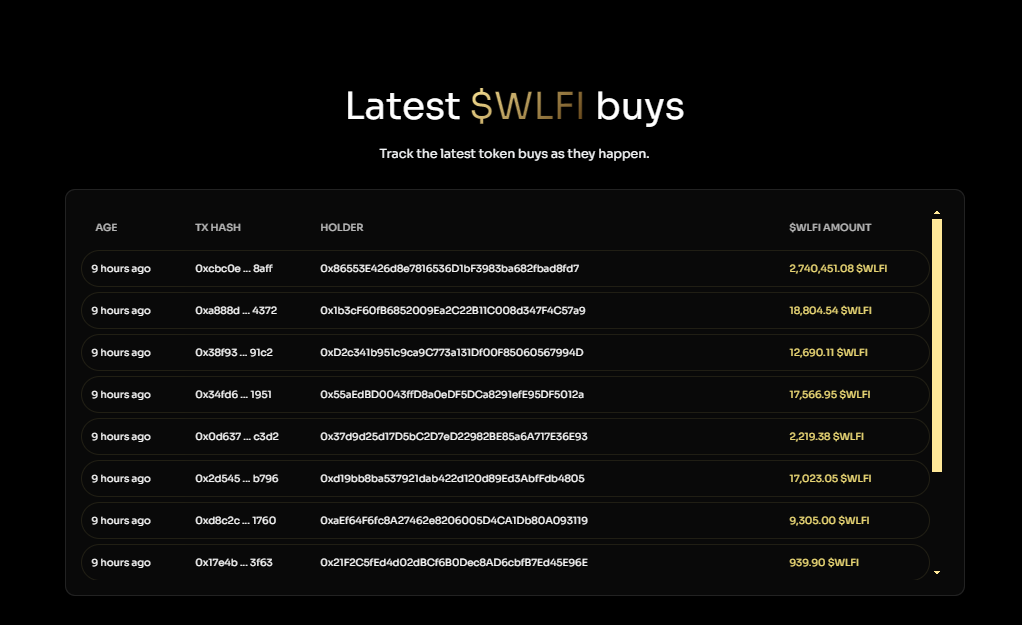

The website data shows that 9 hours ago, the last funding came from0xcbc0e ... 8aff, who bought 2,740,451.08 WLFI tokens worth $137,000.

2. Token Economics: Centralized Governance and Liquidity Dilemma

WLFI has a total token supply of 100 billion, with a current circulating ratio of 25%. The core distribution mechanism includes:

- Public sale: 63% (about 630 billion tokens), of which 25% (250 billion) have been sold, and 38% remain to be released

- Team reserve: 20%, with an undisclosed lock-up period, but co-founder Zak Folkman emphasized "no VC privileges"

- User incentives: 17%, for protocol governance voting rewards

The token's functional design highlights its governance tool attributes: holders can participate in protocol parameter modifications and product roadmap voting, but do not have dividend rights, and the tokens are non-transferable for the first 12 months after issuance. This design, while avoiding securities risks, also leads to a lack of liquidity.

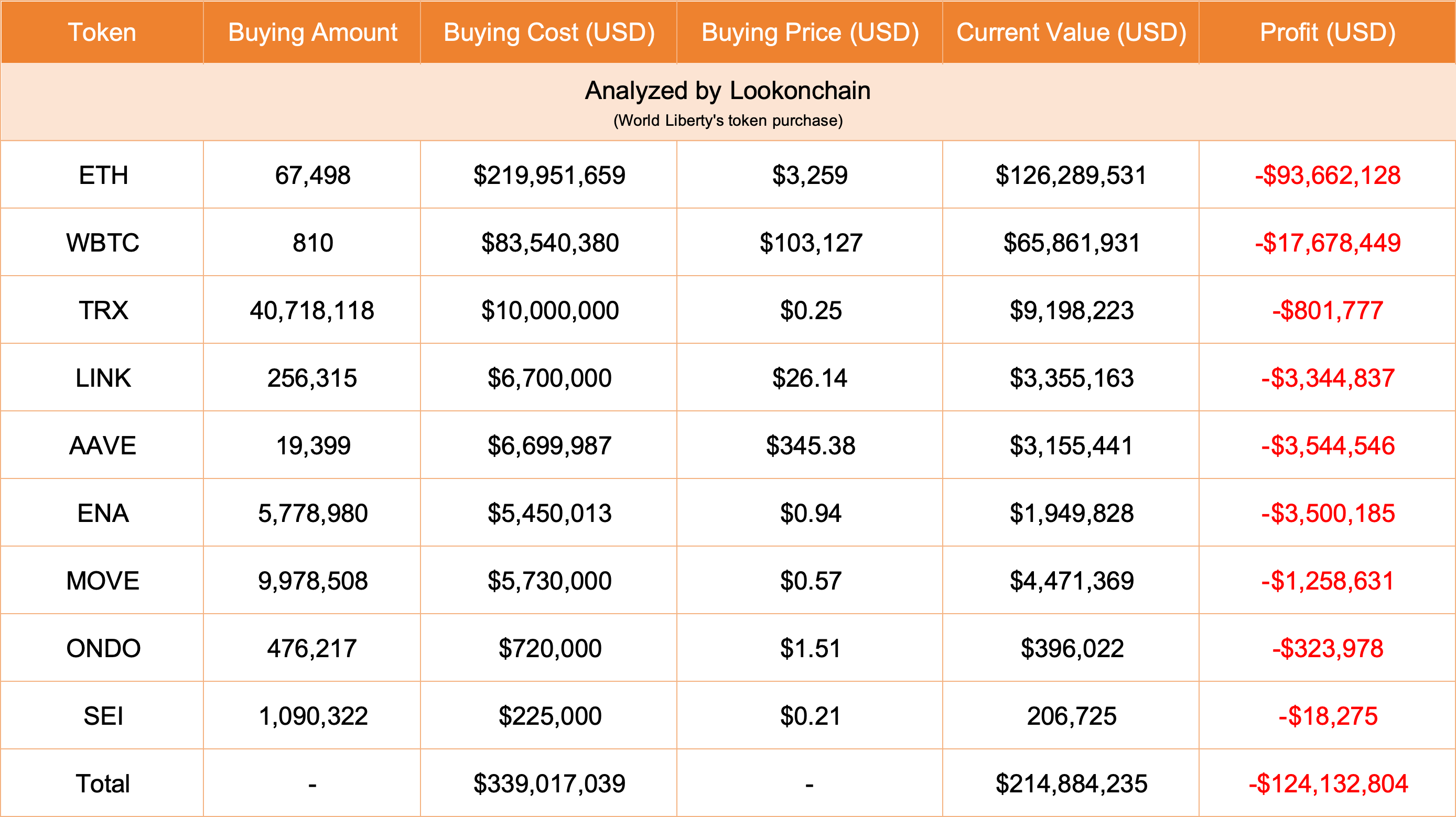

Lookonchain data shows that the multi-signature wallet holdings of WLFI have unrealized losses of over $124 million in ETH, WBTC, and other assets, partly due to the inability to timely realize losses.

Top Buyer Landscape: The Collusion of Politics and Capital

1. Institutional Investors: Justin Sun's "High-Stakes Gamble"

TRON founder Justin Sun is WLFI's largest individual buyer, investing $75 million in two tranches:

- November 2024: Purchased $30 million worth of tokens through a Huobi-affiliated wallet

- January 2025: Added $45 million and facilitated a deep integration between WLFI and the TRON ecosystem (such as a $10 million TRX purchase)

Sun's entry was seen by co-founder Zach Witkoff as a "turning point" for the project, and his investment logic may include:

- Political bet: Leveraging Trump's policy dividends to drive crypto compliance

- Ecosystem layout: Accessing traditional US financial institution resources through WLFI

2. Compliant Capital: Web3Port's "Regulatory Arbitrage"

Investment platform Web3Port invested $10 million in January 2025, and its background is worth exploring:

- License advantage: Holding a US MSB license, helping WLFI avoid SEC regulatory scrutiny

- Channel value: Providing a fiat currency channel for WLFI's future integration of real-world assets (RWA)

3. Retail Investors: "Qualified Players" under KYC Screening

WLFI has set strict entry barriers for retail investors:

- Geographic restriction: US-based investors must meet the "accredited investor" standard (annual income over $200,000 or net worth over $1 million)

- Whitelist mechanism: The first round of sales was only open to 100,000 pre-registered users

This "elite" strategy, while reducing regulatory risks, has also led to a lack of community activity. On-chain data shows that WLFI's governance proposal voting rates have been consistently below 15%.

WLFI Key Events Timeline

September 16, 2024: The crypto project World Liberty Financial (WLFI) was launched, aiming to "embrace the future of cryptocurrencies" and "abandon outdated big banks".

September 17, 2024: World Liberty Financial will sell 63% of WLFI tokens to the public, 17% for user rewards, and the remaining 20% for the team.

September 30, 2024: The DeFi project World Liberty Financial has opened KYC verification on its official website.

October 8, 2024: World Liberty Financial (WLFI) posted on X that the WLFI token sale will soon be launched, and users who have been whitelisted can participate.

October 10, 2024: The DeFi project World Liberty Financial hopes to raise $300 million in its upcoming token initial sale at a $1.5 billion valuation.

October 14, 2024: WLFI has had over 100,000 people register and join the whitelist since September 30, and will release a "golden document" on Tuesday.

63% of the WLFI tokens will be sold to the public starting on Tuesday, October 15th. The remaining 17% will be used to reward users, and 20% will be used for team compensation. WLFI will be open to accredited investors in the United States, accredited investors in the United Kingdom, and investors outside of these countries.

On October 16, 2024, World Liberty Financial launched the public token sale on October 15th. As of 7:25 am Beijing time on October 16th, the project has sold about 610 million WLFI tokens, with 19.4 billion tokens remaining. Calculated at a price of $0.015 per token, the first day's sales amounted to approximately $9.15 million.

On January 20, 2025, the World Liberty Financial (WLFI) official announced that the first 20% of the token supply has been completely sold out. Due to strong market demand, the project team has decided to add an additional 5% of the token supply. The team is preparing to restart the sales process, and the specific launch time will be announced later.

On February 7, 2025, World Liberty Financial co-founder Chase Herro stated that the platform plans to build a "strategic reserve" by purchasing tokens, but Herro did not specify the target for World Liberty's token reserve holdings.

On February 12, 2025, according to the WLFI official announcement, World Liberty Financial (WLFI) announced the launch of the Macro Strategy reserve fund, aimed at supporting leading crypto assets such as Bitcoin and Ethereum, and enhancing market stability. This strategy will be used for diversified investment, reducing market volatility, promoting the development of the DeFi ecosystem, and strengthening community trust.

On March 6, 2025, the Sui blockchain announced a strategic partnership with World Liberty Financial (WLFI).

According to the agreement, WLFI will include SUI assets in its "Macro Strategy" token reserve, and the two parties have begun to explore product development opportunities.

On March 14, 2025, World Liberty Financial has completed the entire community public offering financing (an additional round was previously added), with a total financing amount of $550 million.

Risks and Controversies: Pitfalls under the Halo

Political Binding Risk

If Trump is re-elected and adjusts his crypto policy, WLFI may lose its "policy moat". Historical data shows that the bankruptcy rate of Trump-related companies is 37%, and there are hidden risks in their business credit.

Defects in Token Model

The selling pressure from the 63% of tokens to be released may break through the price defense line. Assuming the remaining tokens are sold at $0.05, the circulating market value will reach $3.15 billion, exceeding Aave (current market value of about $4.5 billion), but the WLFI protocol's TVL is only 1/20 of Aave.

Technical Risks

The code base was directly copied from Dough Finance (which suffered a hacker attack and lost $2 million), and although it has been audited by PeckShield, the smart contract still has the risk of 0day vulnerabilities.

Conclusion: The "New Frontier" of DeFi and Geopolitics

The rise of WLFI reveals a new trend: cryptocurrencies are becoming a tool for political forces to expand their financial discourse power. Its strategy of using a dollar stablecoin as a spearhead and the Ethereum ecosystem as a shield is essentially reconstructing the Bretton Woods system in the digital age. However, when DeFi protocols are linked to presidential campaign funds, and when Justin Sun's capital and Trump's traffic dance together, this experiment is destined to advance painfully amid cheers and doubts. Perhaps, as written on the title page of the WLFI white paper: "What we are building is not another Uniswap, but a flag of freedom planted on the ruins of Wall Street" - whether this flag leads a revolution or becomes a gimmick, time will give a cruel and real answer.