In addition to this, cryptocurrencies are also facing a politicization crisis, as Trump's high-profile embrace of cryptocurrencies has also brought new risks - among non-supporters, cryptocurrencies are being labeled as the "MAGA movement" (Make America Great Again). As expected, this politicization trend quickly raised international alarm, with the EU viewing Trump's support for cryptocurrencies as a threat to European monetary sovereignty.

Of course, there is also a bright side to this, as the cessation of the previous U.S. administration's crackdown on cryptocurrency regulation is undoubtedly a boon for the industry. But it must be admitted that the cryptocurrency industry is currently walking a tightrope under the influence of the Trump administration's policies.

How to change people's perception of cryptocurrencies

The reputation of cryptocurrencies will not self-repair, and if we want to achieve mainstream adoption, we must proactively reshape the narrative framework - this is no easy task, and the change must be initiated from within the industry: because even the native inhabitants of the cryptocurrency industry are beginning to lose confidence in the industry.

To this end, we need to focus on three key directions.

Make Cryptocurrencies Great Again

In past cycles, newcomers to the cryptocurrency market were able to profit from early participation in projects. However, the rampant issuance of Memecoins by the Memecoin group and low-liquidity, high FDV projects supported by venture capital (VC) firms have left new entrants with no advantage.

Although we have successfully resisted low-liquidity projects in this cycle, we have fallen into the collective frenzy of Memecoins. Projects like Legion and Echo have tried to adopt fairer financing models, but their entry thresholds still exclude ordinary investors.

Therefore, the industry needs to create and promote ecosystem rules that can create real value (rather than destroy value), allowing early participants to share in the growth dividends. Kyle's market reconstruction plan based on "first principles" is worth referencing.

However, due to the prevalence of short-termism, the rampant extraction culture, and the loss of the bottom line of integrity, we have fallen into a self-destructive cycle of eternal financial nihilism - when everyone is chasing scam coins with the mentality of "I can escape before the scammer runs away", the emergence of this phenomenon was to some extent predetermined.

To this end, we must oversee the misconduct. The industry needs to take more measures to expose scams and hold influential figures accountable for misleading propaganda. On-chain detective ZachXBT has done this before, but the level of crime is now beyond individual control. As practitioners, we also need to stay away from value extraction behaviors, and investors should truly make money while expanding the cryptocurrency market. After all, when new entrants are constantly being harvested and even ruined, the industry will lose its future.

Shift the narrative from speculative frenzy to practical value

Cryptocurrencies are not just digital casinos - they can also create real-world value.

Therefore, what we really need to focus on are use cases such as cross-border remittances, financial inclusion, and transparent governance, rather than Memecoin culture.

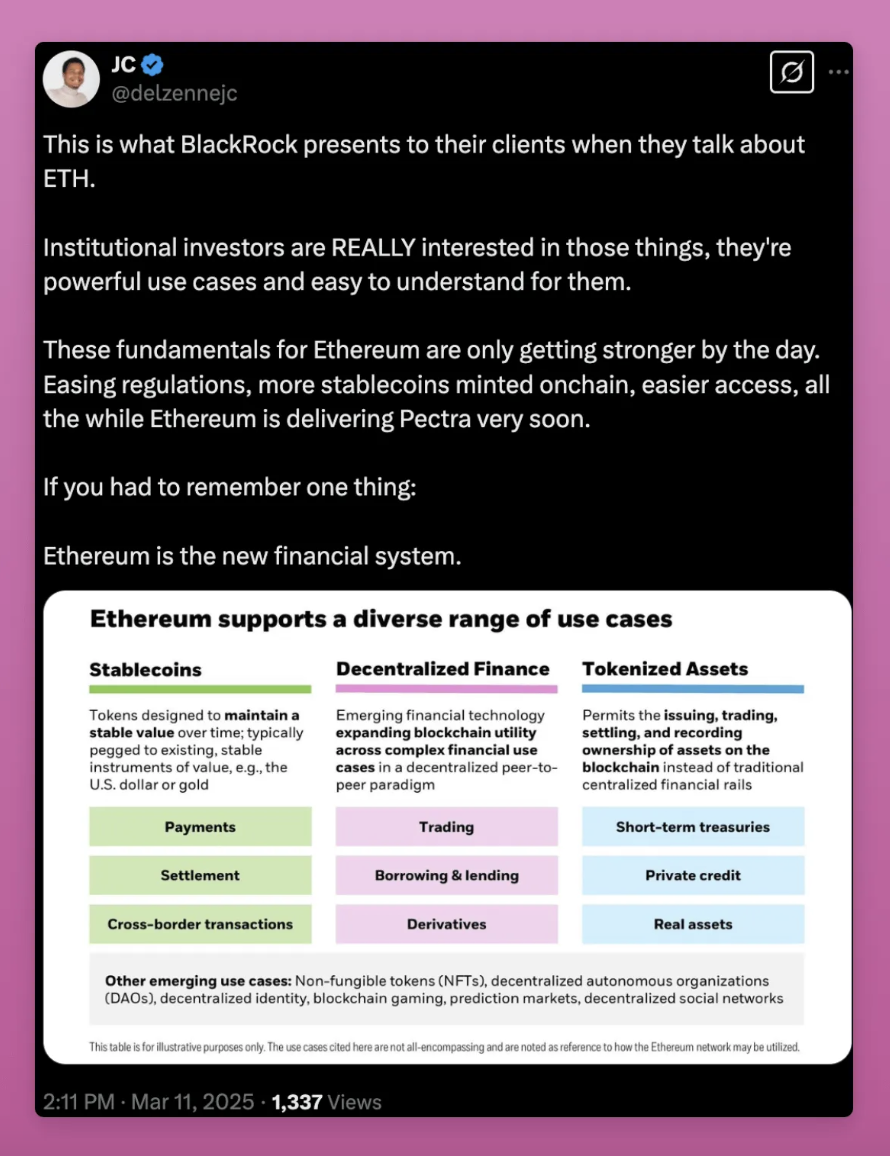

At the same time, the DeFi ecosystem is continuously expanding, and new social networks with innovative monetization models are emerging, such as Lens, Abstract, and Farcaster. Most importantly, the widespread adoption of stablecoins and RWA (real-world assets) helps to preserve and appreciate wealth, rather than destroy it.

However, the cryptocurrency KOLs on X platform may be indifferent to these developments - but we need to make it clear that Crypto Twitter is just the tip of the iceberg of the broader cryptocurrency industry culture.

On the other hand, Bitcoin's advantage lies in gradually establishing its position as "digital gold", but blockchains like Ethereum and Solana are still seen as speculative tools rather than the foundation of an open digital economy.

If I had to define the cultural output of cryptocurrencies, I believe that IPs like Pudgy Penguins will penetrate Web2, rather than the reverse introduction of memes like Doge and Pepe - the latter is accelerating the infantilization of the industry.

Redefine the narrative sovereignty of Bitcoin and Ethereum

Cryptocurrency culture is not a monolith, but contains multiple subcultures, the most prominent of which are "Bitcoin minimalism" and "Ethereum multi-ecosystem".

"Bitcoin is becoming the financial system it was supposed to destroy" - this rhetoric angers me. Only those who store Bitcoin in cold wallets can truly understand the peace of mind that comes with "self-custody, detachment from the system".

ETFs are undoubtedly a good thing for our wallets, but they are also a double-edged sword, depriving ETF buyers of the sense of freedom that comes with self-custody.

More importantly, we need to be wary of the association of Bitcoin with the MAGA movement, as Bitcoin is global and should remain absolutely neutral.

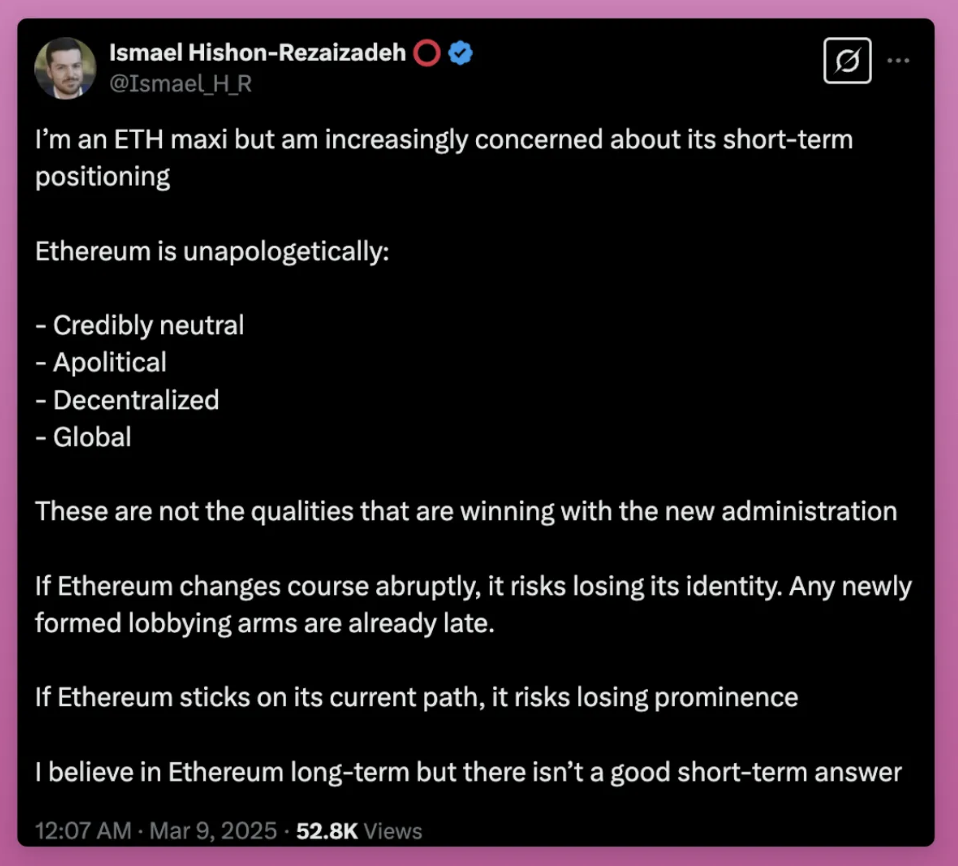

This is also one of the reasons why I like Ethereum. Although many critics have accused the Ethereum Foundation of failing to approach the Trump team, in the long run, this will prove to be a successful strategy.

In an era of privacy erosion, AI-induced confusion, and lack of digital ownership guarantees, Ethereum, with its trustworthy neutrality, de-politicization, decentralization, and global nature, provides not only technological solutions, but also a sanctuary of values.

Unfortunately, people outside the cryptocurrency field are not aware of this, so the task of practitioners is to disseminate this information and create products that truly showcase the value of Ethereum.

Optimistic Outlook: The Path of Value Restoration for the Cryptocurrency Industry

As of the writing of this article, CoinMarketCap data shows that the total cryptocurrency market capitalization is around $2.7 trillion, but does this report card stand up to the test of value scrutiny?

Since Vitalik's post in 2017, cryptocurrencies have undergone changes, and while speculation and zero-sum games still exist, the industry has also given birth to a real value core.

As I wrote in the post, 1.4 billion people worldwide are unbanked. Even in the U.S., this ratio is only 4.5%. Federal Reserve research found that high-income individuals view cryptocurrencies as investment products, but the degree of use for transactions is relatively low. Among those who use cryptocurrencies for transactions, 60% have incomes below $50,000, and 13% are unbanked.

Furthermore, Venezuela ranked 40th in the 2023 Chainalysis Crypto Adoption Index, with stablecoins becoming a lifeline against hyperinflation. This is similar to Argentina, where as the local currency depreciates, stablecoin purchase volumes have soared - this is a sign of widespread cryptocurrency adoption.

In addition to resisting hyperinflation, cryptocurrencies have also been used to resist oppressive regimes. For example, during the COVID-19 pandemic, cryptocurrencies were used to directly aid Venezuelan doctors and nurses without interference from the corrupt regime; at the start of the war, Ukraine raised $225 million in cryptocurrency donations.

It is worth mentioning that the adoption rate of non-speculative decentralized social applications is steadily increasing, with Farcaster and Polymarket each having over 10,000 daily active users, and the numbers are still growing. We now have real DApps that can be used, but these advancements seem to have disappeared on the X timeline, and we have to admit that we have not done a satisfactory job in dissemination.

Nevertheless, the current market is undergoing a value cleansing, and the crash is not necessarily a bad thing, as it will help the industry recover and continue to progress. As the old saying goes, the winter will eventually pass, and when the speculators leave, the true builders will remain and output the positive side of cryptocurrencies.