Chainlink has unlocked 19 million LINK tokens worth approximately $269 million, according to the established quarterly schedule.

The latest token issuance has drawn attention amid concerns about a notable transaction involving a prominent trader on the Hyperliquid platform.

Chainlink's Latest Token Unlock

Of the 19 million tokens unlocked, 14.875 million LINK, worth $212.9 million, have been sent to Binance. This may be to increase liquidity on the exchange, as the majority of LINK trading volume occurs on Binance.

The remaining 4.125 million LINK, worth $56.2 million, have been transferred to a multisignature wallet labeled 0xD50. This token distribution is not new, as Chainlink has consistently followed this model for many years.

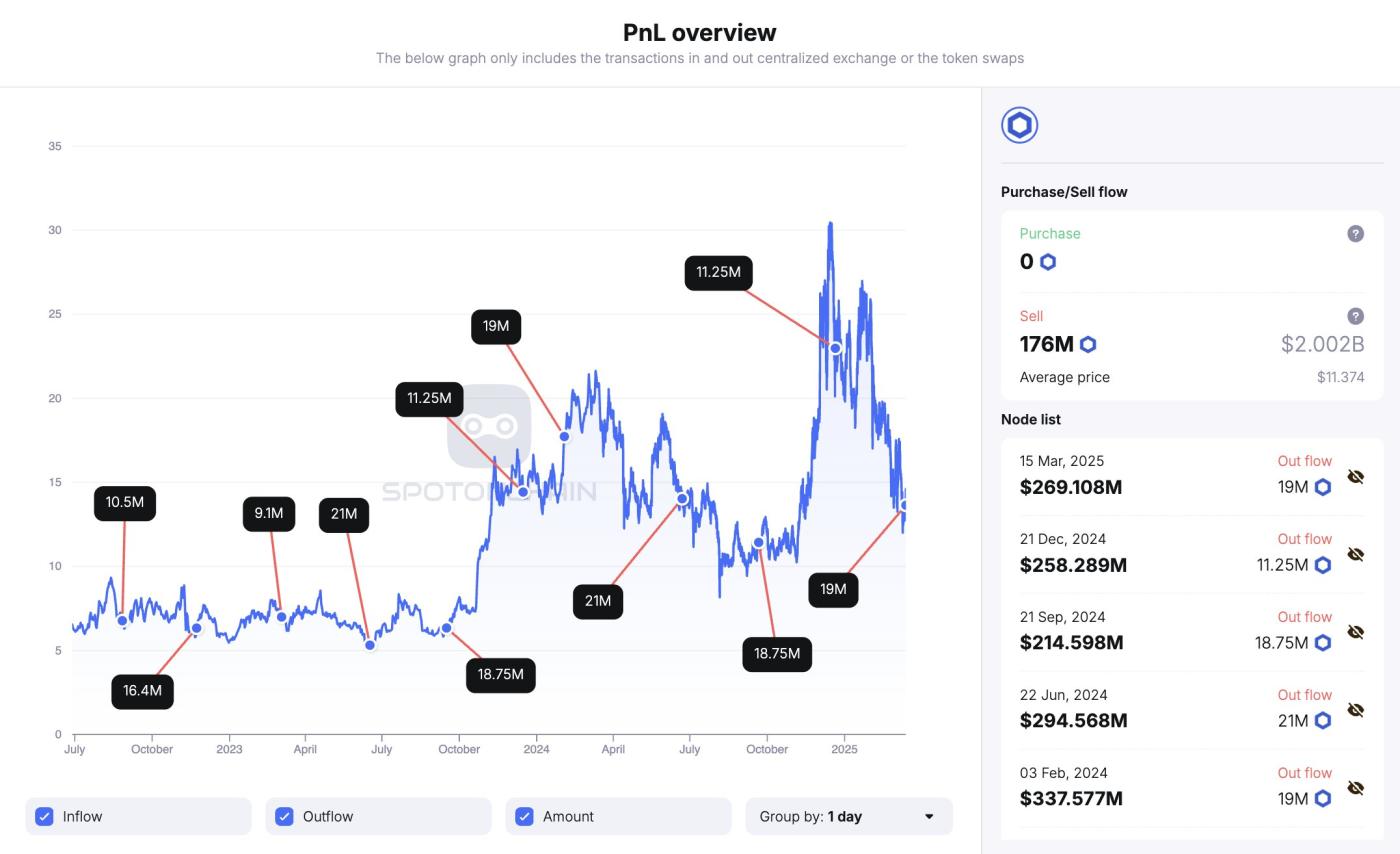

Data from SpotOnChain reveals that since August 2022, Chainlink has unlocked 176 million LINK, worth around $2 billion at the time and $2.43 billion at the current price.

Chainlink's quarterly LINK token unlock. Source: SpotOnChain

Chainlink's quarterly LINK token unlock. Source: SpotOnChainOf this, 151.3 million LINK have been sent directly to Binance at an average price of $11.41.

Despite these transactions, Chainlink still holds 342.5 million LINK, worth $4.7 billion, in non-circulating supply contracts.

Hyperliquid Trader Shifts Focus to LINK

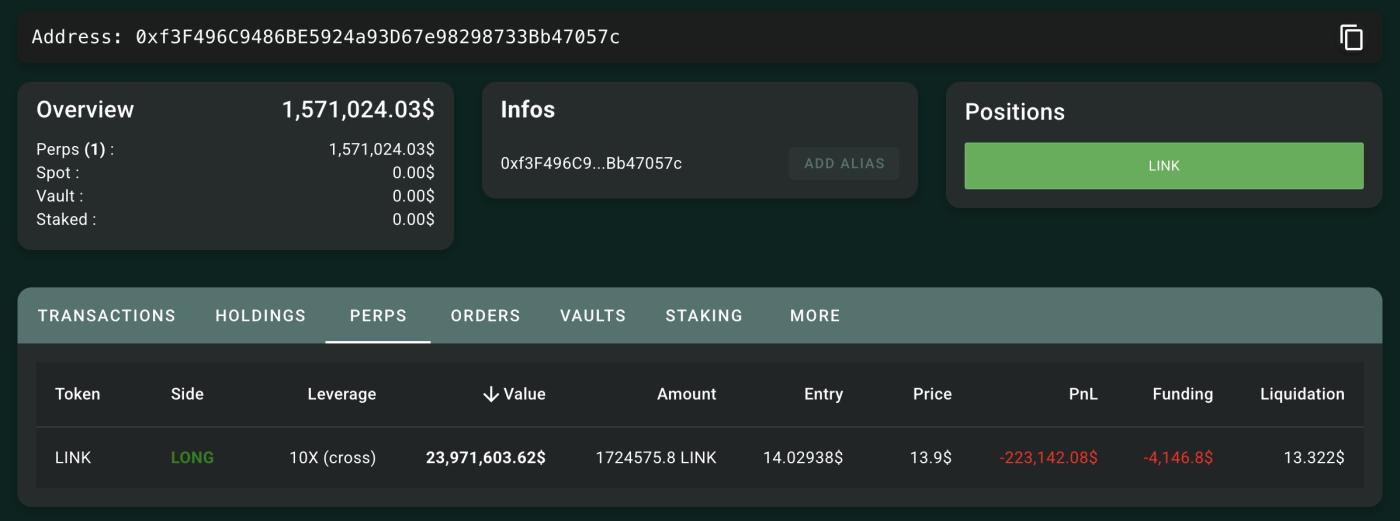

Blockchain intelligence firm Lookonchain has identified a prominent whale shifting attention to LINK. This trader, known as the "ETH 50x Big Guy," has drawn attention for leveraged trades that resulted in a $4 million loss for Hyperliquid.

On March 14, the whale opened a long position of $31,000 on LINK with 10x leverage, executing the trade on Hyperliquid and GMX, two major perpetual contract exchanges. Additionally, the whale bought 863,174 LINK for 12.1 million USDC.

The mysterious trader's long position on LINK on Hyperliquid. Source: X/Lookonchain

The mysterious trader's long position on LINK on Hyperliquid. Source: X/LookonchainHowever, blockchain data shows the whale has gradually reduced their LINK holdings through multiple small trades converting to stablecoins just hours after opening the long position.

This trader first gained attention on March 12 after aggressively testing Hyperliquid's trading framework. The platform suffered a $4 million loss, prompting them to announce upcoming risk management changes.

Hyperliquid stated that starting March 15 at 00:00 UTC, traders will need to maintain a 20% margin ratio on leveraged trades. This update will not affect cross-margin trading unless cross-margin usage exceeds 5x after opening an isolated position.

"This update is to maintain a healthier margin requirement and reduce the systemic impact of large positions with assumed market impact when closing," Hyperliquid explained.

Despite the changes, Hyperliquid has assured users they can still trade with leverage up to 40x. This update is particularly aimed at profit-taking and unrealized P&L from open positions.

Meanwhile, these incidents have not negatively impacted the price of LINK, which has recovered more than 4% to $13.90 in the past 24 hours. This reverses a 12% drop from the previous week and a 27% decline over the past month.