Source: Talk Li Talk Outside

In the previous article, we mainly rethought the development of the market. In terms of the current market sentiment, many people seem to have new hope for the expectation of rate cuts (the Federal Reserve).

The crypto market last enjoyed the benefits of rate cuts in 2020, before the outbreak of the COVID-19 pandemic, when the federal funds rate (the rate adjusted by the Federal Reserve) was actually not high, only 1.5% - 1.75%. But to cope with the impact of the COVID-19 pandemic, the Federal Reserve made two emergency rate cuts within a month: the first cut was 50 basis points (0.5%), and the second cut was 100 basis points (1%).

As a result, the federal funds rate was directly lowered to 0% - 0.25%, which meant that borrowing (credit) became easier than ever before, and with the reduction in borrowing costs, a large amount of liquidity flowed into the market (including the crypto market) and pushed up the prices of various risky assets, which also became one of the main driving factors of the 2021 bull market.

1. Trump's Obsession with Rate Cuts

At the time, a BBC report (March 16, 2020) was also quite interesting: as the Federal Reserve made an emergency rate cut to zero interest rates, "using up all its ammunition at once", Trump, who had previously criticized Powell for "not doing enough", surprisingly changed his tune and praised it as "great", "very good news", and "makes me very happy". As shown in the image below.

From the report at the time, it seems that Trump has always had a certain "obsession" with "rate cuts".

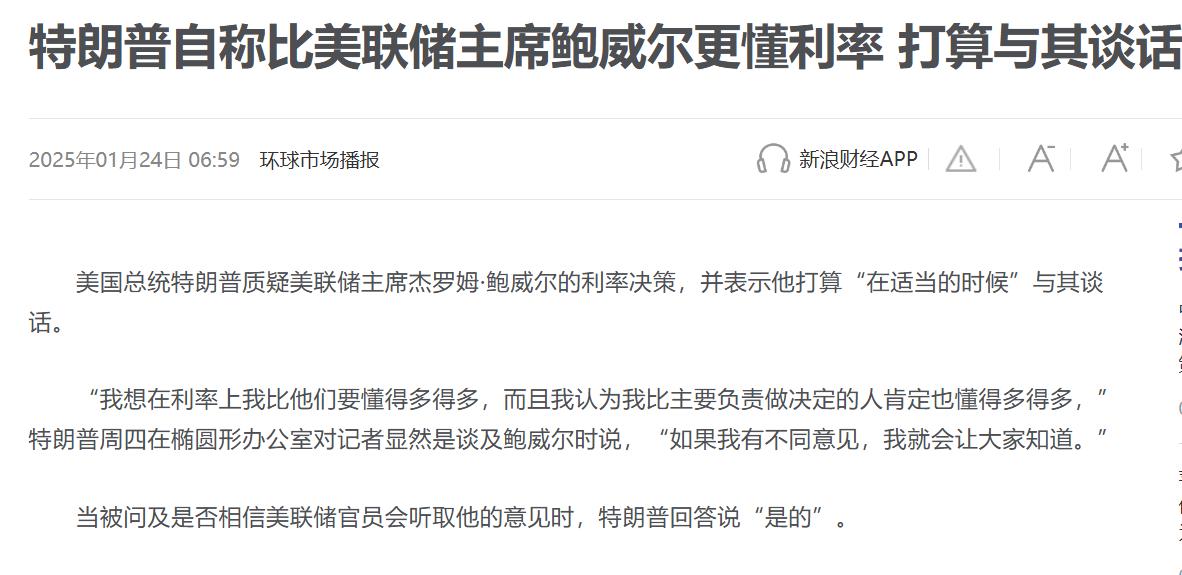

Five years have passed, and I remember that after Trump was re-elected as president this year (2025), he also publicly stated that he understands interest rates better than the Federal Reserve Chairman Powell. As shown in the image below.

However, based on the series of actions taken by Trump in the past two months and the resulting huge market (including US stocks and the crypto market) volatility, it seems that the Federal Reserve still did not "listen to him" this time, and this is also what many people in the market are currently speculating about. Trump is now causing so much trouble just to "force" the Federal Reserve to cut rates.

2. The Impact of Rate Cuts on the Market

Let's continue with the topic of the crypto market.

It was precisely because of the rate cuts in 2020, the extremely low borrowing costs and the larger scale of liquidity that also nurtured the process of a new round of bull market.

But if we look back at the historical price trends, we can also find that the effect of the rate cuts at the time was not immediately reflected in the crypto market, and the big bull market did not break out until 2021. This is actually the point we mentioned in our previous article: the crypto market mainly enjoys the "excess liquidity", that is, the large-scale liquidity brought by the rate cuts will first flow into the traditional markets such as the US stock market, and then the excess liquidity will flow into the high-risk markets like the crypto market.

However, this situation will gradually change, because as more and more large institutions have started to participate deeply in the crypto market in recent years, the crypto market has become more and more synchronized with the US stock market. Once there is large-scale liquidity in the market, some of the funds may choose to flow into the crypto market in advance.

As time moved into 2022, the rate cuts (zero interest rates) also led to a steady rise in US inflation, with the CPI reaching a historic high in 40 years. Therefore, the Federal Reserve restarted a new round of rate hikes, raising rates 6 times in 2022 (in March, May, June, July, September and December), and by July 2023 had raised rates 11 times, reaching 4.33% - 5.50%, the highest level in 20 years. As shown in the image below.

From a time perspective, the 2022-2023 period was also exactly the time when the crypto market was in a new round of bear market.

As time continued into 2024, the Federal Reserve began to cut rates again (starting a new round of rate cuts in September 2024) and injected new liquidity into the market, coupled with the push of macro narratives such as ETFs and the hype of the BTC ecosystem and other internal narratives, the crypto market restarted a new round of bull market.

And we can also see from the continuous growth of stablecoins that some funds have just about started to enter the market on a large scale around that time. What followed is what we have all experienced, such as the large-scale prosperity (price speculation) of MemeCoin, BTC breaking through the $100,000 milestone and continuing to create new highs...

So what will the script be like going forward? I don't know, we need to first focus on the Fed's policy meeting next week (March 19th), as shown in the image below.

However, based on some current forecast data, the expectation of rate cuts in June is still relatively high, as shown in the image below.

Although the expectation of rate cuts this year still exists, but as we can see from the above, the difference between the rate cuts in 2020 and 2025 is that in addition to the different starting interest rates, the biggest difference is the speed of rate cuts. The last round of rate cuts was faster and more aggressive, while this round of rate cuts is currently looking to be a slow and gradual process, unless there is also a larger black swan event, such as the stock market circuit breaker we mentioned in our article a few days ago (March 11).

As we mentioned above, the crypto market mainly enjoys the excess liquidity, and even if this situation may change in the future, if the rate cut process is slow and gradual, then the current crypto market may also see a gradual trend, and this will make trading more difficult and require more caution for ordinary investors, unless there are also extreme conditions, such as:

On the positive side, meeting the other two core factors (narratives and policies) mentioned in our previous article, that is, there are new breakthroughs or innovations within the crypto market (which we currently do not see), or there are major positive policy stimuli, with the policy mainly referring to the US (of course, if a major country in the East can open up, that would be an even bigger positive, but it is currently impossible). On the negative side, the occurrence of a black swan event larger than the trade war, which can directly bring the market to a collapse.

Trump said: Let's make America great again!

The retail investors said: As long as there are rate cuts, even Viagra can do it!