MicroStrategy (MSTR) has amplified the high volatility of Bitcoin and transmitted it to the US stock market through unique financial operations, creating arbitrage opportunities for institutional investors. Retail and long-term shareholders, however, face the risks of violent stock price fluctuations and dilution of equity, in exchange for the long-term appreciation potential of Bitcoin. So, in this leveraged game, who is the biggest winner, and who is silently bearing the losses? The following is the post by F2Pool and Cobo founder Shenyu.

Background

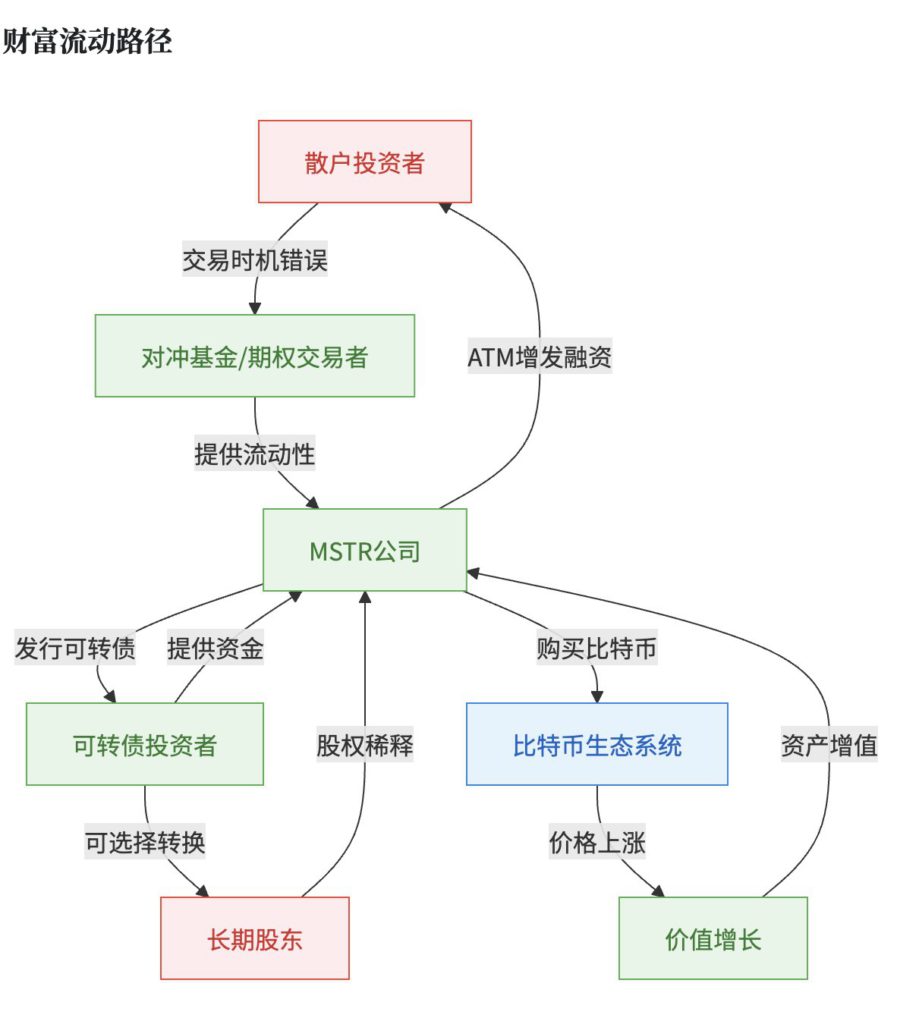

MSTR has cleverly designed to amplify the high volatility of Bit by 2.5 times and transmit it to the US stock market: Professional institutions (hedge funds, bond investors, and option traders) use the high volatility to capture short-term profits through volatility arbitrage.

MSTR company raises cash through the issuance of convertible bonds and ATM offerings to accumulate a large amount of Bit.

Common shareholders bear the risk of violent stock price fluctuations and short-term declines due to high volatility and ATM dilution. They capture the "BTC Yield" of increasing Bit per share, exchanging short-term volatility for long-term holdings.

Bit holders capture the continuous inflow of market funds and the rise in Bit prices.

So the question is,who lost?

Claude provided a response and an illustration: MSTR has established a mechanism to convert the funds of retail and long-term shareholders into Bit holdings, while creating opportunities for volatility arbitrage. Ultimately, the wealth in the system flows from the information-disadvantaged party (retail investors) to the information-advantaged party (hedge funds and MSTR company), while long-term shareholders bet that the long-term appreciation of Bit will offset the high risks and dilution they bear.

Conclusion

MSTR's financial ecosystem is essentially a complex mechanism for the redistribution of risks and returns. The "losses" in the system mainly come from the wealth transfer between participants with information asymmetry, risk tolerance differences, and mismatched time horizons.