Original | Odaily ([@OdailyChina](https://x.com/OdailyChina))

Author | Azuma ([@azuma_eth](https://x.com/azuma_eth))

The market has gradually entered a boring stage, but for arbitrage, there is no such thing as a waste of time.

Over the past three weeks, we have shared three issues of A Lazier's Guide to U-Collateral Finance (February 24), A Lazier's Guide to U-Collateral Finance (March 3), and A Lazier's Guide to U-Collateral Finance (March 10), aiming to cover the relatively low-risk yield strategies (systemic risk can never be completely eliminated) based on stablecoins (and their derivative tokens) in the current market, and help those users who want to gradually scale up their capital through U-collateral finance to find more ideal earning opportunities.

This week, Odaily will continue to focus on the latest developments in the U-collateral finance market.

Basic Rates

Odaily Note: The basic rates temporarily cover the single-token finance solutions on mainstream CEXs, as well as the mainstream DeFi lending, DEX LP, and RWA deposit solutions.

For single-token finance within CEXs, apart from the subsidized portion (generally within 500 U), the rest are still not recommended.

To add, last week, Binance Wallet launched a new token offering for Bubblemaps (BMT), with a single-token yield around 70 USDT - although this does not belong to the finance category, from an arbitrage perspective, this opportunity is a must-participate, and the more the better, as BNB chips can be borrowed from Venus, with the entire daily borrow and repay process almost no loss.

On the DeFi side, the following pools can be considered for active funds.

Fluid deployed to Polygon last week, with the current USDT single-token deposit APR at 11.91% (paid in POL incentives) - Fluid itself, as a mainstream EVM protocol, has certain security guarantees, and the Polygon in-and-out friction is extremely low, which is relatively suitable for low-risk players looking for a higher yield path for their active funds;

Meteora had already withdrawn, but the team reiterated the content of the LP incentives (translation: airdrop) last week, so they went back in again... Although the team has some black history in market manipulation, the product itself is still performing well, and can be considered for investment. By entering through the Kamino Liquidity portal, the Meteora FDUSD-USDC LP is currently reporting an APY of 8.28%, and you can also simultaneously earn Meteora points - Others like the Orca FDUSD-USDT LP have a higher APY (14.78%), but lack the airdrop expectation, the specific trade-off is up to individual preference.

Some other small ecosystems can also earn higher yields, and can simultaneously earn ecosystem or protocol points (airdrop expectations), such as Shadow on Sonic, Kyo on Soneium, and Echelon on Aptos, which have been recommended before, so I won't go into details here.

In addition, the stablecoin project Falcon under DWF can also earn higher yields, but access requires an application to the whitelist, for details see How Falcon Finance Achieves High Yields with 22.6% APY, Backed by DWF Partners.

Pendle Zone

First, let's talk about fixed income. The real-time ranking of PT yield rates in the major ecosystems (Ethereum mainnet, Base, Arbitrum, BNB Chain) on Pendle is as follows.

This weekend (March 23), the third season of Ethena airdrop will end, and users who previously invested in USDe and sUSDe in the form of YT and LP are expected to see the "harvest" results soon, and then consider whether to participate in the fourth season based on the actual earnings.

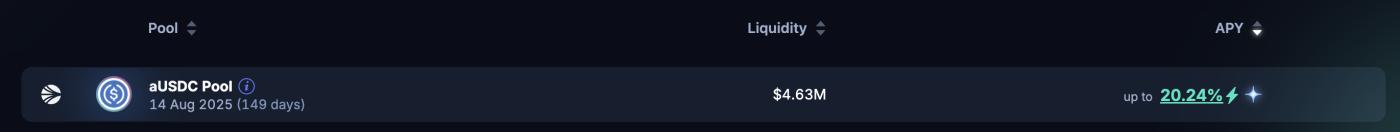

If you are willing to invest your assets in a small-scale ecosystem, forming an LP in the Sonic aUSDC pool can achieve a maximum APY of 20.24% (requires staking PENDLE, without staking the APY is 9.495%), and you can also earn 10x Soinc, which I personally think is the most mindless and relatively efficient way to participate in the Sonic ecosystem at the moment.

Other Opportunities

Let's continue talking about Sonic (and by the way, please fill in an invitation code: OO5ZUD), in my opinion, this has already become one of the most diverse DeFi ecosystems at the moment, with different participation strategies suitable for different risk appetites.

For example, since lending protocols like Silo have started to support some Pendle PTs as collateral, this has brought more recycling lending opportunities for users, thereby achieving higher yields and faster point accumulation.

For example, the recycling lending strategy recommended by @defi_mago: deposit USDC into Rings to exchange for scUSD ➡️ pledge scUSD to exchange for stkscUSD ➡️ pledge stkscUSD again to exchange for wstkscUSD ➡️ exchange wstkscUSD for wstkscUSD PT on Pendle ➡️ pledge wstkscUSD PT as collateral on Silo and borrow USDC ➡️ repeat the cycle, achieving 117% APY (directly citing @defi_mago's data, not personally tested) + multiple points...

Except for DeFi players who are more professional and diligent in monitoring their positions, I personally don't recommend ordinary players to repeat this strategy, as the lengthening of the path and the increase in leverage will inevitably introduce additional risks.

In addition, let's look back at the Noble we mentioned before. Due to the enthusiasm of users to deposit in the points pool, the yield-enhanced pool (Boosted Yield Vault) has already risen to 17.2% (the profits in the points pool cannot be earned, and are transferred to the yield pool)... I personally think it's worth considering diversifying the deposit, both wanting and wanting.

The highlight of this issue is that the derivatives trading protocol Vest launched its points program last week - Vest recently completed a $5 million financing, with investors including BlackRock and Jane Street Group, which is worth looking forward to in the future.

Currently, directly depositing stablecoins into the LP on Vest can earn around 15% APY, and you can also participate in mining points at the first time.

You must have heard about the incident of the whale dumping HLP last week... The founder of Vest explained how to avoid such situations, and you can consider participating based on your own judgment.

Finally, to reiterate, systemic risks in DeFi can never be completely eliminated, so please take your own risks and DYOR.