Author: Aaron Wood Source: Cointelegraph Translator: Shan Eoba, Jinse Finance

With the U.S. Congress relaxing crypto tax reporting obligations, the decentralized finance (DeFi) industry has temporarily breathed a sigh of relief. However, how lawmakers can balance regulatory realities and user privacy needs remains an unresolved issue.

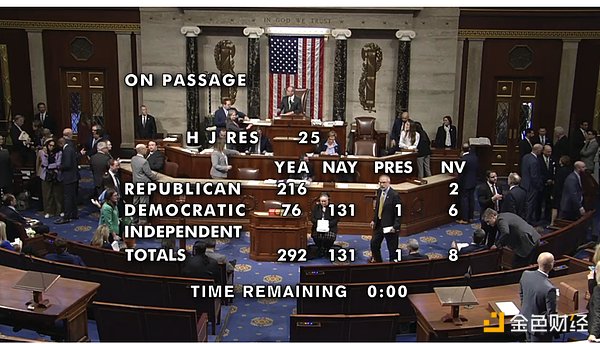

On March 12, the House voted to repeal a rule that would have required DeFi protocols to report to the Internal Revenue Service (IRS) the total proceeds from crypto asset sales and the taxpayer information involved.

The rule was issued by the IRS in December 2024, originally scheduled to take effect in 2027, and major industry lobbying groups felt the rule was too burdensome and exceeded the agency's authority.

The White House has expressed support for the bill. President Trump is ready to sign it when it reaches his desk. But DeFi observers point out that the industry has not yet found the right balance between privacy and regulation.

Bipartisan vote to repeal the rule

DeFi rules raise privacy concerns

The House vote was widely cheered by the crypto industry. Marta Belcher, chair of the Filecoin Foundation, said that blocking the rule was critical to protecting user privacy.

In an interview with Cointelegraph, she said:

"People must be able to use open-source code (like smart contracts and decentralized exchanges) to transact directly and remain anonymous, just as they can with cash."

Privacy issues have been the core reason for the crypto industry's opposition to the rule, with many in the industry believing the regulation does not fit the industry's needs and even violates users' basic privacy rights.

Bill Hughes, senior regulatory affairs advisor at Consensys, warned in December 2024:

"The rule would require transaction front-ends to track and report user activity - not just for U.S. citizens, but for non-U.S. citizens as well... And the rule would apply to sales of all digital assets, including NFTs and stablecoins."

In addition, the Blockchain Association - a major crypto industry lobbying group - also stated that the rule infringes on individual privacy rights and could prompt DeFi projects to migrate overseas.

Although the rule has now been repealed, the market still lacks a clear privacy protection framework. Etherealize CEO Vivek Raman believes this is key to the industry's future development.

He told Cointelegraph: We need a clear blockchain privacy framework that also meets regulatory requirements such as anti-money laundering (AML) and know-your-customer (KYC). Certain transaction and customer data must remain private, but we need clear guidance to define the boundaries of privacy protection.

How to regulate DeFi?

The crypto industry has long been seeking a balance between user privacy needs and regulators' AML and KYC requirements.

However, DeFi's decentralized nature makes regulation extremely challenging. If a network is created by many people but not controlled by any single entity, who should the government pressure?

Raman pointed out: "Decentralized protocols have no central controller, so they cannot file 1099 forms (tax reporting forms) or fulfill broker responsibilities like traditional financial institutions. While companies can operate as brokers, DeFi software itself is not designed for traditional compliance rules."

While DeFi developers can proactively cooperate with regulators, they still face many difficulties in practice. For example, after the $285 million KuCoin hack, some protocols chose to freeze the stolen funds to assist law enforcement investigations. However, this does not replace a comprehensive regulatory framework.

On March 12, the U.S. House of Representatives voted to repeal the IRS crypto tax rule that would have required DeFi protocols to report to the IRS the total income from all crypto transactions and the taxpayer information involved.

The regulation was issued by the IRS in December 2024, originally scheduled to take effect in 2027, but the crypto industry generally believed it imposed an excessive regulatory burden that exceeded the IRS's authority.

The White House has expressed support for the bill to repeal the rule, and President Trump is ready to sign it when it reaches his desk.

However, many DeFi observers point out that although this vote is a victory for the industry, DeFi has not yet found the optimal balance between privacy and compliance.

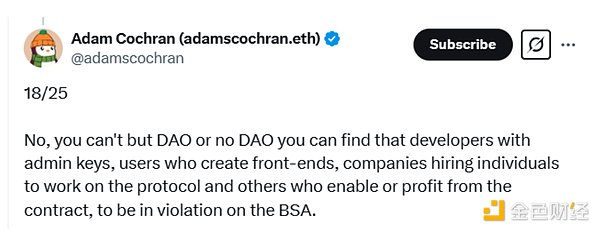

Adam Cochran, partner and advisor at Cinneamhain Ventures, believes that while DeFi protocols can cooperate with law enforcement in certain ways, this does not mean the market has a complete regulatory framework, and regulators still need to develop clearer rules.

However, these specific cases do not constitute a comprehensive regulatory framework that the industry and investor protection agencies can follow.

In this regard, crypto analytics firm Chainalysis stated in 2020 that regulators may need to consider the limitations of decentralized reporting when formulating regulations for the DeFi sector.

Raman suggests that a possible solution may be zero-knowledge proofs, which allow users to confirm certain data without revealing it.

He is optimistic about regulators' ability to find a way to regulate the sector while maintaining user privacy: "I think we'll see a positive-sum environment where DeFi and compliance coexist."

Long-awaited crypto regulatory framework

Trump has taken a series of measures to support cryptocurrencies, including through executive orders and appointing crypto-friendly individuals to lead parts of his administration - the most recent being the establishment of a strategic Bitcoin reserve.

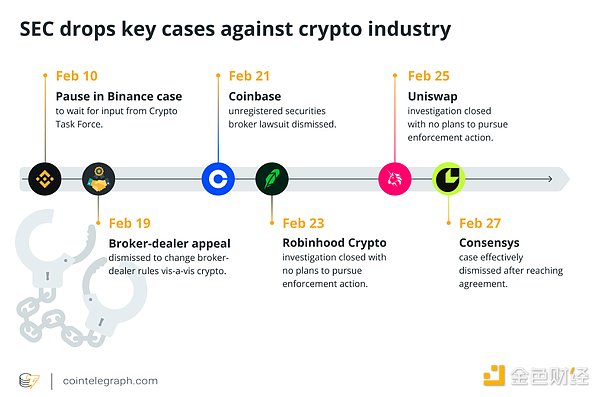

Key financial regulators like the SEC and CFTC have also withdrawn several high-profile enforcement actions against crypto companies, signaling their support for cryptocurrencies.

Notably, the crypto industry is awaiting the crypto regulatory framework and stablecoin bill circulating in Congress, which will provide the guardrails the industry claims it needs to thrive.

On March 13, the Senate Banking Committee approved the stablecoin bill GENIUS Act, bringing it one step closer to a Senate vote.

The crypto framework bill FIT 21 was initially introduced in the 2024 legislative session but ultimately failed in the Senate. However, in February this year, House Financial Services Committee Chair French Hill said he expects the bill to pass this session with "moderate modifications".

But even if FIT 21 is quickly passed, the regulation of DeFi may still be far off. The bill would exclude DeFi from SEC and CFTC oversight, but would also establish a working group to study 12 key areas related to DeFi.

This study will seek to understand the risks and benefits of DeFi and ultimately make regulatory recommendations.