Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

With each cycle of bull and bear markets, a new batch of curious faces emerges. In their eyes, Ethereum is often an important gateway to the crypto world - technologically advanced, with a mature ecosystem, and a stable industry position.

But is the reality really so rosy?

On one side, there is the trust that newcomers have in Ethereum, and on the other, the ruthless indifference of the market. After communicating with several blockchain-specialized university students, we found that there may be a certain disconnect between their expectations and the current state of ETH.

Are these hopeful newcomers the future builders, or ultimately the transient visitors who will be mercilessly eliminated by the market?

Ethereum from the Perspective of Newbies: Trust, Technology, and Understanding

Rabbit

A freshman student in the blockchain major, a complete beginner who has not yet engaged in cryptocurrency or contract trading.

Rabbit currently has not entered the market, as he believes his knowledge reserve is insufficient and he does not dare to invest rashly. However, when it comes to Ethereum, he expresses a natural sense of trust, believing it to be a top-tier project and relatively authoritative.

When asked about the possibility of purchasing ETH in the future, he said he would consider it, as he believes the risk of ETH is lower compared to other cryptocurrencies.

Lucien

A senior student in the blockchain engineering major, mainly focused on smart contract development and the technical aspect, with less understanding of the market. ETH accounts for 20% of his cryptocurrency spot investments. Overall, he is optimistic about Ethereum.

Lucien stated that from his understanding, Ethereum's technology is developing, and Ethereum's development is driving the industry's development. For example, the recent Ethereum upgrade has significantly reduced on-chain gas fees, lowering the interaction cost for users. The improvement proposals in the Cancun upgrade, such as the new operation codes in EIP1153, have also become an important part of Uniswap V4.

However, he also pointed out that Ethereum's framework is relatively mature, and the current improvements are mainly optimizations, so the growth rate is relatively limited.

Vernon

A blockchain engineering graduate who has been in the industry for nearly a year, focusing on meme coins and contract trading, with a preference for short-term operations.

Among all crypto assets, ETH is the only large-cap coin that Vernon has invested in, mainly for wealth management and risk diversification. When asked about the reason for choosing ETH, he said that the price of ETH had fallen significantly when he bought it, and as the current cycle had not yet broken the historical high, he believed there was still room for upside.

Regarding ETH's lackluster performance in this cycle, he expressed understanding and shared a similar view with Lucien - Ethereum's challenge lies in its limited innovation. Nowadays, Ethereum finds it difficult to undergo major reforms, and its innovation pace has become cautious and fragmented.

The three newcomers in this exchange, though with different perspectives, all have a positive sentiment towards Ethereum and recognize its value. In other words, Ethereum's "public relations" in the newbie circle remains strong, like the "friendly big brother" in the crypto world. However, the ideal may be rosy, but the reality may not be as optimistic as they wish, and the current state of Ethereum may not be as bright as the newcomers perceive.

The Reality of Ethereum: How Long Can the Faith Last?

Weakening New Demand for ETH

Crypto KOL Murphy published an article revealing the current state of investors based on ETH data: high-position investors are adding positions, but new demand for ETH is weakening. After ETH fell below $2,000, there has been almost no new buying power.

The recent cost basis distribution (CBD) of ETH shows two main holding groups:

- High-position accumulation group ($3,200-$3,500): These investors did not sell during the dip to $1,900, and have continued to accumulate, demonstrating strong faith and holding intentions.

- Mid-position reduction group ($2,600-$2,800): This group of holders have gradually reduced their positions after ETH fell below $2,300, with only a portion of their holdings still remaining.

ETH's CBD data over the past 3 months

The Controversy of ETH's "Deflationary Failure"

Peking University doctoral student Hu Yilin published an article stating that the so-called "deflation" of ETH is essentially a failed design. Under the PoS mechanism, even if the total supply of ETH is decreasing, it does not necessarily mean fair or healthy development.

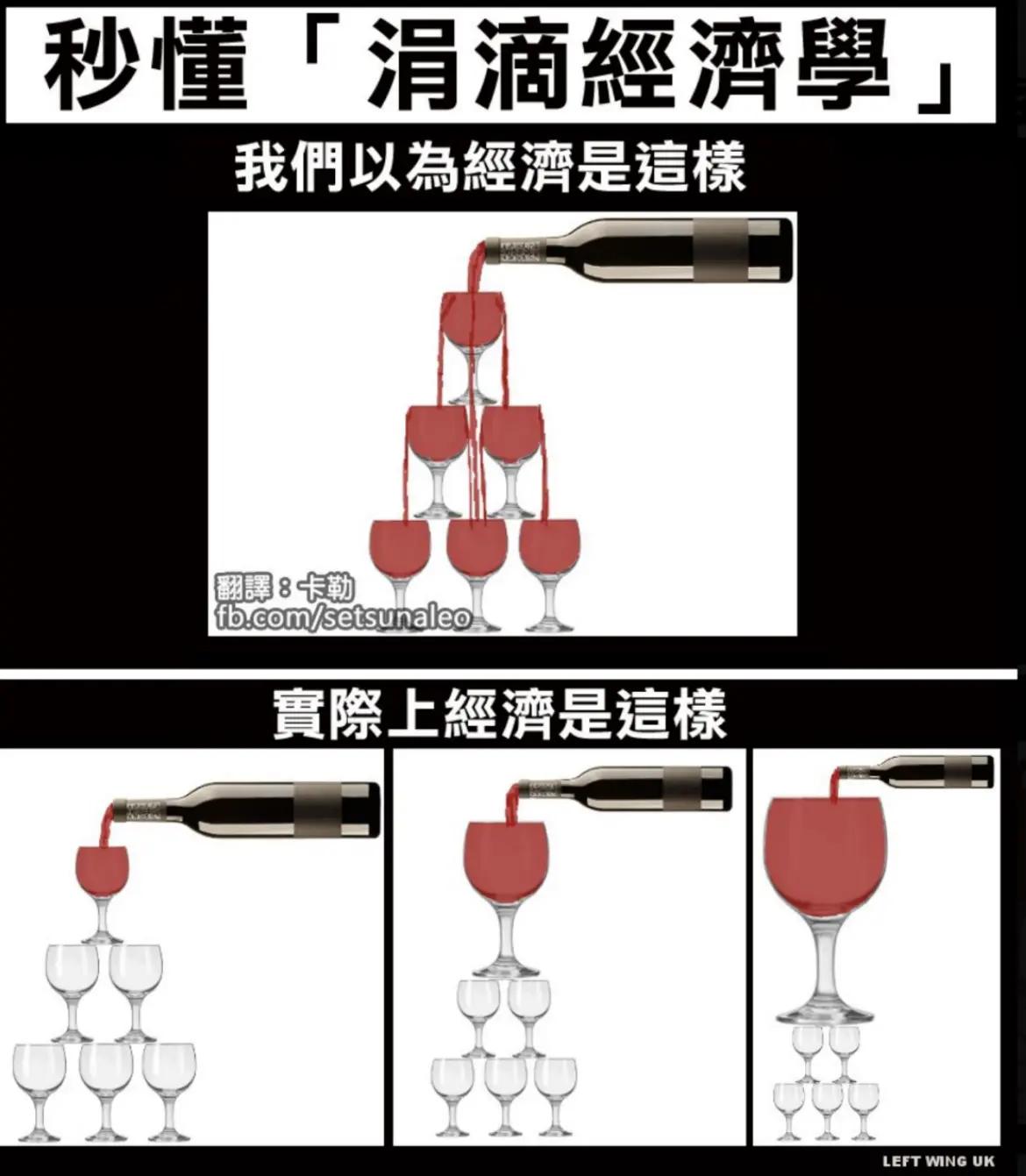

He pointed out that Ethereum's economic model has structural inequality - stakers are always the "inflating" party, while frequent traders bear the "deflationary" cost. The rich, vested interests, and old money always sit comfortably in the profit zone, and the more active the network transactions, the more ETH is burned, the more they benefit. For newcomers, small investors, and bottom-level traders, the more frequent the transactions, the heavier the gas fee burden, and they are further squeezed by the deflationary mechanism.

Hu Yilin incisively summarized: In the ETH system, the old money not only can risk-free outperform inflation, but also enjoy interest; even under the deflationary mechanism, the "faucet" above the old money's head not only has not been turned off, but has become even more forceful.

Whales Exiting Frequently

According to on-chain analyst Ali, whales have sold nearly 130,000 ETH in the past week.

- On March 13, the whale address ..eCa41 cleared its position and sold 6,401 ETH bought in December 2023, incurring a loss of $1.974 million.

- On March 14, an ETH whale deposited 16,467 ETH to HTX after holding for 25 years, potentially realizing a profit of $13.1 million.

- On March 17, a wallet that had been dormant for 3 years sold all of its 67 ETH (worth $192,000), making only $126,000 in profit.

- ...

Don't Let Faith Become a Massacre

The world is bustling, all for the sake of profit.

Ethereum's years of accumulated brand, technology, and ecosystem have shaped its trust in the eyes of newcomers, making them willing to take root, learn, try, and explore here.

But the market is ruthless...

Ethereum, don't let them ultimately only learn one thing - "to run fast".