Author: ChandlerZ, Foresight News

On March 17, Binance Wallet announced the launch of a six-month zero-fee trading event, applicable to all trading pairs within the Binance Wallet. The event will last until 16:00 on September 17, 2025. During the event, all transactions completed through the exchange and cross-chain bridge functions in the Binance Wallet or the quick purchase function of Binance Alpha will be exempt from transaction fees, but users will still need to pay the network Gas fee. However, transactions made through third-party dApps are not within the scope of the event.

According to the market page on the Binance main site, Binance has added an Alpha section on its official website, where users can purchase assets on the BNB Chain and Ethereum Chain using USDT, and purchase assets on the Solana and Base Chain using USDC, but currently cannot switch to other purchase methods.

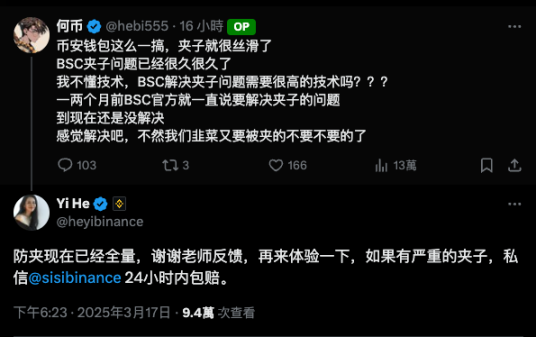

In addition, in response to the community's long-standing "sandwich" problem that has plagued users of the BSC ecosystem, Binance co-founder He Yi replied on social media that "anti-sandwich has been fully launched on the BNB Chain, and if there is a serious sandwich, it will be compensated within 24 hours."

BSC ecosystem tokens surge

Under the new hype, the market reacted quickly and strongly. Among them, BSC-based tokens surged, with the recent BNB Chain-based leading MEME MUBARAK reaching a market cap of over $200 million, a new high, currently priced at 0.21 USDT.

BNX rose 12.93% in 24 hours, currently priced at $1.7852; CAKE rose 23.98% in 24 hours, currently priced at $2.51; 1000Chems rose 30.4% in 24 hours, currently priced at $0.0013; BAKE rose 1.46% in 24 hours, currently priced at $0.1327;

In addition, the Binance Alpha section also saw varying degrees of increase, with BMT up 121.74% in 24 hours, currently priced at $0.20; JELLYJELLY up 40.28% in 24 hours, currently priced at $0.02; AVL up 4.64% in 24 hours, currently priced at $0.4496.

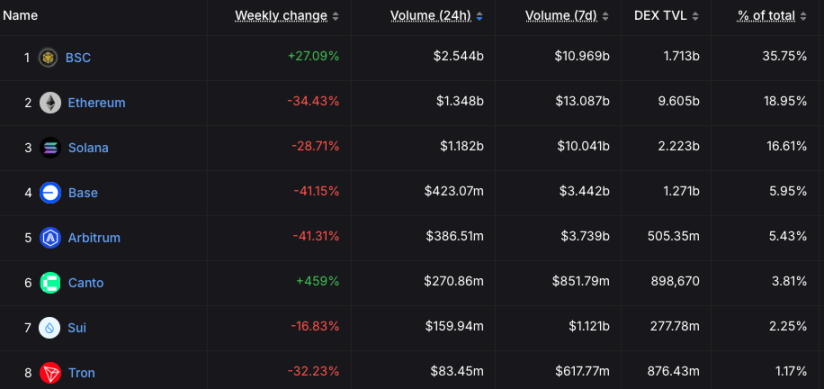

According to DeFiLlama data, the trading volume of BSC ecosystem DEXs reached $2.544 billion in the past 24 hours, surpassing Solana to take the top spot, with a weekly growth of 27.09%. In addition, the BSC ecosystem's leading DEX protocol PancakeSwap has become the DEX protocol with the highest trading volume in the past 24 hours, reflecting the market's positive expectations for the new BSC ecosystem, and capital is flowing back into the BSC ecosystem.

Three moves to revitalize the BNB Chain

As the competition among Layer 1 public chains intensifies, the BSC ecosystem is facing strong competition from Solana, Ethereum, and emerging public chains like Base. Data shows that BSC's DeFi TVL and daily trading volume have declined previously. In addition, the "sandwich attack" problem has long plagued BSC users, affecting user experience and ecosystem development. Recently, He Yi has frequently appeared in public and actively demonstrated investment actions, such as his personal wallet purchasing the MUBARAK token. This series of actions, through symbolic significance, guides market expectations and user enthusiasm, strategically promoting the revival of the ecosystem.

Binance has recently launched a series of strategies, with three moves to deeply revitalize the BNB Chain ecosystem.

On the one hand, the zero-fee policy launched by the Binance Wallet for six months aims to activate the trading activity and capital circulation of users entering the on-chain transactions. During the temporary suspension of the DEX aggregator service by OKX Wallet, the liquidity strategy targeting the BNB Chain ecosystem may bring positive market effects, driving the sustained improvement of the overall activity of the ecosystem.

On the other hand, in response to the long-standing transaction experience issues in the BNB Chain ecosystem, especially the "sandwich attack", Binance has designed and implemented the "full anti-sandwich + 24-hour compensation" mechanism. The core of this strategy is to strengthen the guarantee of user transaction security, reduce the psychological burden of users facing transaction risks, and thus rebuild the trust relationship between users and the ecosystem.

It is worth noting that the launch of the Binance Alpha asset section further expands the channels for capital to enter the on-chain ecosystem. Centralized exchange users can directly invest in small-cap tokens on the chain using stablecoins, greatly simplifying the user's asset management and trading steps, forming an efficient on-chain and off-chain capital circulation. This innovative mechanism can effectively strengthen the interconnection of capital between the Binance main site and the on-chain ecosystem, thereby enhancing the ecosystem's ability to absorb liquidity resources, ultimately realizing the efficiency of internal capital circulation and resource allocation within the ecosystem, and promoting the sustainable development of the ecosystem.

Is it the return of the "BSC Summer" or a wave?

Although Binance has effectively activated the market in the short term through the above strategies, in the long run, whether the Binance ecosystem can continue to develop in a healthy manner remains to be further verified. The cyclical attenuation risk often exists in the heat brought by simple liquidity stimulation and marketing effects. Once the heat gradually fades, if the ecosystem lacks solid fundamentals, investor sentiment may cool down quickly.

From the perspective of community and governance, Binance has temporarily reduced the user threshold through innovative policies, temporarily boosting user activity, but the long-term resilience and vitality of the ecosystem ultimately depend on sustainable governance structures and community consensus. The possibility of the return of the "BSC Summer" ultimately requires Binance to shift from short-term marketing and liquidity-oriented strategies to more solid community governance, economic model iteration, and technological innovation in its long-term strategic layout. Whether the short-term heat can be transformed into long-term ecosystem value will become an important topic in Binance's next stage of strategic layout.