Author: Tanay Ved, Coin Metrics Analyst; Compiled by: Jinse Finance xiaozou

Abstract:

The crypto market is under dual pressure from macroeconomic headwinds and industry-specific challenges, leading to increased volatility.

Bitcoin remains largely uncorrelated with traditional assets (such as gold) and the S&P 500 index, highlighting its unique positioning in the current macroeconomic environment.

Bitcoin's dominance continues to rise, reinforcing a market structure driven by institutional capital, while retail participation remains relatively low.

Market conditions remain uncertain, but improvements in macroeconomic dynamics, regulatory clarity, and changes in capital flows could lay a solid foundation for long-term market growth.

1. Introduction

Buffeted by waves of volatility and uncertainty, the digital asset market is caught in the crosshairs of macroeconomic pressures and crypto-specific factors. Just a few weeks ago, BTC was consolidating around $100,000, and market participants were optimistic about a new wave of growth supported by stronger government and structural catalysts. Now, with BTC hovering around $80,000, the market sentiment has clearly shifted. Speculative activity has cooled, the Bybit hacking incident has heightened unease, and economic uncertainty has dampened risk appetite. However, there are still positive developments, such as the establishment of a Bitcoin strategic reserve in the US and the constructive shift in the regulatory approach to the crypto industry.

In this article, we will assess the drivers behind the recent crypto market weakness and explore our position in the broader market cycle, discussing the macroeconomic and crypto-specific factors that will shape the path forward.

2. Macroeconomic Factors Take the Lead

Both the broader equity markets and crypto assets have experienced turbulent months, erasing the post-election gains. The primary driver of this volatility is the intensifying macroeconomic pressures, manifested in Trump's aggressive trade policies, retaliatory measures by the US's major trading partners, and the escalating geopolitical tensions - all of which have created an environment of uncertainty, suppressing inflation expectations and economic growth.

Despite some positive developments, such as the establishment of a Bitcoin strategic reserve before the White House's first crypto summit, the SEC's withdrawal of high-profile lawsuits, and the growth of institutional momentum, the macroeconomic headwinds and recent industry-specific challenges have continued to weigh on the digital asset market.

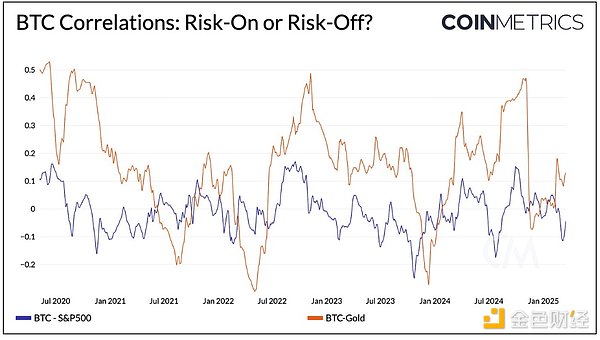

In the current uncertain market environment, gold has surged above $3,000, with investors flocking to this primary safe-haven asset. Meanwhile, the S&P 500 and Nasdaq Composite indices have declined by 3.8% and 8.2% year-to-date, respectively, as risk appetite wanes. However, Bitcoin seems to be caught between these two forces. Although often viewed as "digital gold" and a hedge against inflation or market instability, BTC has not yet established a meaningful correlation with gold, and its 90-day correlation with the S&P 500 and gold remains weak (around 0), pointing to its lack of correlation and ambiguous role in the current market dynamics.

3. Internal Factors in the Crypto Market

(1) Where are the retail investors?

While the larger macroeconomic forces are playing a primary role, the inherent dynamics of crypto assets continue to shape the market in a unique way. Bitcoin (BTC) remains the key market driver and a barometer of overall risk appetite. Bitcoin's dominance (the measure of its market capitalization as a percentage of the entire crypto market) has steadily risen from 37% in November 2022 to 61% today. Although this is a characteristic of past cycles, structural changes such as the launch of spot Bitcoin ETFs and the demand from holders like MicroStrategy have amplified this Bitcoin-driven market structure.

The dominance of Altcoins has approached 39%. While the decline in Bitcoin's dominance has historically signaled a rotation of funds into Altcoins, marking the start of an "Altcoin season," the reversal of the current trend remains elusive. The persistent weakness in Altcoins may reflect the growing divergence between institutional and retail sentiment, which is also evident in spot trading volumes. Although Altcoins have generally struggled to keep pace, meme coins have become the preferred tool for retail speculation. However, the recent cooling in this space has further dampened retail sentiment.

The dominance of Altcoins has approached 39%. While the decline in Bitcoin's dominance has historically signaled a rotation of funds into Altcoins, marking the start of an "Altcoin season," the reversal of the current trend remains elusive. The persistent weakness in Altcoins may reflect the growing divergence between institutional and retail sentiment, which is also evident in spot trading volumes. Although Altcoins have generally struggled to keep pace, meme coins have become the preferred tool for retail speculation. However, the recent cooling in this space has further dampened retail sentiment.

(2) ETH's Underperformance and Altcoin Divergence

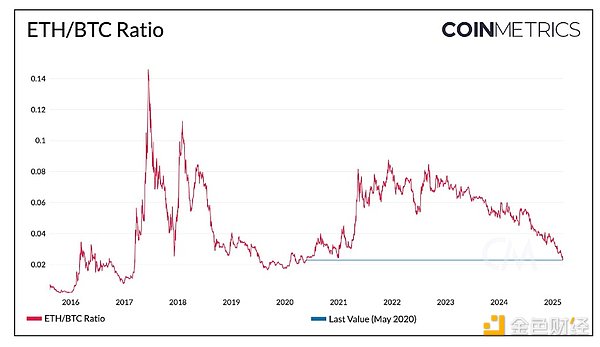

Another factor is the continued underperformance of Ethereum (ETH) relative to Bitcoin (BTC). Historically, changes in the ETH/BTC ratio have correlated with shifts in Altcoin dominance, with the reversal of ETH/BTC weakness in 2017, 2018, and 2021 coinciding with the rise in Altcoin dominance. Currently, the ETH/BTC ratio stands at 0.022, back to the levels seen in May 2020.

While this underperformance can be attributed to Ethereum's own challenges, such as reduced L1 activity, value accrual in L2s, and competition from other L1s, it has also suppressed the broader Altcoin sentiment. A reversal in the ETH/BTC ratio, along with improvements in the macroeconomic outlook and regulatory clarity, could potentially serve as a catalyst for Altcoins, especially those with more solid foundations and clearer investment themes in areas of structural growth.

3. Increased Volatility and Leverage Reset

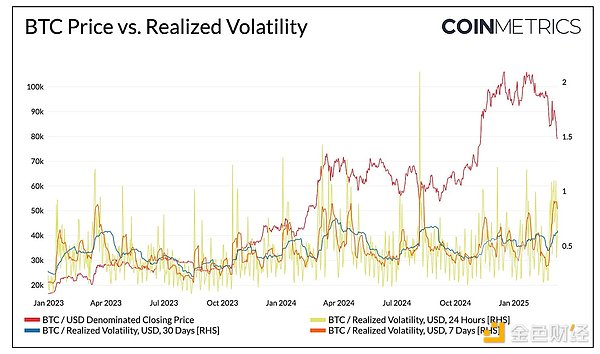

BTC is volatile. While BTC's volatility has moderated over time, it remains prone to significant drawdowns and price fluctuations. Recently, we have seen daily volatility on the rise, with BTC's 7-day realized volatility reaching 0.9 amid a roughly 25% decline.

This volatility has recently triggered a wave of liquidations in the spot and derivatives markets. However, the Bitcoin futures market indicates that positions are healthier compared to a few months ago. Open interest has declined to pre-November election levels, suggesting that excess leverage has been flushed out. The ratio of open interest to market capitalization has also decreased, indicating that speculative positions have been reset. This provides a more stable foundation for the next phase of growth.

4. Where Are We in the Cycle? What's Next?

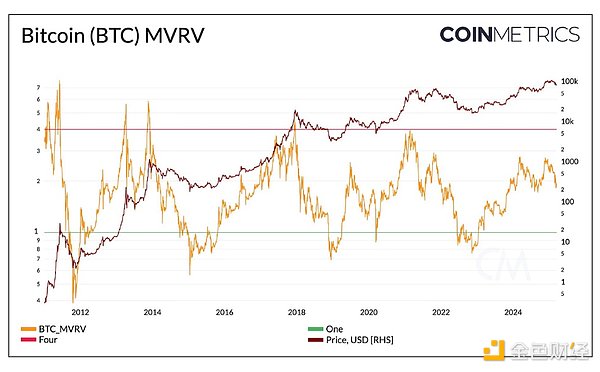

Given the current environment, where are we relative to the previous "cycle"? Among the many indicators, Bitcoin's MVRV ratio (a measure of Bitcoin's market value relative to its realized value - the sum of the last on-chain transfer price for each coin) can serve as a useful metric for cycle positioning. Historically, high ratios (>3.5) have indicated market overheating, while low ratios (1) have signaled attractive accumulation zones.

Currently, Bitcoin's MVRV ratio stands at 1.9, having peaked near 2.65 at the start of the year. This places it above the bear market lows but below the past cycle peaks, suggesting we are in a mid-cycle reset phase. While historical trends provide a useful framework, structural changes (such as ETF-driven demand, the evolution of investor profiles, and regulatory clarity) may reshape the development of this cycle and our understanding relative to past cycles.

Looking ahead, the medium to long-term outlook remains optimistic. Expectations for highly supportive governments and the SEC are being realized. Regulatory clarity in areas such as custody and bank participation, stablecoins, and the tokenization of real-world assets (RWAs) could unleash a wave of widespread adoption.

Although the macroeconomic outlook remains uncertain, the foundation has been laid, and with the implementation of structural changes, interest rate cuts and a new round of liquidity may help drive the next stage of market growth.