In the early morning of March 20 Beijing time, the Federal Reserve will announce its latest interest rate decision, and then Chairman Powell will hold a press conference, with the global market holding its breath.

The financial markets are facing many uncertainties. The special feature of this meeting is that it will comprehensively evaluate the impact of a series of new policies of the Trump administration on the US economy, and the Federal Reserve's policymakers will discuss the progress of inflation control and decide whether to adjust monetary policy.

The market has been under pressure in advance, and Bitcoin has consolidated and fallen back

The optimistic sentiment only lasted a few days, and the risk market fell back again before the Federal Reserve's interest rate meeting. As of the time of writing, the price of Bitcoin is around $82,715, down 1.5% in the past 24 hours.

Mainstream cryptocurrencies such as Solana, Ethereum and XRP have seen more significant declines. The US stock market is also under pressure, with the Nasdaq Composite Index and the S&P 500 Index both declining. Market concerns about the Federal Reserve not immediately easing policy are intensifying, although inflation data in February has slowed, the magnitude is not significant, and it is only a single-month data.

The Federal Reserve is most likely to remain unchanged, but the "dot plot" is hiding mysteries

The market generally expects that the Federal Reserve will maintain the current federal funds rate target range of 4.25%-4.50% unchanged this time. According to the FedWatch tool from CME Group, traders believe the possibility of a rate cut in March is negligible.

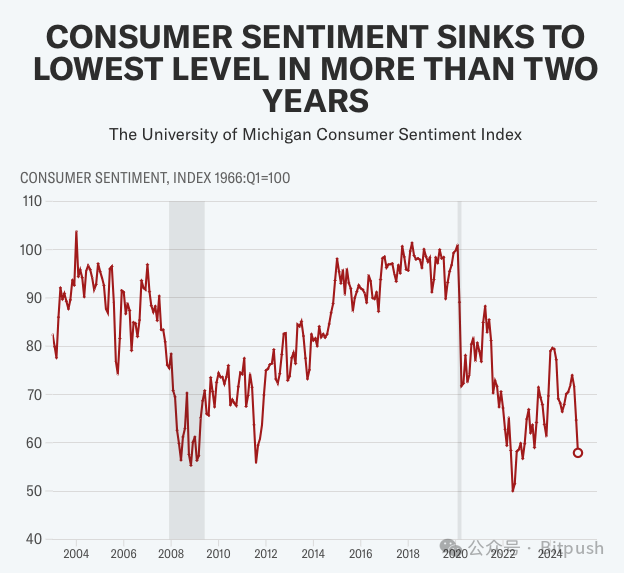

Previously, Federal Reserve officials have repeatedly emphasized that they will adopt a "wait-and-see" attitude, partly because President Trump's economic policies have brought significant uncertainty, which has begun to affect corporate and consumer confidence, and has triggered stock market declines and concerns about economic recession.

The focus of this meeting will be the "Summary of Economic Projections" released along with the policy statement, especially the closely watched "dot plot". This chart will show the median forecast of the 19 committee members on the future federal funds rate, which is an important basis for the market to speculate on the future interest rate path.

Although Nomura Securities analysts expect that the median forecast in the "dot plot" this time will not change much, considering the tense market sentiment and the uncertainty about future rate cut expectations, any slight adjustment may trigger violent market fluctuations.

Under the "policy fog" of Trump: the shadow of stagflation looms, Wall Street sounds the alarm

Recent economic data and market sentiment all show that analysts are beginning to worry about the risk of "stagflation", which means that if bad news emerges in the future, the US stock market may also fall.

In simple terms, everyone is worried that Trump's policies may slow economic growth, while prices are still rising, which is "stagflation". Wall Street institutions have already started to worry about this and adjust their expectations.

Several institutions, including JPMorgan Chase, Goldman Sachs and Morgan Stanley, have recently lowered their economic growth forecasts for the United States, mainly because they believe that the Trump administration's restrictive trade and immigration policies may have an adverse impact on the economy.

Looking at inflation, although the price index in February showed that inflation has slowed, Goldman Sachs' economists pointed out that considering that the Trump administration has already started to impose tariffs, and may further increase in the future, the Federal Reserve may have to re-evaluate their inflation forecasts. Goldman Sachs even predicted that in the Federal Reserve's 2025 economic forecast, the core inflation rate may be revised upward to 2.8%, while the GDP growth rate may be revised downward to 1.8%, mainly due to the impact of tariff policies.

How do the Federal Reserve's expectations affect the crypto market nerves?

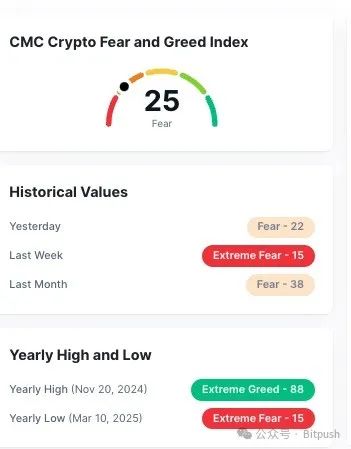

Cryptocurrencies such as Bitcoin are often seen as "risk assets", and their price trends are closely related to investors' risk appetite. In a high-interest rate environment, relatively safe assets such as bonds are more attractive, which may lead to capital outflows from high-risk assets such as cryptocurrencies. Currently, the price of Bitcoin is hovering around $83,000, and the market sentiment index is still in the "fear" range, which may mean that the market has already anticipated potential negative news.

According to the forecasts of Polymarket participants, economic uncertainty and global tensions may exacerbate the bearish pressure on the cryptocurrency market. Polymarket data shows that the probability of Bitcoin's closing price this week being between $81,000 and $87,000 is 51%.

Summary

The Federal Reserve's policy statement and Powell's speech will undoubtedly set the tone for the short-term direction of the cryptocurrency market. Dovish signals may ignite hopes for a market rebound, while hawkish positions may prolong the current downward trend. In a market where sentiment is already quite pessimistic, any slightly positive signal could become a catalyst for price increases. However, for cryptocurrency investors, maintaining vigilance and caution is always the best strategy to deal with market volatility.