Author: BUBBLE

Supported by three rounds of Meme hype, BSC has evolved from CZ's retweet supporting the "Happy Trading" single-point attack of newbies, to now becoming the "outer armor" that connects the liquidity of exchanges, and the "veteran" who is familiar with market sentiment and can freely adjust the market sentiment. What has BSC done? Why is it most likely to replicate Solana?

Testing starts with "test tokens"

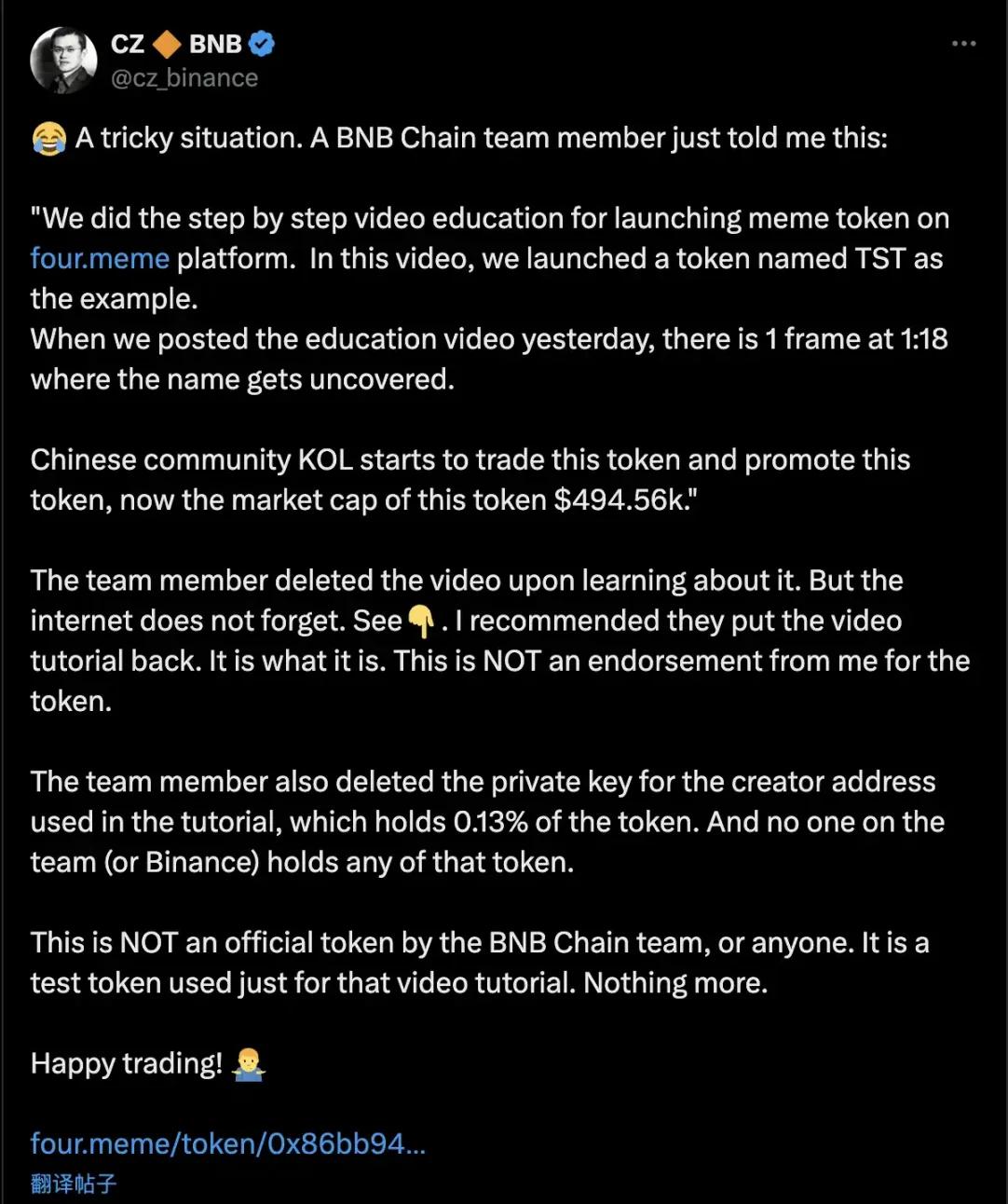

The growth of BSC's Meme tactics can be divided into three parts. On February 5th, the BNB chain team released a promotional video for Four.meme containing test tokens. Such test tokens being hyped by the market is not uncommon, including the previous pumpfun or demo videos of various Dexes. The strange thing is the attitude of CZ, who has never played Meme. The next day, CZ retweeted the video and explained the situation, and his solution can be summarized in one sentence: "Happy Trading".

The gears of fate started turning from then on. The market's reaction to the industry's top influencer's first Meme shill was to push the market cap of the token to $50 million on the same day, and when it was listed on Binance three days later, $Tst directly pushed its ATH to $600 million. This wealth effect caused the trading volume of BSC's Dexes to grow by more than 3 times, but the wave did not last long.

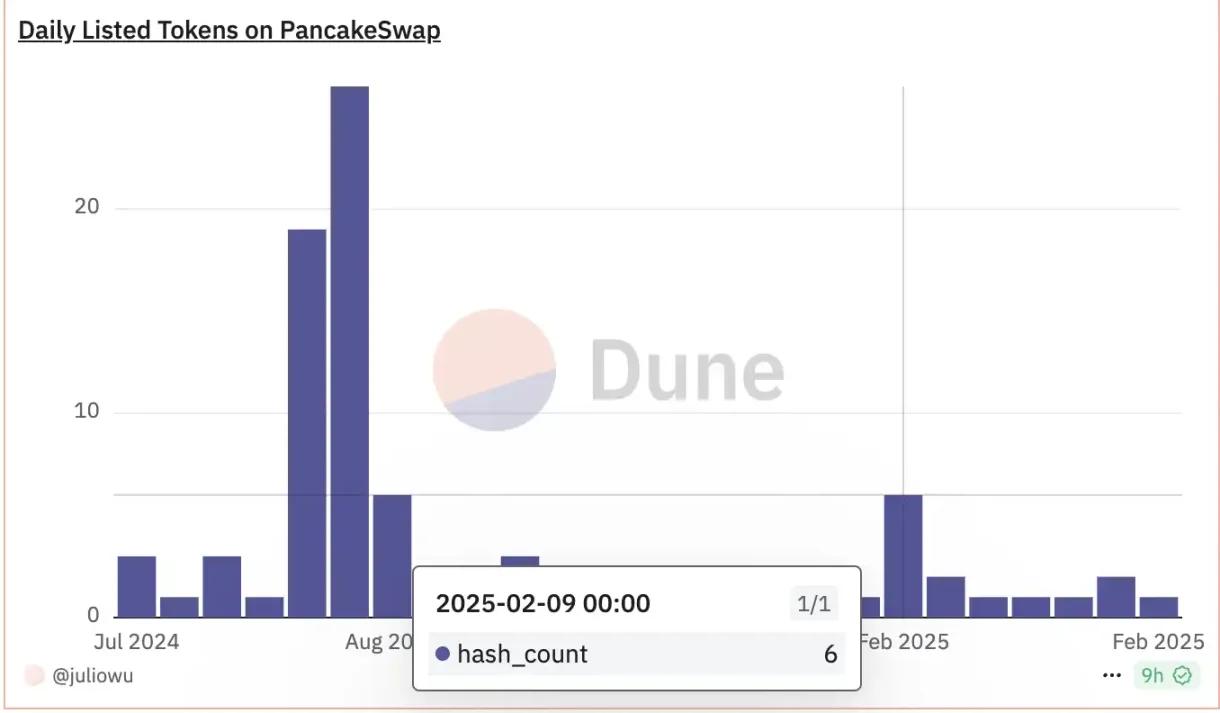

However, at this stage, CZ's Meme tactics were still immature. He underestimated the appeal of his own rhetoric, trying to end it lightly with "Happy Trading", but failed to control the spread of the market's FOMO sentiment. After $TST was listed on Binance, its liquidity did not continue to grow, but was seen as a short-lived attention economy carnival. Judging from the fact that only 10 tokens were successfully launched on the Four.meme platform that week, CZ's initial "test" did not bring long-term vitality to the BSC ecosystem. This shows that he is still in the exploratory stage in terms of grasping the community-driven nature and market rhythm of Meme coins.

But what really sparks the imagination is the change in Binance's attitude towards Meme. Compared to the previous cautious Bsc Meme to avoid suspicion, this time "Binance can even pull the test coins onto the exchange, what about other Memecoins?" planted a seed in the community's mind, how high can the liquidity that the No. 1 Cex bring to Meme? This got an answer a few days later.

Dogs are a must-take course

On the morning of February 13th, CZ tweeted that he was curious about the operating mechanism of MEME coins, asking if just sharing pet names and photos would lead to the creation of related tokens, and questioning how to distinguish the "official" version. After understanding the relevant mechanism, CZ said "the way things work is interesting. Like handling major decisions, I need to consider for about a day. Should I respect his privacy, or make the dog information public for everyone? Okay, I might even interact with a few MEME coins on the BNB Chain."

When someone suggested using random dog photos, CZ responded that no, that would be deception. If you're going to do it, do it right. It's just sharing a dog photo and name.

Subsequently, the entire network began guessing the name of CZ's pet dog and began ambushing related MEME coins in an attempt to "occupy seats" early, with a few token market caps even being pushed up thousands or even hundreds of millions of dollars. And that night, CZ previewed that he would release the dog's photo in about 3 hours (around 8pm Dubai time), whetting the appetite of MEME players.

After hours of waiting, CZ finally announced the pet dog Broccoli's photo and their story in the early morning of February 14th, and he also said, "I just posted a photo and name of my dog. I won't personally issue Meme coins. It's up to the community to do so. The BNB Foundation may provide rewards, LP support or other incentives for top MEME on the BNB Chain. Details are still being discussed. More content to come."

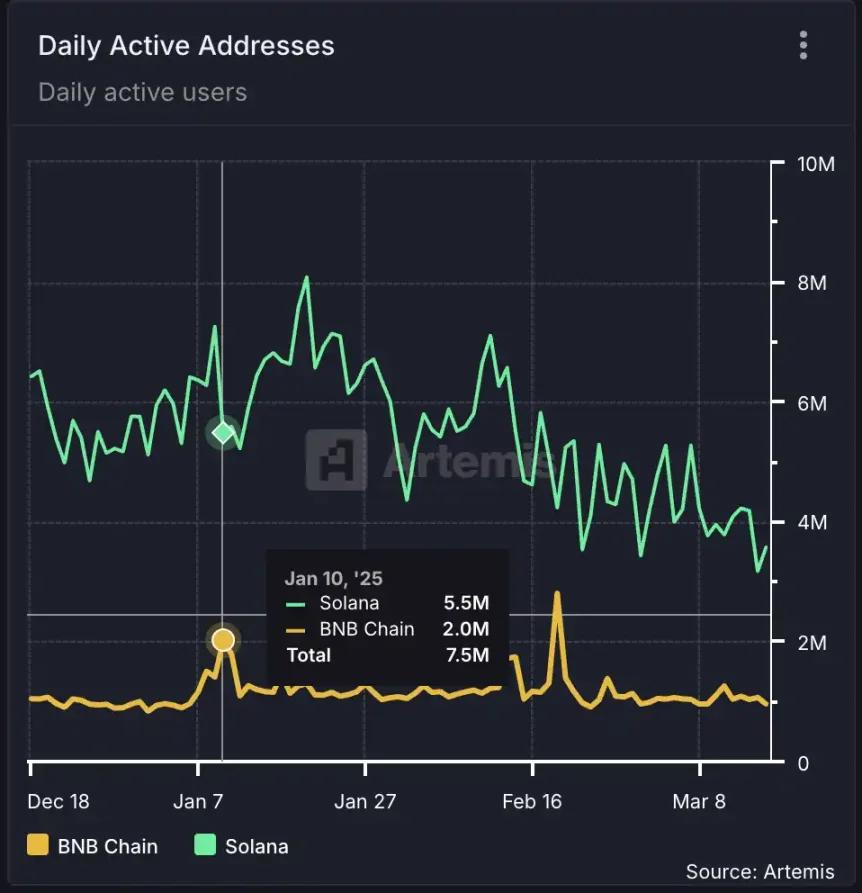

Subsequently, a crazy scene emerged on the BNB Chain. Thousands of MEME coins named after Broccoli instantly appeared, to the extent that a "CZ's Dog" section even appeared in the Binance Web3 wallet. Investors were dazzled, followed by an on-chain PVP battle and rug pull performance contest themed around Broccoli "broccoli". BNB Chain underwent a large-scale stress test, but the results were not optimistic. BNB Chain did not withstand this wave of stress testing, with congested networks, lagging front-ends, and scattered gas fees. The Meme players who came from the smooth Solana directly complained about the poor experience.

As AC Bro commented, since CZ did not disclose the CA "contract address", the Meme that was originally intended to let the community grow itself directly led to heavy losses for retail investors on BSC, and the highest market cap of the many Broccoli coins was only in the hundreds of millions of dollars. Although market participation was high, the funds were highly dispersed and failed to form a highly consensual leading project. Instead, it allowed liquidity to be transferred to the pockets of developers and insiders, with a lot of crypto honeypots and insider trading involved, and investors becoming the victims of liquidity withdrawal. According to on-chain data analyst Yu Jian's monitoring, there was a Broccoli creator on BNBChain who only spent 1 BNB to make a profit of $6.72 million, creating a 9517x return in 24 minutes.

In this round, the "intern" CZ's progress in BSC Meme manipulation has limitations. He began to understand the cultural attributes of Meme, using previews and story-based tweets to mobilize community sentiment, showing higher participation than the $Tst period. However, he still failed to master how to guide market consensus, listing multiple same-named tickers on Binance Alpha, causing serious dilution of token homogeneity. And the poor basic infrastructure caused the BSC network to be congested due to high concurrent transactions, and the MEV situation was serious, and the bad experience failed to form a smooth Meme ecosystem like Solana.

CZ later reflected that this was an unexpected "stress test", admitting that BSC still has shortcomings in scalability and community guidance. This experience made him realize that Meme not only needs hype, but also infrastructure support and clear guidance. This social experiment has indeed brought some on-chain education reflections to BSC, and they should deeply realize that to promote on-chain culture, they need to improve basic infrastructure, cultural education, community guidance, and even the impact of the "freedom of speech" of leaders.

Culture, characters and infrastructure, the three-piece suit of meme

In the following month, due to the continued bearish market, BSC had time to improve some of the problems encountered in the previous "stress test". Just before the "Mubarak" event, everything was ready.

They completed the distribution of the previous $4.4 million liquidity incentive plan to the top Meme, and announced the launch of the second round of liquidity incentive plan three days later on March 10th. Previously, CZ personally got involved in on-chain products, and the "rookie" CZ only knew the problems after using his own Dex. In March, they launched the Pascal hard fork test, introducing gas abstraction, smart contract wallets, bundled transactions, and repeatedly published articles determined to thoroughly improve the malicious MEV.

After all this preparation, a new round of "stress test" came. With CZ's retweet with the caption "Mubarak", the third wave after the "test concept" and "broccoli concept" officially kicked off, the global "Middle East concept" of the richest. About the "Mubarak" event, BlockBeats has also reported relevant content, so I won't repeat it here.

Further reading: "Mubarak Surged 1300% on the Weekend, CZ Gave BSC a Few More A8 Players | 100x Recap"

Here is the English translation:This market has a positive attitude towards CZ's Meme Szn operation this time, and it is more about the grasp of the rhythm, which is completely different from the previous ones. First, the news of MGX investing in Binance attracted everyone's attention. Coupled with Binance's Chinese Twitter account, CZ's "conjuring" the "Middle East" concept of Mubarak, He Yi and the simple and easy-to-understand IP image "Palu" interacted. Later, CZ quickly interacted with one of the Mubarak community members on Twitter, avoiding the chaos of the previous Broccoli period. At important time points, he used very clever positive news to push Mubarak to a new height. This triggered a broader Meme Season, and after Mubarak went online on Binance's contract, it brought Binance Alpha2.0 and the launch of the "BNB Goodwill Alliance" to resist Mev.

More unofficial and spontaneous infrastructure has also begun to appear, such as Flap taking over the "DDDD" hot spot of He Yi when Four.meme was paralyzed, and the new token launch mode FairMint, etc. More and more infrastructure is appearing in this cycle.

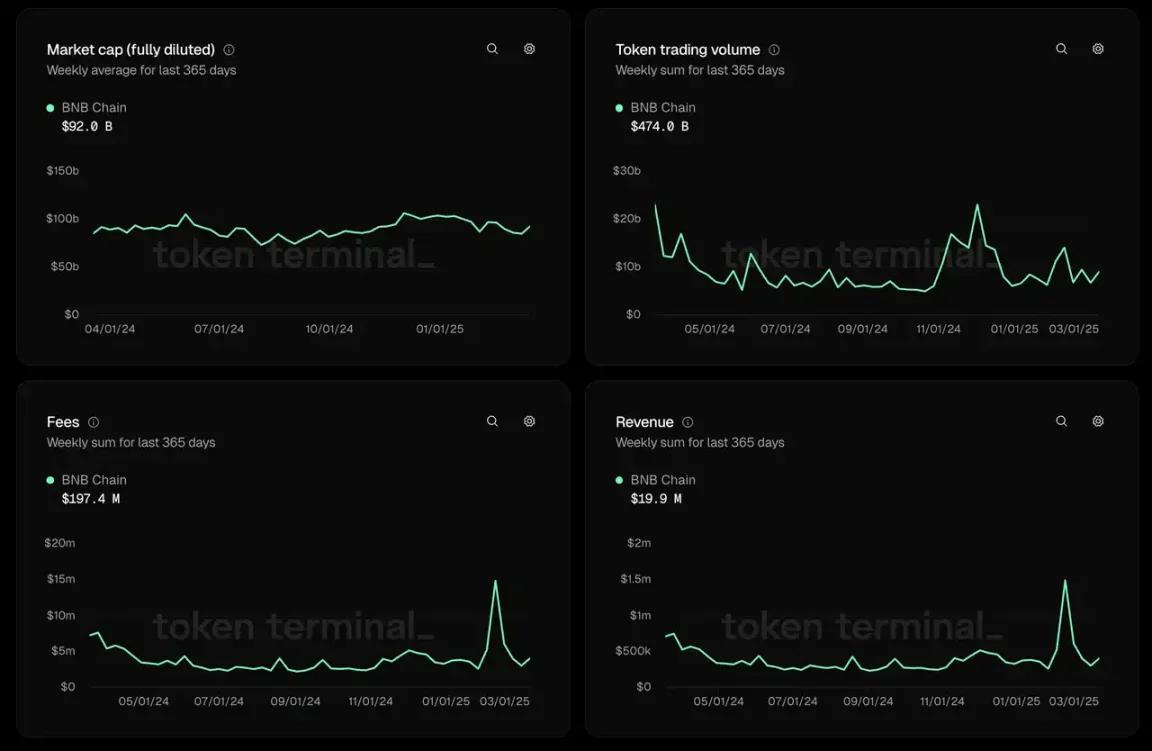

From the data perspective, the effects of this Meme Szn have also brought considerable benefits to Binance. The most prominent is the trading volume of the Dex, which once reached twice that of Solana during this cycle.

The token turnover rate has surged multiple times, but the capital has not entered the external chain in large quantities, indicating that the liquidity is formed by real buy and sell orders within the market, and it still maintains a certain upward trend.

The GDP represents the ratio of fees earned by applications in the ecosystem, and the GDP and ecosystem transaction volume have remained basically stable, but the TVL in the ecosystem has already doubled, and the liquidity within the market is still not saturated relative to the number of participants.

The community influencer and researcher Timo "@timotimo007" believes that Binance this time has directly fired a big cannon from the "demand side" of liquidity, using the changes in liquidity to influence asset issuance. In simple terms, the huge liquidity on Binance's main site will affect how subsequent assets are issued, but Binance did not think from the supply side, but directly took a big move on the liquidity side, which will in turn affect the supply side.

The KOL event triggered by the BNB Card incident has made people think about the development of memes on BSC. The market seems to be full of "post-traumatic stress" about this "conspiracy group" behavior. Using Neso's concept of memes, most of the meme coins on BSC currently belong to "Forced memes" - those that are artificially promoted or tried to be popularized, rather than naturally spreading through people's love and sharing. This type of meme lacks external extensibility and cannot form a community-scale free development on the chain, which will be the key to whether BSC can successfully replicate Solana.

As for whether this round of heat on BSC can continue, the market's reaction needs to be observed. If attention and liquidity can continue and generate inertia. According to CZ's 2025 BNB Chain plan, AI is highly likely to occupy a larger share of resources, and the DeSci that previously caused a craze may also return to BSC. BlockBeats will continue to follow BSC's next moves.