Author: Jesse Myers, Crypto Analyst; Translator: Jinse Finance xiaozou

In this article, we will understand Michael Saylor's grand new initiative: STRF. Strategy is like a water pump, accelerating the flow of funds from the bond market to Bit. How will Saylor raise $3 trillion from the bond market to purchase Bit?

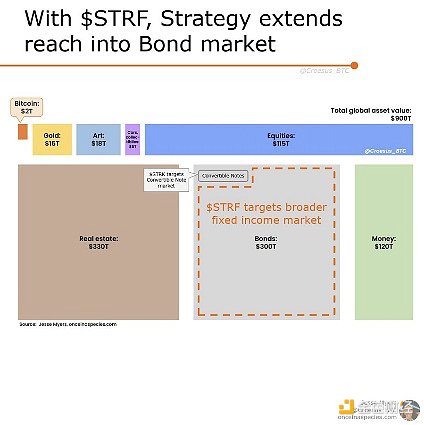

The bond market is about 2% convertible bonds and about 98% regular bonds.

So far, Strategy has been raising funds through personal convertible notes. Now they have added:

STRK, to simplify the issuance of convertible notes.

STRF, to leverage the $300 trillion in the broader fixed income market.

Don't believe what I'm saying? Listen to what Saylor says: "The fixed income market has $300 trillion, and I want 1% of that." He is making such a plan. That's why he mentions it in every public speech.

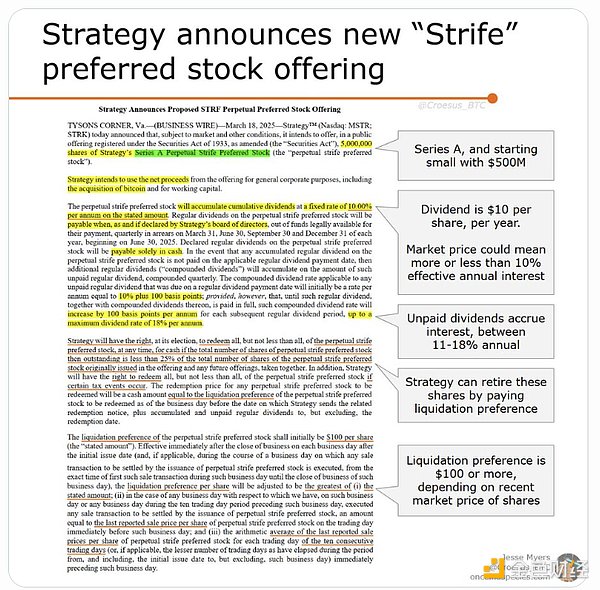

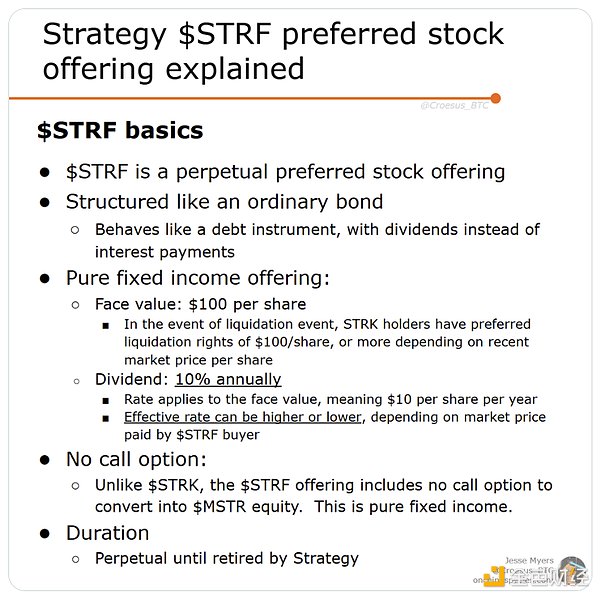

Here are the key details of the STRF announcement. STRF is a fixed income product, packaged as a preferred stock issuance, so that Strategy can easily (and continuously) raise funds to purchase Bit.

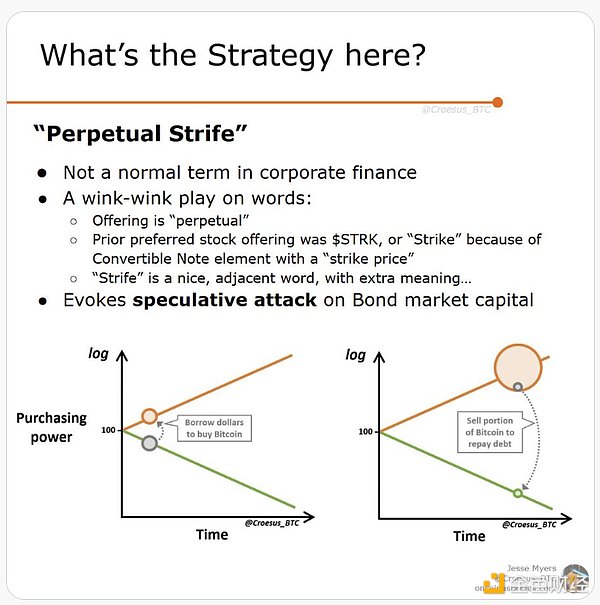

What does the name STRF mean? "Perpetual Strife" is not a financial term. Saylor is throwing a big wink at Bit enthusiasts and Pierre Rochard's "speculative attack" concept.

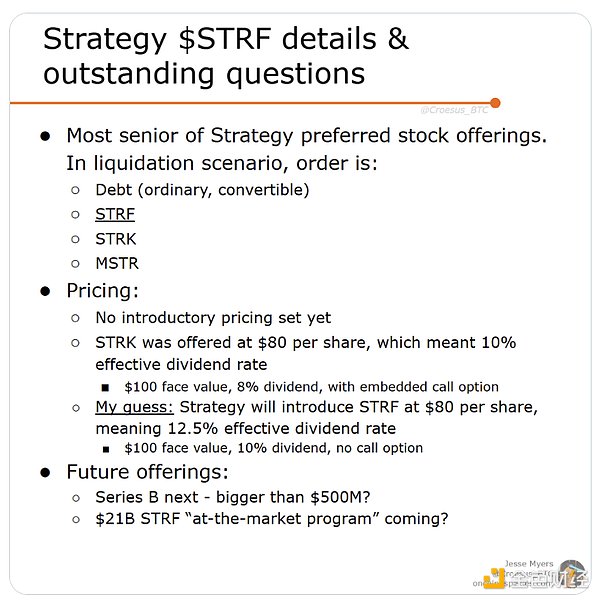

The design of STRF is clear, which is to make it irresistible to fixed income portfolio managers. It has a higher annualized dividend rate than STRK, but forgoes the embedded call option.

Remaining to be seen:

Will it be priced like STRK, creating a 12.5% annualized dividend for initial buyers?

How strong will the demand be for the initial issuance?

When and how large will the Series B financing be?

When will the $21 billion "at-the-market" (ATM) program be launched?

When will the ATM program be expanded to $3 trillion?