Author: Kazu Umemoto Source: Bankless Translator: Shan Ouba, Jinse Finance

Stablecoin protocols have long been a common sight in the crypto industry, but the way stablecoins are pegged to the US dollar is constantly evolving. Currently, most protocols use over-collateralized debt positions (CDPs) to issue stablecoins. The latest trend is to create "Delta neutral" positions through perpetual contracts, i.e., shorting perpetual contracts, whose value is equal to the value of the underlying collateral assets.

However, f(x) Protocol has recognized the limitations of these mechanisms and introduced a completely new stablecoin model whose value is derived from yield-bearing assets.

So how does it work? Why is it worth paying attention to?

How the f(x) Stablecoin Works

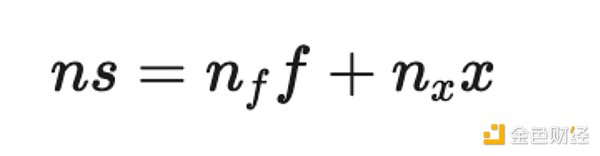

The key concept to understand about f(x) Protocol is the f(x) Invariant Formula, which is the core mechanism behind its native stablecoin and leveraged tokens.

This formula contains three key variables:

• ns (Collateral Asset Value): The quantity of collateral assets multiplied by their current price, i.e., the total collateral value.

• nff (Total Value of Minted Stablecoins): The total value of stablecoins generated from the collateral assets.

• nxx (Total Value of Leveraged Positions): The total value of the leveraged tokens (xTokens) in the protocol.

When the value of stablecoins + the value of leveraged positions = the value of collateral assets, the protocol can create synthetic leveraged positions.

The value of the stablecoin remains stable because it is pegged to the US dollar. But if the price of the collateral assets fluctuates, this volatility is passed on to the leveraged token holders, not the stablecoin itself.

In addition to the innovativeness of the f(x) stablecoin, the protocol also provides leveraged exposure to BTC and ETH without worrying about funding rates or liquidations.

Risks

While this mechanism may represent the future of stablecoins, it also introduces some additional risks compared to other stablecoins. The two main risks of this system are the potential for the stablecoin to depeg and the risk of all leveraged tokens potentially going to zero.

Leveraged Token Depegging

In extreme cases, all xTokens (leveraged tokens) could completely lose their value. This could happen in the event of a sharp drop in the price of the underlying collateral assets. If f(x)'s rebalancing mechanism fails to maintain the leveraged positions due to violent market fluctuations, the leveraged tokens could go to zero.

Stablecoin Depegging

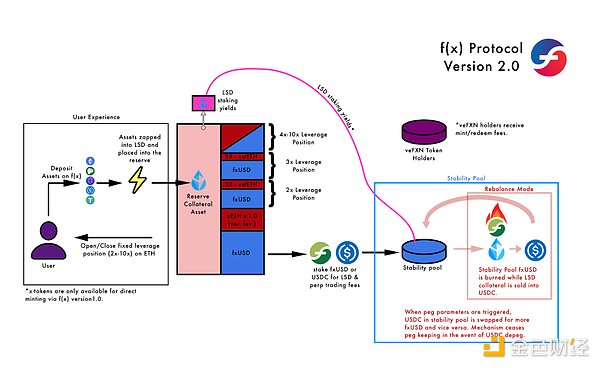

In the worst-case scenario, this risk could lead to fxUSD depegging, but this would typically require a catastrophic collapse of the entire crypto market. However, f(x) has deployed a stability pool to maintain the peg:

• When fxUSD is below $1, the stability pool will convert USDC to fxUSD to restore the peg.

• When fxUSD is above $1, the stability pool will convert fxUSD to USDC to restore the peg.

Introduction to f(x) V2

In f(x) V1, users could leverage certain tokens, but the leverage ratio was variable. To address this, f(x) V2 introduced fixed leveraged positions to cater to users who prefer stable leverage. This mechanism is achieved through the xPOSITION token model.

The V2 mechanism uses Balancer's flash loans to obtain the required ETH and immediately repay the loan with newly minted fxUSD tokens. The protocol then uses the f(x) Invariant Formula to calculate the correct fxUSD and xPOSITION token amounts and return them to the user to meet their desired leverage ratio.

Additionally, due to f(x)'s automatic rebalancing mechanism, the risk of liquidation is relatively low. If a user's LTV (loan-to-value ratio) exceeds 88%, the protocol will automatically sell a portion of the debt position to restore it to a healthier level.

Stability Pool

The stability pool plays a crucial role in maintaining the fxUSD peg, as it uses the conversion between USDC and fxUSD to maintain the exchange rate. However, it is not just a stabilization mechanism; a significant portion of the protocol's revenue is also fed back into the stability pool, allowing participants to earn high yield returns on the stablecoin.

Main Revenue Sources

The first revenue source for this pool is the yield from collateral token xTokens. Since the leveraged tokens bear the volatility of the collateral, all the yield accrues to fxUSD. For example, the staking rewards from ETH are directed to the stability pool, while the token's volatility is passed on to the leveraged token holders.

The next revenue source comes from the opening and closing of xPOSITIONS. Each time a user opens an xPOSITION, a 0.3% fee is charged, and when a user closes it, a 0.1% fee is charged. 70% of these fee revenues are returned to the stability pool. Additionally, if the xPOSITION needs to be rebalanced, a small fee is charged and returned to the stability pool.

Finally, if the protocol needs to implement a funding cost on the xPOSITIONS, this will only occur if fxUSD depegs from the US dollar. In this case, xPOSITION holders must pay a funding rate calculated based on the current USDC borrowing rate on Aave, which is fed back into the stability pool, as theyborrow fxUSD to hold their leveraged positions.

In the current market environment, finding suitable investment opportunities is not easy, and stablecoin yields remain an attractive choice for capital allocation.

f(x) offers stablecoin yields in the double digits, and they are not dependent on native token issuance, which could be an attractive liquidity parking option in the current market cycle.