Source: Talk Li Talk Outside

Ethereum has been on a downward spiral from around $4,100 last December to around $1,700 in March this year. In just over three months, Ethereum, the king of altcoins, has plummeted by around 59%. This process has caused many who were originally bullish on Ethereum to gradually lose patience and become increasingly disappointed and pessimistic...

But with ETH rebounding to the $2,000 level yesterday (March 19), it seems to have rekindled hope in some people. Many trapped partners, seeing ETH at $2,000, are filled with longing and excitement, and are telling each other the news.

1. Is ETH going to rebound?

As for whether ETH can really rebound this time, I don't know. Because ETH is still in an overall downtrend, let's focus on a few aspects first:

First, on the technical level, let's see if it can close around $2,200 this month (March). If it can successfully regain and stabilize at $2,200, then we may have a chance to see higher levels, otherwise it will just continue as usual. Additionally, it is reported that Standard Chartered Bank's analysts have lowered their target price for ETH in 2025 from the original $10,000 to $4,000.

Second, on the news front, such as the progress of the Pectra upgrade, the progress of the ETF staking approval, the institutional adoption rate (such as WLFI's continuous hoarding and buying, and the opportunities in the RWA application), the positive or negative impacts brought by the Ethereum Foundation and Vitalik personally, and so on.

Third, on the data level, such as the inflow/outflow of ETF funds, the activity on the Ethereum chain, the changes in the supply held by non-exchange top-tier addresses, and so on.

As for the reasons for the current market rally, we won't play Monday morning quarterback here. There are already many summaries on the internet, such as the macro factors being the signal released by the Fed early this morning (Beijing time on March 20), that is, the interest rate remains unchanged (as expected), but the QT (Quantitative Tightening) pace will be slowed down, which the market sees as a positive signal. As shown in the figure below.

In plain language, the fact that the Fed kept the interest rate at 4.25%-4.50% unchanged has already been digested by the market, but the slowdown in balance sheet reduction is beyond the original expectations, which has also rekindled some confidence in the market and provided some momentum or reasons for the market rally.

So, can Ethereum be bought at low prices now?

Currently, the price of ETH is equivalent to the level in October 2023, so many people may tell you that now is a good time to buy at low prices, because Ethereum has fallen 60% from the high of $4,100. But you need to think about one more thing: if (this is just an assumption) ETH drops another 60% from -60%, can you accept it? If you can accept or bear this possible risk, then you can buy at any time.

Since it's about buying at low prices, the so-called "low" may have different definitions for different people. What's your definition?

Many people think that the current $2,000 Ethereum is a low price because they are anchored to the $4,100 price, but if your anchor is the $800 low in 2022, the conclusion may be completely different.

Selling at high prices is similar. If you are anchored to the idea that Ethereum will eventually reach $10,000, then what's there to be pessimistic about if you hold $2,000 Ethereum or are trapped at a $3,000 cost basis?

So, asking others directly whether you should buy or sell is not very meaningful. If you can't find your own anchor and can't strictly control your position (position management + risk management), then all your questions may be futile, and others can't give you the answers or results you need.

As for me, I always believe that as ordinary people, when investing in a field, we must form our own strategies or methodologies, such as:

- Even though I am bullish on BTC in the long run and have been following a coin-based strategy, I still choose to take some profits during bull markets to optimize capital efficiency and increase my long-term BTC reserves.

- Although from a technical or market perspective, I have the opportunity to significantly increase my returns through the use of leverage in trading operations, I still choose the slowest way of spot trading (just hoarding coins).

- Rather than spending more than an hour a day watching the market, I prefer to spend 10 minutes a week simply looking at the market and then spend the rest of my time and energy on things I enjoy more, instead of letting myself get exhausted by frequent trading or getting stuck in trading.

- Always keep yourself in the game, always keep yourself with chips to stay on the table. Persisting to the end is more likely to succeed than betting it all on one roll of the dice. Only those who persist to the end have a higher probability of getting the result.

- Don't get caught in the extreme survivor bias. We always hear about those who get rich overnight, but rarely hear about the thousands who tried the same thing and went bankrupt.

- In fact, most people tend to overestimate what they can achieve in a year, and underestimate what they can achieve in ten years. If you can design a reasonable ten-year plan and stick to executing it in stages, I believe you will outperform most people.

2. Trump urges the Fed to cut interest rates

As mentioned above, the Fed has been withdrawing hundreds of billions of dollars from the market each month since launching QT in 2022. Now (starting April 1), the pace of balance sheet reduction will be reduced from $250 billion to $50 billion, which in a sense means that the Fed's withdrawal has been reduced by four-fifths, equivalent to injecting some liquidity back into the market (if rate cuts can be considered as a strong medicine, then this QT can be considered as a supplementary medicine).

And today (March 20) there is another interesting thing, which is that Trump posted a tweet on Truth Social (a Twitter-like social platform owned by the Trump Media & Technology Group) urging a rate cut, arguing that with the adjustment of tariff policies, the US economy will need lower interest rates to adapt to the changes. As shown in the figure below.

Regarding Trump's interest rate cut obsession and the potential impact of Fed rate cuts on the crypto market, we have already covered some of this in our previous articles (such as March 16, March 12, March 11, etc.), so I won't go into too much detail here. Interested partners can go back and read the historical articles of Talk Li Talk Outside.

3. Continue to talk about investment styles

Next, let's continue to talk about investment styles based on the previous article (March 17):

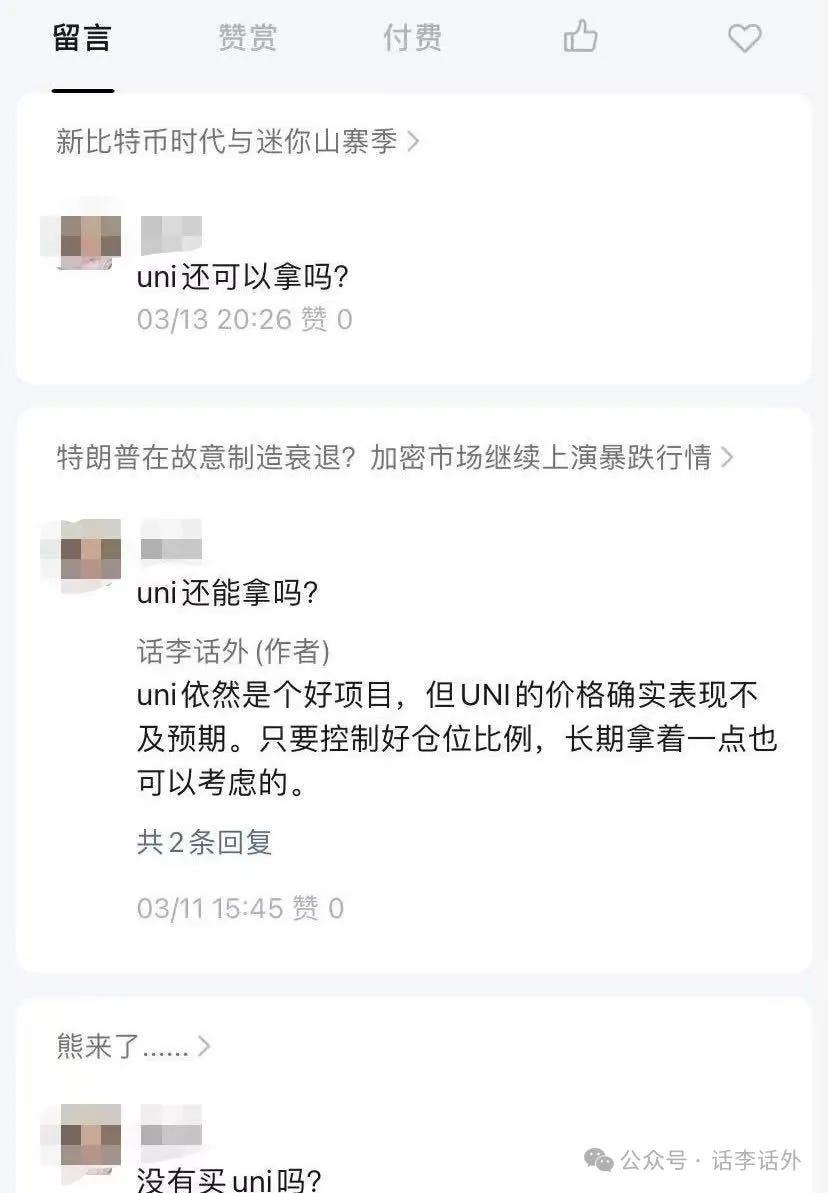

A few days ago, I saw a message from a partner in the background asking: Can UNI still be held?

Here is the English translation of the text, with the specified terms translated as instructed:When I saw this comment, my first reaction was to simply copy and paste the reply I had already given to the same question a few days ago, and then give this young man my own thoughts as well. But I discovered an interesting thing - the young man who asked the above question, I had already replied to him about this question before, and then I continued to check his historical comment record and found that, regarding the UNI issue, he has repeated the question 8 times in the past half year or so. As shown in the image below.

It is clear that this young man has probably been trapped in UNI for quite a long time, and his mentality may have been a bit pessimistic in the past half year. He may have left messages inquiring about the same question under the posts of many other bloggers, but he has never gotten the result he wants.

To be honest, if you encounter a problem (loss) and do not go through a good summary, reflection and review, but instead try to seek help from others (strangers) everywhere, hoping that others can give you a perfect result, and rely on others to directly change your own destiny, this is actually very difficult.

Everyone is chasing money and also likes to chase money, but some people seem to have a hard time understanding a basic principle or logic, which is: chasing money is not the most important thing, the important thing is to develop a certain (or several) suitable earning habits for yourself.

Many people just want to be able to make a big profit or earn quick money, and then they hope to establish this goal more on the help of others (such as some KOLs, bloggers, etc.). In fact, what others do and what you should do are two completely different concepts. In our previous articles, we have mentioned this issue many times, such as the fact that different people have very different backgrounds, experiences, and risk tolerance, and their thinking models, knowledge, observation perspectives, and interests are also not the same.

The investment method of others may not be suitable for you, the best way should be: through learning and understanding the investment ideas or logic of others, and then based on this, you can combine your own situation to make inferences, and then form a set of investment methodology or investment system that is applicable to yourself.

And in this process, you should avoid being high-minded and low-handed. For example, if you want to be at the forefront of the crypto field you are interested in, then you need to continue to learn (learn + take notes + think) in the investment process. Learning can be achieved in many ways or channels, such as:

- Some people like to follow a bunch of bloggers on Twitter and scroll through all kinds of news every day.

- Some people like to join various chat groups and scroll through all kinds of messages every day.

- Some people like to leave messages everywhere, asking all kinds of questions to others.

- Some people like to directly use ChatGPT to get one or a few answers.

- And so on...

Regarding how to learn effectively, remember that in the previous article, I also sorted out some of my personal experiences or methods. Here I will just remind you of a relatively important point: any information must be checked and verified, don't just believe it when you see it.

The purpose of investment is to earn more money, but you need to learn to let your money work for you, rather than becoming a slave to money. In any investment field, no one will take you to get rich for no reason, and the market's money won't just be there waiting for you to pick the fruits. We must pursue the right ways that suit us, whether it's spot, futures, airdrops, new offerings, arbitrage... or any other type of play, you can try them, but in the process of participating, you must think clearly: in a PvP game, what (or what unique method do you have) can you use to earn money from other people's pockets?

The so-called unique method can be divided into two types:

One is a proprietary strategy (possessed by a small number of people, not by the majority), and this uniqueness is mainly reflected in scarcity and leadership. For example, you have developed a set of indicator systems, and through your own indicators, you can accurately judge the trend of the market and take the lead in getting the returns. Or you can get some differentiated news earlier than others, you can filter out effective information faster from a large amount of information, or you yourself have a large amount of traffic that can be used to lead or shill.

The other is a general strategy (possessed by the majority, but only a few can execute it), and this uniqueness is mainly reflected in psychological and cognitive leadership. For example, the old cabbage persuades you patiently that as long as you invest in BTC and hold it, you will get a good return, but you still unhesitatingly go to All In various altcoins, because you think the altcoins will have a bigger increase and the money will come faster.

In short, many times, some people see the brilliance of others and always hope to directly possess the brilliance of others, while ignoring their true selves. In any investment field, just doing transactions is not enough (such as buying whatever others tell you to buy, or buying whatever you hear is hot), we need to learn to create and form our own unique methods. For ordinary people, most people find it difficult to succeed immediately after entering a new field, the first few attempts may fail, but failure often also means more experience than others, and how to use your own experience (combined with some methods of others to make inferences) to establish your own investment method, is the correct way to accumulate wealth.

That's all for today. The pictures/data references involved in the text have been supplemented in the Notion of 'Talk Outside the Talk'. The above content is just my personal perspective and analysis, and is only for learning and exchange, and does not constitute any investment advice.