Author: @BlazingKevin_, the Researcher at BlockBooster

The consensus is changing, with users losing confidence in CEXs after the listing of new Altcoins, although a few projects can buck the trend, most projects cannot escape the gravitational pull of the unilateral downward trend. Once this consensus continues to strengthen, gradually shifting from two to three months to a complete bull-bear cycle collective consensus, the user retention rate and user growth rate of CEXs may be severely hit.

The core contradiction is the divergence in pricing between users and project parties. Project parties need to recover their early costs from retail investors, and the high FDV due to a large proportion of VC lock-up has become a norm at the time of launch. The combination of the two inevitably leads to a TGE price that exceeds the psychological expectations of retail investors.

The high FDV and low MC strategy was acceptable in the previous bull-bear cycle because the "Buy and Hold" consensus would ultimately reward the diamond hands. But this consensus began to weaken after BTC went through the ETF, and was completely destroyed by the Memecoin frenzy in the past year. BTC is deeply tied to the US stock market and has become a reservoir of US dollar assets, being the first to decouple from the four-year cycle; the animal kingdom, Agent, and celebrity coins have put Memecoins on a pedestal and then caused them to plummet at lightning speed, and retail investors can no longer adapt to the market-making cycle of VC coins. The market has undergone earth-shaking changes, but the VC coins are still sitting on the death train of inertia without realizing it. The death spiral is caused by the following three points:

Due to the large lock-up of VC and team shares, only a small portion can circulate in the early stage. The excessively high FDV makes retail investors who are used to Memecoin valuation methods extremely uncomfortable.

For this small circulating volume, the project parties are still unwilling to let go, secretly recovering a large amount of chips in airdrops and ecological incentives. The profit experience of retail investors in airdrops is very poor, making the pre-issuance community atmosphere depressed and pessimistic.

Their own shares are locked up, so they can only recover their early costs by dumping the small circulating volume of chips, so they can only ignore the market sentiment and choose a high opening.

The essence of the death spiral is the lack of long-term thinking, the complete collapse of the "Buy and Hold" consensus on Altcoins. Once the price breaks through the key support level, it will be like quicksilver, and the new coins that are launched have no support level, and the psychological support level is the valuation and pricing expectations of the project. For a project with an expected market cap of only $10M, the pricing at $1B will result in an opening cost of -2%, and there will be no miracle before the expectation is met. And the poor price performance will cause the price to fall even further below the $10M. Such projects are increasing, and even if there are some exceptions due to reflexivity in the middle, the success rate of opening short positions on VC coins may still be far above 50%. When long-term thinking disappears and short-term thinking flourishes, the prosperity brought by the lack of regulation of interest groups will also become a mess when the bubble bursts, and it will be a case of "when the wine is gone, the tavern is empty".

Compared to other industries, Crypto is still in its early stages, but the pessimism of practitioners is already like the twilight of the gods, because short-term thinking will not bring faith and value, but will instead accelerate the depletion of the industry's vitality. Therefore, starting from now, we need to return to long-term thinking.

Myshell encounters resistance in returning to long-term pricing strategy

Going back to the opening point, when VC coins are hit, CEXs are the most hurt. Binance took the lead in self-rescue, conducting some experiments on Myshell, for better or worse, this is a signal that the leading exchange has chosen to change. This experiment maintained a good momentum before February 27, but then plummeted sharply after Myshell was listed on Binance. Let's review the key time points and corresponding market sentiment from the airdrop snapshot on February 12 to the Binance listing on February 27.

Two reversals of market sentiment

Myshell's market sentiment went through three stages before the Binance Listing: airdrop, IDO and Binance Listing. In these three stages, the sentiment of retail investors underwent a dramatic change. First, after the airdrop snapshot was taken and distributed, retail investors felt that the airdrop proportion was too low and the airdrop token amount was too small. 30% of the huge proportion was allocated to community incentives, but the total number of airdrop addresses and the proportion allocated to users or ecosystem projects were not clearly stated, leaving a lot of room for operation. At this time, the market had a negative attitude towards Myshell.

However, in the IDO stage, Myshell managed to reverse the market sentiment. The pricing divergence is what we believe to be the core contradiction between current retail investors and project parties. Myshell allocated 4% of the total supply to the IDO, benefiting Binance Wallet users. The corresponding FDV of only $20 million naturally obtained over 100 times oversubscription. The FUD sentiment of retail investors was weakening, but due to the current cycle's change in consensus on project airdrops - distrust, many retail investors are still bearish, so the vast majority of airdrop addresses chose to sell at TGE, as can be seen from the increase in on-chain holding addresses, more than 50% of the airdrop addresses chose to sell immediately.

On the TGE day, according to the $SHELL pool data on dexscreener BSC, the price reached a high of $1.64 in the first hour after TGE, with a trading volume of $3.2 million and a circulating market cap of $420 million; in the second hour, the highest price fell back to $0.9, with a trading volume of $17 million and a circulating market cap of $240 million. The closing price on the 13th was $0.37, with a circulating market cap of $100 million.

Between the 13th and 27th, the price remained between $0.36-$0.6, corresponding to a market cap of $100 million to $160 million. During this period, $SHELL had support at the low point and showed a trend of volume contraction and upward momentum. The chips sold by the airdrop addresses were absorbed by the top holding addresses, further increasing the concentration of chips.

Overly high expectations and concentration led to a rat race

Before the Binance listing, the market evaluation of Myshell was good, and the market mindset of the project was slightly positive. At the same time, the on-chain low opening and the Binance contract following up must have washed away a large amount of the profit-taking positions, and the market makers recovered a large amount of airdrop chips. The low pre-Binance listing pricing, the concentrated chips, and the inherent conditions for pulling up and pushing up the price. But if you add the expectations of "Myshell is the new AI leader on BSC", "Binance invested", and "secondary listing", the on-chain low opening becomes the biggest weakness. The rat race that rushed in after the TGE became the most steadfast holders before the listing, laying the groundwork for the unilateral upward trend after the listing. The joint dumping of the rat race and the market makers completely destroyed Myshell's efforts to benefit users in the IDO.

This is the pain that Myshell and more VC coins will face when they return to value, when they try to practice long-term thinking and let the roadmap and products support the market cap. The rat race that has existed since the birth of Crypto has become rampant under the nourishment of short-term thinking. When a project has strong expectations, whether it opens low or high, it is trading around the expectations, and when the expectations are realized, it will collapse.

Combining the roadmap to reasonably control expectations is Myshell's current homework

Opening low to benefit users and kick-start the community is a reasonable direction, but the balance between expectations and the actual roadmap needs to be properly allocated. Relying on expectations to attract users, with the product fundamentals able to provide support after the expectations are realized, the price management range of the token should be around the reasonable highest market cap expectation and the actual product bottom market cap.

Project parties returning to long-term thinking cannot rely solely on IDO concessions to users to gain market trust, this is just the first step. In the future, they should also focus on the contradiction between project parties and VCs in terms of transparency. After the project party launches the token through the IDO, it no longer depends on the listing, which can solve the contradiction in transparency between the two parties. The token unlocking process on the chain becomes more transparent, ensuring that the past conflicts of interest are effectively resolved. On the other hand, the traditional CEX often faces the dilemma of price plummeting after token issuance, which leads to a gradual decline in the trading volume of the exchange, while the transparency of on-chain data allows the exchange and market participants to evaluate the real situation of the project more accurately.

Projects that open low on-chain must be prepared for a period of time when they cannot be listed, otherwise they are very likely to encounter the dilemma of Myshell's rat race. Only by winning the trust of users and the market on-chain can they lay the foundation for the token price to spiral upwards.

Kaito's Middle Way Fits the Transition Period of Industry Transformation

Kaito's airdrop distribution continues the "unwritten rule" of VC coins: reducing the amount for top users, increasing the number of claimable users, i.e. long-tail distribution. According to the personal weight algorithm, 1 Yap can be exchanged for 5-20 $KAITO. 96 million $KAITO were distributed to Ecosystem yappers, Partners and Yappers, but the detailed proportions were not disclosed. This strategy allows the project party to hide and recycle chips to the greatest extent in the airdrop, and due to the large number of airdrop addresses, the opening pressure is greatly reduced - compared to concentrated airdrops to top KOLs. Pricing at the 1B price point where both bulls and bears are hesitant has facilitated a smooth turnover of floating funds.

Splitting Becomes the Flywheel Foundation

Secondly, Kaito has designed a positive spiral around NFT, Yaps and skaito in the early stage, using the characteristics of the split pool to constrain the token price when necessary. Kaito NFT prices have been rising continuously before the airdrop snapshot, with a peak floor price of 11ETH, about $30,000. After the snapshot, the price dropped, and at the TGE it was worth $5,800, with the current floor price gradually recovering to 2.5ETH. Each individual NFT received 2,620 $KAITO, about $4,700 (average price of $1.8 on February 21), and a total of 1,500 Kaito NFTs received nearly 4 million $KAITO.

The weight of sKAITO is positively correlated with the amount of staking, the length of staking, and the 7-day voting activity, and negatively correlated with the weight of Yappers voting pool and NFT holders.

Source: Kaito

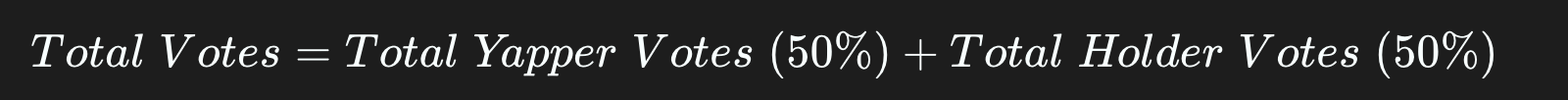

The voting weight is composed of Yappers (50%) + Holder[sKaito, NFT] (50%).

1 Genesis NFT ≈45,980

1 sKAITO ≈11.79

The voting power of each NFT = 3,900 $KAITO

The voting power of NFT and sKAITO dynamically changes, depending on the relationship between the total market value of NFT and the total market value of sKAITO, and the voting power gradually tends towards the side with the higher market value

Simple calculation shows that holding NFT is less costly than using sKAITO.

By staking Kaito tokens, users can obtain voting rights for governance and project decisions. Currently, each Kaito NFT provides 45,980 voting rights, and the voting rights of each NFT are equivalent to 3,935 $KAITO.

The arbitrage space between NFT, Yaps and skaito allows Kaito's price performance to be controlled to a certain extent through the NFT market value.

Choosing a Growth Path Suitable for One's Own Track is More Critical

In terms of pricing strategy, Kaito's choice is neither good nor bad, which is understandable. Because returning to long-termism is a much more arduous journey than ever before. Kaito's chosen approach is to continuously output long-term value, allowing the current market value to gradually return to the product strength.

After the Memecoin stage collapse, Kaito has the tendency to take over the market attention distribution leadership, competing for the Mindshare of a single time period, while Mindshare is actually the responsibility of KOLs to spread, with KOLs working for Kaito and Kaito paying yaps. As the importance of Mindshare increases, more and more projects will join Kaito and pay fees. The continuous increase of KOLs, users and project parties is the foundation of Kaito's positive spiral, and the judgment of whether this spiral is successful depends on the degree of Mindshare's market penetration.

Observing the market acceptance of Mindshare is relatively difficult. Therefore, Kaito has provided tools like the Yapper Launchpad, which is a toc product as well as a tob evaluation indicator. In general, the higher the NFT market value and the higher the sKAITO staking rate, the higher Kaito's market share. And the corresponding yaps will also rise with the tide, attracting more KOLs to join.

Summary

Whether the project party chooses Myshell to lead the transformation, or chooses the token issuance model driven by both community and VC, or like Kaito, recognizes its own track positioning and achieves value return through continuous long-term value output, both are signs of the industry's innovation towards long-termism.

Returning to long-termism is like going from luxury to frugality, which is difficult for an industry without regulation, and even more difficult is that the valuable innovations in Crypto seem to be only in DeFi, while the long-termism of tracks like NFT, Gamfi, and Metaverse has given users a very poor experience. Therefore, with the "wolf" of long-termism completely failing in the past, and the "tiger" of short-termism batch-speeding through the market in the present, returning to long-termism in the current situation is an anti-human path, but it may be the only lifeline. If you do not trust any narrative and are hostile to any technology, then this industry may not be able to continue to grow for you.

We need to wait, patiently wait, wait for the moment of qualitative change in Crypto, which may be opened up by AI Agents, or by other tracks. But before that, we need to adhere to long-termism, and in this process, break the long-standing pus, adapt to and face the pain caused by the return to long-termism.