Although cryptocurrency Airdrop has always been expected to bring assets and acceptance, the latest report from Binance has exposed profound flaws. Reduced rewards, internal profits, and bot mining are increasingly affecting the community's trust in Airdrop.

Once a growth driver, cryptocurrency Airdrop now risks becoming a burden. Can the industry repair them before users lose trust?

Binance's Analysis of Recent Cryptocurrency Airdrops

This report highlights the systemic flaws transforming excitement into disappointment. With this, Binance asks: Is Airdrop the golden ticket of cryptocurrency or a time bomb?

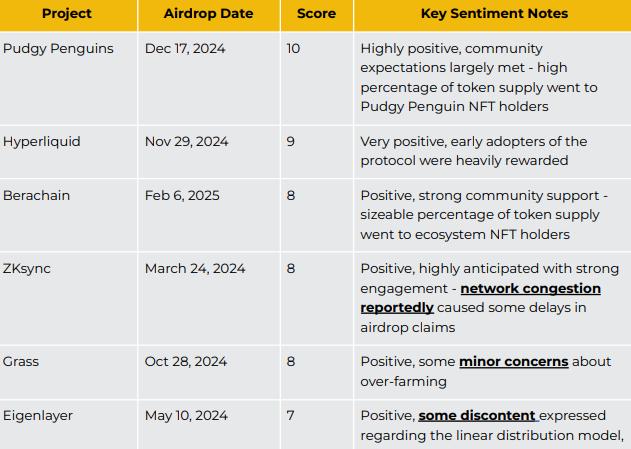

Binance's analysis evaluated Pudgy Penguins' Airdrop with an almost perfect 10/10 community perception. Hyperliquid closely followed with 9/10 after generous rewards and establishing new DeFi standards.

Best Performing Cryptocurrency Airdrops. Source: Binance Research

Best Performing Cryptocurrency Airdrops. Source: Binance ResearchHowever, consequences quickly and severely occur when Airdrop fails to meet expectations. Binance's research cites Redstone (RED), initially committed to distributing 9.5% of token supply to the community but reduced to 5% at the last minute.

This caused a fierce reaction and a gloomy 2/10 perception score, according to Binance's Grok AI analysis.

It also cites Scroll's Airdrop in October 2024 as another disaster, highlighting vague rules and unclear snapshots of participation conditions, leading to a disappointing 3/10 rating.

Similarly, in February 2025, Kaito distributed 43.3% of supply to insiders while allocating only 10% to the community. This move quickly prompted influencers to dump, eroding trust.

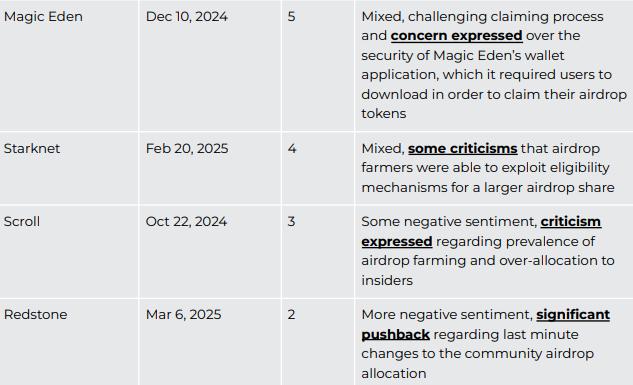

Moreover, the report cites Sybil farming, where bots collect tokens en masse. Technical failures like Magic Eden's request process errors in December 2024 increased user dissatisfaction.

Poorly Performing Cryptocurrency Airdrops. Source: Binance

Poorly Performing Cryptocurrency Airdrops. Source: BinanceWhy Most Airdrops Do Not Meet Expectations

Not only exposing flaws, Binance's report also analyzes the mechanisms behind these failures—last-minute allocation changes, like Redstone's, show poor planning and damage reputation. Lack of transparency, as seen in Scroll's unclear condition criteria, raises suspicions of bias.

Token distribution heavily favoring insiders, like Kaito's, alienates small investors. Meanwhile, technical incidents, including Magic Eden's wallet request errors, turn Airdrop into a disappointing user experience.

With billions of USD threatened, these issues are no longer minor glitches but an existential threat to the legitimacy of cryptocurrency Airdrop models.

"Tokens are a new type of asset....Airdrop is its wild frontier," wrote Binance's macro researcher, Joshua Wong.

Despite volatility, Binance has outlined a potential path to restore trust in cryptocurrency Airdrop. First, they call for transparency, urging retroactive Airdrops to establish clear condition criteria from the start.

Meanwhile, participation-based models should commit to fixed point ratios with tokens.

Next, projects must prioritize genuine community participation, viewing tokens not just as digital assets but as tools to build a loyal ecosystem.

Finally, technical solutions like on-chain monitoring and human identity verification tools, such as those used by LayerZero, can help combat Sybil farming and enhance fairness.

In summary, Binance's report is a wake-up call that while cryptocurrency Airdrop offers a unique opportunity to democratize assets and strengthen the blockchain community, they also risk collapsing under the weight of poor management and exploitation.