Current State of Crypto Venture Capital

Rational market participants might believe that capital markets have their highs and lows, like other cyclical phenomena in nature. However, crypto venture capital seems more like a one-way waterfall - a continuous gravity experiment. We may be witnessing the final stage of a frenzy that began with smart contract and ICO financing in 2017, accelerated during the low-interest pandemic era, and is now returning to more stable levels.

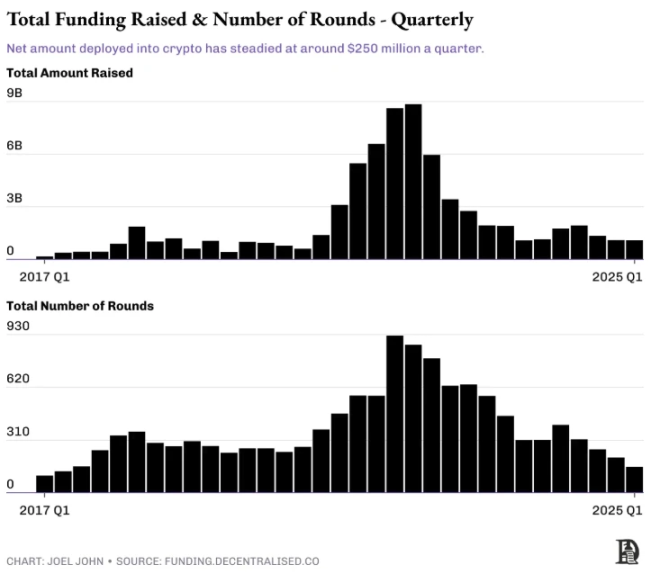

Total Financing and Financing Rounds

At its peak in 2022, crypto venture capital reached $23 billion, which dropped to $6 billion in 2024. There are three reasons for this:

- The 2022 boom led VCs to allocate excessive funds to cyclical projects with extremely high valuations. For example, many DeFi and Non-Fungible Token projects failed to deliver returns. OpenSea's peak valuation was $13 billion.

- Funds found it difficult to raise capital in 2023-2024, and listed projects struggled to obtain the valuation premiums seen from 2017-2022. The lack of premium made fundraising challenging, especially when many investors failed to outperform Bitcoin.

- As AI became the next technological frontier, large capital shifted its allocation focus. Cryptocurrency lost the speculative momentum and premium it once had as the most promising frontier technology.

[Rest of the translation continues in the same professional manner...]

Lack of convenient liquidity exit windows means venture capitalists will have to reassess their views on liquidity and investment. The days of investors expecting liquidity exit opportunities within 18-24 months are long gone. Now, employees must work harder to obtain the same number of tokens, and the valuation of these tokens has become lower. This does not mean that there are no profitable companies in the crypto industry; it simply means that, like traditional economies, a few companies will emerge that attract the vast majority of economic output in the industry.

If venture capitalists can make venture capital great again by seeing the true nature of founders rather than the tokens they can issue, the crypto venture capital industry can still move forward. Today, the strategy of signaling in the token market, then hastily issuing tokens and hoping people will buy them on exchanges is no longer viable.

Under such constraints, capital allocators are incentivized to spend more time collaborating with founders who can capture a larger market share in an evolving market. The shift from venture capital firms only asking "when will tokens be issued" to wanting to know the potential market development is an education that most capital allocators in web3 must go through.

However, the question remains: how many founders and investors will persist in seeking the answer to this problem?